AEON Financial Posts 10% Operating Profit Growth for Nine-Month Period

AEON Financial Service has demonstrated notable resilience in its performance for the nine months ending November 30, 2025, achieving robust top-line growth. The company's results tell a clear story: its strategic investments in a powerful domestic banking and digital payments ecosystem are generating a low-cost funding engine that is proving critical in counteracting margin pressure from higher funding costs. This operational agility highlights the firm's successful navigation of shifting monetary policy.

The consolidated results reflect a solid year-over-year expansion across key profitability metrics, demonstrating the underlying strength of its domestic and global operations.

The 10.0% year-over-year increase in operating profit was primarily fueled by strong performance across core revenue streams. Increased loan revenue contributed an additional ¥6.8 billion, while installment finance revenue grew by ¥7.7 billion. The standout performer was financial revenue, which surged by ¥14.7 billion. These gains, however, were partially offset by significant cost pressures. Financial expenses rose by a substantial ¥18.3 billion, reflecting higher funding costs, while bad debt-related expenses increased by a more contained ¥3.0 billion. This performance sets the stage for a deeper look into the specific revenue and expense items shaping the company's bottom line.

1. Deconstructing the Income Statement: Revenue Drivers and Cost Pressures

An examination of AEON's income statement reveals the two-sided coin of the current interest rate cycle. On one side, higher rates were a boon for the company's banking and investment activities, driving a significant surge in financial revenue. On the other, they were a burden on funding costs, making the performance of the underlying business segments and the management of credit risk even more critical to sustaining profitability.

Key Revenue Streams Analysis (Nine Months Ended Nov 30, 2025)

Revenue Category | Revenue (Millions of Yen) | YoY Change |

Revenue from credit card business | ¥107,016 | +4.6% |

Revenue from installment sales finance business | ¥40,622 | +8.1% |

Financing revenue | ¥131,346 | +5.5% |

Financial revenue | ¥49,977 | +41.7% |

Fees and commissions | ¥62,108 | +15.1% |

The most significant growth driver was Financial Revenue, which surged by 41.7% year-over-year. This substantial increase is attributed primarily to changes in the interest rate environment, as higher prevailing rates directly boosted the income generated from the company's banking and investment activities.

Key Operating Expense Analysis (Nine Months Ended Nov 30, 2025)

Expense Category | Expense (Millions of Yen) | YoY Change |

Financial expenses | ¥45,603 | +67.3% |

Selling, general and administrative expenses | ¥319,067 | +5.0% |

Bad debt related expenses | ¥77,757 | +4.1% |

The expense ledger reveals the stark reality of the current monetary cycle: a 67.3% surge in Financial Expenses served as the primary drag on profitability, a direct consequence of higher funding costs. However, the company's ability to absorb this shock was significantly buffered by its growing domestic deposit base, providing a competitive advantage.

In contrast, the moderate 4.1% increase in Bad debt related expenses suggests that credit risk has been effectively contained. This meticulous management of credit risk, contrasted with the unavoidable inflation of funding costs, underscores the importance of the individual business segments in driving operational profit.

2. Segment Performance Analysis: A Tale of Two Geographies

To fully appreciate AEON's performance, it is essential to analyze its Domestic and Global business segments separately. This approach reveals two distinct but complementary engines. The Domestic segment provides a stable, low-cost funding base and a high-volume, digitally-driven growth engine. In parallel, the Global segment offers higher-margin growth, albeit with the macroeconomic volatility characteristic of its diverse Asian markets.

2.1 Domestic Business: Banking and Payments Fuel Steady Growth

The domestic segment delivered a strong performance, posting an Operating Revenue of ¥248.3 billion (+9.7% YoY) and an Operating Profit of ¥13.6 billion (+11.2% YoY). This growth was built on an expanding and increasingly engaged digital customer base.

- Domestic Valid IDs: Reached 38.40 million, an increase of 2.25 million from the beginning of the fiscal term.

- Number of Valid Card Holders: Grew to 26.57 million, adding 0.41 million members since the start of the term.

- AEON Pay Membership: Surged to 10.30 million, a significant increase of 2.14 million members from the beginning of the term.

This user growth translated directly into higher transaction volumes. While traditional credit card shopping saw healthy growth of 5.6% YoY to ¥5,871.7 billion, the standout was the AEON Pay platform, which saw transaction volume soar by 150% YoY to ¥340.8 billion. This demonstrates a successful pivot towards capturing a larger share of customers' daily transaction flows through its digital platform, moving beyond traditional credit.

The company's banking and lending operations provided further stability. AEON Bank's deposit balance grew steadily to ¥5.47 trillion, securing a substantial and low-cost funding base that is critical in the current rate environment. Furthermore, the balance of high-yield receivables recovered to ¥803.2 billion, a key factor in improving asset portfolio profitability.

