Digital Garage First Quarter FY3/2026 Financial Results

Digital Garage's (DG) first-quarter results for the fiscal year ending March 2026 present a stark dichotomy that requires careful dissection. The headline figure—a consolidated pre-tax loss of ¥1.3 billion—paints a misleading picture of the company's health, triggering a market sell-off. This loss was driven almost entirely by non-cash, non-operational foreign exchange headwinds within the Global Investment Incubation (GII) segment. Beneath this surface-level volatility lies a core operational engine that is not only healthy but demonstrating accelerating strength and profitability.

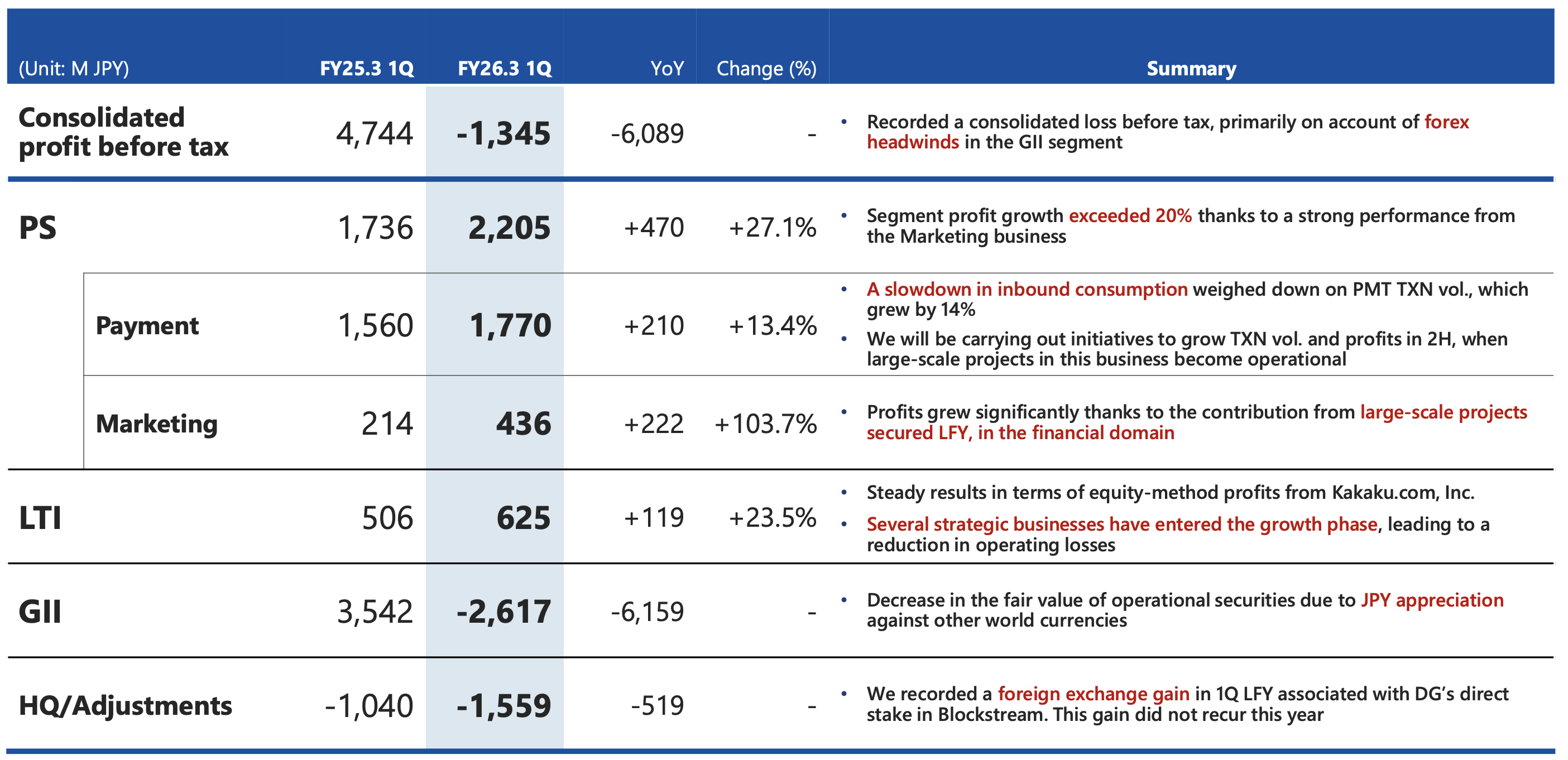

