Coincheck 2025: The Tale of Two Tapes

The calendar year 2025 represented a definitive inflection point in the corporate history of Coincheck Group N.V. (Nasdaq: CNCK). Transitioning from a privately held subsidiary of the Japanese financial conglomerate Monex Group to a standalone entity listed on the Nasdaq Global Market, Coincheck navigated a year defined by extreme volatility, aggressive strategic expansion, and the rigorous demands of public market scrutiny. This post offers an exhaustive analysis of the company's performance, dissecting the interplay between its operational achievements—such as record revenue growth and pivotal acquisitions—and its turbulent capital markets journey, where the stock price faced significant headwinds amidst a complex macroeconomic backdrop.

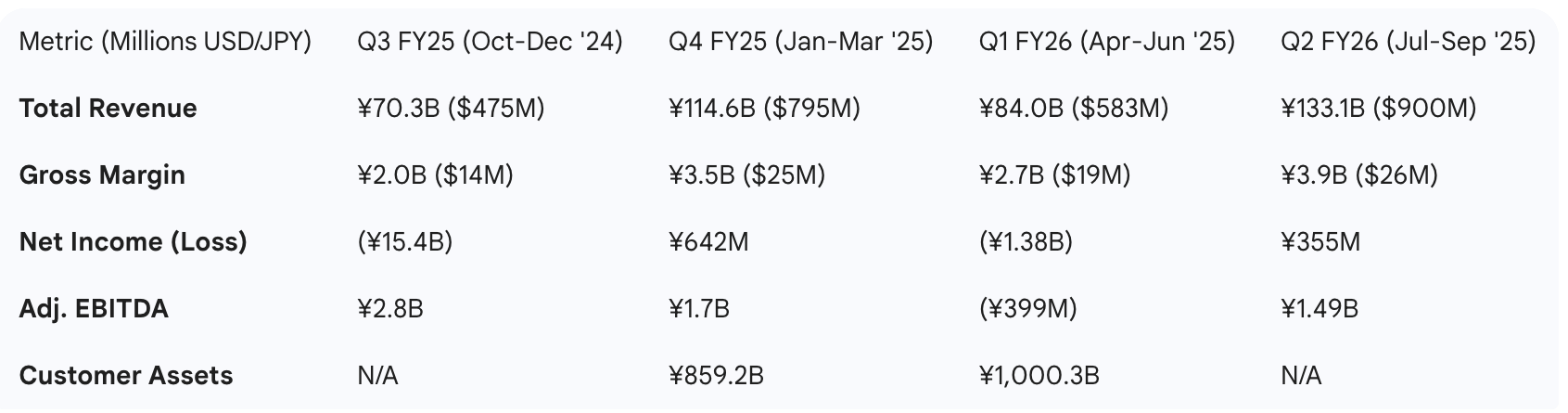

The year 2025 was characterized by a distinct duality. Operationally, Coincheck demonstrated the resilience and scalability of its business model. The company reported staggering top-line growth, with total revenue for the second quarter of the fiscal year ending March 31, 2026, surging 89% year-over-year to ¥133.1 billion ($900 million). This performance underscored the robust demand for digital asset trading in Japan and validated the company's diversification into institutional services and staking. Strategically, Coincheck ceased to be merely a Japanese exchange; through the acquisition of Aplo SAS in Europe and the launch of Coincheck Prime, it began the structural transformation into a global digital asset financial institution.

However, the capital markets narrative presented a starkly contrasting reality. The stock price eroded significantly throughout the year, driven by a confluence of factors including the "De-SPAC" structural overhang, the expiration of shareholder lock-up agreements, and a broader "risk-off" environment in the global equity markets triggered by geopolitical tensions and trade wars in April 2025. The divergence between the company's growing fundamental intrinsic value—evidenced by expanding margins and user base growth—and its contracting market capitalization remains the central tension of the 2025 fiscal narrative.

