Digital Platformer and JPYC Start Joint Study for Business Alliance between JPYC and Regional Financial Institutions

Digital Platformer and JPYC have commenced a joint study aimed at mutual cooperation between Japan's first Japanese Yen-pegged stablecoin "JPYC" and the deposit-backed token "Tochika," launched by Hokkoku Bank in April 2024, as well as the construction of a business alliance model with regional financial institutions.

This initiative aims to promote the efficiency and digitalization of regional economies by fusing the highly reliable deposit and remittance infrastructure possessed by regional financial institutions with new financial infrastructure based on blockchain technology.

Background

Digital Platformer has collaborated with local governments and regional banks to build multiple blockchain platforms for regional currencies and digital vouchers. Notably, in 2024, the company provided technical support to Hokkoku Bank for "Tochika," Japan's first deposit-backed token, contributing to the establishment of a system where regional financial institutions can issue stablecoins themselves.

On the other hand, JPYC has started issuing "JPYC," a Japanese Yen-pegged stablecoin classified as a Fund Transfer Service type. The company has received inquiries from regional financial institutions across the country regarding the issuance and redemption of JPYC and connections to payment infrastructure.

Moving forward, both parties will proceed with joint considerations regarding the following issues, including feasibility and institutional challenges, while incorporating the opinions of experts:

- The ideal model for regional financial institutions to handle JPYC issuance and redemption operations.

- Optimization of fees and payment schemes when merchants introduce JPYC payments.

- Methods for smooth coordination between Yen deposits and JPYC with regional financial institutions.

- Possibilities for improving efficiency in domestic/international remittances and developing new services using JPYC.

Through this initiative, both parties will support the utilization of stablecoins in forms optimized for each region, thereby promoting new revenue opportunities for regional financial institutions and the digital transformation (DX) of regional economies.