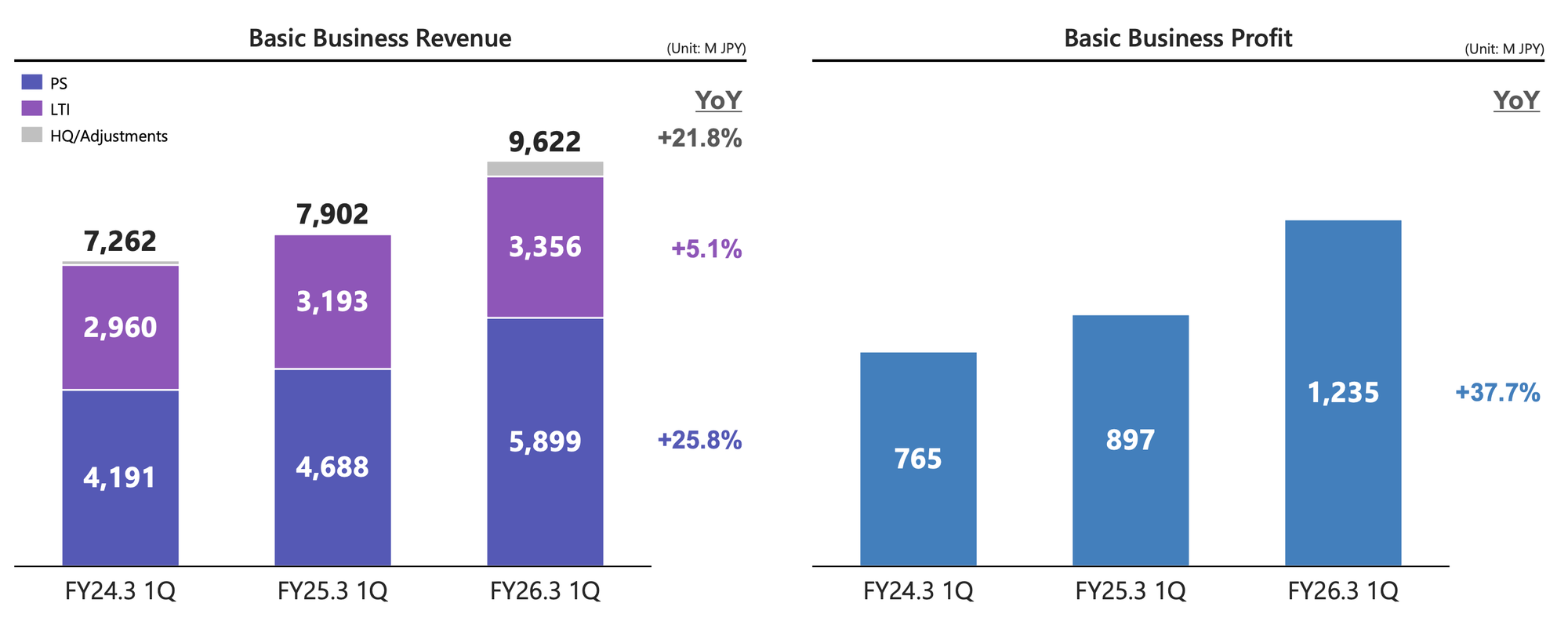

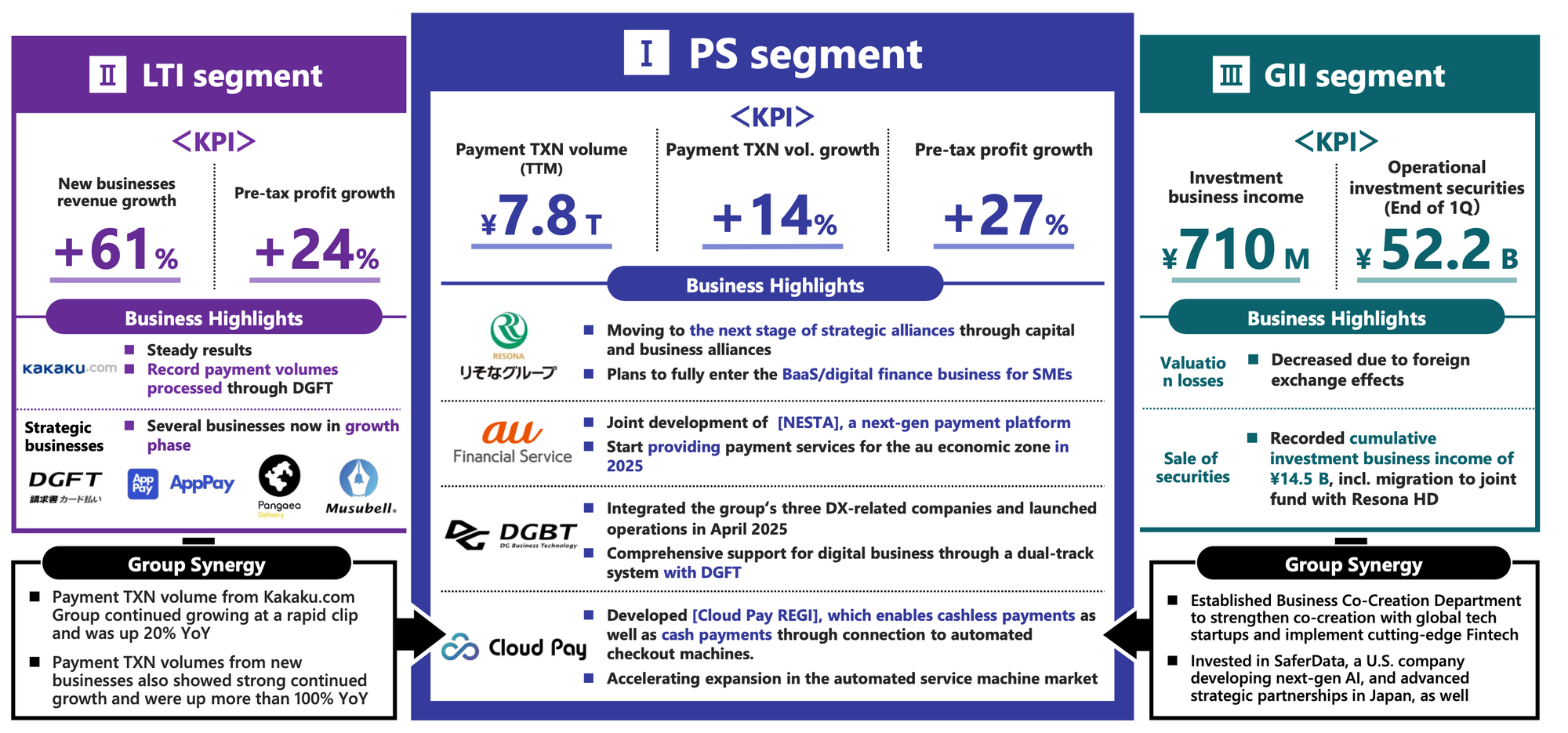

The "Basic Business," a metric management provides to isolate core performance, posted exceptional results: revenue surged +21.8% and, more importantly, profit grew an impressive +37.7% year-over-year (YoY). This robust performance is anchored by the Platform Solution (PS) segment, where profit grew +27.1%, and the Long-term Incubation (LTI) segment, which saw profit increase +23.5% as strategic investments begin to mature and contribute meaningfully. These figures signal that the fundamental business of payments, marketing, and new venture development is executing effectively and exceeding strategic targets.