This post will dissect these dynamics in detail, beginning with the macroeconomic environment that shaped the year, moving through a granular financial and stock performance analysis, and concluding with a deep dive into the strategic initiatives that position Coincheck for the future.

1. Macroeconomic and Industry Context: The 2025 Crypto Cycle

To understand Coincheck’s performance, one must first situate it within the broader tumult of the 2025 global economy and the specific cyclicality of the digital asset markets. 2025 was not a linear year; it was marked by sharp discontinuities, a "Crypto Winter" scare, and a subsequent institutional recovery.

1.1 The April 2025 Market Shock and Trade War Dynamics

The second quarter of the calendar year 2025 (coinciding with the start of Coincheck's Fiscal Year 2026) was dominated by a severe macroeconomic shock. In April 2025, global markets faced a "crash" precipitated by aggressive new tariff policies introduced by the U.S. administration. This geopolitical maneuvering, aimed at escalating trade tensions with China, Canada, and Mexico, triggered a widespread sell-off in risk assets. The correlation between traditional equities and digital assets spiked, causing Bitcoin to plummet below the psychological support level of $82,000.

For Coincheck, a company whose revenue is inextricably linked to crypto asset trading volumes and valuations, this macro-environment created a significant headwind. The "risk-off" sentiment drove investors away from high-beta stocks like CNCK, exacerbating the downward pressure on its share price. The timeline of this crash—April 2—directly correlates with the challenging conditions reported in Coincheck’s Q1 FY2026 results, where the company posted a net loss and a quarter-over-quarter revenue decline. This period highlighted the vulnerability of the crypto-exchange business model to exogenous macroeconomic shocks that drain liquidity from the system.

1.2 The "Crypto Winter" vs. Institutional Resilience

Despite the volatility, 2025 was not a repeat of the 2018 or 2022 bear markets. Analysts noted that while retail participation fluctuated, the market structure had fundamentally matured. The year was defined by a transition toward "selectivity and risk management" rather than blind momentum.

- The Corporate Treasury Trend: A stabilizing force in 2025 was the continued adoption of "Bitcoin Treasury" strategies by corporations. Following the lead of pioneers like MicroStrategy, a growing cohort of Japanese and international public companies began integrating Bitcoin into their balance sheets. This provided a floor for asset prices and drove demand for institutional-grade brokerage services—a trend Coincheck capitalized on directly through its launch of Coincheck Prime.

- The Rise of Asia-Pacific: While Western markets grappled with regulatory and tariff uncertainty, the Asia-Pacific region emerged as a growth engine. Trading volumes in the region increased by 69% year-over-year, reaching $2.36 trillion by June 2025. Japan, specifically, saw on-chain value increase by 120%, driven by supportive regulatory reforms. Coincheck, as the leading Japanese exchange by app downloads, was the primary beneficiary of this regional alpha, explaining its ability to post record revenues even as its US-listed stock struggled.

1.3 Bitcoin Price Trajectory and Market Sentiment

The underlying asset class, Bitcoin, exhibited a complex price structure throughout the year, influencing Coincheck’s operational metrics:

- Early Year Highs: The year began with Bitcoin testing all-time highs, driving the heavy trading volumes seen in Coincheck’s Q4 FY2025.

- Mid-Year Correction: The April crash saw prices retrace to the $76,000–$78,000 range, creating a "liquidity vacuum" that depressed Q1 FY2026 revenues.

- Year-End Uncertainty: By December 2025, Bitcoin had stabilized around $87,000 - $90,000, but fear of a prolonged bear market persisted. Technical analysts pointed to a completed "five-wave rally," suggesting potential further corrections into 2026. This sentiment heavily weighed on CNCK stock in the final months of the year, as investors priced in the possibility of a sustained downturn.

