Digital Garage FY3/25 Financial Results

Digital Garage's financial report for the fiscal year ending March 2025 presents a nuanced picture of growth and strategic realignment, characterized by significant progress in its core payment solutions segment alongside challenges and forward-looking initiatives in its long-term incubation and global investment sectors. The company's strategic focus on integrating financial technology (FinTech) with intelligent data underpins its ambition to design new contexts for a sustainable society, leveraging technology to drive continuous business growth. Digital Garage's business model, built around three core technologies—information technology (IT), marketing technology (MT), and financial technology (FT)—enables it to capture technological evolution and achieve sustained expansion.

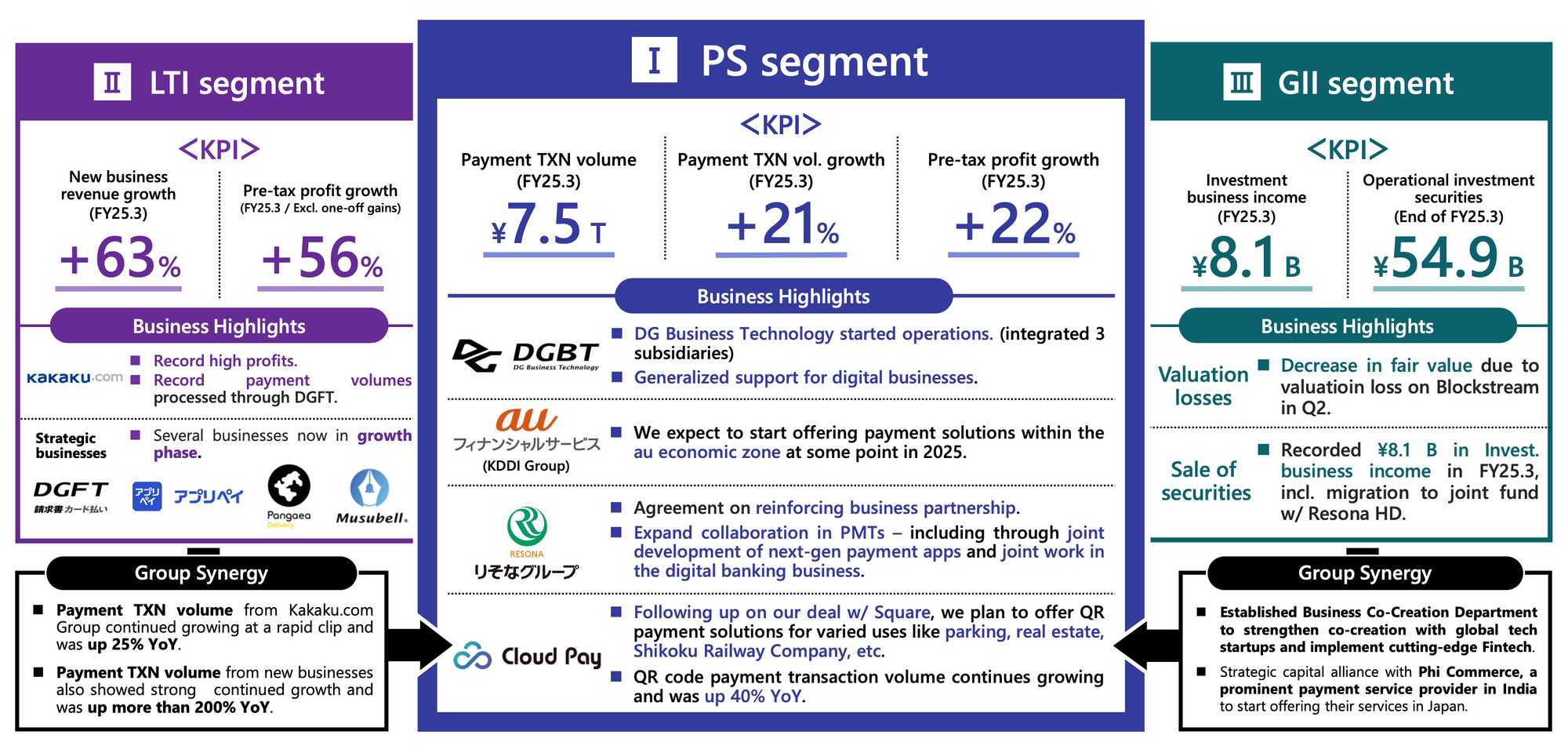

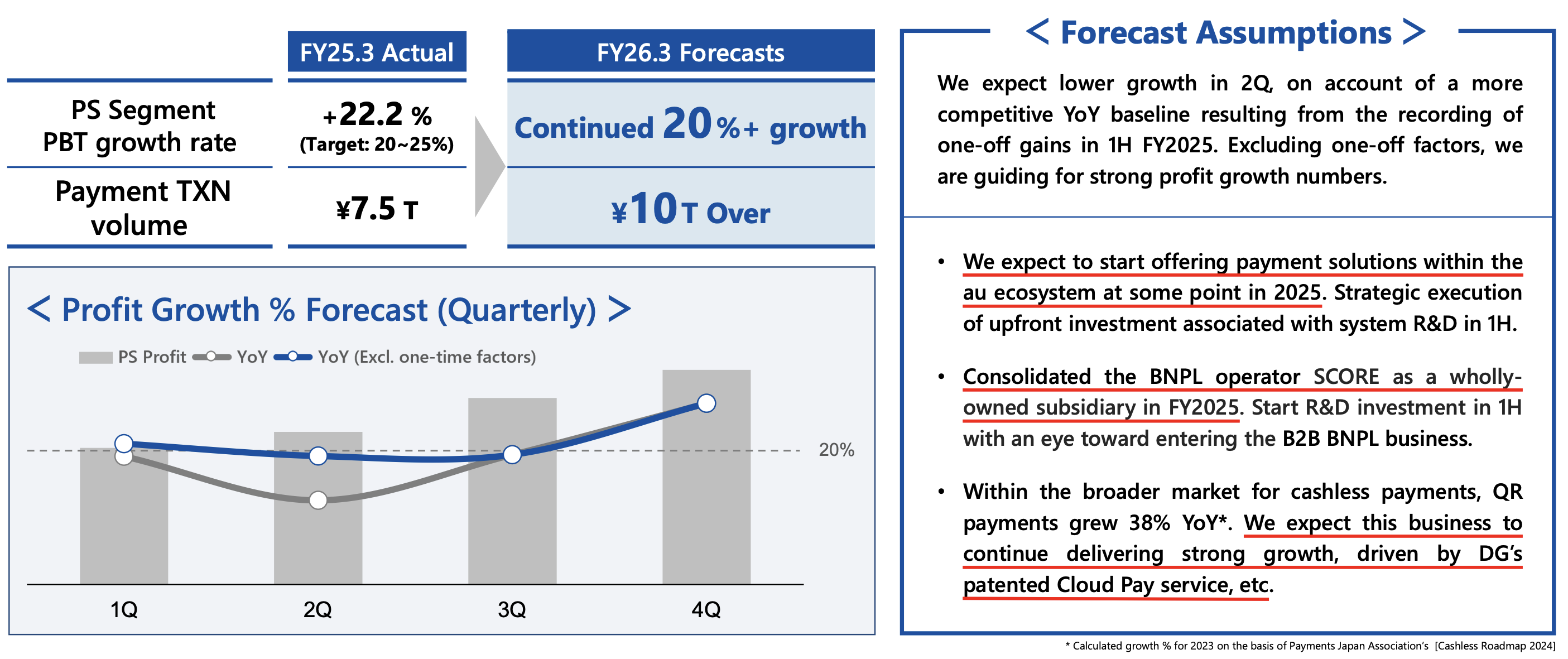

Digital Garage highlights the PS (Platform Solution) segment as a primary growth engine, achieving a notable 22% profit increase and meeting full-year guidance targets. This growth is attributed to the continued strength of payments, the company's core business, and the increased adoption of Square, a payment processing platform, which contributed to a significant rise in transaction volume, now reaching ¥7.5 trillion. Digital Garage is proactively forging strategic alliances to bolster medium-to-long-term growth and penetrate new areas, collaborating with companies like Resona, Toshiba, JCB, and ANA to accelerate expansion. A key element of this strategy involves enhancing its sales structure and promoting the use of its Cloud Pay unified QR code payment solution to broaden its presence in the cashless payments landscape. Furthermore, the acquisitions of SCORE and DG Commerce, which became wholly-owned subsidiaries, along with the establishment of DGBT and the strengthening of buy now, pay later (BNPL) support for e-commerce businesses, signal a commitment to solidifying its position in the payment solutions sector.

