Credit Saison FY3/25 Financial Results

Credit Saison's financial results for fiscal year 2024 demonstrate a period of significant growth and strategic evolution. The company achieved record-high consolidated operating profit, reflecting strong performance across its core business segments and the positive impact of specific accounting factors. Overall, the company's diverse business model, expansion into new markets, and focus on digital transformation contributed to its solid financial standing and set the stage for continued growth in the future.

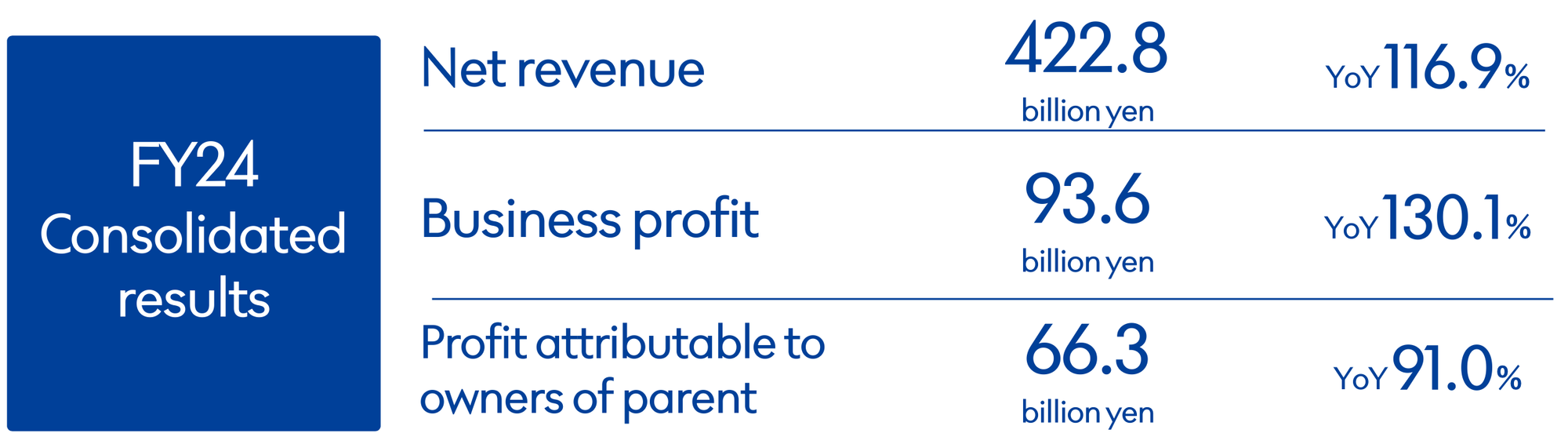

Consolidated Performance Overview

The company reported a substantial increase in net revenue, reaching 422.8 billion yen, a rise of 116.9% compared to the previous fiscal year. Business profit also experienced significant growth, reaching 93.6 billion yen, marking an increase of 130.1% compared to the previous year. While profit attributable to owners of the parent company was slightly down, this was largely attributed to accounting adjustments related to the consolidation of Suruga Bank as an equity-method affiliate.

