Collaboration on Public Offering and Issuance of Real Estate Security Tokens

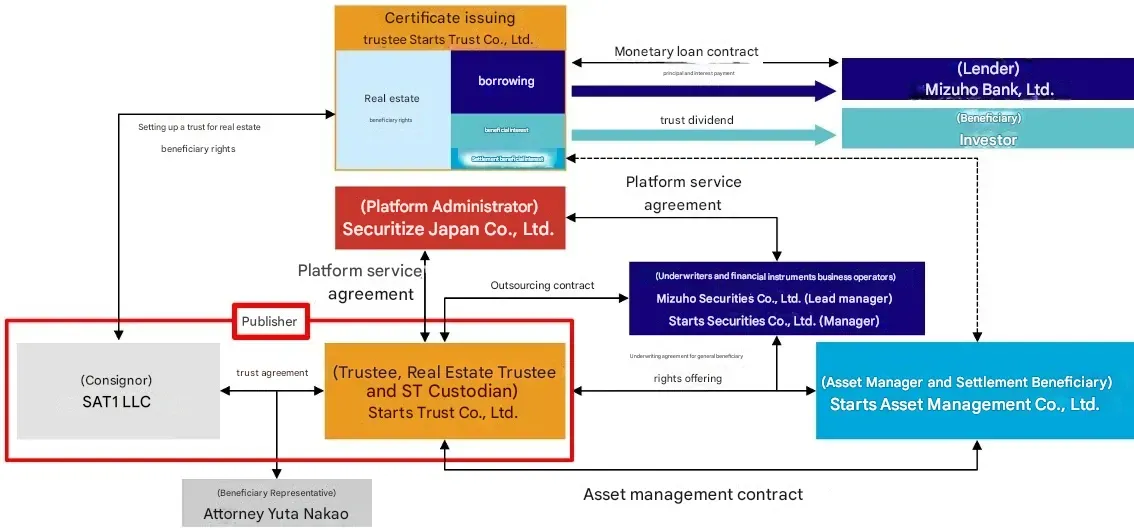

Starts Group, Mizuho Securities, and Securitize Japan have announced their collaboration on the public offering and issuance of security tokens (STs) backed by real estate assets utilizing the "Securitize Platform", a computer system using distributed ledger technology developed by Securitize.

This ST is a real estate security token with two "welfare contribution-type buildings" as the target investment properties. These buildings have a proven track record as complex facilities including licensed childcare centers and communal housing, operated under the "Public-Private Partnership Welfare Contribution Infrastructure Fund" jointly established by the Tokyo Metropolitan Government and Starts Group. Starts Trust will manage the private keys and other information necessary for recording and transferring the property value related to this ST using the Securitize PF.

Overview of this ST

Starts Group is a comprehensive lifestyle culture enterprise with a wide range of businesses centered on construction and real estate. Since the enforcement of the "Act on Securitization of Assets" in 1998, Starts Group has been engaged in various real estate securitization businesses for a quarter of a century. For this ST structure, the group will combine the knowledge cultivated through various real estate securitization businesses: Starts Asset Management will serve as the asset manager, Starts Trust as the issuer (trustee), and Starts Securities as the underwriter and handling financial instruments business operator. Through high-quality real estate security token products leveraging both real estate and financial expertise with close and flexible group collaboration, Starts Group will provide diverse investors with opportunities and options for real estate investment, contributing to the growth and vitalization of the security token market.

Mizuho Securities has contributed to the development of the capital market by working on the issuance of security tokens in various areas, including private real estate funds, private infrastructure funds, private real estate security token offerings (STOs), and public corporate bond STOs. For this ST structure, Mizuho Securities' previous initiatives and knowledge of structuring and sales were evaluated, leading to its participation as an underwriter and handling financial instruments business operator in the consideration of issuing the first public real estate security token using the Securitize Platform, targeting welfare contribution-type buildings that Starts Group has been focusing on. Moving forward, Mizuho Securities will continue to contribute to improving the productivity of society as a whole through financial services utilizing digital technology, and respond to the diversifying asset management needs of customers.

Securitize is a global leader in the STO field with a track record of providing platforms for numerous security tokens domestically and internationally. For this ST structure, Securitize and the Securitize Platform were selected as the ST platform and platform administrator based on their domestic and international performance, growth potential, and scalability. Securitize will continue to contribute to the creation of new investment experiences and modernization of the capital market by utilizing its continuously evolving platform functions and advanced experience and know-how in the global market.