BridgeWise Launches AI-Driven Stock Analysis With Rakuten Securities

Following the announcement of their strategic partnership in November 2024, BridgeWise and Rakuten Securities are launching their advanced StockWise equity analysis solution on Sunday, July 27, 2025. Rakuten Securities will provide its over 12 million customers with free access to cutting-edge investment insights for Japanese and U.S. equities, powered by BridgeWise’s proprietary AI platform.

This collaboration marks a significant milestone in BridgeWise’s expansion across Asia, and particularly in Japan, where investor appetite for transparent, data-driven decision-making tools is surging. Using its AI-powered StockWise solution, BridgeWise enables Rakuten Securities’ customers to access four new types of stock-level insights directly integrated into Rakuten’s existing platforms, including its web interface, “MARKETSPEED II®” desktop tool, and “iSPEED®” smartphone app.

This launch sets Rakuten Securities investors apart in the Japanese market, giving them unparalleled access to investment insights. As the Rakuten Securities and BridgeWise partnership matures, investors will reap the benefits of expanded coverage and additional best-in-class AI solutions, including advanced fund analysis, designed to bring institutional-grade insights to the everyday investor and trader.

Expanding Access to AI-Powered Stock Analysis

BridgeWise’s technology is built to transform raw financial disclosures into expert-level, explainable insights on over 37,000 global stocks in near real-time. By analyzing company filings and earnings reports across markets, BridgeWise generates intuitive outputs, including diverse data sets – such as fundamentals, technicals, and ESG factors – that investors can trust and act on. With this launch, Rakuten Securities users will now benefit from StockWise analyses, including:

- Fundamental Ratings – AI-generated performance outlooks for each stock over a 3–6 month horizon, based on deep analysis of corporate financials.

- Target Prices – Proprietary price targets reflecting the latest earnings data and market signals.

- Industry-Based Financial Comparisons – Clear, sector-relative evaluations across key financial indicators.

- Performance Metrics – Immediate breakdowns of post-earnings stock price reactions for context-driven decisions.

Each data point is refreshed continuously as new reports or material events are disclosed, ensuring that investors are equipped with timely and relevant information, no matter their level of experience.

Rakuten Securities Balance Display Now Available on "Mizuho Direct App"

In other news, Rakuten Securities and Mizuho Bank announced that starting Monday, July 28, 2025, the "Mizuho Direct App," a smartphone application that enables balance inquiries and transfers for Mizuho Bank, will add a new feature allowing display of asset balances and investment gains/losses held in Rakuten Securities comprehensive accounts.

With this update, the "Mizuho Direct App" will newly enable display of asset balances held in Rakuten Securities comprehensive accounts. This will allow Mizuho Bank customers to easily check the status of their financial assets held at Rakuten Securities within the "Mizuho Direct App," alongside their Mizuho Bank balances in a comprehensive view. Additionally, customers can check not only the total deposited assets at Rakuten Securities, but also balances and investment gains/losses by product category, including investment trusts and domestic stocks.

Customers who already have accounts with both Mizuho Bank and Rakuten Securities will be able to display Rakuten Securities balances and investment gains/losses on the home screen after logging into the app, following the integration procedure on the "Mizuho Direct App." They will also be able to check balances and investment performance by product category. Mizuho Bank customers who do not have a Rakuten Securities account can apply to open a Rakuten Securities account through the "Mizuho Direct App."

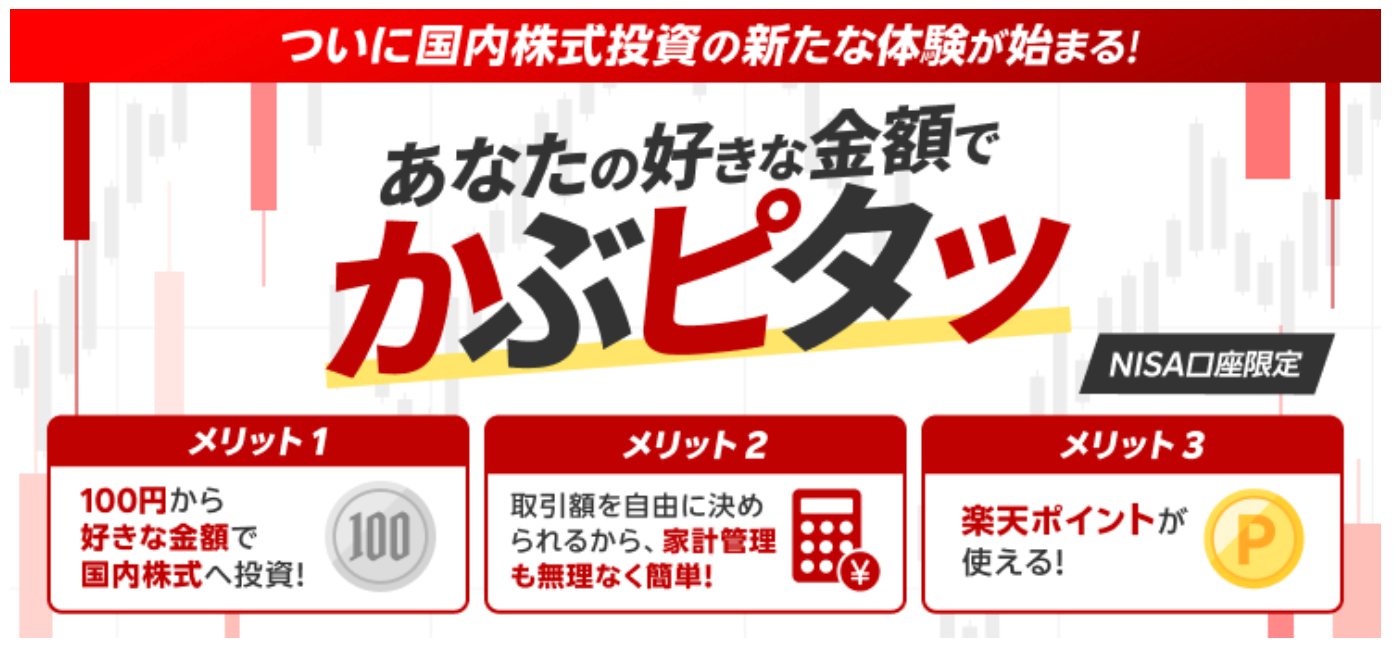

Rakuten Securities Launched "Kabu Pitta" Service

Lastly, Rakuten Securities has launched the domestic stock "Kabu Pitta" service. "Kabu Pitta" is an industry-first service that allows trading of domestic stocks from 100 yen in 1-yen increments with specified amounts and zero trading fees. Rakuten Securities has first begun the service with opening transactions in NISA accounts, with plans to further expand services in the future.

Through "Kabu Pitta", it becomes possible to use up the NISA growth investment framework limit of 2.4 million yen annually without waste. Additionally, since the amount used for investment and asset building from customers' total assets becomes clear, household budget management also becomes easier. Even with less than one share, dividends proportional to holdings can be received, and for whole share portions, shareholder benefits and voting rights are also obtained.

Initially, "Kabu Pitta" handles 829 domestic stocks. The number of handled issues is planned to be gradually expanded in the future.