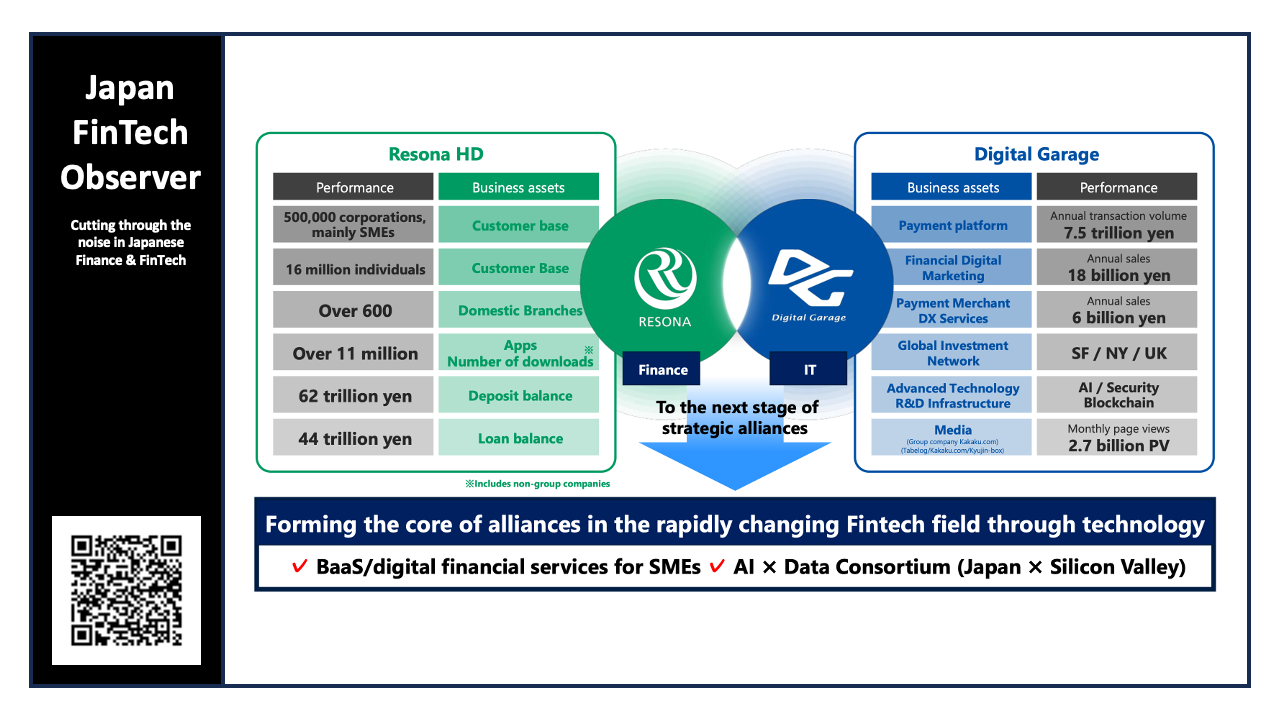

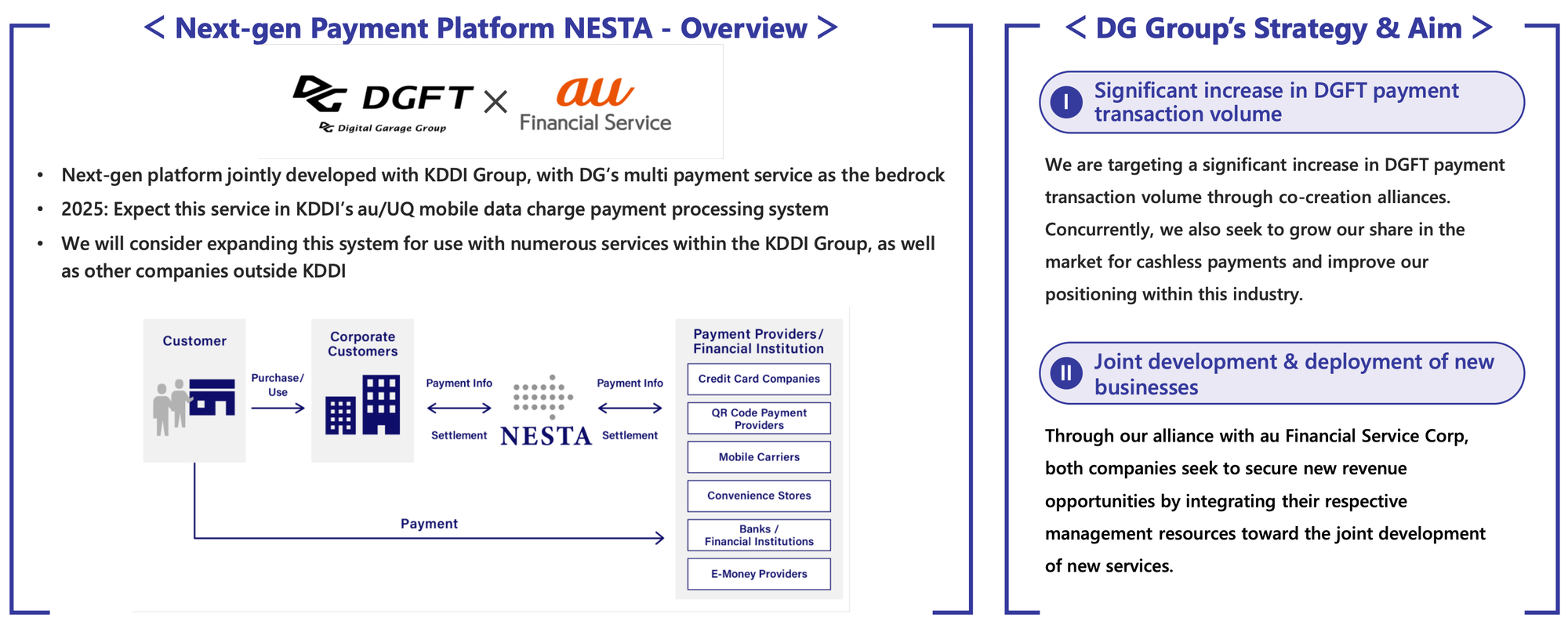

Strategically, the quarter was pivotal. The alliance with Resona Holdings was significantly deepened, culminating in Resona's acquisition of a major stake from activist investor Oasis Management, a move that solidifies a critical long-term partnership and removes shareholder activism overhang. This transaction cements the foundation for the "DG FINTECH SHIFT 2.0" strategy, aimed at penetrating the SME market with higher-value Banking-as-a-Service (BaaS) and digital finance solutions. Concurrently, the planned 2025 launch of the "NESTA" payment platform with KDDI Group represents a formidable catalyst for future transaction volume growth.

