CBDC Insights: Digital Euro and Japan’s Approach

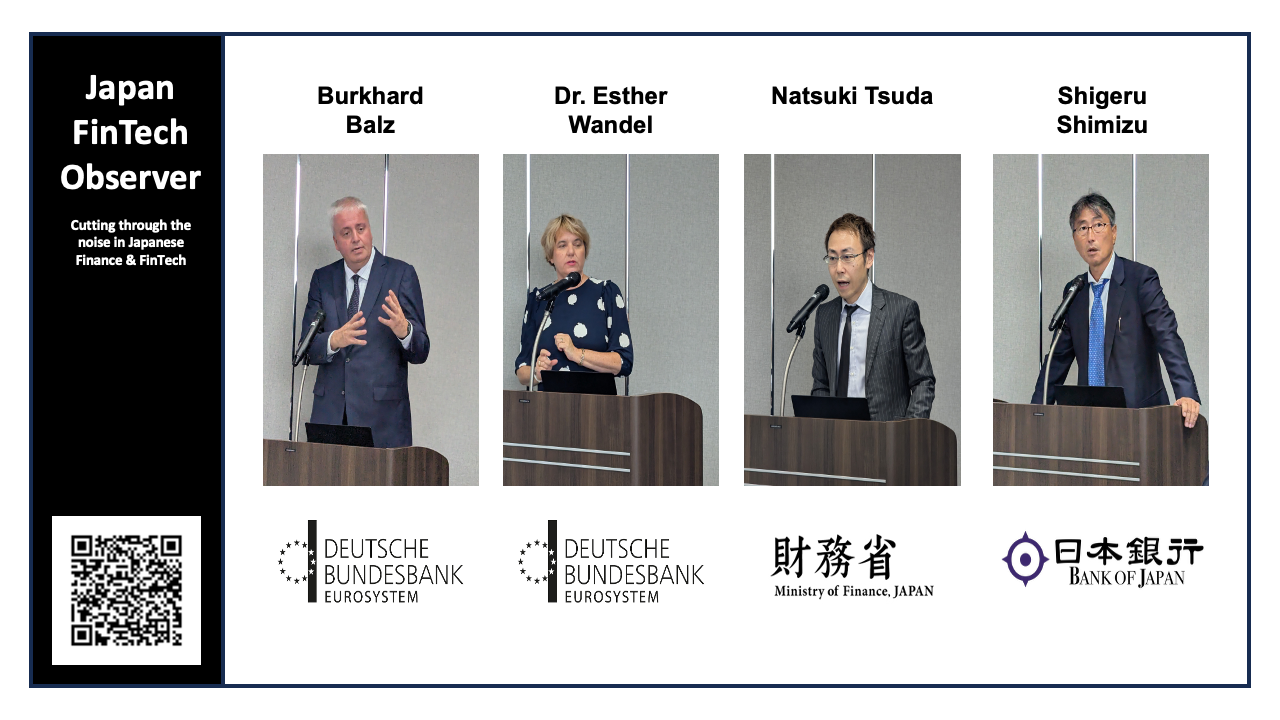

The Deutsche Bundesbank Representative Office, jointly with Japan's Ministry of Finance and the Bank of Japan, held an event titled "CBDC Insights: Digital Euro and Japan's Approach" on Thursday, September 11, 2025, on the occasion of Burkhard Balz's visit, the board member responsible for cash management, payments and settlement systems, the digital Euro, and the Centre for International Central Bank Dialogue. Overall, we identified the following key takeaways:

- Strategic Autonomy is a Core Driver for Europe: A primary motivation for the Digital Euro is to reduce Europe's heavy reliance on non-European (primarily US-based) payment providers, which process approximately 60% of the region's card payments. The Digital Euro aims to provide a sovereign, resilient, and pan-European payment infrastructure.

