Dissolution of the SBI Holdings and Zodia Custody Joint Venture in Japan

Zodia Custody, the institutional digital asset custodian backed by Standard Chartered, and Japanese financial giant SBI Holdings have mutually agreed to terminate their much-anticipated joint venture, "SBI Zodia Custody," nearly two years after its inception. The venture, which aimed to provide bank-grade crypto-asset custody for institutions in Japan, was dissolved before it could secure regulatory approval or commence formal operations.

The dissolution was framed by both parties as a strategic realignment. In a statement, Zodia Custody CEO Julian Sawyer described the move as a "mutual strategic decision aligned with SBI Holdings' priorities in the region," adding that both firms "have other priorities." Echoing this sentiment, a spokesperson for SBI Holdings characterized the decision not as a retreat but as a "proactive decision aimed at pursuing group-wide synergies with greater speed under our digital ecosystem."

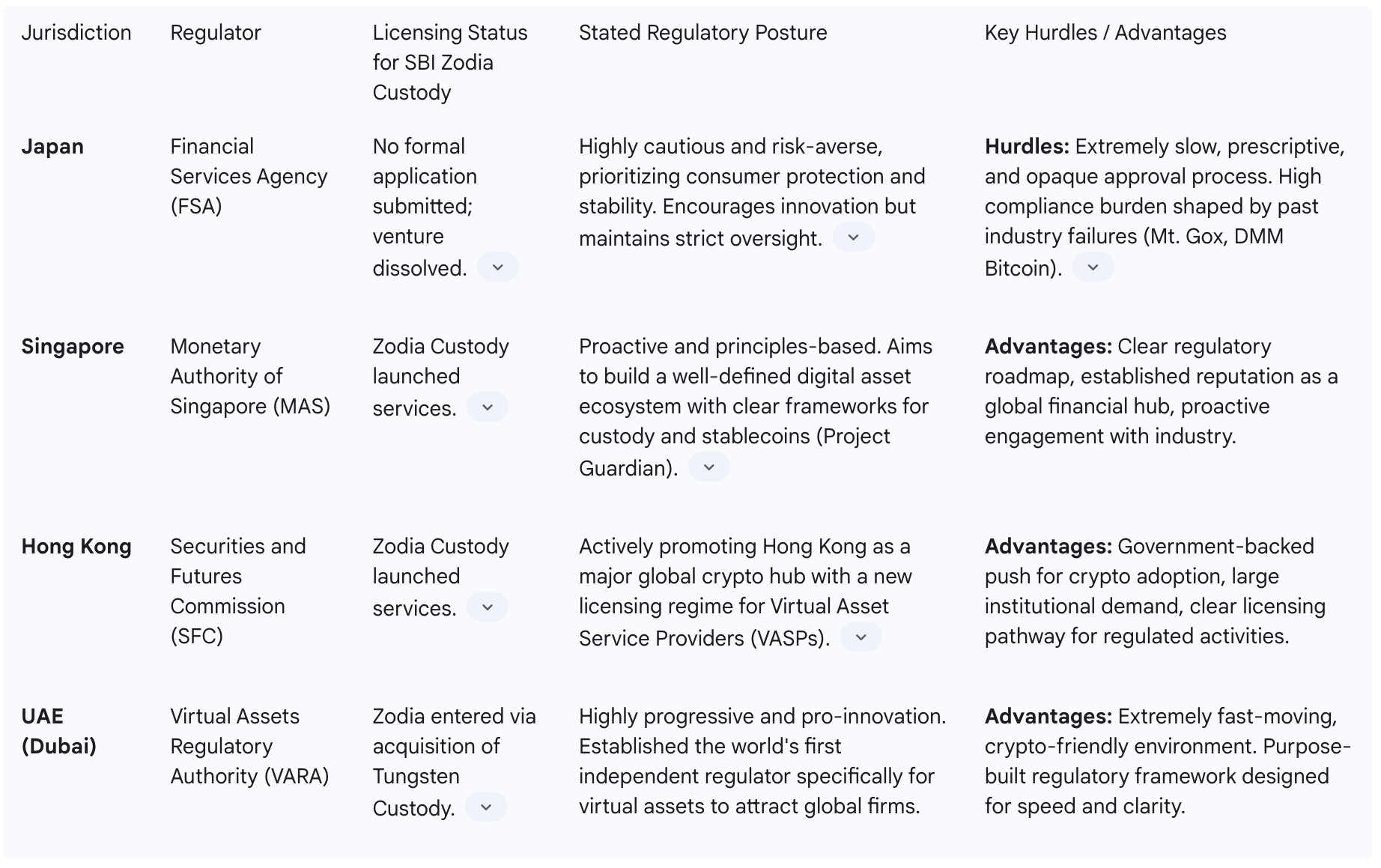

The joint venture, structured with SBI holding a 51% majority stake, was announced in early 2023 with the goal of becoming Japan's first tier-one institutional crypto custodian. However, the entity never progressed to submitting a formal application for local registration with Japan's Financial Services Agency (FSA). According to Sawyer, the venture had been "working and preparing for an application," but the decision to dissolve was made before any regulatory filing. This lack of progress highlights the notoriously stringent and "risk-averse" regulatory climate in Japan, a landscape heavily shaped by the legacy of past industry scandals, including the collapse of Tokyo-based exchange Mt. Gox and the more recent $300 million breach at DMM Bitcoin in 2024.

Despite the venture's closure, SBI Holdings has emphatically stated it is not stepping back from the digital asset space. On the contrary, the Japanese conglomerate is reportedly exploring a new framework for custody services through its own internal entities, including Shinsei Trust & Banking and SBI Clearing Trust. This move suggests a strategic pivot towards building a comprehensive, vertically integrated digital financial ecosystem under its direct control, rather than relying on external partnerships for core infrastructure.

Simultaneously, Zodia Custody is accelerating its global expansion, signaling a clear reallocation of resources to more welcoming regulatory environments. The firm recently acquired Tungsten Custody Solutions in the United Arab Emirates and has successfully launched operations in other key Asia-Pacific markets, including Singapore, Hong Kong, and Australia.Sawyer noted that the firm has "a finite amount of resources available globally," reinforcing the view that the decision was driven by a pragmatic assessment of opportunity cost.

The end of the SBI Zodia Custody partnership serves as a potent case study on the formidable challenges facing international firms in Japan's digital asset sector. The event illustrates how the friction of a cautious regulatory environment, combined with the evolving strategic priorities of a dominant domestic player, can reshape the competitive landscape, reinforcing the formidable position of local incumbents.