The market's negative reaction to the headline loss appears to be an over-indexing on transient, non-cash factors. An investment thesis emerges from this potential valuation disconnect. The opportunity hinges on the market looking through the GII segment's volatility to recognize the underlying strength and growth trajectory of the core payments and marketing businesses. Key catalysts, including the materialization of benefits from the Resona and KDDI alliances and the continued de-risking of the balance sheet via the GII off-loading strategy, are poised to unlock value. While execution risk remains, the current valuation may offer a compelling entry point for investors with a 12 to 24-month horizon. This view is supported by the standing analyst consensus, which maintains a "Buy" rating with a price target of ¥5,720, implying a significant upside from the post-earnings price of approximately ¥3,435.

Consolidated Financial Performance: A Tale of Two Businesses

A top-line review of Digital Garage's 1Q FY26.3 financials reveals a performance narrative split between its volatile investment arm and its robust core operations. Understanding this distinction is paramount to accurately assessing the company's current health and future prospects.

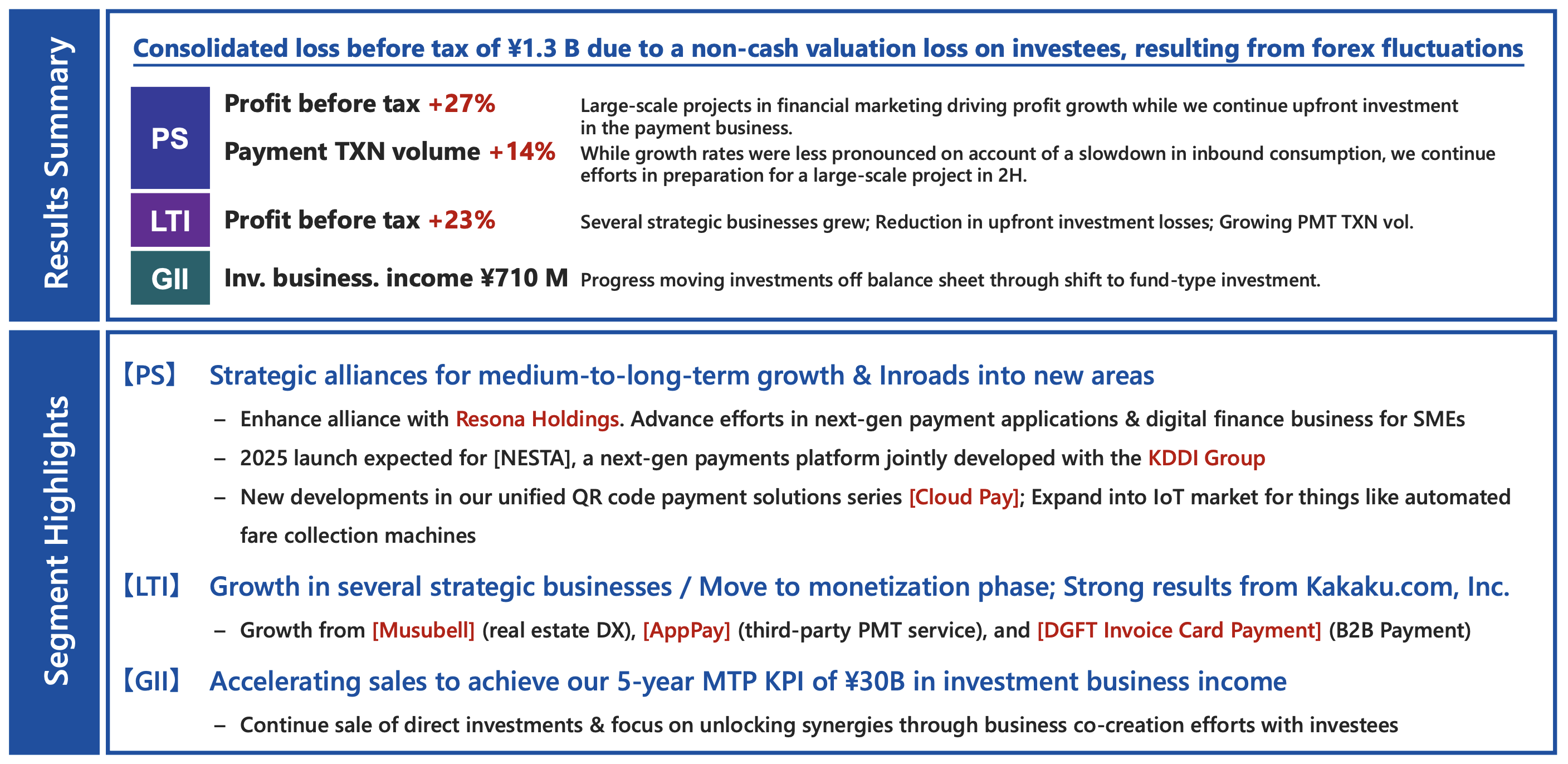

Deconstructing the Headline Loss

The company reported a consolidated profit before tax (PBT) of -¥1,345 million, a sharp reversal from the ¥4,744 million profit recorded in the same quarter of the previous fiscal year (1Q FY25.3). This represents a substantial YoY decline of ¥6,089 million.

However, the company deliberately provides metrics for its "Basic Business," which excludes the investment-related activities of the GII segment and other one-time items. These figures tell a dramatically different story. Basic Business Profit surged by 37.7% YoY to ¥1,235 million, demonstrating that the fundamental operational health of the company remains strong and is, in fact, accelerating.The GII segment alone accounted for a negative PBT swing of ¥6,159 million (from a ¥3,542 million profit in 1Q FY25.3 to a -¥2,617 million loss in 1Q FY26.3), more than explaining the entirety of the consolidated PBT decline.This isolates the source of the loss squarely within the non-operational investment arm.