- Coexistence, Not Replacement: All speakers emphasized that a retail Central Bank Digital Currency (CBDC) is intended to be a "digital twin of cash" that coexists with physical cash and private payment solutions, not replace them. It aims to ensure that public money remains an anchor in an increasingly digital financial system.

- Public-Private Partnership is Essential: Both the European and Japanese projects are structured as a "happy marriage" between the public and private sectors. Central banks will issue the CBDC and manage the core ledger, while private intermediaries (like banks and payment service providers) will handle distribution, customer-facing services (wallets, apps), and KYC/AML obligations.

- Key Design Challenges are Universal: Both projects are grappling with the same core design challenges: ensuring user privacy while complying with anti-money laundering regulations, and implementing safeguards (like holding limits) to prevent bank disintermediation and ensure financial stability.

- Japan's Focus is on Addressing Fragmentation and Cost: While Europe's push is largely strategic, Japan's exploration of a CBDC is also driven by the need to address a fragmented domestic payment landscape (with many competing QR codes and loyalty schemes) and the high cost of card payments for small merchants.

- Cross-Border Interoperability is a Long-Term Goal: While the initial focus is on domestic retail use, all parties see the potential for CBDCs to make cross-border payments more efficient. This will require significant international coordination on technical standards and policy frameworks, with projects like the BIS's Project Agora being a key step.

From here, we provide a deeper dive into the individual presentations and the panel discussion.

Opening Keynote: The Digital Euro

Speaker: Burkhard Balz, Member of the Executive Board, Deutsche Bundesbank

Burkhard Balz delivered the keynote address, framing the Digital Euro project as a crucial step towards Europe's strategic autonomy in payments.

- Motivation: Balz highlighted Europe's significant dependency on non-European payment providers, noting that this poses a risk to the region's economic and political sovereignty. The goal is to create a future-proof, sovereign, and trustworthy European payment infrastructure.

- A Digital Twin of Cash: The Digital Euro is envisioned as a "digital twin of cash." Like cash, it will be a direct liability of the central bank (fail-safe), free of charge for end-users, and offer a high degree of privacy. It will also support offline payments to a limited extent, ensuring functionality even during internet or power outages.

- All-in-One Solution: Unlike the fragmented payment landscape in Europe, where different solutions exist for point-of-sale, e-commerce, and peer-to-peer payments, the Digital Euro aims to be a single, seamless solution that works across all use cases and borders within the Euro area.

- Timeline and Approach: The project is in a multi-year preparation phase. Balz anticipates a gradual introduction, stating it would not be earlier than 2028, pending the completion of the necessary legislative process by European co-legislators.

CBDC in the Eurosystem: perspectives and state of play of the digital Euro

Speaker: Dr Esther Wandel, Deputy Director General, Digital Euro, Deutsche Bundesbank

Esther Wandel provided a more detailed overview of the Digital Euro's design and legal framework.

- Legal Foundation: The project requires a legal act from European legislators. A proposal was made in June 2023, which establishes key features. A crucial element is that the Digital Euro will have legal tender status, meaning it must be accepted by all merchants in the Eurozone.

- Design Features:

- Privacy by Design: The Eurosystem will not be able to see personal data; it will only manage a pseudonymous ledger.

- Holding Limits: To prevent large-scale deposit shifts from commercial banks to the central bank (especially during a crisis), there will be a holding limit on how much Digital Euro an individual can have in their wallet. A "waterfall" function will automatically transfer any excess funds back to the user's linked commercial bank account.

- Free for Basic Use: The Digital Euro will be free for basic use by consumers.

- Compensation Model: Intermediaries (PSPs, banks) will be compensated for distributing the Digital Euro to ensure a viable business model for the private sector.

- Current Status: The project is currently in the "preparation phase," focusing on finalizing the rulebook and selecting providers to develop the platform and infrastructure.

Policy foundation for CBDC in Japan

Speaker: Natsuki Tsuda, Director, Regional Financial Cooperation, Ministry of Finance Japan

Natsuki Tsuda outlined the current payment landscape in Japan and the government's approach to exploring a CBDC.