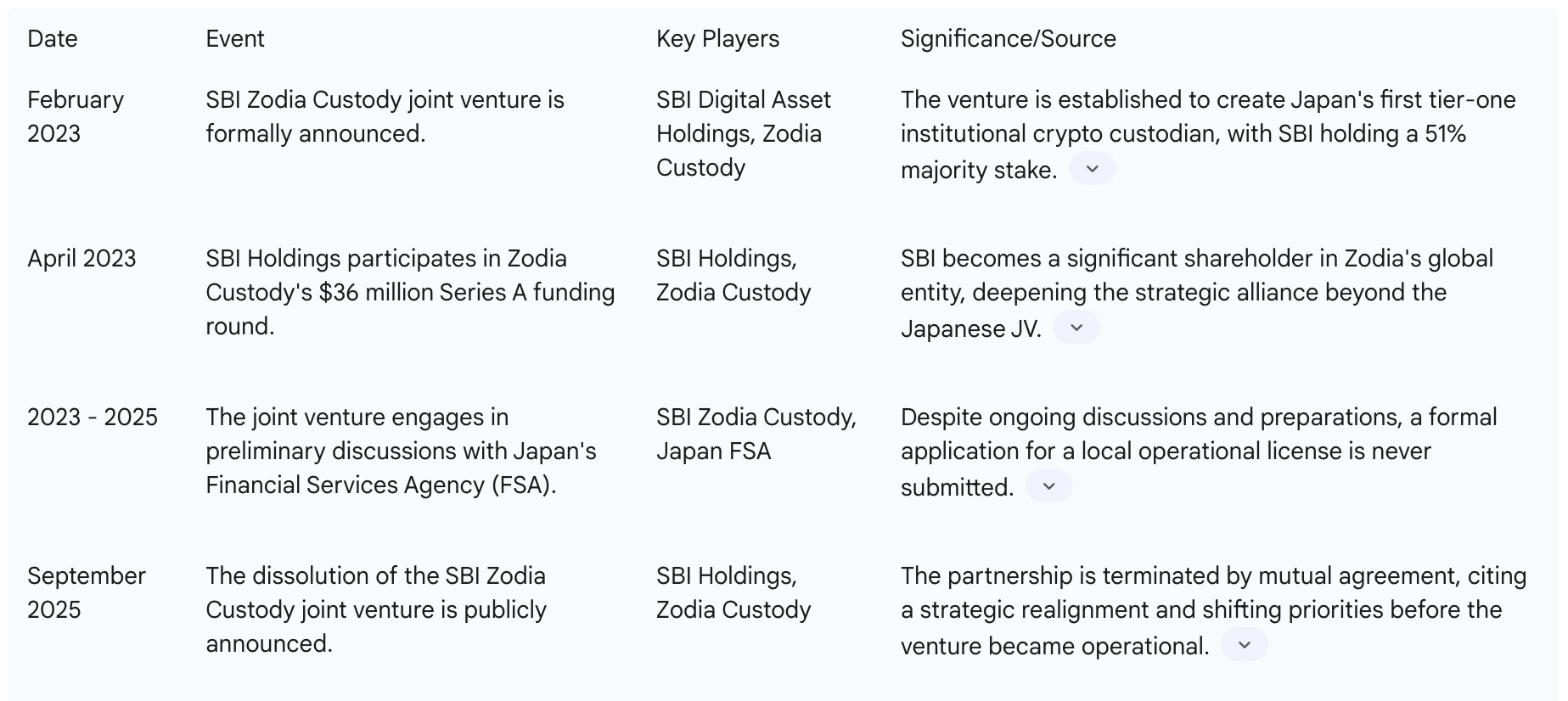

Genesis of the SBI Zodia Custody Venture

The formation of the SBI Zodia Custody joint venture was announced to the market in February 2023, representing what was hailed as a landmark partnership designed to unlock institutional participation in Japan's burgeoning digital asset market. The alliance was forged between two formidable entities: SBI Digital Asset Holdings (SBI DAH), the digital asset arm of Japanese financial services behemoth SBI Holdings, and Zodia Custody, a London-based institutional-grade custodian incubated by SC Ventures, the innovation arm of Standard Chartered, with additional backing from financial services giant Northern Trust.

The structure of the venture was meticulously defined, with SBI DAH holding a 51% majority stake and Zodia Custody retaining the remaining 49%.This ownership split was a critical detail from the outset, signaling SBI's intent to lead the initiative and steer its strategic direction within the Japanese market, while leveraging Zodia's specialized technology and global expertise in institutional custody. The venture's establishment was contingent upon securing necessary clearances, including anti-trust and foreign direct investment approvals, and, most crucially, obtaining the required operational licenses from Japan's powerful regulator, the Financial Services Agency (FSA).

The stated mission of SBI Zodia Custody was ambitious and clear: to establish Japan's first "tier 1 crypto asset custodian" specifically targeting institutional clients. The core strategic objective was to address a well-understood bottleneck that had, until that point, significantly hampered the entry of Japanese financial institutions into the digital asset space. This bottleneck was the conspicuous absence of bank-grade, fully regulated, and highly secure custody solutions that could meet the stringent risk management, compliance, and governance standards demanded by institutional investors. The venture aimed to replicate the trusted custodial services of traditional finance within the digital asset domain, thereby providing a secure and compliant gateway for institutions to gain exposure to cryptocurrencies and other digital assets.