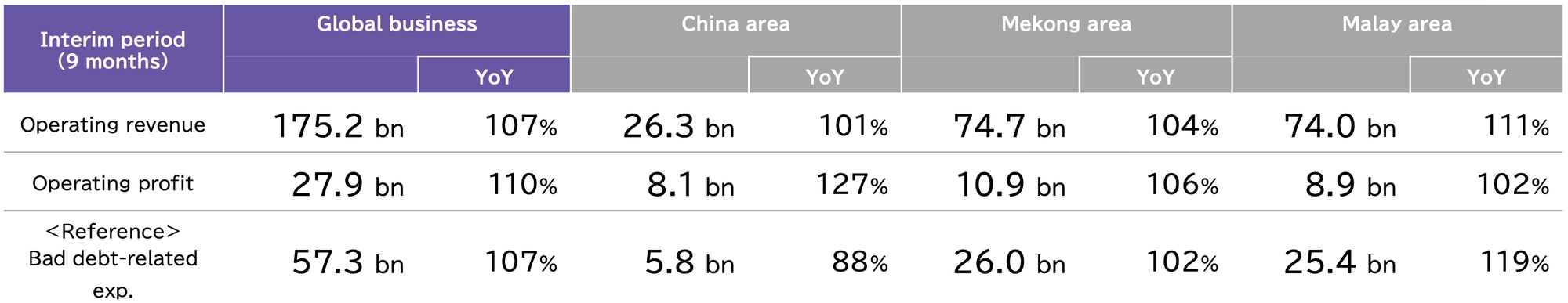

2.2 Global Business: Resilience Across Asian Markets

The global business segment also demonstrated robust growth, with Operating Revenue reaching ¥175.2 billion (+6.8% YoY) and Operating Profit hitting ¥27.9 billion (+10.0% YoY). Performance varied by region, reflecting diverse economic conditions and strategic priorities.

- China Area: Operating profit grew by an impressive 26.6% YoY to ¥8.1 billion. This was achieved through effective cost control, including a reduction in loan loss provisions, which more than compensated for flat revenue resulting from tightened credit screening standards.

- Mekong Area: The region delivered a 6.4% YoY increase in operating profit to ¥10.9 billion for the nine-month period. However, the business faced headwinds in the third quarter from the impact of flooding in Thailand and a deteriorating macroeconomic environment, which led to an increase in bad debt expenses.

- Malay Area: Operating profit saw a modest increase of 2.2% YoY to ¥8.9 billion. The performance was driven by sustained double-digit revenue growth, supported by strong transaction volumes in motorcycle financing, which was prudently managed with stricter credit screening to mitigate rising risks.

The solid performance across both domestic and international segments is reflected in the company's expanding balance sheet, which provides the financial foundation for future growth.

3. Balance Sheet and Financial Position: Fuelling Expansion

A company's balance sheet provides a crucial snapshot of its scale, structure, and financial stability. For a financial institution like AEON, its expansion is a direct reflection of growing business operations. As of November 30, 2025, AEON's consolidated balance sheet shows significant growth, underscoring the expansion of its core lending and deposit-taking activities.

Metric | Value (in billions of Yen) | Change YTD (in billions of Yen) |

Total Assets | 8,338.0 | +581.5 |

Operating Loans & Banking Loans | 3,828.6 | +178.1 |

Accounts receivable-installment | 2,014.4 | +267.0 |

Total Liabilities | 7,730.1 | +559.4 |

Deposits for banking business | 5,479.5 | +273.3 |

Interest-bearing debt | 1,405.8 | +96.5 |

Total Net Assets | 607.9 | +22.1 |

The ¥581.5 billion year-to-date increase in Total Assets was primarily driven by the expansion of the company's core earning assets, particularly a ¥267.0 billion rise in installment receivables and a ¥178.1 billion increase in loans. On the liabilities side, this growth was largely funded by a ¥273.3 billion increase in customer deposits through AEON Bank. This demonstrates the company's ability to attract a stable and comparatively low-cost funding source—a significant competitive advantage that fortifies its financial position and enables the pursuit of its strategic priorities.

4. Strategic Direction and FY2025 Outlook

In response to current market dynamics, AEON Financial Service is undergoing a significant strategic transformation, dubbed the "Second Founding," which represents a clear pivot toward higher-margin, digitally-native business lines. This initiative involves a fundamental review of its business portfolio to prioritize asset profitability and concentrate management resources on its core business areas.

The company's forward-looking strategy is focused on several key initiatives:

- Business Portfolio Restructuring: AEON is concentrating its resources on the core businesses of "Payments," "Lending," and "Banking." This includes strategic moves such as consolidating the WAON e-money business to enhance the payments ecosystem and divesting non-core assets like AEON Allianz Life Insurance.

- Digital Infrastructure Expansion: The company is making a significant push behind AEON Pay, with plans to rename its primary app to "AEON Pay" and aggressively expand the user base, signaling its central role in the company's digital strategy.

- Lending Business Enhancement: AEON aims to expand its profitable revolving and installment loan balances by targeting younger demographics with innovative features like "post-purchase installment" options and developing new digital loan products to meet immediate, small-amount financing needs.

- Global Business Regrowth: The company is revitalizing its international operations, highlighted by the launch of AEON Bank in Malaysia and the strategic rebranding and expansion of its finance business in Vietnam to leverage the AEON brand more effectively.

Looking ahead, AEON is on track to meet its full-year guidance for the fiscal year ending February 28, 2026. After three quarters, the company has made substantial progress toward its annual targets.

In line with its performance, the company has maintained its dividend forecast. It plans an annual dividend of ¥53.00 per share for Fiscal 2025, consisting of a ¥25.00 interim dividend already declared and a planned year-end dividend of ¥28.00.