Revenue and Market Reaction

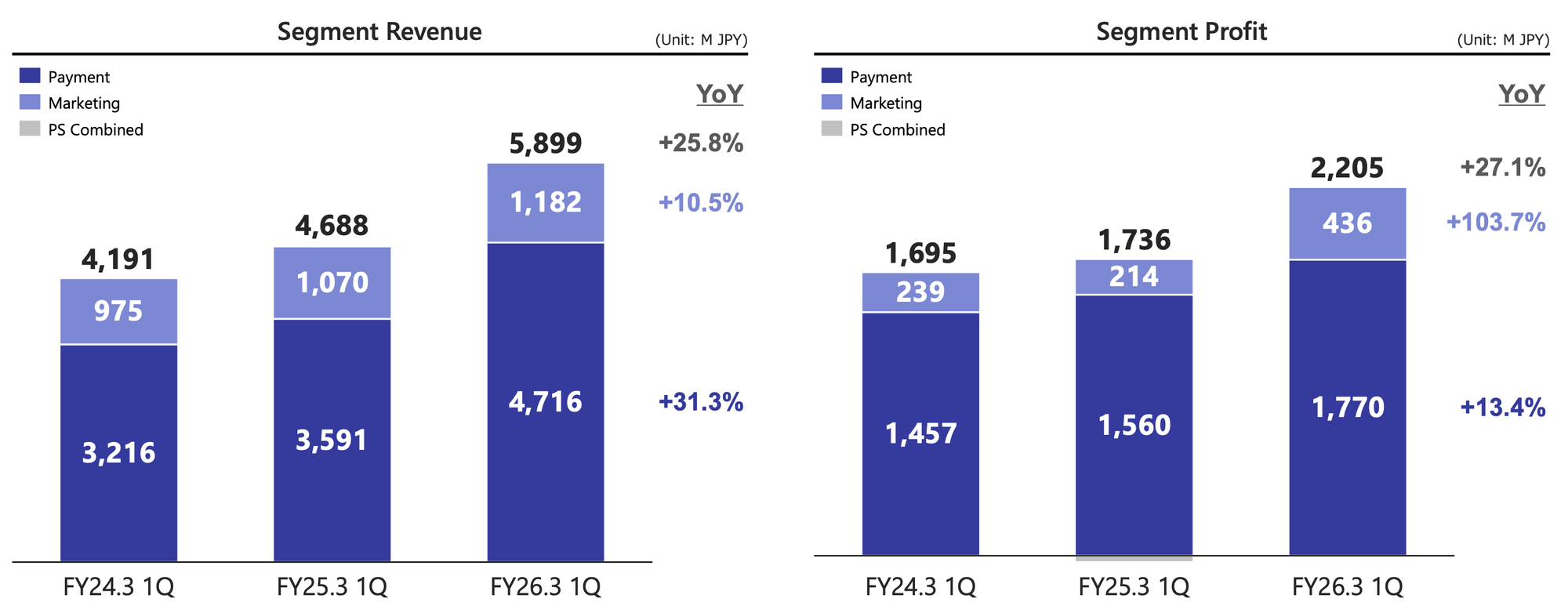

The strength of the core business is further reflected in its top-line performance. Basic Business Revenue grew a robust 21.8% YoY to ¥9,622 million, driven primarily by the PS segment's 25.8% expansion. This strong, recurring revenue growth is a key positive indicator for the underlying business.

The stock market's reaction to the earnings announcement on August 7, 2025, was swift and negative. On August 8, the stock price fell over 6.5%, from a previous close of ¥3,680 to approximately ¥3,435, on trading volume that was significantly higher than the daily average. This sharp decline suggests that the market's initial interpretation was driven by the headline consolidated loss, likely without fully discounting the non-cash, forex-driven nature of the GII segment's write-down. The stock now trades considerably below its 52-week high of ¥5,220 but remains well above its low of around ¥2,646.

The explicit separation of "Basic Business" performance in investor materials is a clear signal from management to focus on the operational metrics. The powerful 37.7% growth in Basic Business Profit underscores the health of the recurring revenue streams. An accurate valuation of Digital Garage must therefore be based on a sum-of-the-parts analysis, applying an appropriate earnings multiple to the stable and growing core business while separately assessing the GII portfolio, accounting for both its inherent volatility and the company's clear strategy to de-risk it. The market's immediate reaction suggests this distinction has not been fully appreciated, creating a potential mispricing opportunity.

Segment Deep Dive: Analyzing the Core and the Periphery

An analysis of Digital Garage's three distinct business segments reveals a powerful core engine in the Platform Solution and Long-term Incubation segments, whose strong performance was overshadowed by external pressures on the Global Investment Incubation segment.

Platform Solution (PS) Segment: The Engine of Growth

The PS segment, the company's core business, delivered an exceptionally strong quarter. Profit before tax grew by an impressive 27.1% YoY to ¥2,205 million, outperforming the company's own medium-term plan guidance of 20-25% growth.This segment was the primary contributor to the robust "Basic Business" results.

Payment Sub-Segment: The foundational payment business continued its steady growth, with PBT increasing 13.4% YoY to ¥1,770 million. Total payment transaction volume (TXN) grew 14.0% YoY to reach ¥2,040 billion for the quarter. While solid, this represents a moderation in the growth rate. The company attributes this to specific, identifiable headwinds: a plateau in high-ticket inbound tourist spending at department stores due to the yen's appreciation, and difficult year-over-year comparisons in the securities category following a surge in transactions related to Japan's new NISA investment program in the prior year. The company anticipates growth will re-accelerate in the second half of the fiscal year as large-scale projects, such as the KDDI partnership, become operational.

A noteworthy aspect of the payment business performance is the apparent contradiction between the company's stated headwind of slowing inbound consumption and the broader macroeconomic data. External sources confirm that Japan experienced a record-breaking year for tourism in the first half of 2025, with visitor arrivals surging YoY and setting new monthly records. The resolution of this discrepancy lies in the nuance of the company's explanation. The issue is not a decline in the number of tourists, but a shift in their spending behavior. The appreciation of the JPY during the quarter (from roughly 149 to 144 against the USD) made high-priced luxury goods at department stores more expensive for foreign visitors. This led to a specific decline in QR code payments from foreign visitors, particularly impacting duty-free sales, even as the overall number of tourists increased. This headwind is therefore highly specific and could reverse if currency trends shift.

Marketing Sub-Segment: This sub-segment was the quarter's standout performer, with profit exploding 103.7% YoY to ¥436 million on revenue growth of just 10.5%. This indicates the execution of extremely high-margin projects. Management explicitly credits this to the contribution from "large-scale projects secured LFY, in the financial domain". This highlights a degree of lumpiness in the marketing business but, more importantly, demonstrates a successful synergy between the payment and marketing arms, leveraging their deep entrenchment in the financial ecosystem to secure lucrative contracts.