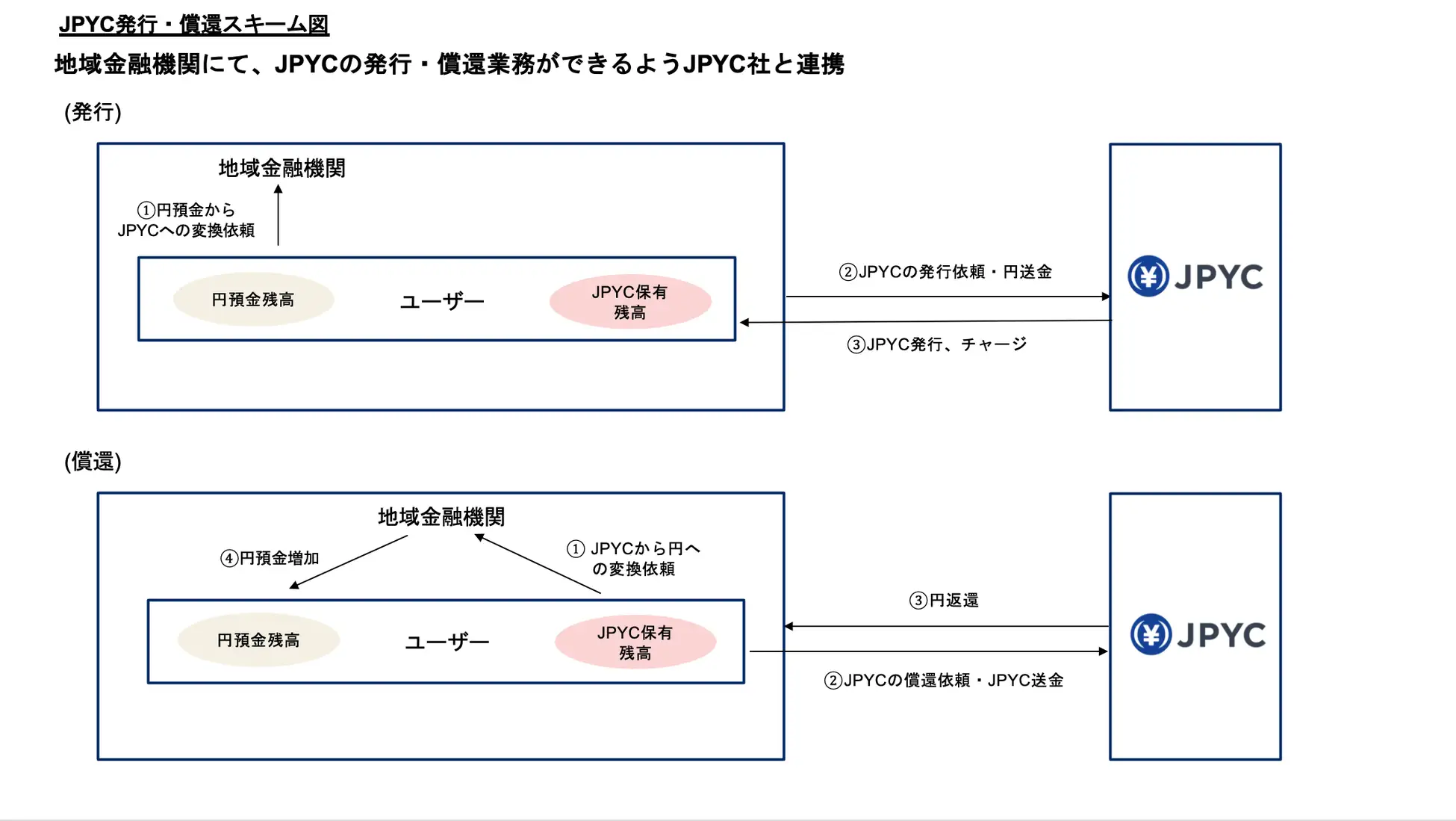

JPYC Issuance & Redemption Scheme

Collaboration with JPYC Inc. to enable Regional Financial Institutions to handle JPYC Issuance and Redemption operations.

Issuance Flow

- User: Requests conversion from Yen Deposit to JPYC.

- Regional Financial Institution: Sends Issuance Request & Yen Funds to JPYC.

- JPYC: Issues JPYC and charges the User's balance.

- Result: User has JPYC Balance.

Redemption Flow

- User: Requests conversion from JPYC to Yen.

- JPYC: Sends Redemption Request & JPYC Remittance to Regional Financial Institution.

- Regional Financial Institution: Returns Yen to User.

- User: Yen Deposit Balance increases.

