Coincheck's FY3/25 Financial Results

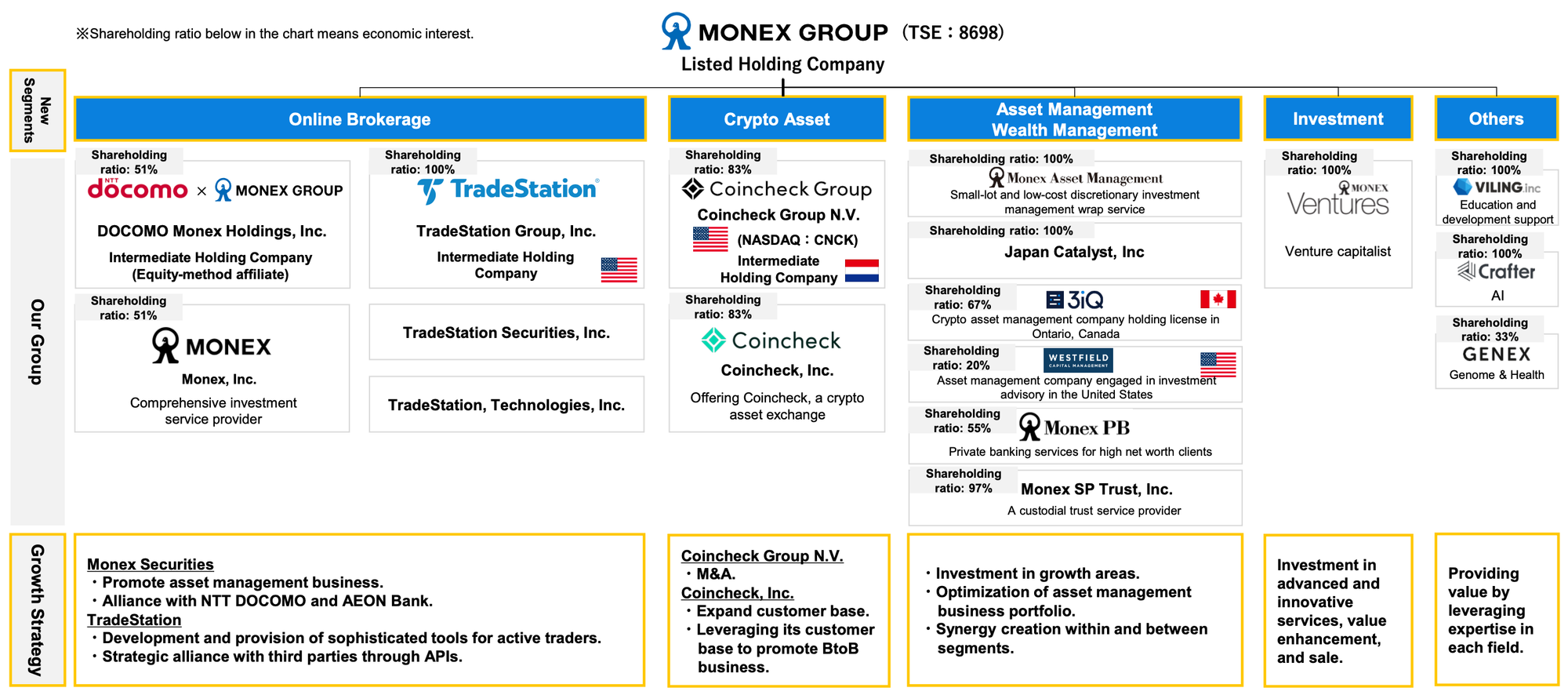

Coincheck Group has reported its first full fiscal year results, after listing on Nasdaq through a SPAC transaction at the end of last year. Before we get into the results announcement, however, let us take a look at where Coincheck fits into the overall Monex Group.

