Annual Report of the Financial Services Agency (FY2024)

The Financial Services Agency (FSA) has published its annual report for the administrative year from July 1, 2024, to June 30, 2025, providing a comprehensive (400+ pages) and transparent overview of its activities. It is intended to inform its stakeholders—including financial institutions, market participants, and the public—about the agency's organization, key policy initiatives, administrative operations, and international engagement.

The FSA is committed to fostering a stable and vibrant financial system that contributes to Japan's sustainable economic growth. The annual report details its efforts to achieve this mission through strategic policy planning, robust supervision, and active international cooperation. The activities of the Securities and Exchange Surveillance Commission (SESC) and the Certified Public Accountants and Auditing Oversight Board (CPAAOB) are detailed in their respective separate reports.

1. Organization and Administrative Operations

To navigate a rapidly evolving economic and technological landscape, the stability and reliability of Japan's financial system depend on a robust and agile administrative foundation. This section provides a comprehensive overview of the Financial Services Agency's organizational framework, strategic priorities, and operational governance. These foundational elements are essential for the effective implementation of its mandate and its ability to respond to the major challenges and opportunities facing the financial sector.

1.1. Organizational Framework of the FSA

The FSA's structure is designed to provide integrated and effective financial administration, ensuring stability and fostering innovation across all sectors.

I. History and Mandate

The FSA was established in July 2000 through the integration of the Financial Supervisory Agency and the Financial System Planning Bureau of the Ministry of Finance. In January 2001, it was restructured as an external bureau of the Cabinet Office. The agency's core mission is to conduct unified financial administration, encompassing planning, legislation, inspection, and supervision across the banking, insurance, and securities sectors. This integrated approach allows for consistent and cross-sectoral policymaking and oversight.

II. Organizational Structure

The agency is led by the Minister for Financial Services (特命担当大臣), or Minister of State for Special Missions, who is responsible for overseeing matters under the FSA's jurisdiction. The FSA's high-level structure consists of:

- Three Core Bureaus:

- Comprehensive Policy Bureau

- Planning and Market Bureau

- Supervision Bureau

- Key Councils and Committees:

- Securities and Exchange Surveillance Commission (SESC)

- Certified Public Accountants and Auditing Oversight Board (CPAAOB)

- Financial System Council

- Compulsory Automobile Liability Insurance Council

- Corporate Accounting Council

III. Human Capital

As of the end of the 2024 fiscal year, the FSA had a total staff of 1,659 personnel, comprising 1,654 general staff and 5 special staff members. To address key policy challenges, a net increase of 6 personnel is planned for the 2025 fiscal year. This strategic enhancement of the FSA's human capital is aimed at strengthening initiatives such as the "Asset Management Nation" plan and enhancing the supervision of insurance agencies.