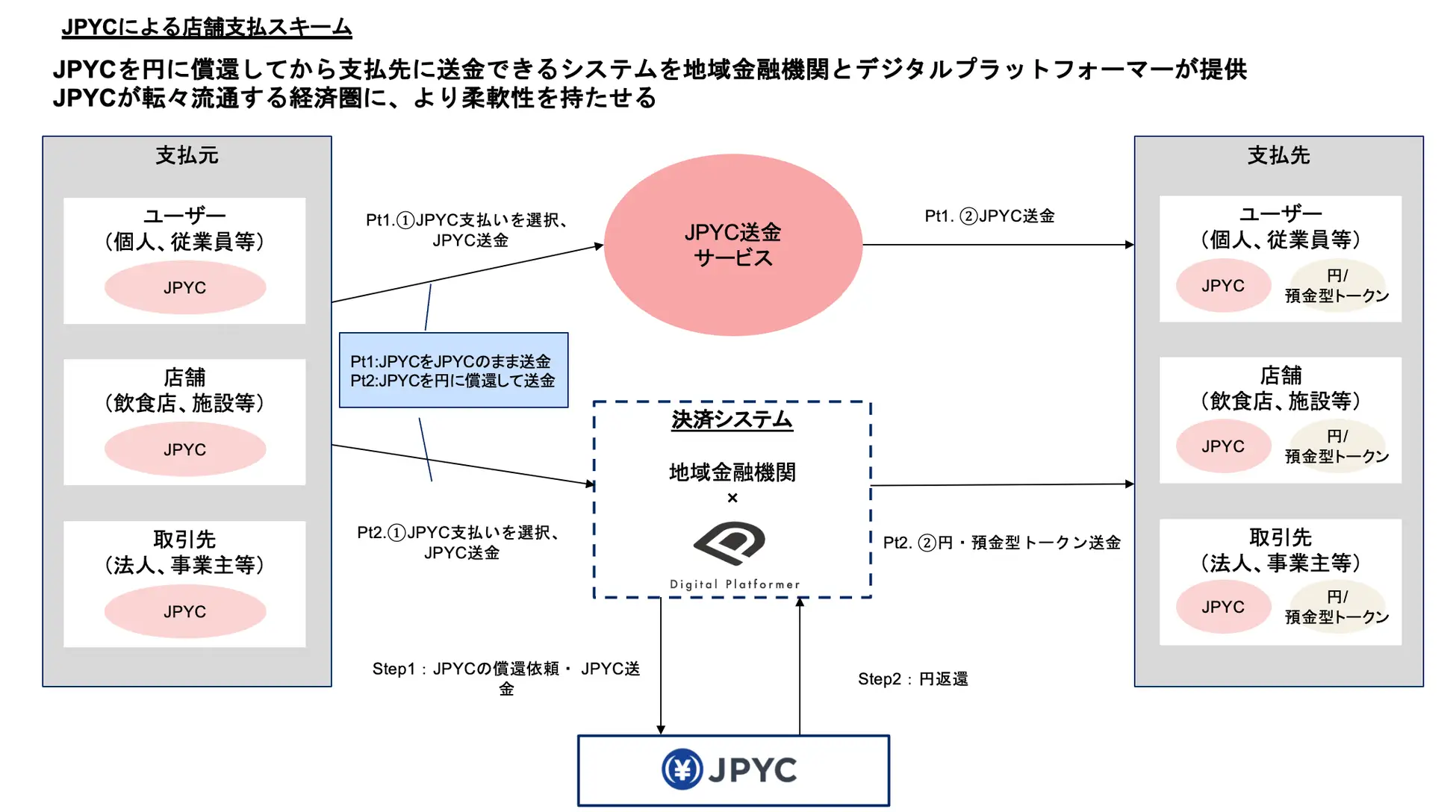

Store Payment Scheme using JPYC

Digital Platformer and Regional Financial Institutions provide a system allowing remittance to payees after converting JPYC to Yen, bringing flexibility to the economy where JPYC circulates widely.

- Central Hub: JPYC Remittance Service.

- Settlement System: Operated by Regional Financial Institutions x Digital Platformer.

Payment Flows

- Pt1 (Direct): User sends JPYC → JPYC Remittance Service → Payee (User/Store) receives JPYC.

- Pt2 (Conversion): User sends JPYC → JPYC Remittance Service converts to Yen via Settlement System → Payee receives Yen or Deposit Token.

