Barbarians at the Gate: Elliott Management & Tokyo Gas

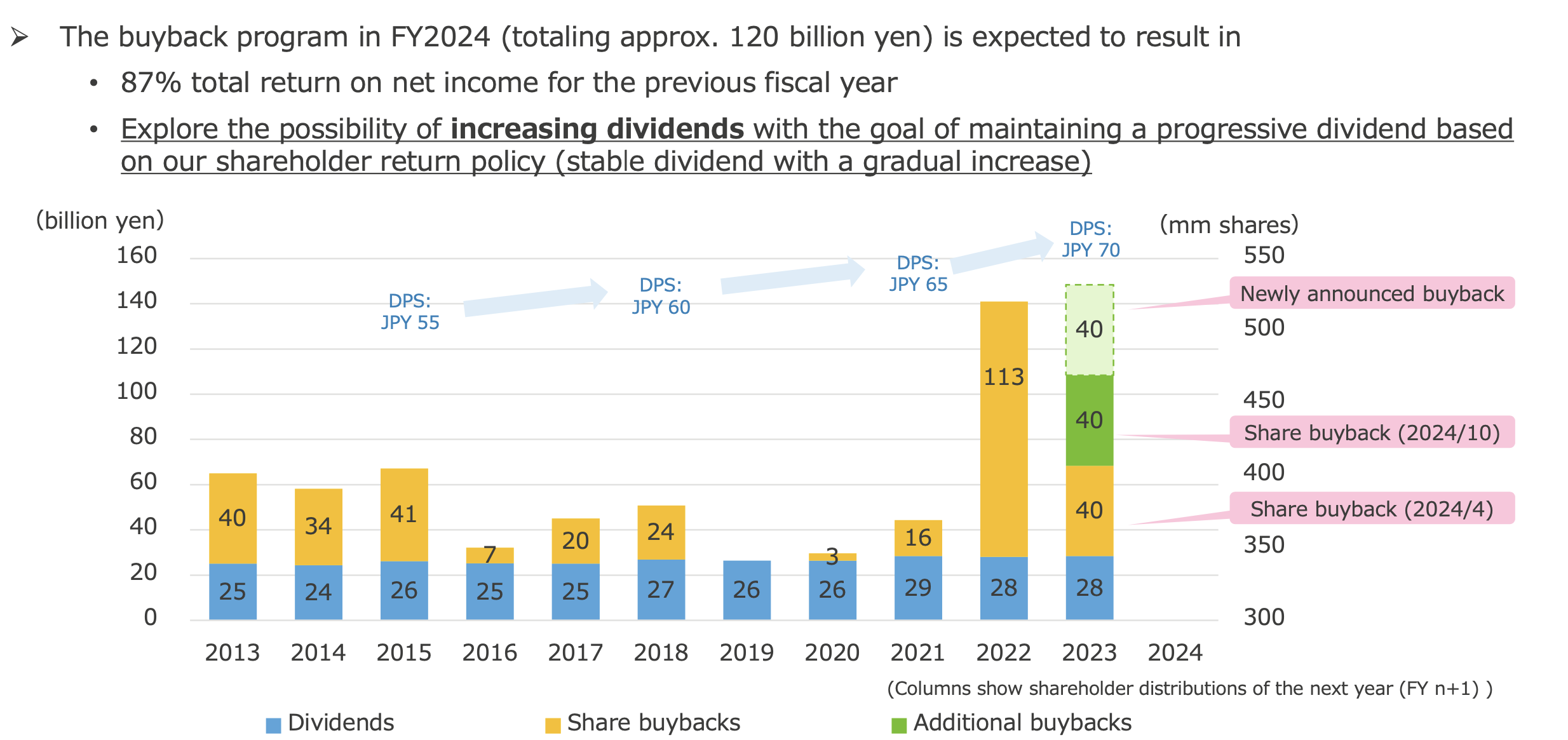

The combination of the Tokyo Stock Exchange's "management that is conscious of capital" policies, and active investors have led to record share buy-backs, and increased dividends during the 2024 calendar year.