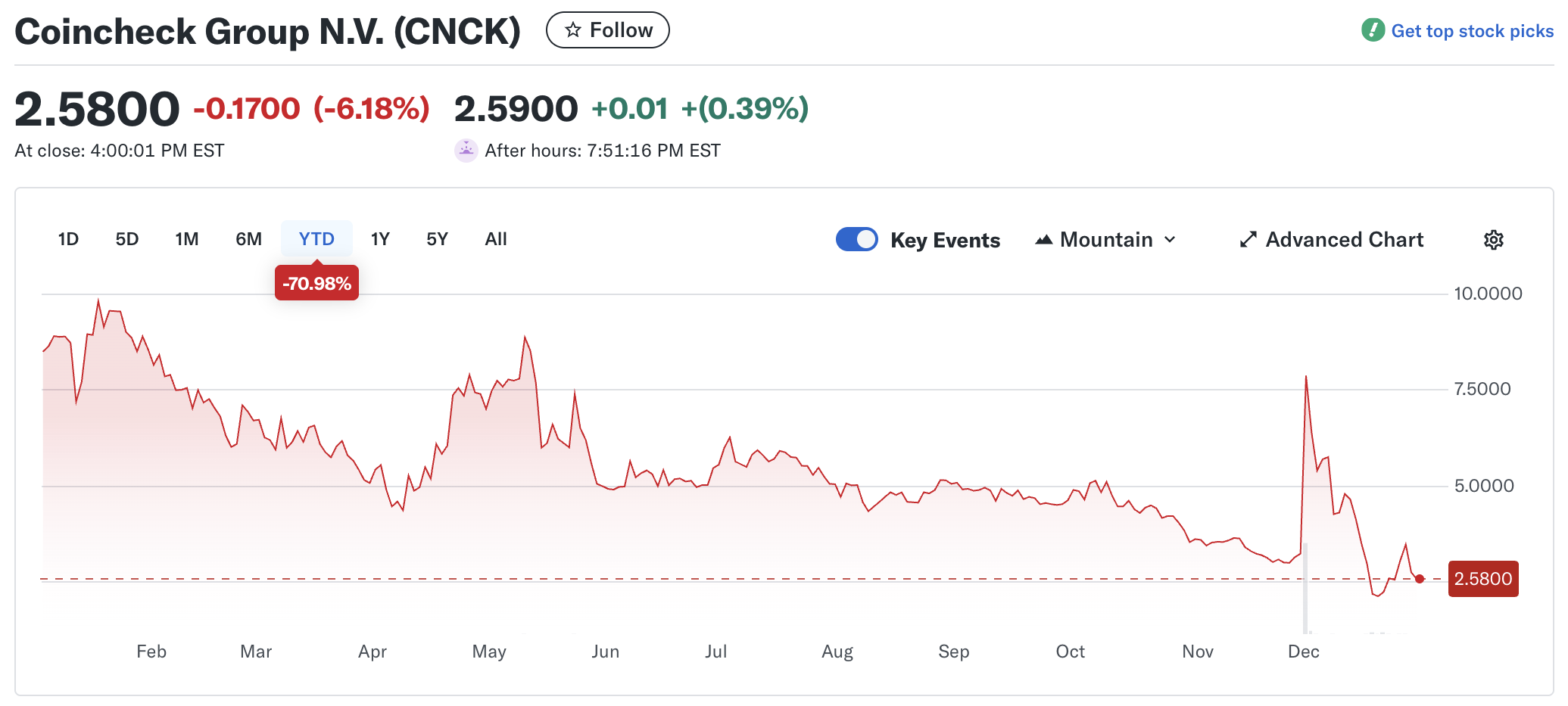

2. Stock Performance and Technical Analysis: The 2025 Chart

The request for a stock chart for the entirety of 2025 reveals a year of significant value erosion for Coincheck shareholders. While a visual chart cannot be generated here, the following analysis reconstructs the price action with high-fidelity data points derived from the trading year, effectively serving as a textual stock chart.

