DBJ's Economic Impact Report: Maximizing the "Silicon Island" Resurgence Following TSMC’s Entry into Kyushu

The entry of Taiwan Semiconductor Manufacturing Company (TSMC), operating through its subsidiary JASM, is a systemic catalyst for the resurgence of Kyushu’s "Silicon Island." This transition marks a pivot from the region’s historical identity as a domestic manufacturing base toward its emergence as a high-value node in the global semiconductor value chain. However, data from the Development Bank of Japan (DBJ), published in a January report, suggests that this resurgence is characterized by a "Structural Decoupling": while macro-indicators like capital investment and land prices show exceptional growth, a gap persists in local supplier integration and regional end-user demand.

To ensure long-term industrial cluster autonomy, stakeholders must address the disconnect between global manufacturing standards and local industrial capabilities. Without strategic intervention, a significant portion of the economic ripple effect will continue to bypass local SMEs.

TSMC Kumamoto (JASM) Facility Specifications

*Note: While official targets are 6/12/40nm, credible media reports suggest potential production of 2nm and 4nm nodes, which would further elevate the region's strategic importance.

Thesis Statement

Maximizing regional economic value capture requires bridging the structural gap between the "Copy Exactly" global procurement standards and the capabilities of local suppliers, while simultaneously fostering a local ecosystem for semiconductor design and end-use application.

1. Evaluation of Regional Economic Ripple Effects (2020–2025)

Large-scale semiconductor investments function as a powerful economic multiplier, stimulating infrastructure, real estate, and secondary service sectors. In Kyushu, the TSMC arrival has signaled a broader industrial revitalization, with total semiconductor-related investments across the region estimated at approximately 5 trillion yen.

1.1 Key Real Estate Volatility Indicators: The "Triangle of Volatility"

The impact on land prices has been concentrated in a specific geographic triangle surrounding the Kumamoto facilities:

- Prefectural Surge: Average land prices in Kumamoto have increased by 1.7x since 2020.

- Kikuyo: Experienced factory land price increases of 25.0% (2024).

- Ozu: Logged the highest sustained surges, peaking at 33.3% in 2024.

- Koshi City: Recorded a significant surge of 29.5% in 2024.

1.2 Regional Decoupling from National Industrial Stagnation

Kyushu’s capital investment trends demonstrate a distinct "Regional Decoupling" from broader national economic patterns. According to the DBJ Investment Plan Survey, investment in non-ferrous metals (semiconductor materials) in Kyushu is projected to be 3x higher in 2024 compared to 2019 levels, while national investment in the same sector remained essentially flat. Similarly, electrical and precision machinery sectors in Kyushu have outpaced national averages by over 1.5x.

The production value of Integrated Circuits (集積回路) in Kyushu broke the 1.3 trillion yen threshold in 2024, driven by the JASM mass production timeline and expansions at other facilities, such as Sony’s Isahaya plant. Despite these macro-level successes, qualitative feedback from regional financial institutions indicates that local contract opportunities have not yet met initial expectations, highlighting the need for deeper supply chain integration.

2. The "Copy Exactly" Barrier and the Import Dependency Crisis

The primary structural barrier to localizing the economic impact is the "Copy Exactly" (CE) manufacturing philosophy. Established as a quality assurance gold standard, CE mandates that every variable in the production environment—equipment models, process sequences, and chemical purity—remains identical across all global sites to maintain high yields.

2.1 The Structural Barrier to Entry

For local Japanese SMEs, the CE methodology presents significant hurdles:

- Rigid Procurement: No substitutions are permitted for verified parts or chemicals.

- Trial Period: New suppliers must undergo a rigorous 2-year trial period to demonstrate technical stability and delivery reliability.

- Front-Loaded Investment: Suppliers must bear the heavy burden of capital expenditure and R&D for two years before realizing revenue.

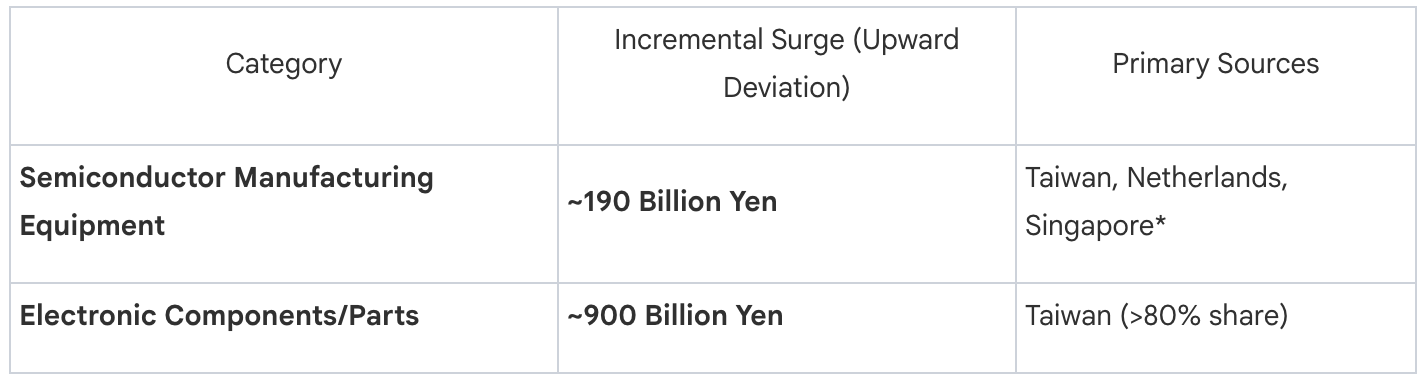

2.2 Quantifying the "Import Leakage"

The region is currently experiencing a massive "leakage" of potential value to overseas providers, particularly from Taiwan and the Netherlands.