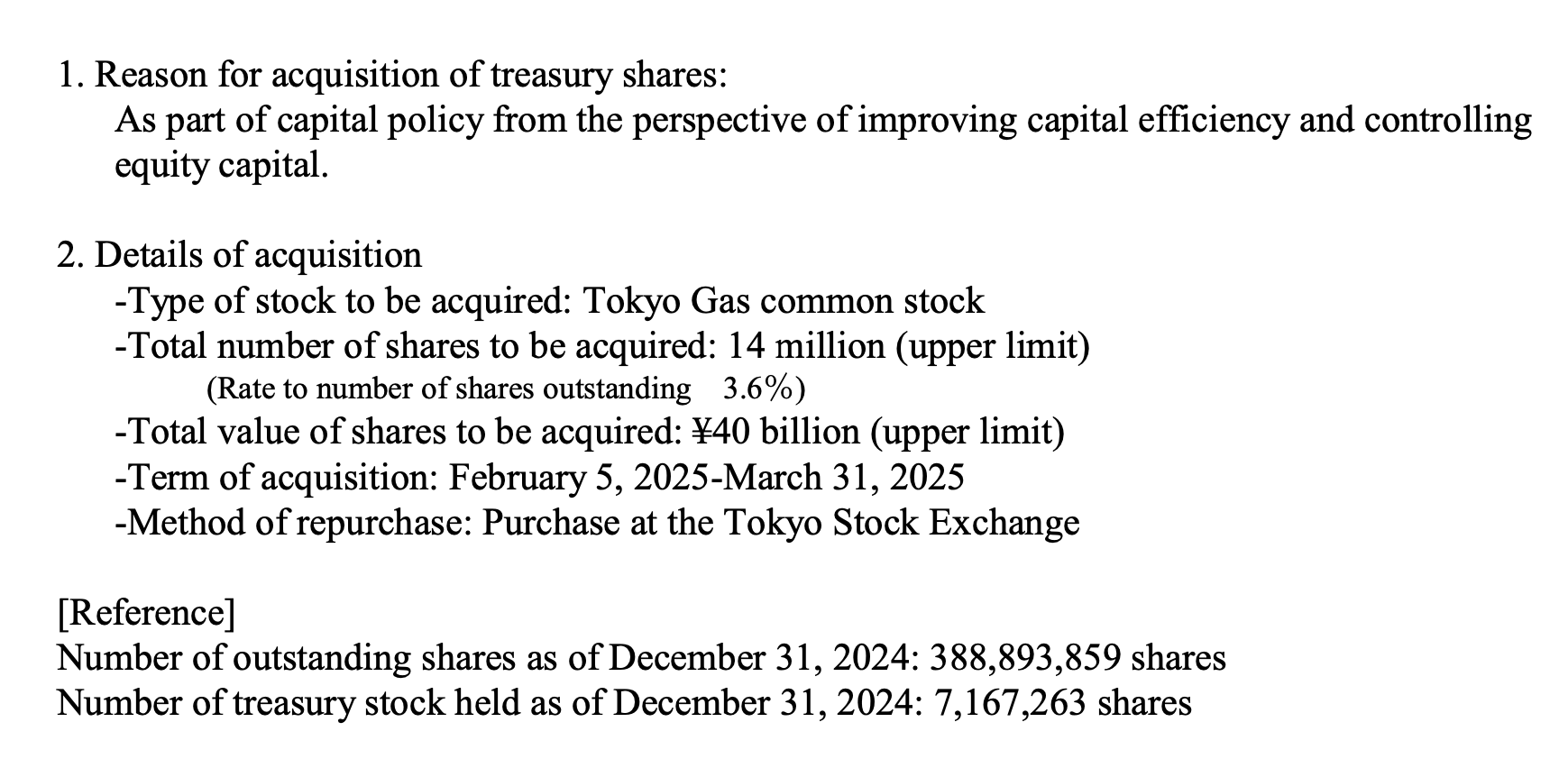

In response to Elliott Management, which had taken a 5.03% stake in Tokyo Gas in November 2024, Tokyo Gas has rolled out a share buyback plan totaling up to 40 billion yen, to be completed this fiscal year.

