Coincheck First Quarter FY3/2026 Financial Results

Coincheck Group reported a mixed first quarter for fiscal year 2026, characterized by a challenging crypto market that impacted trading revenues, but underscored by significant strategic progress and strong underlying growth in its user base and assets.

First, we did not make any money.

Gary Simanson, CEO Coincheck Group

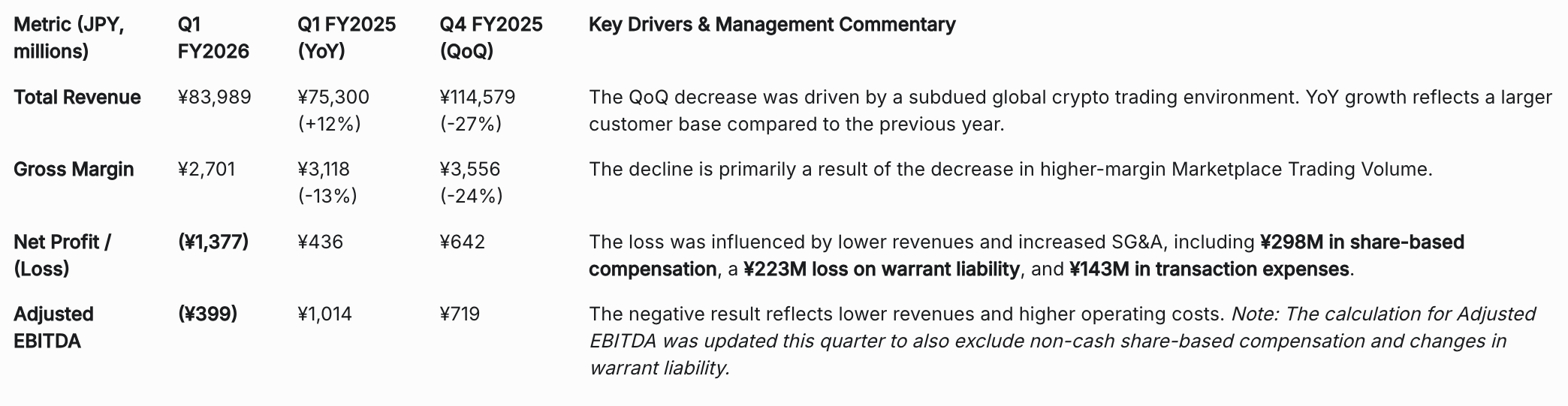

Total revenue increased 12%, to ¥84.0 billion ($583 million) in the first quarter of fiscal 2026 from ¥75.3 billion ($522 million) in the first quarter of fiscal 2025. Net loss was ¥1,377 million ($9.5 million) in the first quarter of fiscal 2026 compared to Net profit of ¥436 million ($3.0 million) in the first quarter of fiscal 2025.

Components contributing to Net loss results in the first quarter of fiscal 2026 included share-based compensation of ¥298 million ($2.1 million), loss from the change in fair value of warrant liability of ¥223 million ($1.5 million) and total transaction expenses of ¥143 million ($1.0 million).