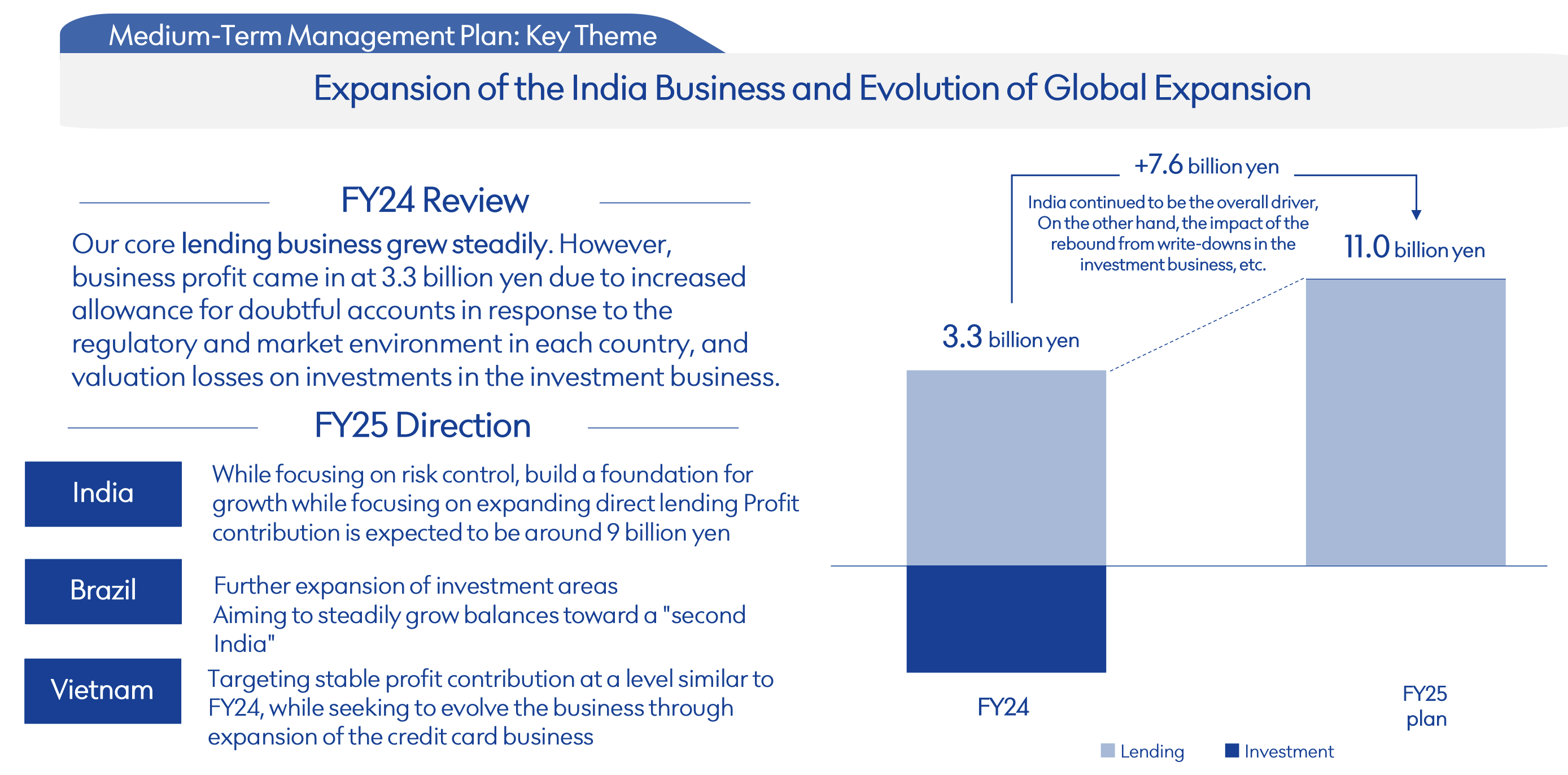

Global Business

The Global Business segment is a key driver of Credit Saison's growth strategy. While the core lending business experienced steady growth, the business profit came in at 3.3 billion yen due to an increased allowance for doubtful accounts in response to the regulatory and market environment in each country, and valuation losses on investments in the investment business.

Within the Global Business, India remained a key growth engine. Credit Saison aims to build a foundation for growth while focusing on expanding direct lending. Profit contribution is expected to be around 9 billion yen. Brazil presents another opportunity for growth, with the company focusing on expanding investment activities. Credit Saison is focusing on stable profit contribution, similar to FY24, while evolving the business through the expansion of the credit card business.