Long-term Incubation (LTI) Segment: Strategic Bets Nearing Monetization

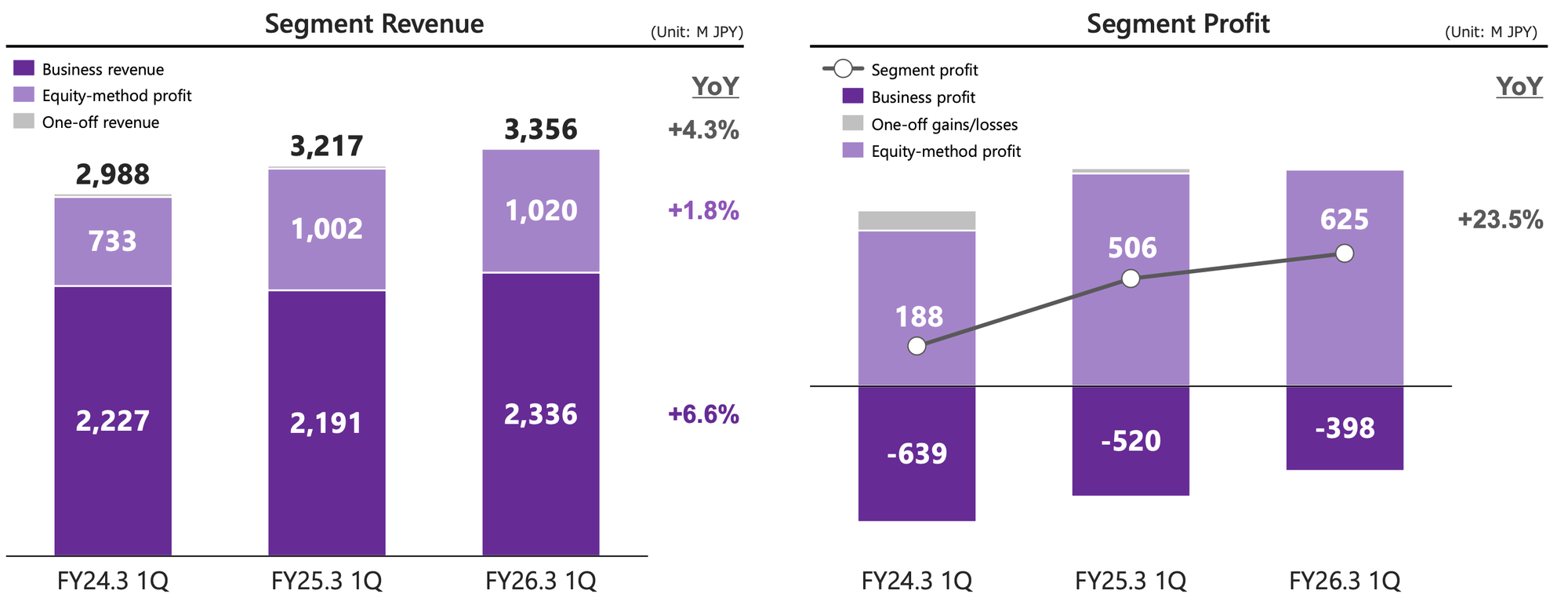

The LTI segment is showing clear signs of reaching a positive inflection point. PBT grew a healthy 23.5% YoY to ¥625 million, a result of shrinking operating losses from its portfolio of strategic businesses and stable equity-method profits from its stake in Kakaku.com.

The portfolio of "Strategic Businesses" is the key area to watch. Revenue from this group of new ventures surged 61% YoY, and critically, the payment transaction volume they generate—which is fed back into the core PS segment—grew by an even more impressive 106% YoY. This demonstrates a positive feedback loop where LTI's new services not only generate their own revenue but also amplify the scale and value of the core payment platform. Key contributors to this growth include

The synergistic relationship with media giant Kakaku.com also continues to deepen. While direct equity-method profit grew modestly by 1.8%, the strategic value is far greater. Payment transaction volume processed by DG from the Kakaku.com group grew over 20% (on a trailing twelve-month basis) to a record high. The recent mutual appointment of board members between the two companies signals a commitment to unlocking further synergies. The LTI segment is successfully transitioning from a cost center focused on investment into a genuine growth and synergy engine for the entire group.