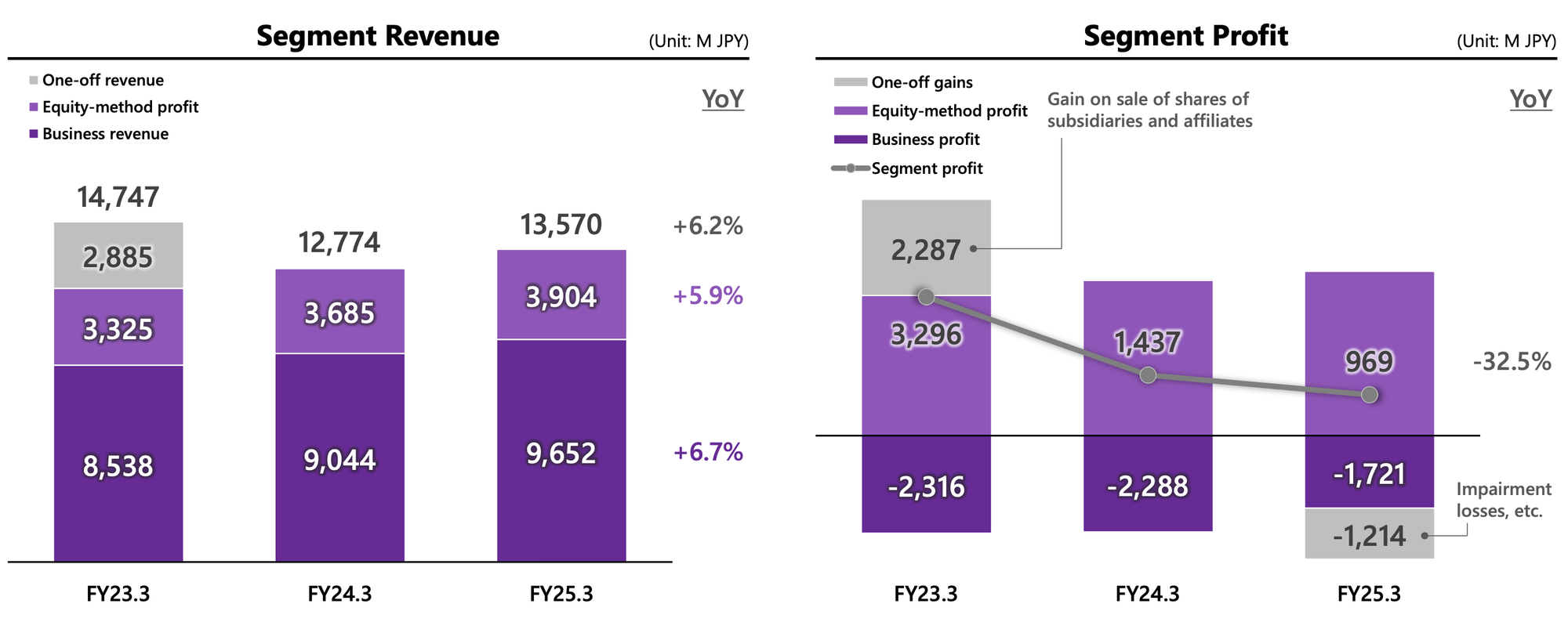

In contrast, the LTI (Long-Term Incubation) segment demonstrated mixed results. Equity-method revenue increased by 5.9%, primarily due to the strong performance of Kakaku.com, driven by its Tabelog food review business and job listing media. However, the segment's overall profit declined, attributed to software asset impairment following a review of some new businesses. Digital Garage anticipates that these losses will diminish as projects transition from investment phases into growth and monetization stages. Kakaku.com continued to show promising results, with several incubation businesses, including Musubell (real estate DX) and Pangaea Delivery (restaurant/retail DX), entering growth phases, indicating potential future value creation.