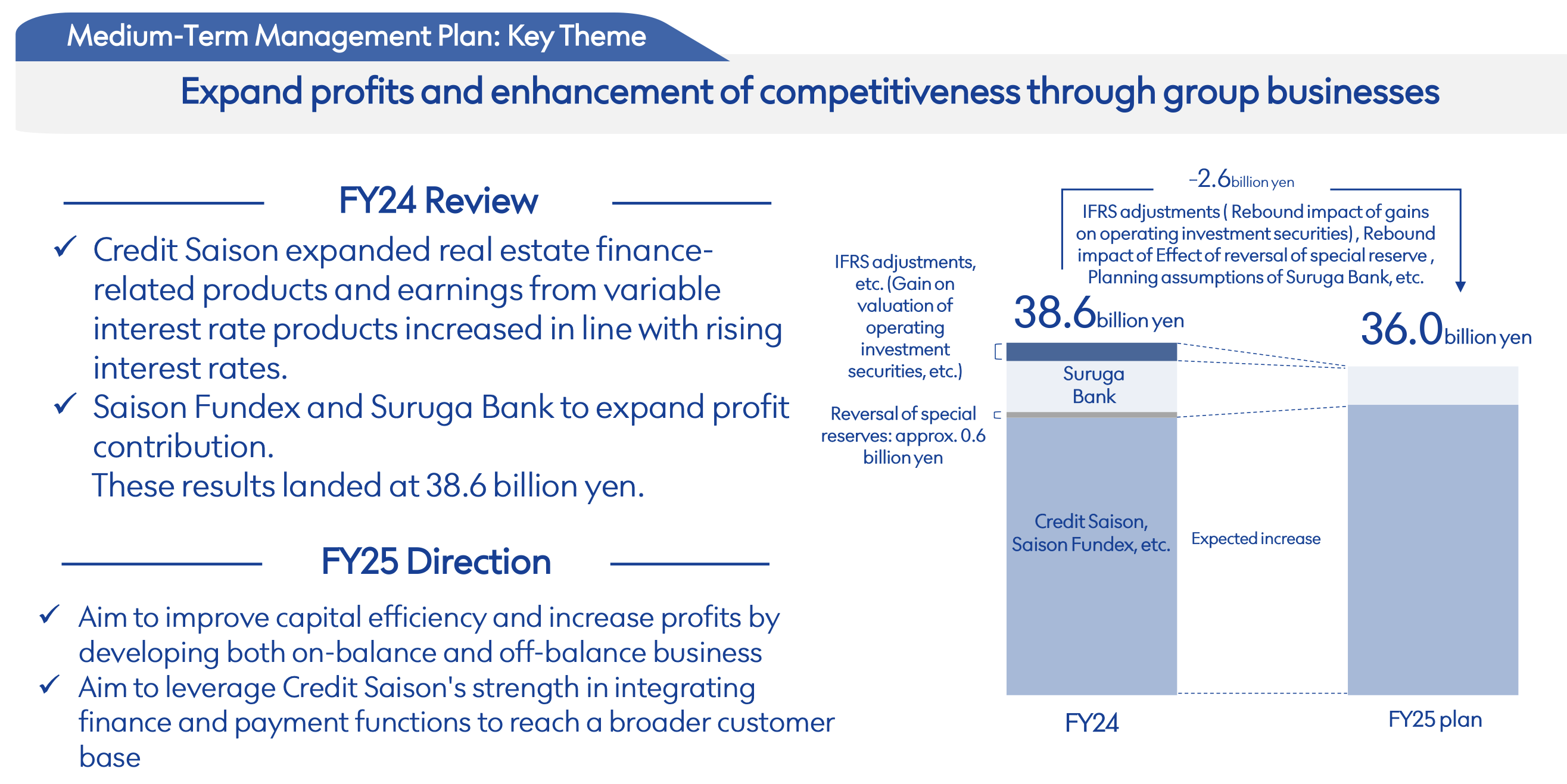

Finance Business

The Finance Business witnessed expanded earnings derived from real estate finance-related products and variable interest rate products, benefiting from the rising interest rate environment. The segment also experienced contributions from Saison Fundex and Suruga Bank.

In the coming year, Credit Saison plans to improve capital efficiency and profitability through both on-balance and off-balance sheet business development. The company also aims to leverage its strength in integrating finance and payment functions to grow its customer base. The plan is to reach 36.0 billion yen in revenue compared to the 38.6 billion from 2024.

