Daiwa falls flat on first quarter earnings

Daiwa Securities reported underwhelming first quarter earnings on Thursday, August 1, and saw its stock price getting severely punished in…

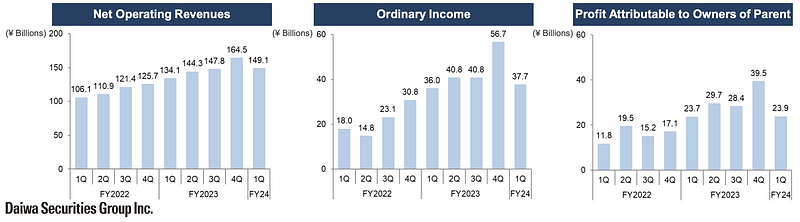

Daiwa Securities reported underwhelming first quarter earnings on Thursday, August 1, and saw its stock price getting severely punished in one of the worst days for the TOPIX in more than four decades, giving up close to 19% and being quoted under JPY 1,000 for the first time since the very first trading days of this calendar year.

Daiwa’s ordinary income of JPY 37.7bn was up 4.6% on the same quarter last year, but more than 10% below expectations, and a far cry of the JPY 56.7bn recorded during the prior quarter, when Japanese markets set new records.

In addition, with all major securities groups reporting first quarter earnings within days, the comparisons are not flattering. Daiwa’s 11.2% increase in net operating revenue vs the prior year quarter falls flat when compared to Nomura (+30%) and SMBC Nikko (+23%). The 1.2% increase in profit pales in contrast to Nomura (about 3x) and SMBC Nikko (about 2.4x).

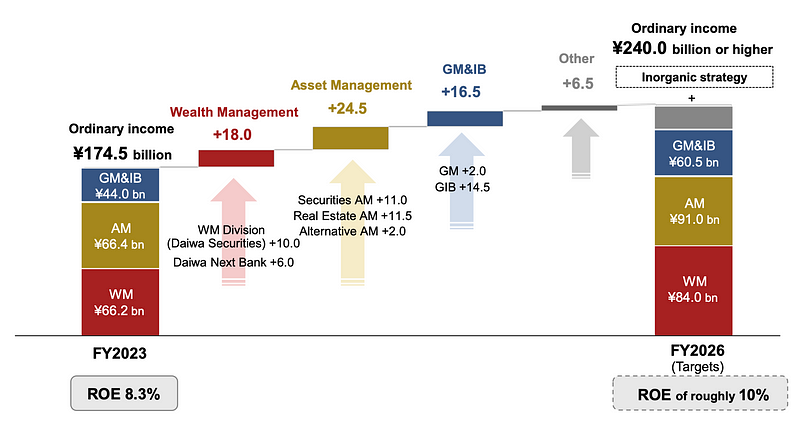

In terms of segments, Wealth Management (consisting of Daiwa Securities and Daiwa Next Bank) performed well, up 12.1% in revenues and 23.4 % in operating income compared to the prior year quarter. Asset Management (Securities, Real Estate and Alternatives AM) increased revenues by 23.5% compared to the prior year quarter, but faced a decline in ordinary income of 1.9% due to weak Real Estate AM (-10.9%) and cratering Alternatives AM (-71.5%). Global Markets & Investment Banking had both declining revenues (-0,9% compared to the prior year quarter) and ordinary income (-45.4%).

Daiwa’s Medium-Term Business Plan (MTBP), presented in May of this year, forcasts an increase in ordinary income from JPY 174.5bn in FY2023 to JPY 240bn in FY2026 (ending March 2027). Unless there will be another stellar quarter like the Q4/FY2023, Daiwa could even struggle to match last year’s results, especially now that the “Black Friday” event this week might dampen domestic enthusiasm for stock investments somewhat, and the strengthening yen takes some tailwind away from the global corporates (although, even the current JPY/USD exchange rate is more favorable than many have budgeted for).

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn. Our global Finance & FinTech Podcast, “eXponential Finance” is also available through its own LinkedIn newsletter, or via our Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.