ASUENE's Final Close of Series C2 Round and Second US M&A

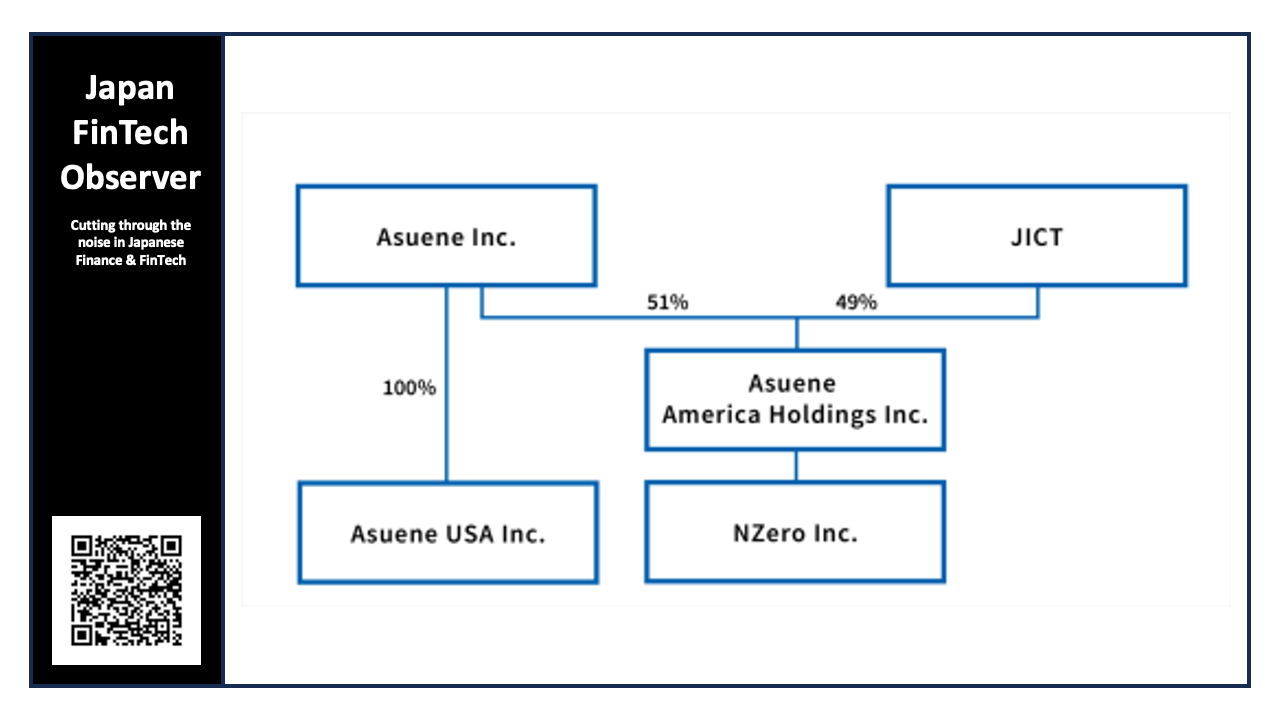

ASUENE has completed the acquisition of 100% of the shares and integration of Iconic Air, a U.S. company providing GHG visualization and methane leak management SaaS. Following NZero, this second M&A further accelerates the expansion of ASUENE's U.S. operations and strengthens our technological foundation.

Additionally, ASUENE has completed the final close of its Series C2 round through a third-party allocation of shares to new investors including JGC Mirai Investment (a CVC fund managed by Global Brain, with LPs: JGC Holdings and JGC Corporation) and SFV・GB No. 2 Investment Limited Partnership (LP: Sony Financial Ventures), as well as existing investor Sumitomo Mitsui Financial Group. Through this funding round, ASUENE raised 780 million yen through new share issuance in Series C2 and completed 2.2 billion yen in secondary transactions by existing shareholders. The cumulative funding now totals 11.5 billion yen. Through this capital and business alliance, ASUENE will strengthen business collaborations in both the energy and financial sectors.

Background of Iconic Air M&A

As global pressure to reduce greenhouse gases intensifies, GHG emissions and methane emission management have become urgent issues for the oil and gas industry. Methane has approximately 25 times the greenhouse effect of CO2, resulting in extremely high environmental impact when leaks occur. Additionally, strict rules have been introduced through the U.S. EPA's greenhouse gas emission reporting requirements and strengthened European regulations. Consequently, operators are strongly required to calculate, monitor, and report emissions in real-time with high accuracy. Against this backdrop, following the NZero M&A in May 2025, Iconic Air represents ASUENE's second U.S. M&A.

With Iconic Air joining ASUENE group, their business will be integrated with ASUENE's CO2 emission visualization and supply chain management capabilities. This will establish a comprehensive management system covering not only GHG visualization but also energy efficiency and equipment operation monitoring across all operations, enabling risk management support for companies seeking to balance environmental regulatory compliance with cost reduction.

Background and Objectives of Series C2 Round Final Close

In this Series C2 round final close, ASUENE welcomed JGC and Sony Financial Ventures as new investors—limited partners (LPs) in CVC funds managed by Global Brain—and received additional investment from Sumitomo Mitsui Financial Group, continuing from the Series C round. This strengthens ASUENE's decarbonization promotion framework from both energy and financial perspectives.

Sony Financial Ventures is a member of Sony Financial Group, which positions sustainability as one of its top management agenda items and operates diverse financial businesses. ASUENE is advancing discussions on data collaboration for green bonds promoted by its group and cooperation with the carbon credit and emissions trading platform "Carbon EX," aiming to support decarbonization for both corporations and individuals.

Through partnerships with both JGC and Sony Financial Ventures, ASUENE will accelerate domestic and international business development as a GX platform providing one-stop support from CO2 emission visualization to reduction, reporting, and financing support.

Under ASUENE's mission of "A Better World for the Next Generation," tehe group will continue to accelerate the realization of a decarbonized society in Japan, the United States, and globally.