Payment Business

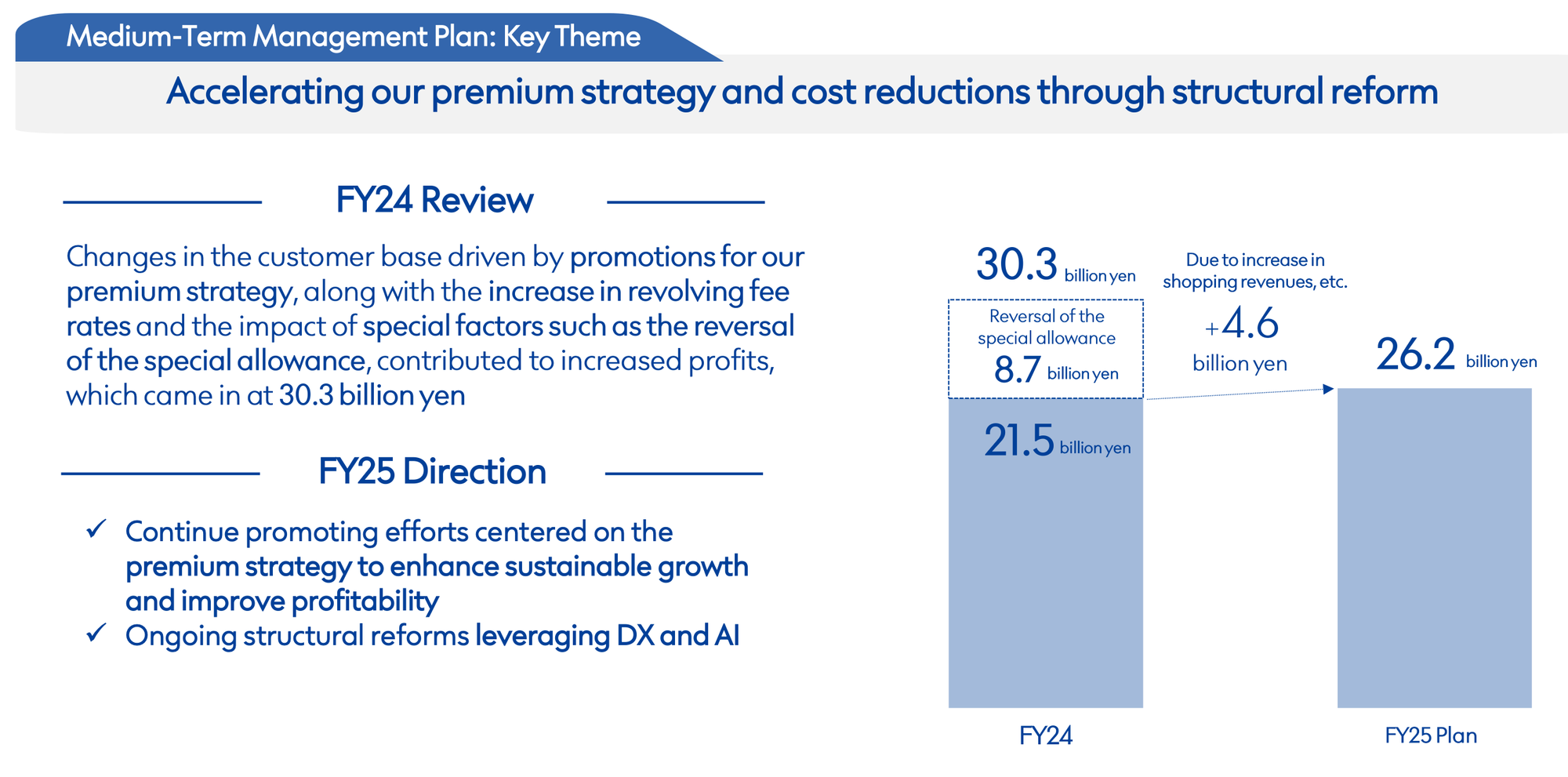

The Payment Business showed significant growth and profitability. Changes in the customer base driven by promotions for Credit Saison's premium strategy, along with the increase in revolving fee rates and the impact of special factors such as the reversal of the special allowance, contributed to increased profits, which came in at 30.3 billion yen. The company intends to further strengthen this segment by focusing on its premium strategy to enhance sustainable growth, including profitability by focusing primarily on the sole proprietor and SME segment.

In the coming year, Credit Saison plans to achieve greater revenue using their AI and DX to improve efficiency. The plan is to reach 26.2 billion yen in revenue compared to the 30.3 billion from 2024.

Capital Policy and Shareholder Returns

Credit Saison remains committed to a shareholder-friendly capital policy. The company is executing on its share buyback program of 70.0 billion yen, to be implemented in FY24-26. By the end of the fiscal year, a total of 50 billion yen was executed. The company is also actively reducing its cross-shareholdings, equivalent to 70% of cross-shareholdings in the new medium-term management period, with 58.2% already completed. Credit Saison plans to increase the ordinary dividend by 10 yen from the most recent year-end dividend forecast to a year-end dividend of 120 yen per share. Looking ahead to the next fiscal year, FY25, the year-end dividend is expected to be 130 yen per share.

FY25 Earnings Forecast

The company is projecting continued growth in the coming fiscal year. Net revenue is forecasted to reach 479.0 billion yen, a rise of 113.3%. Business profit is expected to reach 96.0 billion yen, an increase of 102.5%. To assist in this, Credit Saison will be focusing on their IT and DX efforts.

Vision for the Future

Credit Saison is focused on realizing its vision for 2030, becoming a "Global NEO Finance Company." This vision centers on the creation of a global comprehensive life services group with finance at its core. The company is leveraging the strengths of its Payment and Finance businesses while exploring new avenues for growth through partnerships and strategic acquisitions. As part of this journey, Credit Saison is committed to building a robust talent portfolio and fostering a corporate culture that promotes innovation and collaboration.