Overview

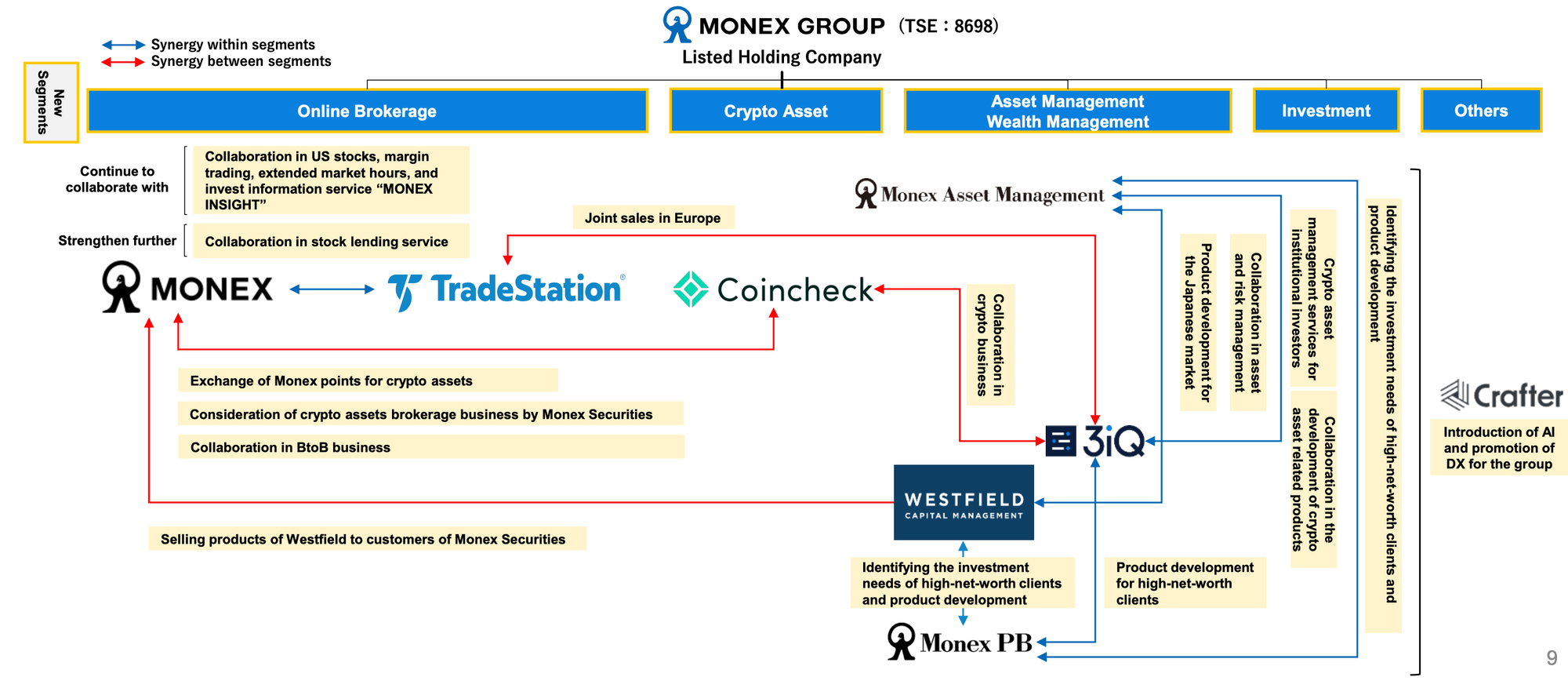

Monex Group has re-organized its business segments from April 2025 onwards as shown above. Post-Nasdaq listing, Monex Group still holds 83% of Coincheck Group. The strategy behind going public was always for Coincheck to have a "currency" for talent acquisition & retention, as well as for M&A. This strategy has been put immediately into action with the acquisition of Next Finance Tech, a blockchain infrastructure company headquartered in Tokyo, in February 2025.

Driving synergies across Monex Group, Monex Securities is considering obtaining a crypto assets brokerage business license, which is currently being formulated, while Coincheck and 3iQ plan to collaborate in crypto asset management.

With its strong reputation and large customer base, Coincheck promotes not only trading services but services for corporate entities and institutional investors to support their Web3 business.