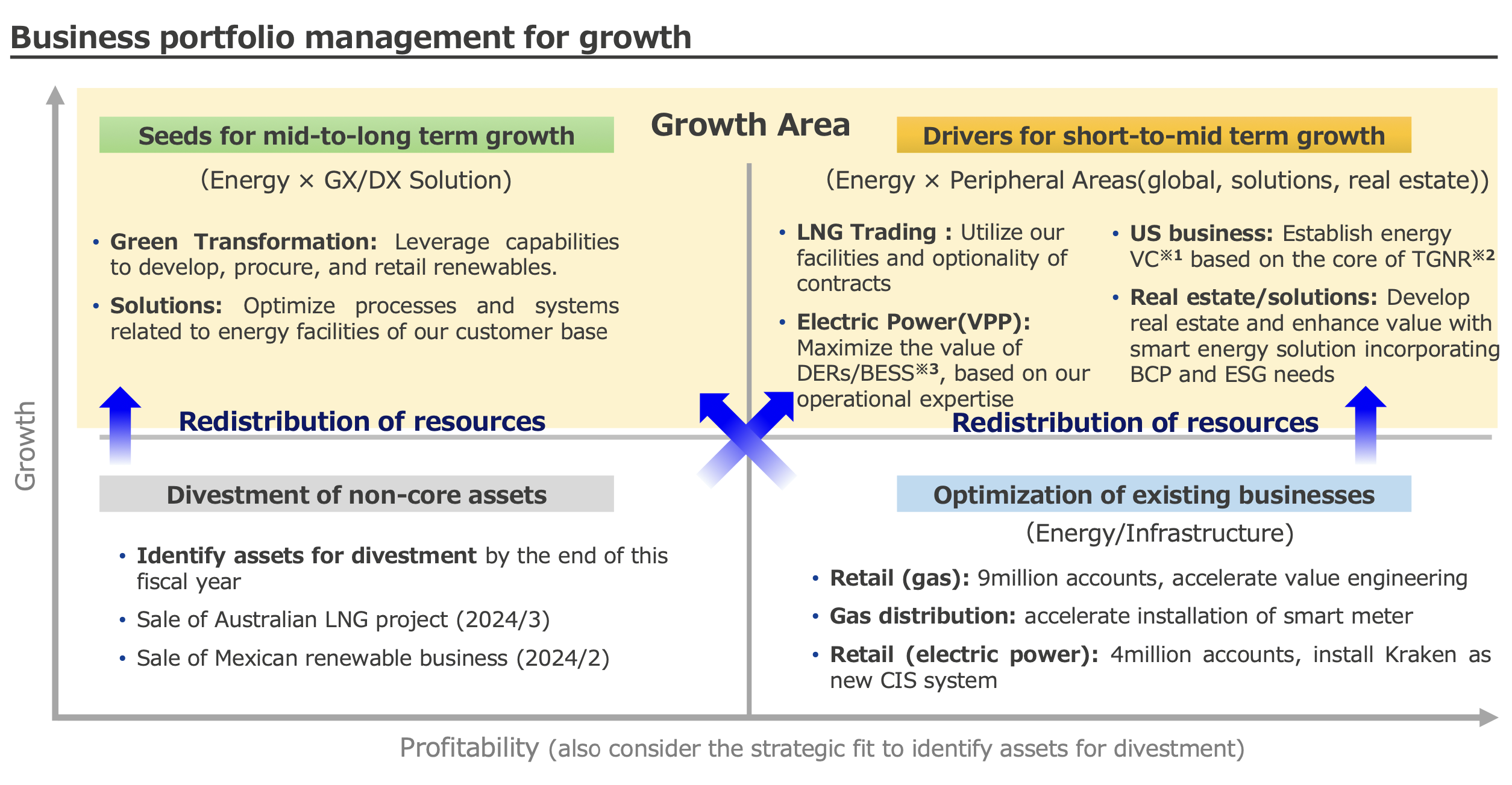

Overall, Tokyo Gas aims to be a leader in next generation energy systems while creating value with their customers, society and business partners (“Compass 2030”). They also aim to realize the above accompanied by earnings growth and increased capital efficiency through asset optimization (ROE of 10% around 2030).

The newly announced buyback program adds to 80 billion yen of buybacks already executed by April and October 2024, respectively, and 28 billion yen of dividends. (Please note that the horizontal axis is mis-labelled both in the Japanese and English version of the deck, it should be read as "+1", i.e. 2024 instead of 2023, and so forth).

Elliott Management responded to these plans on Sunday, February 2, 2025, as follows:

"We welcome Tokyo Gas's decision to expand its buyback program and implement additional measures to enhance capital efficiency and accelerate growth. We view these measures as meaningful first steps to unlock the substantial value embedded in Tokyo Gas's asset base, and we believe this plan demonstrates the Company's commitment towards value creation. We also support the establishment of the Corporate Value Enhancement Committee, and we anticipate the results of the Company's review of Tokyo Gas's non-core assets for divestment – including its extensive and underappreciated real estate holdings – to be announced at the comprehensive investor update in March. We look forward to continuing our engagement with the Company."

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.