Global Investment Incubation (GII) Segment: Navigating Forex Headwinds

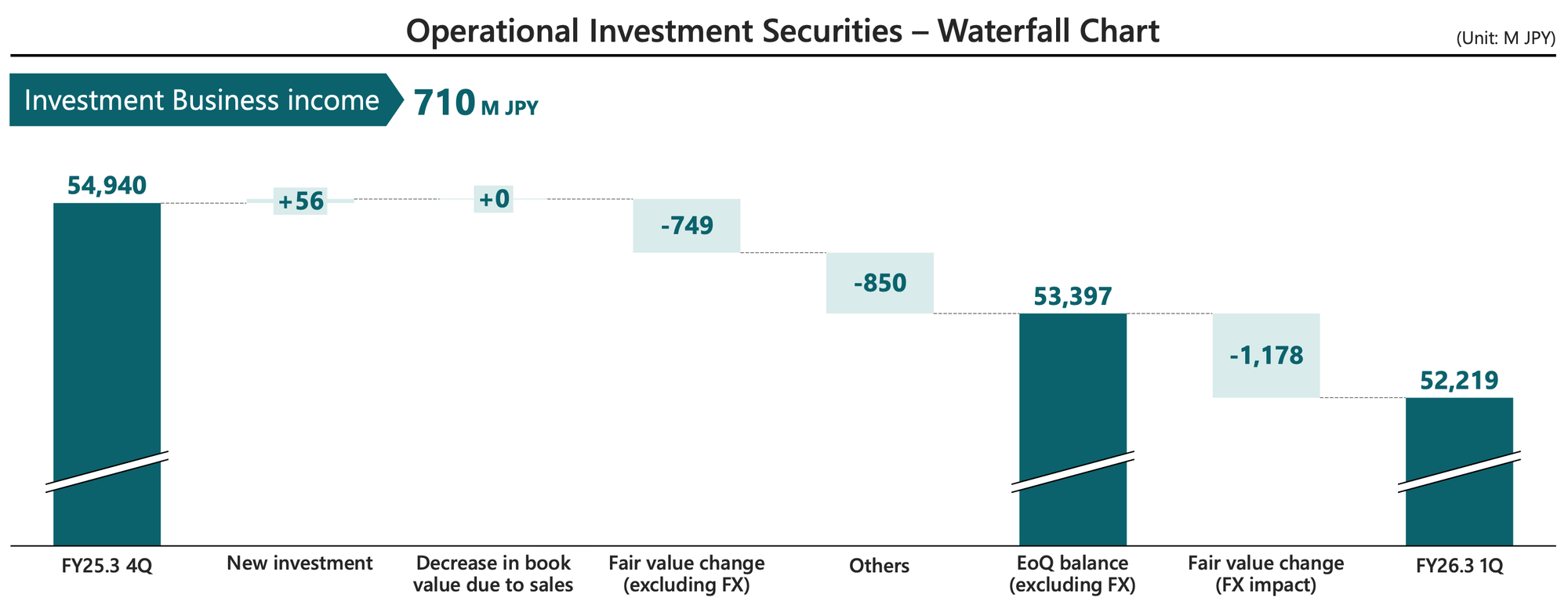

The GII segment was the sole source of the consolidated loss, posting a PBT of -¥2,617 million. This represents a massive negative swing of ¥6,159 million from the ¥3,542 million profit in the prior-year quarter.

The cause of this loss is clearly delineated by the company and is non-operational in nature. A waterfall chart reconciling the change in the value of operational investment securities shows that a -¥1,178 million "Fair value change (FX impact)" was a primary driver of the decline. This is a non-cash accounting adjustment resulting from the appreciation of the Japanese Yen against the US Dollar and other currencies. With 47.1% of the portfolio's value in North America and 80.2% of its investments denominated in USD, the GII segment is highly exposed to such currency fluctuations. An additional factor was the non-recurrence of a large foreign exchange gain related to a stake in Blockstream that was recorded in 1Q FY25.3.

This quarter's result serves as a powerful validation of management's strategic decision to de-risk this segment. A core pillar of the Medium-Term Plan is to move these volatile, on-balance-sheet investments into fund structures, such as the joint fund with Resona, precisely to "keep the impact on earnings from fair value fluctuations...to a minimum". The company is making good progress, having already achieved ¥14.5 billion of its five-year, ¥30 billion investment income target. Therefore, the GII loss should not be viewed as a new operational failure, but rather as a clear demonstration of a pre-existing, recognized problem that the company is actively and transparently addressing.

Strategic Imperatives: Execution and Future Value Creation

Digital Garage's long-term value proposition is intrinsically linked to the successful execution of its strategic initiatives, particularly the "DG FINTECH SHIFT 2.0" and its cornerstone alliances with Resona Holdings and KDDI Group.

The "DG FINTECH SHIFT 2.0": Progress and Potential

"DG FINTECH SHIFT 2.0" is the company's guiding strategy for FY26.3, representing a deliberate evolution from being a pure payment processor to becoming an integrated "Fintech Intelligent Data" company. This involves moving up the value chain to provide more sophisticated, data-driven BaaS and digital finance solutions. The first quarter showed tangible progress on this front:

- Launch of DGBT: In April 2025, DG consolidated three of its DX-focused subsidiaries to create DG Business Technology (DGBT). This new entity works in tandem with the core payment company, DGFT, to provide a "two-pronged strategy" supporting the entire digital business value chain. This includes new offerings like the "DGBT Security Assessment Service," designed to help merchants comply with evolving e-commerce security standards.

- Expansion of Cloud Pay: The Cloud Pay unified QR code payment platform is expanding into new physical environments. The launch of Cloud Pay Regi, which integrates with automated checkout machines, and a new partnership with Nayax, a global leader in payment terminals for unattended machines, push DG's payment footprint into the growing IoT market, including vending machines, laundromats, and ticketing kiosks.

- Focus on B2B Payments: The company is making a concerted push into the large B2B payments market. This is evidenced by the strong growth of its DGFT Invice Card Payment service and a new strategic partnership with Visa and SAP to offer embedded finance solutions for B2B payments, which is set to launch in 2025.

Alliance Analysis: The Cornerstones of Future Growth

The alliances with Resona and KDDI are not merely sales channels; they are transformative partnerships designed to embed Digital Garage's technology into the core of Japan's banking and telecommunications ecosystems.

Resona Holdings: The partnership with Resona has evolved into a deeply strategic and integrated alliance. A landmark event occurred on July 31, 2025, when Resona Holdings announced it would acquire the approximately 18.6% stake held by activist investor Oasis Management, making Digital Garage an equity-method affiliate of the banking group. This transaction is highly significant as it removes the potential for activist-driven disruption and aligns both companies for the long term. The alliance is built on five key initiatives:

- Joint Sales: Leveraging Resona's sales force to offer DG's payment solutions to Resona's vast client base of 500,000 SMEs.

- Next-Gen Payment App: Jointly developing a new payment application tailored for SMEs.

- BaaS for SMEs: Supporting DG's entry into the BaaS and digital finance business, which is envisioned as a "second profit pillar" for the company.

- New Business Development: Collaborating on new services, such as specialized payment solutions for the medical industry.

- Joint CVC Fund: Investing in startups together to accelerate innovation.

KDDI Group (au Financial Service): The co-development of the "NESTA" (Next Standard) payment platform with KDDI's financial arm is a major potential catalyst for transaction volume. Built upon DG's secure "VeriTrans4G" infrastructure, NESTA is a next-generation platform designed for high security and performance. The platform is scheduled to launch within 2025, with the initial implementation being the processing of au and UQ mobile telecommunication bills. The strategic plan is to subsequently expand NESTA's use to other services within the massive KDDI ecosystem and eventually offer it to third-party companies. This single initiative has the potential to significantly increase DGFT's payment transaction volume and is a key factor in the company's forecast to exceed ¥10 trillion in TXN volume in FY26.3.

These alliances are fundamentally changing DG's business model. They are transitioning the company from being a commoditizable payment service provider (PSP) that serves merchants, to becoming the core, non-displaceable infrastructure for major banking and telecom ecosystems. This shift should lead to stickier client relationships, higher barriers to entry for competitors, and substantially greater long-term revenue and profit potential.

Market Environment and Competitive Positioning

Digital Garage operates within a favorable but competitive market environment, with macroeconomic factors playing a significant role.