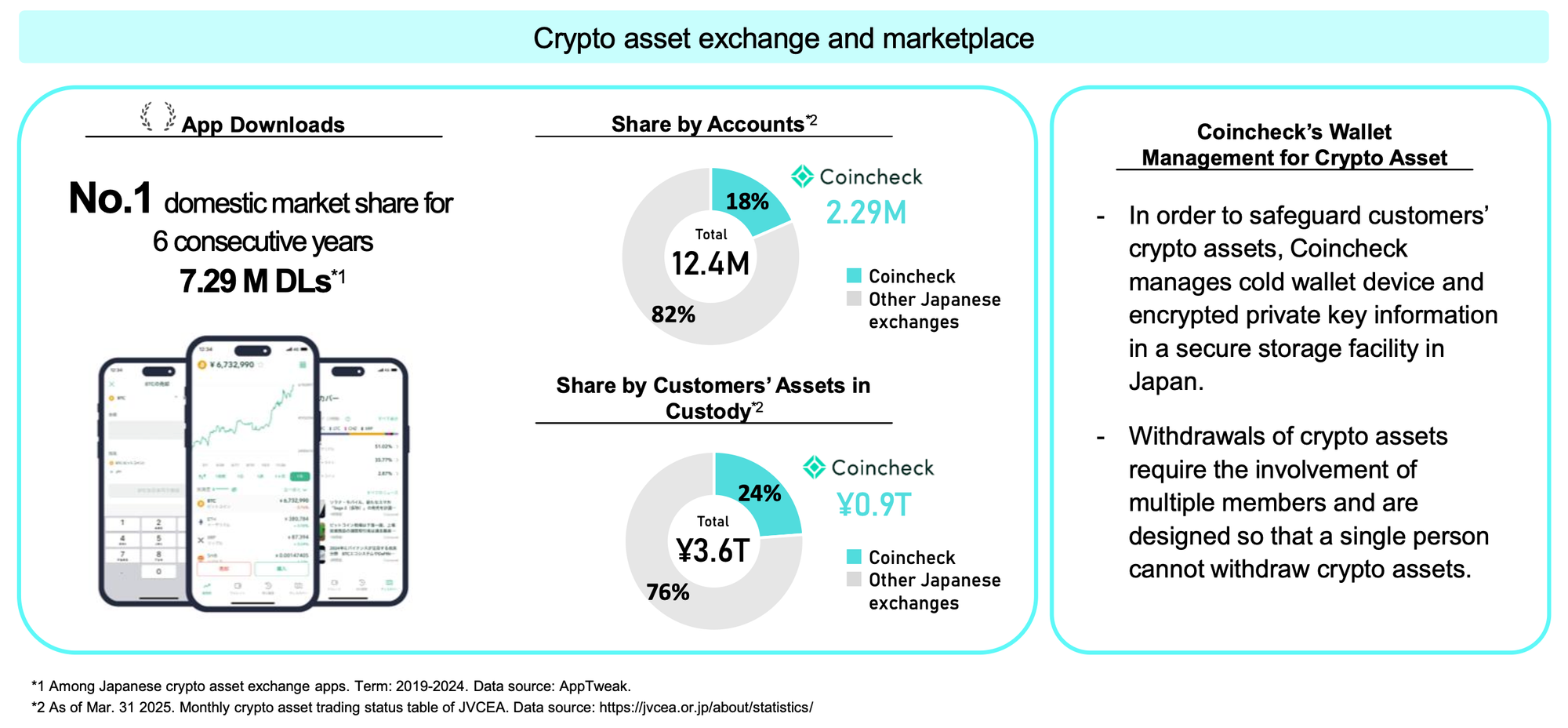

Coincheck continues to attract customers as one of Japan’s premier and most trusted crypto assets trading platform.