Personnel Trends | 2024 Fiscal Year | 2025 Fiscal Year |

Planned Increase | 26 | 22 |

Reductions (Rationalization, etc.) | -10 | -16 |

Net Change | +16 | +6 |

Year-End Total | 1,654 | 1,660 |

1.2. 2024 Financial Administrative Policy: Strategic Priorities

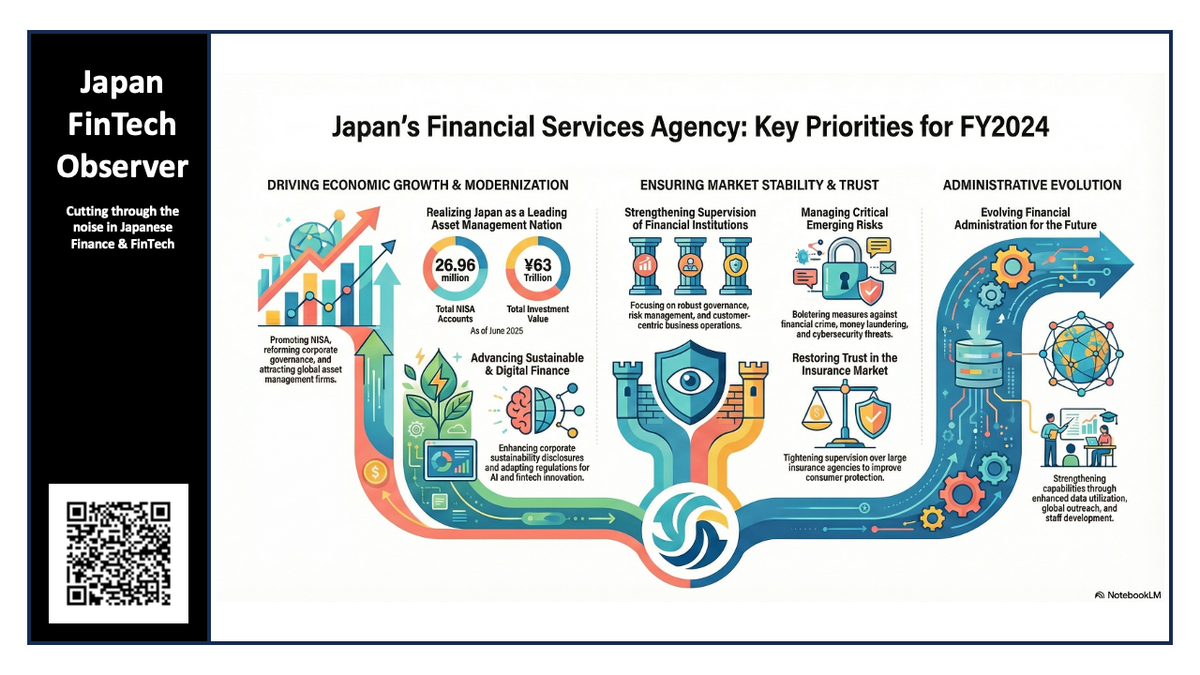

In August 2024, the FSA published its "2024 Financial Administrative Policy," which outlined the strategic direction. The policy is built upon three core pillars designed to foster economic growth, ensure financial system stability, and continuously evolve administrative capabilities.

I. Contributing to Sustainable Economic Growth through Financial Mechanisms

This pillar aims to reverse decades of stagnant household asset growth by creating a dynamic investment environment that channels capital toward corporate growth, thereby fostering a virtuous economic cycle. The FSA is leveraging financial mechanisms to achieve this goal.

- Realizing Japan as a Leading Asset Management Nation: The FSA is promoting the widespread adoption of the new Nippon Individual Savings Account (NISA) and advancing corporate governance reform to enhance corporate value. To attract overseas talent and capital, the FSA hosted "Japan Weeks" and is actively engaging in international outreach.

- Promoting Sustainable Finance: The FSA is encouraging enhanced corporate disclosure on sustainability and working to expand the practice of impact investing, which seeks both financial returns and positive social or environmental outcomes.

- Driving Financial Innovation: To adapt to technological change, the FSA is reviewing regulations governing payment and credit services. It is also developing discussion papers on the effective and sound utilization of Artificial Intelligence (AI) in the financial sector to foster responsible innovation.

II. Ensuring a Stable, Reliable, and High-Quality Financial System

This pillar underscores the FSA's focus on proactive risk management, moving beyond mere compliance to ensure the operational resilience of the financial system against both traditional and emerging threats. The FSA is committed to maintaining the integrity and quality of Japan's financial system to support individuals and businesses.

- Robust Supervision and Monitoring: The FSA closely monitors the governance and risk management frameworks of financial institutions to ensure their soundness and are enhancing supervision of group-wide business operations.

- Supporting Business Growth: The FSA is encouraging financial institutions to actively support business growth, including through Mergers and Acquisitions (M&A) support, to help companies adapt and expand.

- Customer-Centric Operations and Risk Management: The FSA is promoting customer-oriented business conduct and urging financial institutions to strengthen their defenses against emerging risks, including financial crime, money laundering, and cybersecurity threats.

III. Continuously Evolving and Deepening Financial Administration

This pillar reflects the FSA's recognition that in a rapidly changing world, the effectiveness of its external policies depends directly on the strength and adaptability of its internal organization. To meet these challenges, the FSA is dedicated to improving its own organizational capabilities.