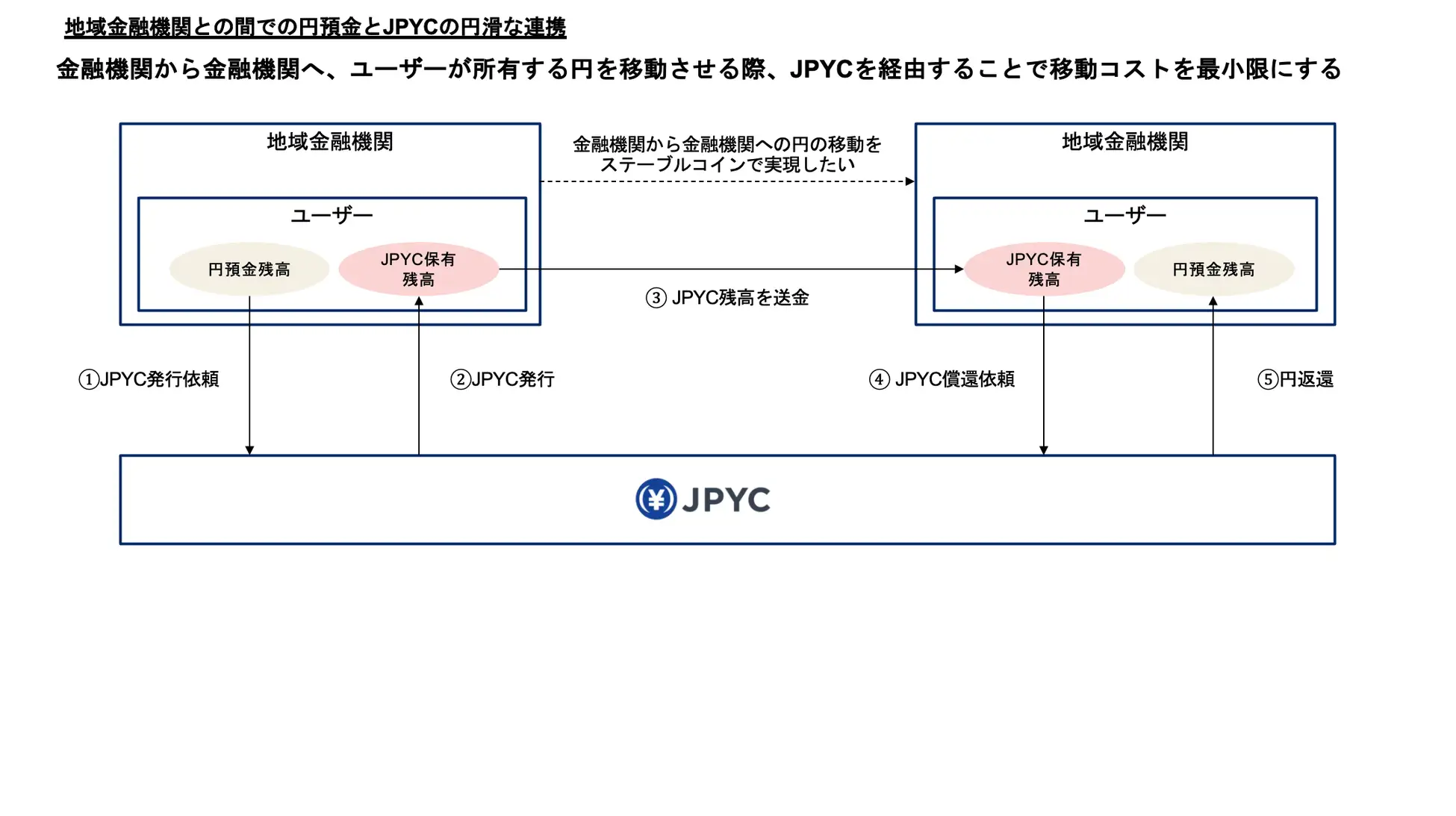

Smooth Linkage of Yen Deposits and JPYC between Regional Financial Institutions

Minimizing movement costs by routing through JPYC when users move Yen they own from one financial institution to another.

Flow

- User requests JPYC issuance at Bank A.

- Bank A issues JPYC (User now holds JPYC).

- User sends JPYC balance to their account context for Bank B.

- User requests JPYC redemption at Bank B.

- Bank B returns Yen to User's deposit account.