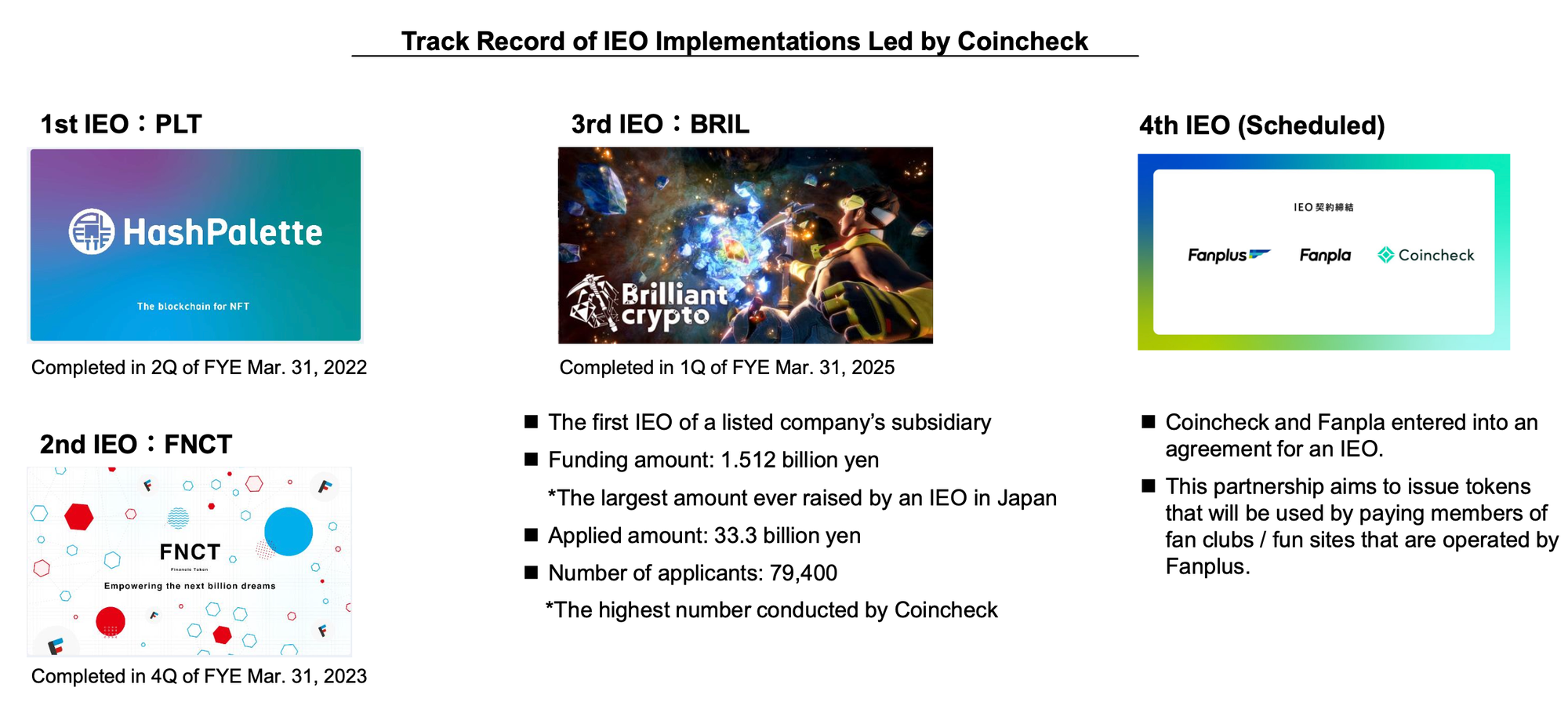

Coincheck is the leading player in the Japanese Initial Exchange Offering (IEO) market, completing the most IEOs. It is now preparing for the 4th IEO with Fanpla.

Financial Results

Certain Year-Over-Year Highlights

- Total revenue increased 13% to ¥114.6 billion ($764 million) in the fourth quarter of fiscal 2025 from ¥101.4 billion ($676 million) in the fourth quarter of fiscal 2024, and increased 71%, to ¥383.3 billion ($2,557 million) in the fiscal 2025 full year from ¥224.0 billion ($1,495 million) in the fiscal 2024 full year.

- Gross margin2 decreased 20% to ¥3.5 billion ($24 million) in the fourth quarter of fiscal 2025, compared to ¥4.4 billion ($30 million) in the fourth quarter of fiscal 2024, and increased 46% to ¥13.5 billion ($90 million) in the fiscal 2025 full year, compared to ¥9.3 billion ($62 million) in the fiscal 2024 full year.

- Verified Accounts3 increased 16%, to 2,291,103 as of the end of fiscal 2025 from 1,981,152 as of the end of fiscal 2024.

- Customer Assets4 increased 15%, to ¥859.2 billion ($5,732 million) as of the end of fiscal 2025, from ¥744.2 billion ($4,965 million) as of the end of fiscal 2024.

- Marketplace Trading Volume5 increased 44%, to ¥337.5 billion ($2,252 million) for the fiscal 2025 full year from ¥234.6 billion ($1,565 million) for the fiscal 2024 full year. Fluctuations in Marketplace Trading Volume are usually driven by crypto-asset industry market volumes and conditions generally, and the size and level of trading activity at Coincheck specifically, as well as market-price fluctuations in the crypto assets most frequently traded.