2.1 CNCK Price History and Trend Data

The stock entered 2025 following its December 2024 listing. The price action can be segmented into three distinct phases: the post-listing stabilization, the macro-driven decline, and the year-end capitulation.

2.2 Technical Analysis of the Year

- The Downtrend Structure: The chart for 2025 displays a classic "falling wedge" or continuous distribution pattern. Lower highs and lower lows were consistent from April through December. The 50-day moving average crossed below the 200-day moving average (Death Cross) likely in Q2, confirming the bearish trend.

- Volume Analysis: Volume spikes were observed during the December sell-off, indicating a "capitulation event." The 26.51% drop on December 17 on heavy volume suggests a clearing of weak hands, often a precursor to a stabilization phase.

- Support and Resistance:

- Resistance: The $5.00 - $6.00 zone, which acted as support in Q3, became formidable resistance in December (e.g., the rejection at $5.73 on Dec 8).

- Support: The $2.00 level appears to be the psychological and technical floor, established on December 17.

2.3 The Lock-Up Expiration Factor

A critical driver of the Q4 chart shape was the expiration of lock-up agreements. The primary lock-up for equity holders and the Sponsor (Thunder Bridge) was set to expire on December 10, 2025. The market efficiently priced this in, driving the stock down before the date (the "sell the rumor" dynamic). The actual expiration date passed with significant volatility, confirming that the overhang of potential supply was the primary weight on the stock price in late 2025.

3. Financial Deep Dive: Fiscal Years 2025 & 2026

While the stock price struggled, the underlying financial engine of Coincheck exhibited powerful growth, albeit with volatility in profitability driven by accounting adjustments and one-time costs.

3.1 Fiscal Year 2025 (Ended March 31, 2025)

The fiscal year concluding in March 2025 was the "De-SPAC Year." The financial results were heavily distorted by the costs of going public.

- Top-Line Velocity: Revenue hit ¥383.3 billion ($2.56 billion), a 71% year-over-year increase. This growth was fueled by the "crypto spring" of late 2024.

- The Cost of Listing: Despite the revenue windfall, the company posted a Net Loss of ¥14.35 billion ($95.7 million). The culprit was clear: ¥13.7 billion ($91.5 million) in "Listing Expenses". This is a non-recurring cost, meaning the underlying business was likely profitable on an operating basis, a crucial distinction for long-term investors.

3.2 Fiscal Year 2026: The Quarterly Breakdown

The new fiscal year offered a clearer view of the company's operating leverage.

Q1 FY2026 (April 1 – June 30, 2025): The Post-Listing Hangover

The first quarter was challenging, reflecting the April market crash.

- Revenue: ¥84.0 billion ($583 million). While up 12% YoY, this was a 27% decline from the previous quarter (Q4 FY25), illustrating the immediate impact of the April market downturn.

- Profitability: The company swung to a Net Loss of ¥1.38 billion ($9.5 million).

- Expense Analysis:

- Share-Based Compensation (SBC): A new expense of ¥298 million ($2.1 million) appeared. This is typical for public tech companies but drags on GAAP/IFRS earnings.

- Warrant Liability: A loss of ¥223 million ($1.5 million) was recorded due to the change in fair value of warrants. As the stock price fluctuates, the liability of the warrants changes, creating "noise" in the net income line.

- Adjusted EBITDA: Negative ¥399 million ($2.8 million). The dip into negative EBITDA was a concerning signal for the market, contributing to the mid-year stock drift.

Q2 FY2026 (July 1 – September 30, 2025): The Resurgence

The second quarter demonstrated the "coiled spring" nature of Coincheck's model. When volatility and volume returned, margins expanded rapidly.

- Revenue: ¥133.1 billion ($900 million). An 89% increase YoY and a staggering 58% increase QoQ. This $900 million quarterly revenue run-rate places Coincheck among the top tier of global exchanges by revenue generation.

- Gross Margin: Expanded 44% QoQ to ¥3.9 billion ($26 million).