- Enhancing Administrative Functions: The FSA is advancing its use of data analytics, strengthening policy communication to improve transparency, and enhancing collaboration with Local Finance Bureaus to ensure consistent administration nationwide.

- Bolstering Organizational Capacity: The FSA is investing in its staff through comprehensive development programs and fostering a productive and inclusive work environment that encourages initiative and autonomy.

1.3. Administrative Operations and Governance

The FSA's commitment to excellence is reflected in its internal operations, from personnel development to public engagement.

I. Organizational Revitalization and Personnel

The FSA actively incorporates external expertise to enhance its analytical and supervisory capabilities. As of March 1, 2025, a total of 384 external experts were employed.

Category of External Expert | Number of Personnel |

Lawyers | 50 |

Certified Public Accountants | 72 |

Real Estate Appraisers | 3 |

Actuaries | 11 |

Researchers | 1 |

Information Technology Specialists | 48 |

Financial Practitioners | 199 |

Total | 384 |

The FSA's personnel development initiatives include:

- Postgraduate Programs: In fiscal year 2024, 26 staff members were sent to domestic and international postgraduate programs to deepen their expertise.

- Secondments: As of March 1, 2025, 50 staff members were seconded to external organizations, including international bodies and private companies, to broaden their experience.

To ensure strict service discipline, the FSA took disciplinary action in 4 cases and issued corrective measures in 1 case during the administrative year. Following an insider trading incident in December 2024, the agency implemented comprehensive preventative measures, including enhanced ethics training and stricter rules on stock trading for relevant staff.

II. Research and Training

The Financial Research Center provides the theoretical foundation for the FSA's financial administration. In the 2024 administrative year, it published five discussion papers on key topics:

- The Regional Financial Market under the COVID-19 Pandemic

- Advancements in Evaluating Large Language Models in the Financial Domain and Efforts to Improve Accuracy with Retrieval-Augmented Generation

- A Study on the Current State of Impact Measurement and Management (IMM) and Its Future Direction from a Management Accounting Perspective

- The Significance and Content of the Enterprise Value Security Interest and Its Treatment under Bankruptcy Law

- A Survey of Overseas Systems for Insurance Agencies, Focusing on Large-Scale Independent Agencies

The FSA also conducted extensive training programs for its staff, covering mandatory courses, specialized professional training by department, language skills, and IT proficiency, reflecting its commitment to continuous learning.

III. Digital Government Initiatives

In line with the government's "Digital Government Medium- to Long-Term Plan," the FSA has advanced its digital transformation:

- Migrated its core operational environment to the Government Solution Service (GSS).

- Automated 3 new business processes using Robotic Process Automation (RPA), bringing the total to 20 automated processes.

- Digitized 71 new administrative procedures, for a total of 4,753 digitized procedures.

IV. Public Relations and Information Disclosure

The FSA is committed to transparency. During the year, the FSA held 103 ministerial press conferences and issued 655 press releases. Under the Act on Access to Information Held by Administrative Organs, it processed 153 disclosure requests in fiscal year 2024.

Information Disclosure Requests (FY2024) | Number of Cases |

Total Requests Received | 153 |

Full Disclosures | 12 |

Partial Disclosures | 46 |

V. Stakeholder Engagement and User Support

Constructive dialogue with market participants is vital. The FSA held regular opinion exchanges with various sectors, including major banks (11 times), regional banks (10 times), and insurance companies (5 times). The Financial Services User Consultation Office is the primary channel for public interaction, receiving a total of 48,257 inquiries in the fiscal year.

Public Inquiries (FY2024) | Number of Cases |

Questions/Consultations | 34,879 |

Opinions/Requests | 11,424 |

Information Provided | 1,358 |

Total | 48,257 |

VI. International Communication

To enhance the FSA's global outreach, it has strengthened its English-language communication by publishing translations of press conferences, the FSA Weekly Review, and key regulations. The English-language one-stop inquiry window handled 469 inquiries during the 2024 administrative year, providing a crucial point of contact for international stakeholders.

This robust organizational and operational foundation enables the FSA's core function of policy and legislative development.