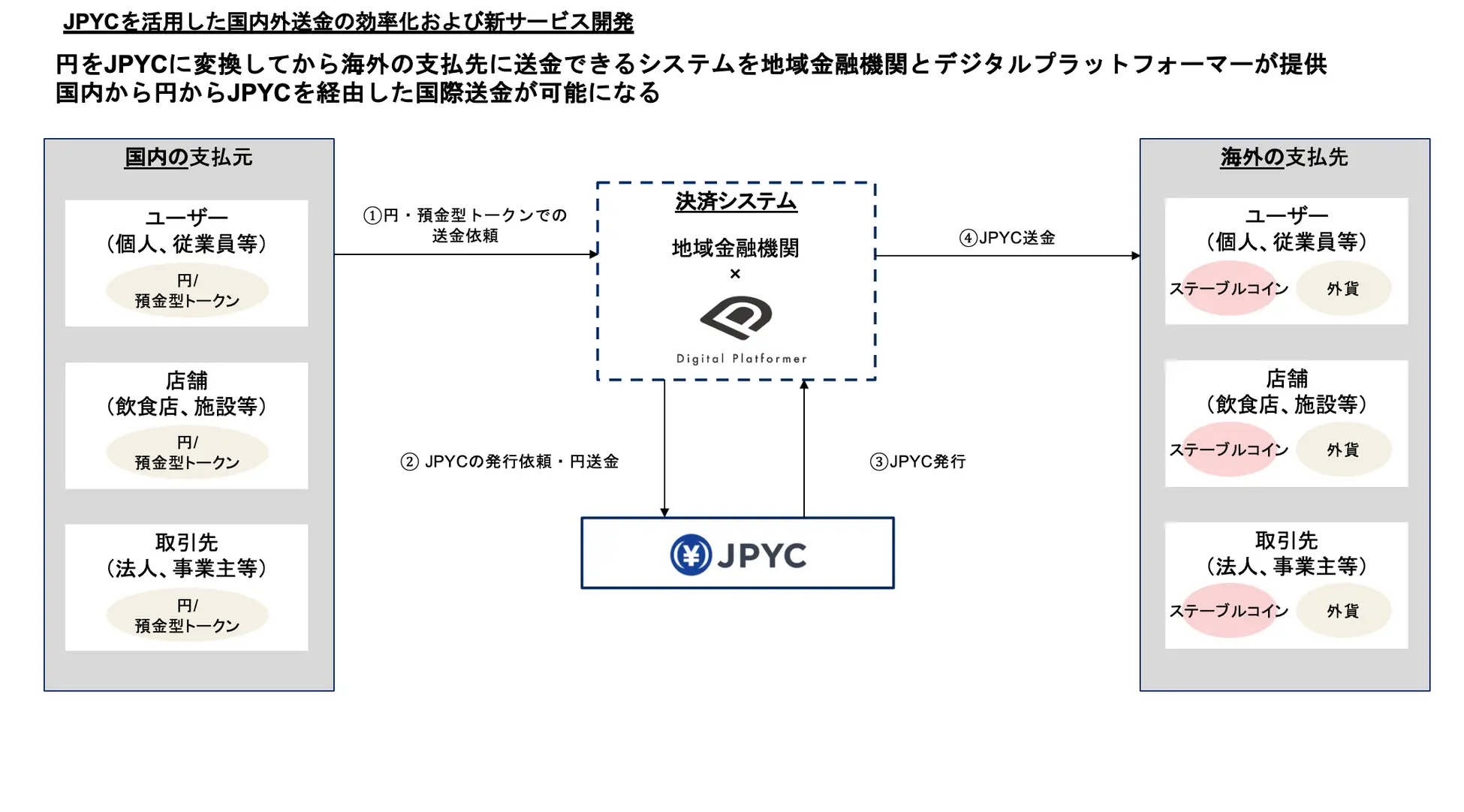

Efficiency of Domestic/International Remittance utilizing JPYC and New Service Development

Digital Platformer and Regional Financial Institutions provide a system enabling remittance to overseas payees after converting Yen to JPYC. Domestic Yen-to-International remittance via JPYC becomes possible.

- Domestic Sources: User (Individual/Employee), Store, Business Partner.

- Action: Request remittance via Yen or Deposit Token.

- Settlement System: (Regional Financial Institution x Digital Platformer).

- Process:

- Issuance request & Yen remittance.

- JPYC Issuance.

- JPYC Remittance to overseas.

- Receipt: Stablecoin or Foreign Currency.

Future Schedule & Outlook

In this joint study, referencing existing cases such as Hokkoku Bank's "Tochika," the parties aim to expand JPYC into a form that can be utilized in both regional payments and international remittances.

Additionally, through a stablecoin exchange that JPYC plans to open, the parties will proceed with considerations to build a highly flexible digital money circulation infrastructure that enables the exchange of domestic and international electronic payment instruments and regional tokens.

In the future, the parties aim to develop an environment that can provide highly convenient financial services to users by significantly reducing foreign exchange costs and remittance times.

About the Deposit-Backed Token "Tochika"

"Tochika" is Japan's first deposit-backed token, jointly developed by Hokkoku Bank and Digital Platformer.

By registering a charging bank deposit account within the "Tochituka" app, a Tochika account is opened. Users can pay at merchants at a rate of 1 Tochika = 1 Yen by charging from the registered bank deposit account.

Merchants can introduce cashless payments at an internationally low cost level, with a settlement fee of 0.5% (tax included).

Features of the Japanese Yen Stablecoin "JPYC"

The Fund Transfer Service type stablecoin "JPYC" possesses the following features as an "Electronic Payment Instrument" based on Article 2, Paragraph 5 of the Payment Services Act:

- Exchangeable 1:1 with Japanese Yen (Issuance and Redemption).

- Can be sent and received instantly while maintaining Yen-pegged value.

- Low-cost, high-speed on-chain remittance utilizing blockchain.

- Assets backing the issuance value are secured at 100% or more of the issuance balance in Japanese Yen (Deposits and Government Bonds).

Beyond various on-chain services combined with smart contracts, there are possibilities for use cases in diverse fields such as receiving salaries and compensation in the future, or withdrawing as cash via ATMs. It is expected to be widely used as future financial infrastructure.