- Payment Landscape in Japan: While cashless payments are growing (reaching the 40% in 2025), Japan remains a cash-heavy society. The growth in cashless payments is driven heavily by credit cards and, increasingly, QR code payments. A unique feature of the Japanese market is the powerful incentive of loyalty points and rewards offered by private providers.

- Friction and Fragmentation: The payment system faces challenges, including high merchant discount rates for card payments (2-3%) that burden small shops, and fragmentation from numerous competing payment instruments that lack interoperability.

- Joint Exploratory Approach: The Government of Japan and the Bank of Japan are taking a joint, cautious approach. They are currently exploring the design of a potential retail CBDC but have not yet made a decision to issue one. This exploration involves a liaison meeting with 15 different ministries to discuss policy implications.

- Open Questions: Key questions being addressed include identifying the appropriate role for intermediaries, establishing safeguards against risks like bank disintermediation, and ensuring robust data protection and privacy.

CBDC Experiments Progress on the Pilot Program in Japan

Speaker: Shigeru Shimizu, Deputy Director General, Payment and Settlement Systems, Bank of Japan

Shigeru Shimizu detailed the technical progress of the Bank of Japan's (BOJ) CBDC pilot program.

- Core Features: The BOJ has identified five core features that a potential CBDC must have: universal access, security, resilience, instant payment capability, and interoperability.

- Pilot Program: The pilot program, which began in April 2023, aims to test the end-to-end process flow and connect with external systems.

- Performance: The pilot system has successfully processed 50,000 transactions per second (TPS), consisting of 10,000 write transactions and 40,000 read-only transactions.

- CBDC Forum: To ensure a collaborative "happy marriage," the BOJ established a CBDC Forum with over 60 private sector entities. This forum discusses practical issues across seven working groups covering topics like connection methods, value-added services, and KYC.

- Privacy Architecture: A key design choice is the separation of data. The BOJ's central ledger would be pseudonymous (linking transactions to account numbers), while private intermediaries would hold the personal information connecting those account numbers to real identities. This ensures the central bank does not hold personally identifiable transaction data.

Panel Discussion

Moderator: Professor Shuji Kobayakawa

Panelists: Esther Wandel, Shigeru Shimizu, Natsuki Tsuda

The panel discussion explored the motivations, challenges, and future of CBDCs in Europe and Japan.

- On Use Cases and Technical Challenges:

- Shimizu emphasized covering all three main use cases: peer-to-peer, point-of-sale, and e-commerce.

- Wandel agreed, adding that the offline function is a particularly important use case for resilience and inclusion.

- Tsuda noted that a CBDC could address market failures (like high merchant fees) and serve as a platform for further private sector innovation.

- On the Role of Stablecoins and Tokenized Deposits:

- Wandel expressed concern that widespread use of unbacked stablecoins could create financial stability risks and fragment the monetary system. She stressed that any private digital money must be robustly regulated and anchored to central bank money.

- Tsuda acknowledged the potential benefits of stablecoins for cross-border payments but also highlighted the risk of currency substitution, especially in emerging economies.

- Shimizu concluded that while various forms of private digital money will emerge, a CBDC is essential to provide a secure public anchor for the entire system.

- On "Crowding Out" the Private Sector:

- All panelists rejected the idea that CBDCs would crowd out private innovation. They reiterated the "happy marriage" concept, where the central bank provides the core infrastructure and private companies build innovative, customer-facing services on top of it. Wandel noted the Digital Euro would be a "no-frills" product, leaving room for private firms to offer premium features.

- On CBDCs vs. Fast Payment Systems:

- When asked why a CBDC is needed when fast payment systems (like India's UPI) exist, the panelists explained they serve different purposes. While fast payment systems improve the efficiency of moving commercial bank money, a CBDC is a form of public central bank money itself, offering ultimate safety and finality. The Indian Reserve Bank Governor's response to this question was cited: "Why not have both?"