- Net Income: Returned to positive territory at ¥355 million ($2.4 million).

- Adjusted EBITDA: Surged to ¥1.49 billion ($10.0 million). The expansion from negative $2.8M to positive $10.0M EBITDA in a single quarter highlights the extreme operating leverage of the business; once fixed costs are covered, additional revenue flows almost entirely to the bottom line.

4. Strategic Pivots and Operational Highlights

In 2025, Coincheck executed a deliberate strategy to diversify away from a pure "retail trading fee" model, which is highly cyclical, toward a more robust ecosystem including institutional services, staking, and platform integrations.

4.1 The Mercari Partnership: Integrating Crypto into Daily Life

Perhaps the most significant organic growth initiative of 2025 was the strategic alliance with Mercari, Japan's largest Community-to-Community (C2C) marketplace. Announced on August 5, 2025, this partnership integrates Coincheck’s trading infrastructure directly into the Mercari app via its subsidiary, Mercoin.

- Strategic Rationale: Mercari has over 20 million monthly active users. Mercoin had already onboarded 3 million users to its simple Bitcoin trading service by late 2024. By integrating Coincheck, Mercari users gain access to Coincheck’s full suite of altcoins.

- The "Funnel" Effect: This partnership effectively turns Mercari into a massive customer acquisition funnel for Coincheck, lowering Customer Acquisition Costs (CAC) significantly. It targets the "crypto-curious" demographic that may be intimidated by a standalone exchange app but is comfortable using Mercari for selling second-hand goods.

- Market Impact: This move solidifies Coincheck’s dominance in the Japanese retail market, where it has held the No. 1 spot in app downloads for six consecutive years.

4.2 The Staking Revolution: Acquisition of Next Finance Tech

Recognizing the shift toward "yield" in the crypto economy, Coincheck acquired Next Finance Tech on March 14, 2025.

- Vertical Integration: Previously, Coincheck relied on third-party providers for staking services, splitting the revenue. This acquisition allowed the company to internalize the technology stack, thereby capturing the full margin of staking rewards.

- Coincheck Staking Launch: Following the acquisition, the "Coincheck Staking" service (launched Jan 13, 2025) was expanded. It allows users to earn rewards (primarily ETH) simply by holding assets, with no lock-up periods. This product is crucial for retention, giving users a reason to keep assets on the platform even during bear markets.

4.3 Dominating the IEO Market: The Fanpla (FPL) Success

Initial Exchange Offerings (IEOs) remain a unique strength of the Japanese crypto market due to strict regulatory oversight which confers legitimacy on approved projects. In 2025, Coincheck executed the IEO for Fanpla (FPL), a token designed to power a "Fan Economy" connecting artists and supporters.

- Execution: The IEO application period ran from October 21 to November 4, 2025.

- Demand: The offering was massively oversubscribed (24x), demonstrating deep retail liquidity and hunger for new, regulated assets.

- Token Performance: FPL began trading on November 11, 2025. While many IEOs suffer immediate crashes, FPL maintained a trading range of $0.0026 - $0.0028 into late December, validating the "Fanpla Economy" thesis and Coincheck's vetting process.

5. Global Expansion: The Institutional Play

A core criticism of Coincheck in previous years was its over-reliance on the Japanese retail market. 2025 marked the definitive end of that isolationism through aggressive M&A and product development targeting institutional clients globally.

5.1 The Aplo Acquisition: Entering Europe

On October 14, 2025, Coincheck completed the acquisition of Aplo, a Paris-based digital asset prime brokerage.

- Deal Mechanics: The transaction was valued at approximately $24 million and was an all-stock deal (using CNCK shares), proving the utility of the Nasdaq listing as an M&A currency.

- Strategic Fit:

- Regulatory Foothold: Aplo is a PSAN-registered entity in France, providing Coincheck with immediate, compliant access to the European Union market just as the Markets in Crypto-Assets (MiCA) regulation framework standardizes the region.