- Net profit was ¥642 million ($4.3 million) in the fourth quarter of fiscal 2025 compared to ¥1,953 million ($13.0 million) in the fourth quarter of fiscal 2024, and Net loss was ¥14,350 million ($95.7 million) in the fiscal 2025 full year, compared to Net profit of ¥1,967 million ($13.1 million) in the fiscal 2024 full year. A large component of the Net loss results for the fiscal 2025 full year was total transaction expenses6 of ¥18,321 million ($122.2 million), partially offset by gain from the change in fair value of warrant liability of ¥1,435 million ($9.6 million) in the third and fourth fiscal quarters.

- Adjusted EBITDA7 decreased 46%, to ¥1,692 million ($11.3 million) in the fourth quarter of fiscal 2025 from ¥3,111 million ($20.8 million) in the fourth quarter of fiscal 2024, and increased 52%, to ¥5,718 million ($38.1 million) in the fiscal 2025 full year from ¥3,773 million ($25.2 million) in the fiscal 2024 full year.

Certain Quarter-Over-Quarter Highlights

- Total revenue decreased 7% to ¥114.6 billion ($764 million) in the fourth quarter of fiscal 2025, compared to ¥123.1 billion ($821 million) in the third quarter of fiscal 2025.

- Gross margin decreased 26% to ¥3.5 billion ($24 million) in the fourth quarter of fiscal 2025, compared to ¥4.8 billion ($32 million) in the third quarter of fiscal 2025.

- Verified Accounts increased 4.3% to 2,291,103 as of the end of the fourth quarter of fiscal 2025, compared to 2,197,619 as of the end of the third quarter of fiscal 2025.

- Customer Assets decreased 25% to ¥859.2 billion ($5,732 million) in the fourth quarter of fiscal 2025, compared to ¥1,142.2 billion ($7,620 million) in the third quarter of fiscal 2025.

- Marketplace Trading Volume decreased 22% to ¥92.0 billion ($614 million) in the fourth quarter of fiscal 2025, compared to ¥117.4 billion ($783 million) in the third quarter of fiscal 2025.

- Selling, general and administrative expenses decreased 45% to ¥3,556 million ($23.7 million) in the fourth quarter of fiscal 2025, compared to ¥6,429 million ($42.9 million) in the third quarter of fiscal 2025.

- Transaction expenses included in Selling, general and administrative expenses were ¥540 million ($3.6 million) and ¥3,804 million ($25.4 million), respectively for the fourth quarter and third quarter of fiscal 2025. Excluding transaction expenses, Selling, general and administrative expenses increased 15% to ¥3,016 million ($20.1 million) in the fourth quarter of fiscal 2025, compared to ¥2,625 million ($17.5 million) in the third quarter of fiscal 2025.

- Total transaction expenses were ¥540 million ($3.6 million) for the fourth quarter of fiscal 2025, compared to ¥17,518 million ($116.9 million) for the third quarter of fiscal 2025, which included the transaction expenses related to the Company’s recent de-SPAC business combination (“Listing Expense”) of ¥13,714 million ($91.5 million).

- Net profit was ¥642 million ($4.3 million) in the fourth quarter of fiscal 2025, compared to Net loss of ¥15,445 million ($103.0 million) in the third quarter of fiscal 2025. Net profit in the fourth quarter of fiscal 2025 included transaction expenses of ¥540 million ($3.6 million), compared to transaction expenses of ¥17,518 million ($116.9 million) in the third quarter of fiscal 2025's Net loss, and change in fair value of warrant liability was ¥973 million ($6.5 million) in the fourth quarter of fiscal 2025, compared to ¥462 million ($3.1 million) in the third quarter of fiscal 2025.

- Adjusted EBITDA decreased 39% to ¥1,692 million ($11.3 million) in the fourth quarter of fiscal 2025, compared to ¥2,767 million ($18.5 million) in the third quarter of fiscal 2025.

Strategic and Operational Highlights

- Launched Coincheck Staking on January 13, 2025, allowing users to automatically earn Ethereum (ETH) simply by depositing ETH with Coincheck.

- Completed the acquisition of Next Finance Tech Co., Ltd., a staking platform service company, on March 14, 2025, to enhance Coincheck Staking and offer staking platform services to other cryptocurrency marketplace providers both in and outside of Japan.

Stock Chart