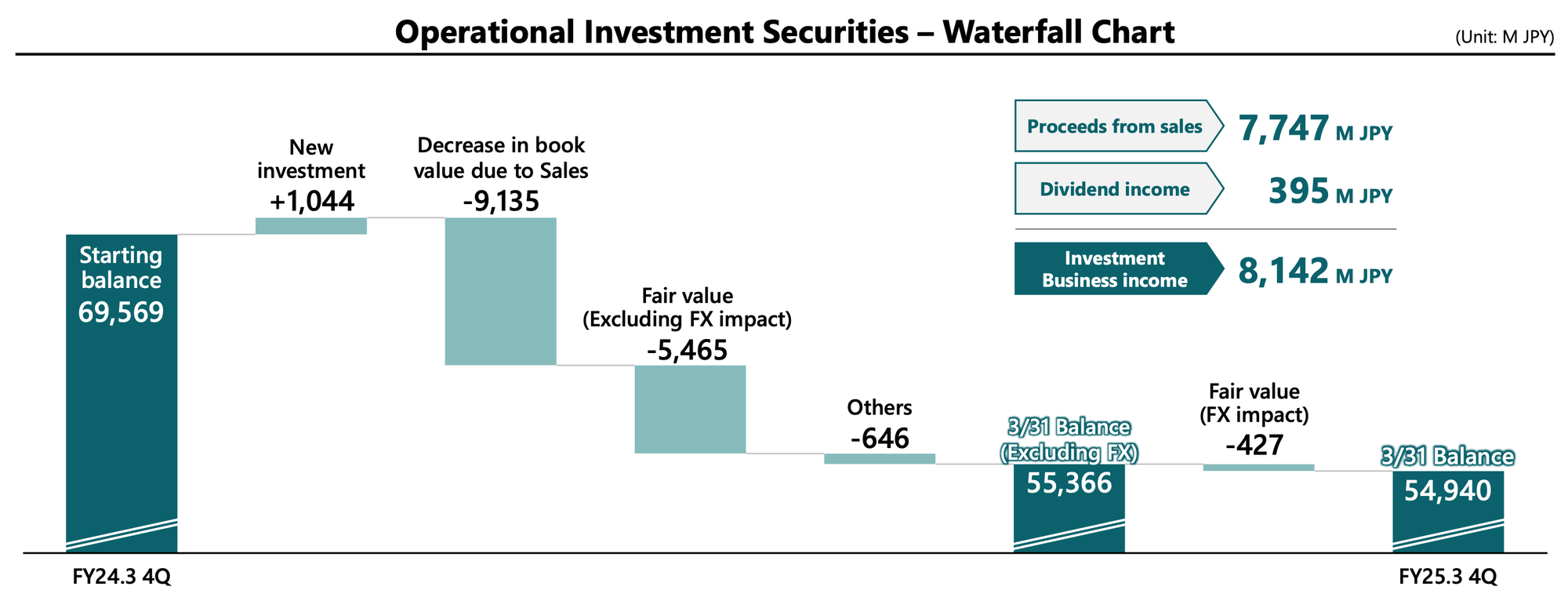

The GII (Global Incubation Investment) segment reflects Digital Garage's strategic shift towards a fund-type investment model, aimed at reducing earnings volatility and unlocking synergies through co-creation. While the segment recorded an investment business income of ¥8.1 billion, it also experienced valuation losses, primarily due to Blockstream in Q2. Progress is being made in moving investments off balance sheet. The company has reached 46% of its 5-year medium-term plan investment business income target of ¥30 billion in just two years.

Consolidated financial highlights reveal a consolidated loss primarily attributable to Blockstream valuation losses. The PS segment emerges as a strong performer, boosting payment business results. Though profit was affected in the LTI segment due to impairment losses, the overall performance of the underlying operations remain strong.

Looking forward, Digital Garage has provided earnings guidance for the fiscal year ending March 2026. It expects profits to cluster in the second half of the year due to upfront investment to drive future growth. The Company is guiding for a 20% YoY growth. The Company expects that Annual payment transaction volume will exceed ¥10T. The assumptions take into account lower growth in 2Q due to a competitive YoY baseline. These initiatives include strategic alliances in the PS segment, which are expected to result in monetization initiatives in new businesses and growth in payment transaction volume. The operation of DG Business Technology (DGBT) will support and expand the monetization domain and allow strategic payment alliances. The Company intends to be in the au ecosystem. DG recently consolidated BNPL operator SCORE as a subsidiary.