2. Policy Planning and Legislative Initiatives

This section details the FSA's core policymaking activities during the 2024-2025 administrative year. Through these initiatives, the FSA is actively adapting Japan's financial system to global trends, fostering responsible innovation, and supporting the nation's broader economic growth strategies. Its work in this area provides the legal and regulatory framework for a sound and dynamic financial sector.

2.1. Enhancing Financial and Capital Markets

The FSA has advanced several initiatives to improve the quality, integrity, and international competitiveness of Japan's financial and capital markets.

I. Corporate Disclosure and Accounting Standards

- Improving Disclosure Quality: To promote best practices, the FSA published the "Collection of Good Practices in Disclosure 2024." It also conducted a comprehensive review of annual securities reports, with a particular focus on the newly mandated sustainability-related disclosure requirements.

- Mandatory Sustainability Disclosure: A clear roadmap has been established for the mandatory application of sustainability disclosure standards developed by the Sustainability Standards Board of Japan (SSBJ). The implementation will be phased:

- From the March 2027 fiscal term: Companies with a market capitalization of ¥3 trillion or more.

- From the March 2028 fiscal term: Companies with a market capitalization between ¥1 trillion and ¥3 trillion.

- From the March 2029 fiscal term: Companies with a market capitalization between ¥500 billion and ¥1 trillion.

- IFRS Adoption: The adoption of International Financial Reporting Standards (IFRS) continues to expand. As of June 2025, 303 listed companies have either adopted or are scheduled to adopt IFRS, representing 48.4% of the total market capitalization of listed companies.

- Global Audit Quality: The FSA continues to contribute to the improvement of global audit quality through its leadership role in the International Forum of Independent Audit Regulators (IFIAR).

II. Market Infrastructure and Development

- Regulatory Amendments: Key amendments were made to refine market rules, including a revision of the "Principles for Customer-Oriented Business Conduct" and an examination of regulations for Private Trading Systems (PTS).

- Market Accessibility: The FSA has supported ongoing efforts to enhance the Tokyo Stock Exchange's Growth Market and promote smaller investment lot sizes, making equity investment more accessible to a broader range of individuals.

- International Financial Center Initiatives: To establish Japan as a leading international financial hub, "Financial and Asset Management Special Zones" have been created in four key areas—Hokkaido/Sapporo, Tokyo, Osaka, and Fukuoka—to create internationally competitive ecosystems that attract global talent and capital. The "Base for Overseas Asset Managers," the FSA's one-stop support office, has continued to facilitate market entry, completing 9 new registrations in the past year, bringing the total to 47 since its launch in 2021.

2.2. Legislative Developments for Financial Institutions

During the administrative year, the FSA spearheaded critical legislative reforms to modernize regulatory frameworks and address emerging vulnerabilities across key sectors:

I. Insurance Business Act

Amendments were designed to strengthen the governance of large-scale insurance agencies and prohibit the provision of excessive benefits to policyholders. These measures aim to restore consumer trust in the insurance market.

II. Payment Services Act

Revisions were introduced to address rapid digitalization. This includes the creation of a registration system for crypto-asset brokers and the introduction of a domestic asset retention order for crypto-asset exchanges to enhance user protection.

III. Trust Business Act

Changes were made related to the regulation of public interest trusts.

IV. Act on Promotion of Business Finance

The FSA developed the necessary ordinances for the implementation of the new enterprise value security interest system, which is designed to facilitate financing based on a company's overall business value rather than traditional collateral.

2.3. Role in National Government Strategies

The FSA's policies are closely aligned with and contribute to major government-wide strategies, ensuring that the financial sector plays a pivotal role in achieving national objectives.