- Japanese Payment Market: The broader market provides a powerful secular tailwind. Japan is undergoing a significant government-supported shift toward a cashless economy. Various market reports forecast the payment gateway market to grow at a robust compound annual growth rate, with estimates ranging from 5.5% to over 23%, depending on the specific scope and methodology. This growing pie benefits all participants. The competitive landscape includes global giants like PayPal and Stripe, domestic tech leaders like PayPay and Rakuten Pay, and other payment service providers. Digital Garage's key competitive advantages are its 30-year history, its designation as providing critical payment infrastructure in Japan, and its unique strategy of deep, embedded partnerships with ecosystem leaders like Resona and KDDI, which are difficult for more transactional competitors to replicate.

- Macroeconomic Factors: The operating environment is influenced by two key macro variables. First, inbound tourism continues to set records, providing a volume boost for payments, although spending patterns are sensitive to currency shifts. Second, the JPY/USD exchange rate is a double-edged sword. The yen's appreciation in the quarter hurt GII valuations, but a significant reversal to a weaker yen, while beneficial for the GII portfolio, could introduce other pressures like domestic inflation. This forex volatility remains a key external risk to monitor.

Financial Health and Shareholder Return Policy

Digital Garage maintains a solid financial position and a clear, shareholder-friendly capital return policy.

- Balance Sheet: As of the end of the quarter, total assets stood at ¥212.0 billion, down from ¥226.3 billion at the end of FY25.3. This decrease was primarily driven by the change in the value of operational investment securities in the GII segment and normal fluctuations in trade receivables and payables related to the payment business.The company maintains a healthy liquidity position with a current ratio of 1.48.

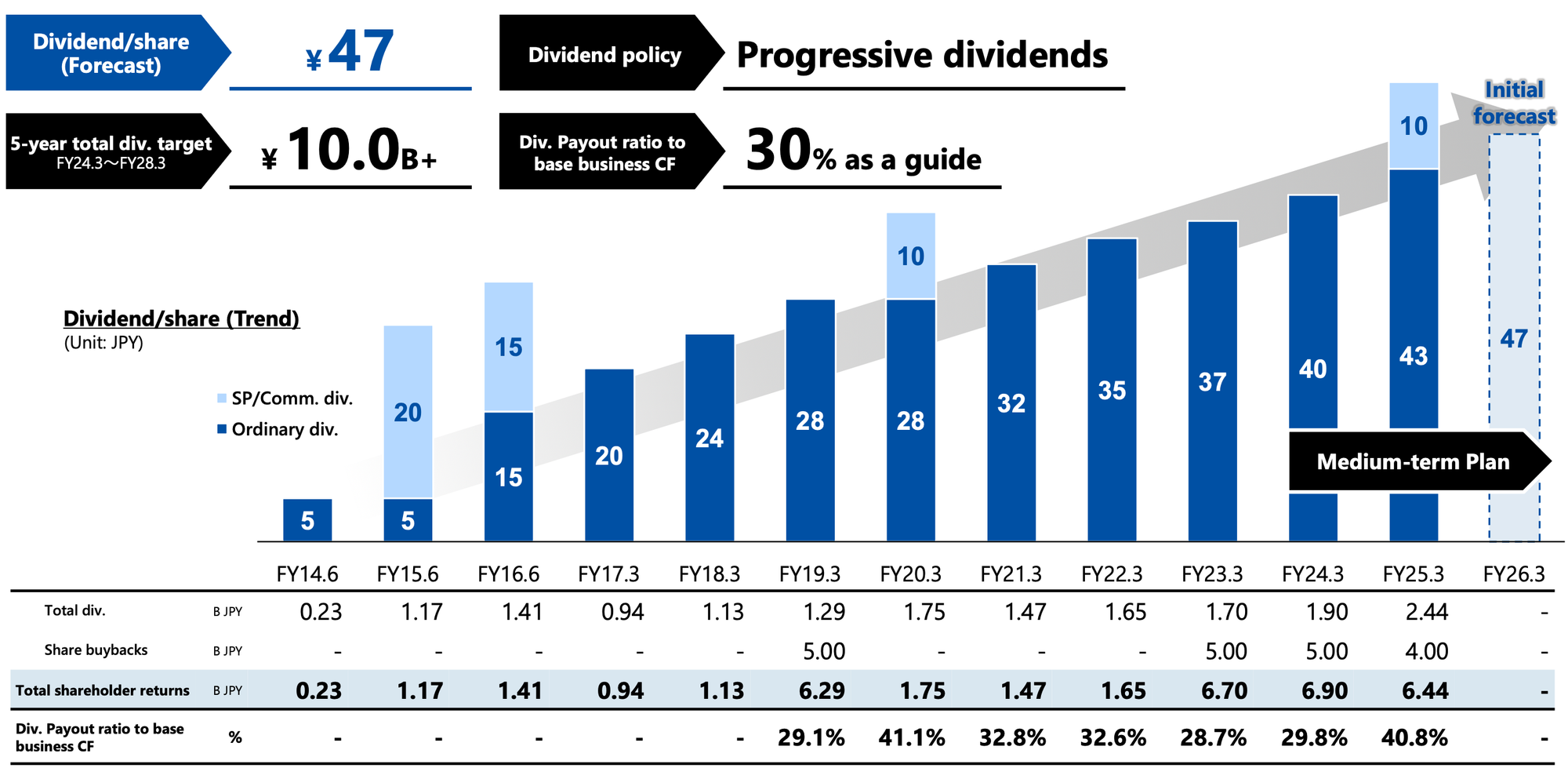

- Shareholder Return Policy: The company's policy is both transparent and prudent. It is structured around a progressive dividend funded by the stable and growing cash flows of the core business, supplemented by additional returns funded by the more opportunistic cash flows of the investment business.

- Progressive Dividend: The company is committed to steadily increasing its dividend. The forecast for FY26.3 is a dividend of ¥47 per share, representing a 9.3% increase from the ¥43 per share paid for FY25.3. This demonstrates management's confidence in the earnings power of the core business. The target payout ratio against base business cash flow is 30% or more.

- Additional Returns: The policy explicitly allows for "additional returns," such as special dividends and share buybacks, to be funded from the proceeds of the investment business. The company has a strong track record of following through on this, having completed ¥9.0 billion in share buybacks over the last two fiscal years. This dual-source framework provides a reliable base dividend with the potential for upside, which is an attractive structure for long-term investors.