Kyushu Semiconductor Trade: Incremental Import Surges (2022–2024)

*Note: Singapore has emerged as a vital partner due to the presence of major U.S. equipment manufacturer hubs.

The data indicates that local procurement remains confined to facility construction and maintenance. To achieve Strategic Import Substitution, local firms must evolve from standard delivery to high-level R&D collaboration that satisfies CE requirements.

3. Strategic Redesign of the Supplier Ecosystem

The historical "Silicon Island" model of the 1970s was built on Vertical Integration. Using the "Toshiba Oita" example, the lead firm created its own suppliers by training local founders who came from non-technical backgrounds—ranging from bamboo wholesalers to former police officers. Today’s cluster requires a Horizontal Specialization model, where local firms must be "Niche Top" global players to fit into TSMC's ecosystem.

3.1 Taiwanese Supplier Categorization in Kyushu

Over 15 Taiwanese companies have established bases in the region, categorized into essential service slots:

- Analysis & Reliability: MSSCorps, Materials Analysis Technology (MA-tek), Ace Solution.

- Specialized Facilities (Gas/Water/Electric): Trusval, UIS, MIC, Hwa Song Technology, Rayzer.

- Precision Consumables: Gudeng Precision (photomask cases), Yeedex, Kinik.

3.2 Three-Pillar Strategy for Value Capture

- Taiwanese Partnership: Leveraging Taiwanese networks for tech transfer and entrance into the verified TSMC supply chain.

- Supplier Alliances: Horizontal cooperation among local SMEs to share the capital burden of front-loaded investment and increase bargaining power.

- Academic Collaboration: Implementing ITRI-style models (Industrial Technology Research Institute) for joint R&D to lower the entry barrier for new materials and processes.

4. Addressing the End-User Gap in AI, Robotics, and Automotive Sectors

A cluster that only manufactures chips without designing or consuming them is economically fragile. Kyushu must transition from a "foundry-only" site to an autonomous innovation hub by cultivating Semiconductor Design Companies (設計企業).

4.1 The Missing Links in Regional Design

- EDA (Electronic Design Automation) Barrier: The prohibitive cost of EDA tools is a primary deterrent for local SMEs attempting to enter the design phase.

- Talent Shortage: A critical lack of specialized IC design engineers within the regional labor pool.

- "Dumb" Manufacturing Risk: Without local design capacity, Kyushu remains a manufacturing outpost vulnerable to global market shifts.

4.2 Strategic Directions for Regional Utilization

To create an autonomous cycle, Kyushu must support the integration of JASM-produced chips into local high-growth sectors: Automotive, AI, Robotics, and Healthcare. By subsidizing shared design infrastructure and EDA tools, the government can lower the barrier for SMEs to develop specialized applications for these industries.

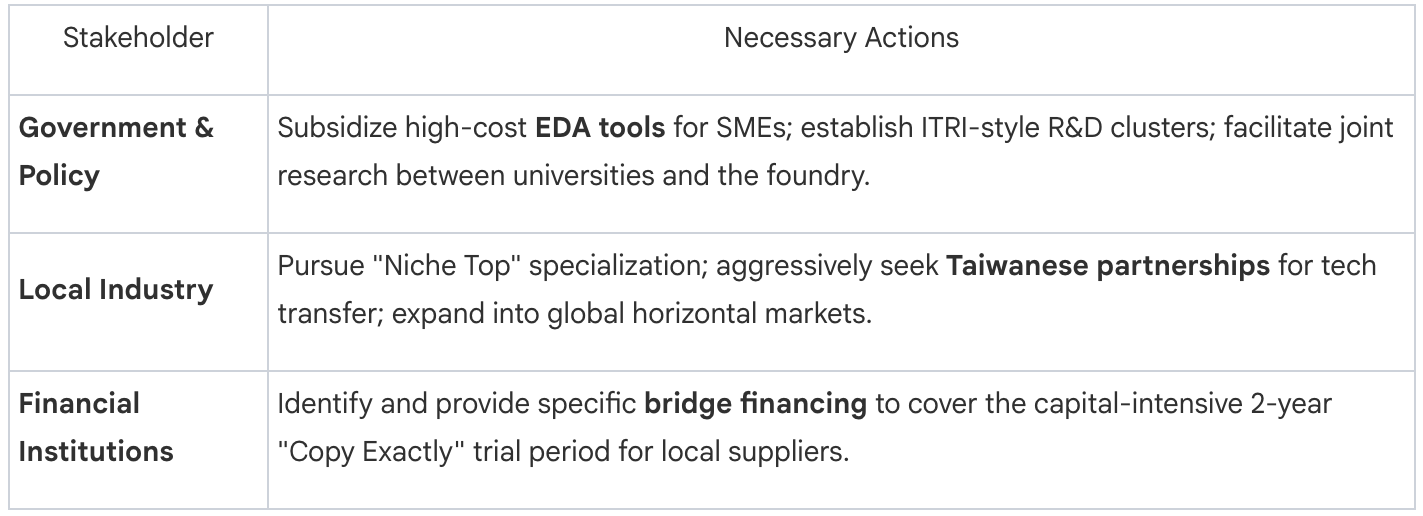

5. Conclusion and Strategic Roadmap for Stakeholders

The strategic goal for Kyushu is to achieve Industrial Cluster Autonomy. This requires moving beyond land provision toward becoming a center of high-value semiconductor innovation.

Strategic Directions Matrix

By addressing the "Copy Exactly" barrier and fostering a design-led ecosystem, Kyushu can transform a localized investment boom into a sustainable, self-reinforcing economic engine.