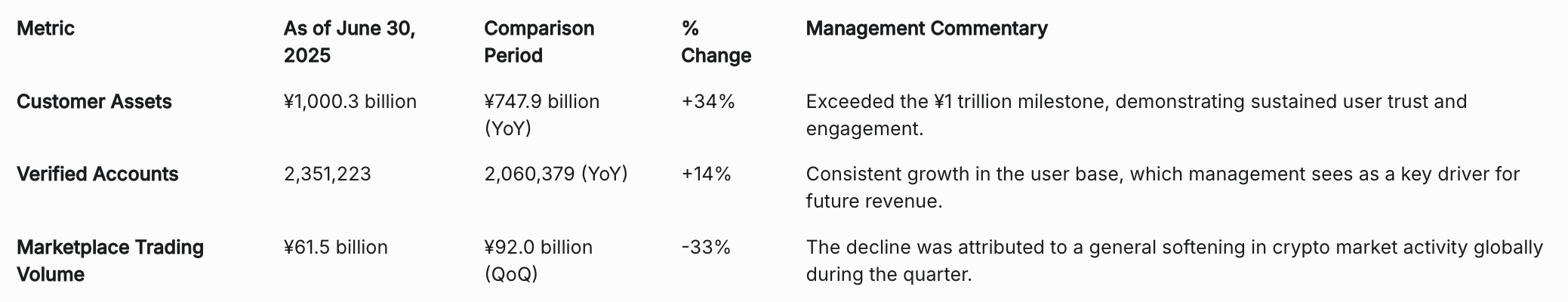

Despite the market headwinds, the company achieved several key milestones. Customer Assets surpassed the ¥1 trillion mark for the first time, growing 34% year-over-year. Verified Accounts also saw robust growth, increasing 14% year-over-year to 2.35 million.

Strategically, the quarter was highlighted by the announcement of a landmark partnership with Mercoin (a subsidiary of Mercari), Japan's largest C2C marketplace, which is expected to significantly expand Coincheck's customer base. The company's new staking service also gained significant traction, with revenue growing more than six-fold from the previous quarter. Management expressed optimism about the future, citing favorable regulatory developments in Japan and a clear strategy for global expansion.

I. Financial Performance Highlights

II. Key Performance Indicators (KPIs)

III. Strategic and Operational Highlights (Management Commentary from Earnings Call)

1. Strategic Partnership with Mercoin (Mercari)

This was the most significant announcement of the quarter. Coincheck has entered a strategic partnership with Mercoin, the crypto subsidiary of Mercari, which boasts over 23 million monthly active users.

- Objective: To dramatically expand Coincheck's customer base by allowing Mercari's users to open and trade on Coincheck accounts directly within the Mercari app.

- Scale: Management highlighted that Mercari has over 3 million users who have already tried Bitcoin trading, and Mercoin opened 1.72 million new accounts in 2024 alone (58% of all new crypto accounts in Japan).

- Impact: CEO Gary Simanson called this a "game-changer" for delivering enhanced crypto services to a broader segment of Japanese consumers.

2. Growth in Staking Services

The "Coincheck Staking" service, launched in January 2025, has become a significant new revenue stream.

- Revenue Growth: Staking revenue increased to ¥381 million in Q1 FY2026, up from just ¥61 million in the previous quarter.

- Driver: The growth was fueled by heightened customer participation and the acquisition of staking platform Next Finance Tech, which will help Coincheck retain a larger share of staking rewards.

3. Cost Structure and Public Company Expenses

Management addressed the increase in expenses that contributed to the net loss.

- Share-Based Compensation (SBC): The quarter included a ¥298 million non-cash SBC expense. Approximately 60% of this was related to one-time RSU awards granted in connection with the merger transaction that took the company public. Management noted this makes the quarter's expenses appear "lumpy" and is not expected to recur at this level.

- Operating Expenses: The company is incurring additional costs related to building out its corporate infrastructure as a newly listed public company.

4. Favorable Regulatory Outlook in Japan

The CEO highlighted two key potential regulatory tailwinds in Japan:

- Asset Reclassification: Japan's Financial Services Agency (FSA) has proposed reclassifying certain crypto assets under the same framework as traditional securities, which would enhance governance and investor protection.

- Tax Reform: A proposal is under discussion to change the tax on individual crypto gains from a marginal rate of up to 55% to a flat 20% rate, consistent with other capital gains. Management believes this would "dramatically increase the velocity of trading crypto in Japan."

IV. Key Financial Tables

Condensed Consolidated Interim Statements of Profit or Loss (Unaudited)

(in millions of Japanese Yen)

Reconciliation of Adjusted EBITDA (Unaudited)

(in millions of Japanese Yen)