AMT: Japan's New "Early Business Turnaround Act"

In a newsletter published at the end of June, Anderson Mori & Tomotsune (AMT) lawyers explained the newly enacted "Act on Procedures for Adjustment of Debts Owed by Business Operators to Financial Institutions, etc. for Facilitating Business Turnaround," referred to as the "Early Business Turnaround Act." The Act is set to be implemented within 18 months of its promulgation.

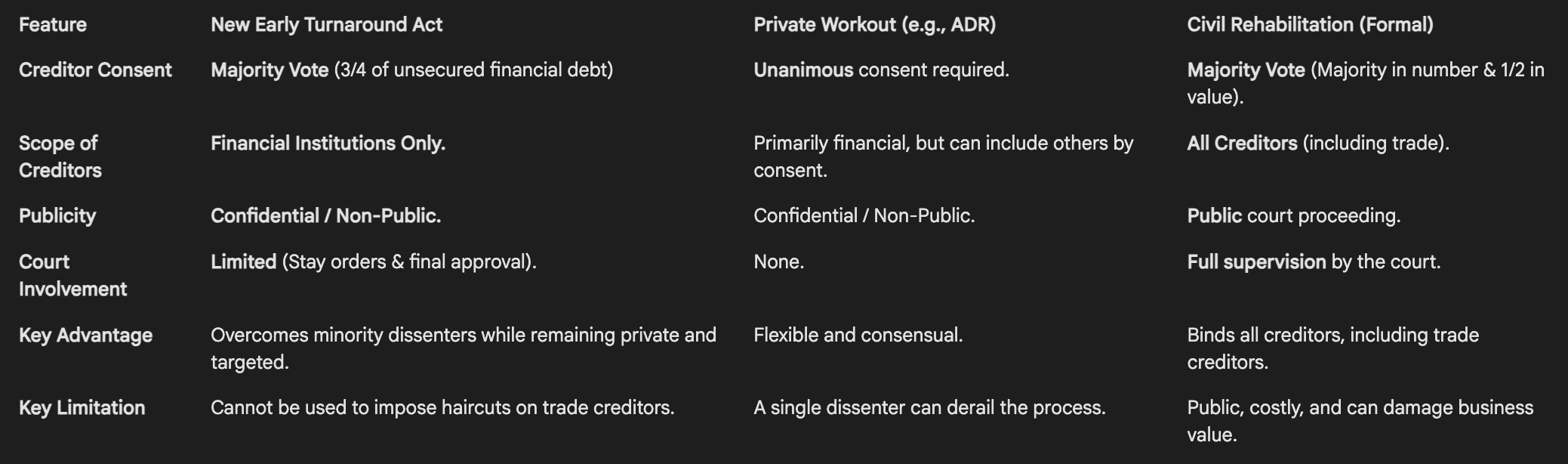

The Act introduces a groundbreaking "private restructuring by majority vote" system in Japan, creating a new, hybrid procedure that sits between fully consensual private workouts (like Turnaround ADR) and formal, public court-led proceedings (like Civil Rehabilitation or Corporate Reorganization).

I. Overview and Objective

The primary goal of the Act is to enable businesses in the early stages of financial distress to restructure their debts to financial institutions quickly and smoothly, thereby preventing the destruction of business value and the loss of technology and personnel. It addresses a key weakness in Japan's existing restructuring framework, where out-of-court workouts often failed due to the need for unanimous consent from all financial creditors. This new procedure allows a restructuring plan to be approved over the objections of a minority of financial creditors, provided certain conditions are met.

The procedure is designed to be non-public and confidential, even with its court-involvement component, which helps preserve the debtor's corporate value.

II. Key Parties Involved

- Debtor ("Confirmed Business Operator"): A business that is "at risk of falling into financial distress." This is a lower threshold than that for formal bankruptcy proceedings, encouraging earlier intervention.

- Designated Confirmation and Investigation Body ("Third-Party Body"): A neutral, expert organization designated by the Minister of Economy, Trade and Industry (METI). This Body oversees the process, confirms the debtor's eligibility, and appoints a case-specific "Confirmation and Investigation Officer." It is analogous to the role played by the Japanese Association of Turnaround Professionals in Turnaround ADR.

- Subject Creditors: The procedure is strictly limited to financial institutions and similar entities (e.g., banks, credit unions, loan servicers). It does not apply to trade creditors, employees, or tax authorities.

- The Court: The court plays a limited but crucial role. It does not supervise the entire process but has the power to:

- Issue stay orders to halt enforcement actions and foreclosure on collateral.

- Provide final approval (authorization) for a restructuring plan, making it legally binding on all financial creditors, including those who dissented.

III. The Restructuring Process Flow

- Application: The debtor applies to the Third-Party Body for assistance.

- Confirmation: The Third-Party Body confirms that the debtor meets the criteria, such as the necessity of a debt workout and a reasonable prospect of a successful turnaround.

- Standstill & Stay Orders: The Body requests a standstill from creditors. The debtor can also petition the court for a legally binding stay order to prevent individual creditors from taking enforcement actions or foreclosing on collateral, which is critical for stabilizing the business.

- Plan Formulation: The debtor prepares a property valuation, a business turnaround plan, and a "Right-Modification Proposal" (the restructuring plan).

- Creditors' Meeting and Vote: The proposal is put to a vote at a meeting of the financial creditors.

- Approval Threshold: The plan is approved with the consent of creditors representing three-quarters (3/4) of the total value of the voting debt.

- Voting Rights: Only the unsecured portion of the financial debt carries voting rights.

- Minority Protection: If a single creditor holds more than 3/4 of the debt, a "headcount" majority of the creditors present is also required for approval.

- Court Approval:

- If the vote is unanimous, court approval is not required, and the plan becomes effective immediately.

- If the vote passes with the required majority but is not unanimous, the debtor must seek approval from the court. The court will approve the plan unless there are procedural flaws or the plan is unfair (e.g., it violates the "liquidation value guarantee," meaning creditors would receive less than in a liquidation).

- Effectiveness: Once approved by the court, the plan becomes legally binding on all subject financial creditors, and their rights are modified accordingly.

IV. Comparison with Other Restructuring Procedures

V. Conclusion and Key Takeaways

The Early Business Turnaround Act provides a vital new tool for viable businesses struggling with financial debt. Its main strength is its ability to implement a restructuring plan without the unanimous consent of financial creditors, avoiding the need to enter a disruptive and public formal bankruptcy proceeding just to deal with a few holdouts.

However, the newsletter cautions that this procedure is not a universal solution. Because its scope is strictly limited to financial creditors, companies that also need to restructure their trade debts will still have to rely on traditional, fully consensual private workouts or resort to formal court-led proceedings. The exact scope of "financial institutions" and "loan claims" will be further defined in forthcoming METI ordinances.