- Prime Brokerage Capabilities: Aplo serves over 60 institutional clients (hedge funds, banks, asset managers). It brings sophisticated capabilities like cross-margining and deferred settlement.

- Synergy: Coincheck plans to leverage Aplo to offer these prime services to its Japanese corporate clients ("Bitcoin Treasury" adopters) who need global liquidity and 24/7 execution.

5.2 Coincheck Prime

Complementing the Aplo deal, Coincheck launched Coincheck Prime in the first half of 2025.

- The Offering: An OTC (Over-the-Counter) and white-glove service for clients trading over ¥10 million.

- The Trend: This service was timely, launched to capture the wave of Japanese listed companies entering the crypto space as a hedge against yen depreciation or inflation. The "Bitcoin Treasury" narrative in Japan gained significant traction in 2025, and Coincheck Prime positioned itself as the compliant gateway for these corporate flows.

6. Corporate Structure and Governance

The transition to a Dutch public company (N.V.) introduced new governance dynamics in 2025.

6.1 Monex Group's Continued Control

Despite the public listing, Monex Group retained an approximate 80% stake in Coincheck Group. This high ownership concentration has two implications:

- Stability: Monex provides a stable, long-term backing, shielding Coincheck from hostile takeovers.

- Liquidity Constraint: With only ~20% of shares in the free float (and much of that locked up until December), the stock is prone to illiquidity and high volatility, as seen in the December price swings.

6.2 Governance Milestones

- First AGM: The company held its inaugural AGM on September 23, 2025, in Amsterdam.

- Board Continuity: All nine board members were reappointed, ensuring that the team who orchestrated the De-SPAC remained at the helm to execute the post-listing strategy.

- IFRS Adoption: The shift to IFRS reporting standardized Coincheck’s financials for global investors, though it introduced the volatility of fair-value accounting for warrants.

7. Conclusion and 2026 Outlook

7.1 Summary of 2025

2025 was a year of "building foundations in a storm." Coincheck Group successfully:

- Went Global: Through the Aplo acquisition and Nasdaq listing.

- Diversified Revenue: Through Staking, IEOs, and the Mercari partnership.

- Proved Scalability: Generating $900M in quarterly revenue and turning profitable in Q2 FY26 despite market headwinds.

However, the shareholder experience was undeniably painful. The stock price (CNCK) suffered from the classic "De-SPAC cycle"—initial hype, followed by the reality of lock-up expirations and macro shocks. The 50%+ decline in shareholder value stands in stark contrast to the operational wins.

7.2 Outlook for 2026

As Coincheck enters 2026, the key catalysts will be:

- Post-Lock-up Stabilization: With the December 2025 lock-up expiration now in the past, the stock should theoretically find a natural floor based on fundamentals rather than technical supply overhang.

- Synergy Realization: 2026 will be the year Coincheck must prove the value of Aplo. Investors will look for revenue contributions from the European arm and growth in the institutional client base.

- Profitability Discipline: The market has punished "profitless growth." Coincheck’s management must focus on maintaining positive Adjusted EBITDA and, crucially, consistent GAAP/IFRS Net Income to attract long-term institutional capital.

- The Macro Beta: Ultimately, Coincheck remains a high-beta play on the crypto economy. If the "Crypto Winter" thaws and Bitcoin resumes its trajectory toward the $120k+ targets predicted by some analysts, Coincheck’s operating leverage suggests it could be a prime beneficiary. Conversely, a deepening recession or trade war in 2026 would continue to challenge its high-growth narrative.

For the professional observer, Coincheck in 2025 represents a case study in the friction between operational scaling and public market recalibration. The infrastructure is now built; 2026 will be the test of its monetization.

Disclaimer

This post is for informational purposes only. It is based on public data and research snippets available as of December 31, 2025. It does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. Past performance is not indicative of future results.