B2C2 Launches PENNY for Instant, Zero-fee Stablecoin Swaps

SBI Holdings-owned B2C2, a global leader in institutional liquidity for digital assets, has launched PENNY, the industry’s first zero-fee stablecoin swap solution. As the number of different stablecoins grows worldwide—each with different issuers, blockchains, and redemption processes—institutions face mounting operational complexity in managing liquidity across this fragmented ecosystem.

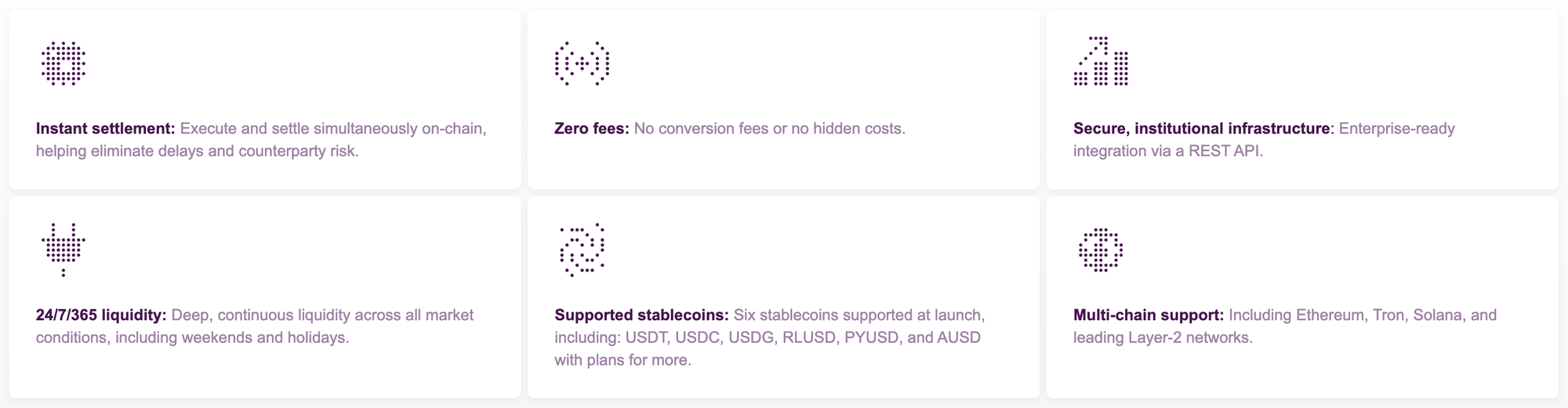

PENNY solves this challenge by enabling market participants, including banks and merchant acquirers, stablecoin infrastructure firms, money transfer organizations, and crypto exchanges, to instantly and automatically swap one stablecoin for another with no fees. Using B2C2's institutional-grade trading platform, trade execution and settlement happen simultaneously on-chain to help eliminate counterparty and operational risk.

"PENNY is a strategic step forward for B2C2," said Thomas Restout, Group CEO. "Stablecoins have outgrown the crypto trading use case. As traditional financial institutions and corporates increasingly adopt stablecoin payment rails, PENNY offers them valuable infrastructure for real-time execution and settlement, without the risks of network fragmentation or the friction and high costs of trading on exchanges."

The solution supports six stablecoins, including USDT, USDC, USDG, RLUSD, PYUSD, and AUSD across multiple blockchains—Ethereum, Tron, Solana, and leading Layer-2 networks. PENNY operates 24/7, providing continuous liquidity. Support for additional stablecoins will be added based on demand.

Stablecoin adoption expected to increase worldwide

New regulatory frameworks in the US, EU, and Asia have clarified rules for issuance and are accelerating stablecoin adoption. Furthermore, the technology to issue stablecoins has become more accessible, leading banks, payment companies, and other fintechs to consider launching their own versions to optimize money movement, treasury operations, and commerce. The stablecoin market cap is expected to rise from approximately $300 billion in 2025 to as much as $4.0 trillion by 2030, according to Citigroup.

B2C2: the trusted market leader for stablecoin liquidity

As one of the first liquidity providers in crypto, B2C2 has facilitated $2 trillion in digital asset trading volumes, providing reliable pricing even during periods of market volatility. B2C2 is one of the largest wholesale providers of stablecoin liquidity, processing $1 billion daily. Its global footprint includes regulated entities in the Americas, Europe, and APAC.