Credit Saison Bets on Brazil’s Zippi in USD 42.3m FIDC Expansion to Fuel Micro-Credit Boom

Zippi, the Brazilian FinTech specializing in working capital for micro-entrepreneurs, has successfully closed the third issuance of its Credit Rights Investment Fund (FIDC), raising BRL 220m (approximately USD 42.3m).

The transaction marks a watershed moment for the São Paulo-based firm, not only as its largest single capital injection to date but also for securing its first international backer: the Tokyo-based financial services major, Credit Saison.

Institutional Validation

The round attracted a heavy-hitting syndicate of domestic financial institutions, including Itaú Asset, the treasury arm of Itaú BBA, Bradesco BBI, and Valora Investimentos. However, the entry of Credit Saison signals a pivot in Zippi’s capitalization strategy, moving beyond domestic borders to validate its credit model on the global stage.

“We enter 2026 with an even more solid capital structure,” said Bruno Lucas, CFO and co-founder of Zippi. “We have significantly increased credit volume while simultaneously improving costs, predictability, and the alignment of funding with our operating cycle.”

The “Pix” Paradox: Redefining Risk

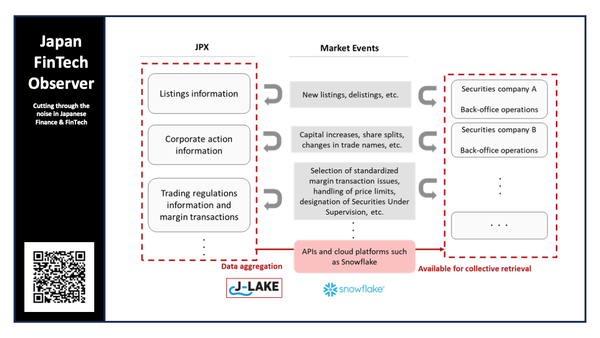

Zippi’s rapid ascent is attributed to its proprietary technology, which leverages Brazil’s instant payment infrastructure, Pix, and Open Finance data to underwrite risk in real-time. Unlike traditional banking models that rely on rigid monthly billing cycles, Zippi offers weekly working capital that aligns with the cash flow realities of gig workers and small merchants.

“For decades, the Brazilian micro-entrepreneur was treated as a final consumer, receiving products that did not reflect how their business actually operates,” said André Bernardes, Zippi’s CEO. “We designed credit based on the real flow of retail.”

Aggressive Growth Trajectory

The fresh capital arrives on the heels of a bullish performance. Zippi reported 100% growth in revenue and transaction volume in 2025. The company has demonstrated a consistent ability to raise capital, securing BRL 66m (USD 13.2m) in 2024 and BRL 80m (USD 16m) in 2025.

With the new FIDC resources, Zippi projects a transaction volume of BRL 10bn (USD 1.9bn) for fiscal year 2026. The firm expects to have BRL 350m (USD 70m) under management in the fund by the end of the year, as it aggressively expands its active client base across all regions of Brazil.