Government Plan | Key FSA Contributions |

"Grand Design and Action Plan for a New Form of Capitalism 2025" | Deepening of "Asset Management Nation" initiatives, enhancing corporate governance, and strengthening financial support for startups. |

"Basic Policy on Economic and Fiscal Management and Reform 2025" | Establishing lending practices that are not reliant on personal guarantees and strengthening the capabilities of regional financial institutions. |

"Digital Garden City Nation Comprehensive Strategy (2023 Revision)" | Strengthening human resource matching to support regional companies. |

"Priority Policy Program for Realizing a Digital Society" | Promoting Web3 technologies, expanding online inquiry services for deposit accounts, and driving the adoption of digital invoices. |

The "Asset Management Nation Realization Plan" is a central pillar of the FSA's efforts. This initiative has seen significant progress, particularly in the utilization of the NISA scheme. As of June 2025, there were 26.96 million NISA accounts with a total invested value of ¥63 trillion, substantially exceeding the government's target of ¥56 trillion.

Key tax reforms related to finance for the 2025 fiscal year were also introduced to support these goals:

- Enhancements to NISA convenience, such as allowing immediate purchasing of assets upon transferring an account between financial institutions.

- Expansion of the life insurance premium deduction for households with children under the age of 23.

2.4. Activities of Key Advisory Councils

The FSA's policy development is informed by robust discussion and analysis within its key deliberative bodies.

I. Financial System Council

The Council held three plenary meetings. Its working groups produced influential reports, including the "Report by the Working Group on Payment and Settlement Systems" (January 2025) and the "Report by the Working Group on Systems for the Non-Life Insurance Business" (December 2024).

II. Compulsory Automobile Liability Insurance Council

The Council held its 150th and 151st meetings. After reviewing the 2024 premium rate verification results, it concluded that no rate revision was necessary for the upcoming year.

III. Financial Services ADR/Financial Troubles Liaison and Coordination Council

The Council convened its 67th and 68th meetings to exchange information and discuss the operational status of designated dispute resolution organizations. From April 1, 2024, to March 31, 2025, these organizations accepted a total of 7,731 complaint cases and resolved 7,673.

These legislative and policy frameworks are not static principles; they are the active toolkit we deploy to supervise the market and safeguard its integrity, as detailed in the following section.

3. Supervisory and Monitoring Framework

This section details the FSA's role as the frontline defense against increasingly sophisticated systemic risks in a volatile global economy. Shifting from policy formulation to implementation, this section highlights the key cross-sectoral initiatives undertaken to ensure the stability of the financial system and protect consumers. The supervisory framework is designed to be dynamic, data-driven, and forward-looking in an environment of evolving risks—from cyber threats to climate change.

3.1. Modernizing Monitoring and Cross-Sectoral Supervision

The FSA has transitioned its supervisory approach to be more adaptive and effective in the modern financial landscape.

I. Dialogue-Oriented Monitoring

The FSA has moved from a traditional, manual-based inspection process to a more dynamic monitoring approach centered on substantive dialogue with financial institutions. To enhance transparency, the FSA has published a series of discussion papers detailing its "Approach and Progress" in supervising various risk areas.

II. Collaboration with the Bank of Japan

Building on their March 2021 agreement, the FSA continues to strengthen cooperation with the Bank of Japan. This includes coordinated inspections and unified regulatory reporting to reduce the burden on financial institutions and improve the efficiency of the FSA's oversight.

III. Data-Driven Supervision

The FSA is increasingly leveraging data to enhance its supervisory capabilities. This includes the publication of the "FSA Analytical Notes," which shares insights from its data analysis. A significant milestone will be the launch of full-scale data collection via the "Common Data Platform" in August 2025, which will further advance the FSA's ability to conduct risk-based supervision.

3.2. Addressing Emerging and Systemic Risks

The FSA's supervisory focus is sharpened on a range of emerging and systemic risks that pose a threat to financial stability and consumer trust.

I. Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT)

The FSA's comprehensive strategy in this critical area is detailed in the "Efforts and Challenges in AML/CFT and Financial Crime Countermeasures (June 2025)" report.

II. Cybersecurity and IT Governance

The FSA is working to bolster the financial sector's cyber resilience. The 2024 cross-industry cybersecurity drill, "Delta Wall IX," involved 170 participating financial institutions. The FSA is also advancing initiatives related to post-quantum cryptography (PQC) and engaging in dialogues on effective IT governance.