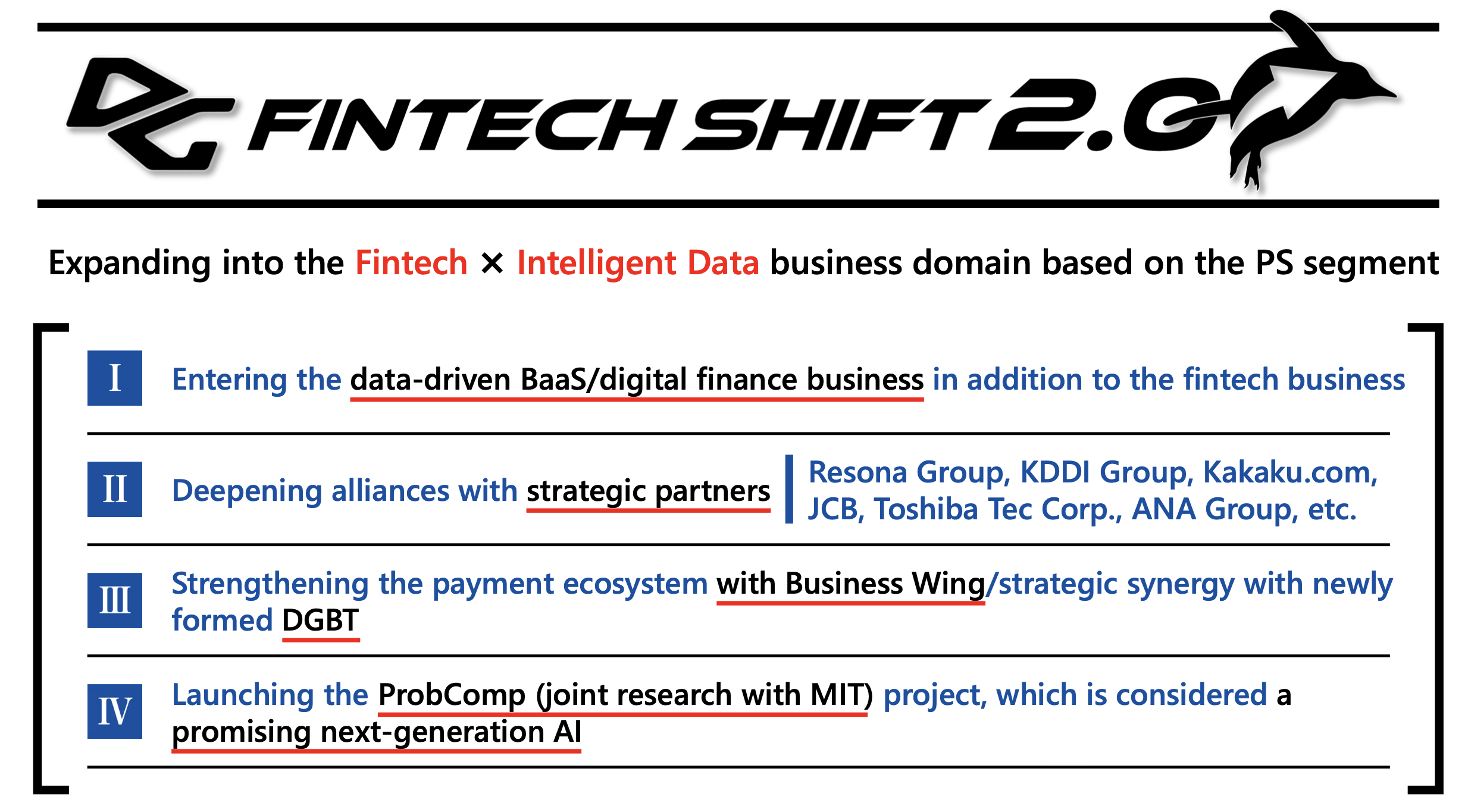

Digital Garage's business strategy for the fiscal year ending March 2026 revolves around "Fintech Shift 2.0," focusing on expanding into the Fintech x Intelligent Data domain based on the PS segment. This involves several key initiatives, including entering the data-driven BaaS/digital finance business, deepening alliances with strategic partners, strengthening the payment ecosystem with Business Wing/strategic synergy with newly formed DGBT, and launching the ProbComp (joint research with MIT) project, considered a promising next-generation AI endeavor. The Company is focusing on expanding relationships with Resona and au.

Digital Garage actively monitors its investments and has a policy to retain cash through earnings.The company's strategy emphasizes the monetization of existing and new payment volume via Fintech, including intelligent data and banking initiatives. DG will seek strategic financial and capital investment, as well as sales and deployment for growth in value and payments.

Finally, the company is implementing several environmental, social, and governance (ESG) and social initiatives, with a specific focus on creating the right structure and platform to increase its long-term shareholder value and achieve sustainable growth.