III. Economic Security

The FSA is implementing the framework for critical infrastructure protection under the Economic Security Promotion Act. From May 2024 to March 2025, it reviewed 33 prior notifications for the introduction of critical systems and 353 notifications for critical maintenance contracts.

IV. Climate-Related Financial Risks

The FSA is focused on ensuring that financial institutions appropriately manage climate-related risks. In June 2025, it published the second round of scenario analysis reports for the banking and insurance sectors, providing insights into potential impacts and resilience.

V. Customer-Oriented Business Conduct

The FSA's commitment to consumer protection is evidenced by its ongoing monitoring activities, as detailed in the "Monitoring Results on Customer-Oriented Business Conduct by Sellers and Originators of High-Risk Financial Products."

This domestic supervisory framework is continuously informed by and contributes to the FSA's engagement with the international community, ensuring its standards and practices remain aligned with global best practices.

4. International Engagement and Cooperation

In an interconnected global financial system, international engagement is a strategic necessity. The FSA actively participates in international forums and collaborates with foreign authorities to establish robust global standards, ensure financial stability, and promote Japan's financial markets on the world stage. The FSA's international activities are integral to maintaining a safe and competitive domestic financial environment in the face of cross-border challenges and opportunities.

4.1. Participation in Global Financial Forums

The FSA plays an active role in key multilateral organizations that shape the global financial architecture. Its engagement ensures that Japan's perspective is incorporated into international standard-setting and that the FSA remains at the forefront of global regulatory developments. Key forums include:

- G7 and G20: Participating in discussions among the world's leading economies on financial stability, sustainable finance, and digital innovation.

- Financial Stability Board (FSB): Contributing to the development and implementation of policies to address vulnerabilities in the global financial system.

- Basel Committee on Banking Supervision (BCBS): Working to strengthen the regulation, supervision, and risk management practices of banks worldwide.

- International Organization of Securities Commissions (IOSCO): Collaborating to set and enforce global standards for securities regulation to protect investors and ensure market integrity.

- International Association of Insurance Supervisors (IAIS): Engaging in the development of principles, standards, and guidance for the supervision of the insurance sector.

- Financial Action Task Force (FATF): Working to combat money laundering, terrorist financing, and the financing of proliferation of weapons of mass destruction.

- Other Key Bodies: We also actively participate in work undertaken by the Organisation for Economic Co-operation and Development (OECD) and the International Monetary Fund (IMF).

4.2. Bilateral and Regional Cooperation

In addition to its multilateral engagement, the FSA maintains strong relationships with counterpart authorities through direct dialogues and regional partnerships.

I. Economic Partnership Agrements

The FSA contributes to the financial services components of major agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Japan-EU Economic Partnership Agreement (EPA), to facilitate cross-border financial services.

II. Bilateral Dialogues

The FSA conducts regular high-level dialogues with regulatory authorities in key jurisdictions to share information, coordinate on supervisory matters, and discuss emerging trends. The primary dialogue partners include the United States, Europe, the United Kingdom, Switzerland, India, and South Korea.

III. Engagement with Emerging Economies

The FSA is focused on strengthening ties with emerging economies, particularly in Asia, to promote financial stability and cooperation across the region. The Global Financial Partnership Center (GLOPAC) plays a central role in this effort, providing technical assistance and capacity-building programs to counterpart authorities.

5. Concluding Remarks

The 2024-2025 administrative year was marked by the dedicated execution of the FSA's strategic priorities. The agency made significant strides in contributing to sustainable economic growth, most notably by advancing the "Asset Management Nation" initiative, which saw NISA investments surpass national targets and empower a new generation of investors.

The FSA has reinforced its commitment to ensuring a stable, reliable, and high-quality financial system by modernizing its supervisory framework, enhancing cybersecurity resilience across the industry, and spearheading legislative reforms to protect consumers and restore trust.

Finally, the FSA has continued its work to continuously evolve and deepen financial administration, strengthening its organizational capacity, advancing data-driven supervision, and expanding its international engagement.

Looking ahead, the FSA remains steadfast in its mission to foster a robust, innovative, and globally integrated financial system that protects consumers, empowers businesses, and supports Japan's sustainable economic growth.