The joint venture was not an isolated transaction but rather the culmination of a deepening strategic relationship between SBI and Zodia Custody. Underscoring its commitment, SBI Holdings participated as a lead investor in Zodia Custody's $36 million Series A funding round in April 2023. This significant investment made SBI a key shareholder in Zodia Custody's global parent company, solidifying the strategic alignment and mutual confidence that underpinned the Japanese venture. This financial tie-in demonstrated that SBI's interest extended beyond a simple domestic partnership, viewing Zodia as a critical component of its broader global digital asset strategy. The initial optimism surrounding the venture was palpable, as it appeared to combine the best of both worlds: the deep local market penetration and regulatory acumen of a Japanese financial titan with the cutting-edge, institution-first technology of a globally recognized, bank-backed custodian.

SBI: Building a Vertically Integrated Fortress

SBI's strategy is to build a self-contained, end-to-end digital financial infrastructure, a "walled garden" that can service every need of a domestic institutional client. This ecosystem is being assembled through a combination of internal development, strategic acquisitions, and a carefully curated network of alliances. The components of this fortress are multifaceted and reveal a highly sophisticated approach:

- Internalizing Custody: The most direct evidence of SBI's pivot is the explicit statement that the company is already exploring a "new framework for its custody services in Shinsei Trust & Banking and SBI Clearing Trust." This is a definitive move to bring the critical function of institutional custody in-house. By leveraging its own licensed trust banks, SBI can develop a bespoke custody solution that is fully integrated with its other services, compliant with Japanese regulations from the ground up, and entirely under its control. This eliminates the need to share revenue or strategic control with an external partner.

- Dominating Trading and Liquidity: SBI already possesses a commanding presence in the trading and liquidity layers of the market. The group owns and operates licensed crypto-asset exchanges, including SBI VC Trade and BITPoint Japan, which provide direct market access. Furthermore, SBI holds a majority stake in B2C2, a leading global crypto market maker. This gives SBI significant influence over liquidity provision for its trading platforms and institutional clients, ensuring efficient execution and tight integration within its ecosystem.

- Leading Issuance and Tokenization: Through its subsidiary SBI Digital Markets, the group is at the forefront of tokenization and digital asset issuance. This entity is actively involved in high-profile initiatives like the Monetary Authority of Singapore's (MAS) Project Guardian, where it has collaborated with global banks like UBS on tokenized funds. This positions SBI not just as a manager of existing digital assets but as a key player in the creation of new, tokenized real-world assets (RWAs).

- Cultivating Strategic Alliances: While bringing core infrastructure in-house, SBI maintains a vast network of powerful global partnerships that serve as "plug-ins" to its ecosystem. These are not joint ventures for core functions but rather alliances for specific technologies or services. Key partnerships include a deep relationship with Ripple for cross-border payments and the use of XRP; a joint venture with Circle for the circulation and use of the USDC stablecoin in Japan; and a new strategic partnership with Chainlink to utilize its oracle data and cross-chain interoperability protocol (CCIP) for tokenized assets and secure data feeds.

From this perspective, the Zodia Custody joint venture became a strategic liability for SBI. The overarching goal of creating a seamless, end-to-end "digital financial ecosystem" requires tight integration, rapid decision-making, and unified control. A joint venture with a foreign entity holding a 49% stake inherently introduces external dependencies, the potential for conflicting strategic priorities, and a slower, more consensus-driven decision-making process. By dissolving the JV and internalizing the custody function, SBI eliminates this friction. It gains full, autonomous control over a critical pillar of its infrastructure, allowing it to integrate custody more tightly and quickly with its trading, issuance, and payment services. Therefore, the dissolution was not a failure of the partnership's original goal but rather a strategic upgrade for SBI, enabling it to pursue its ambitious ecosystem vision with greater speed, agility, and independence.

Zodia Custody's Global Gambit: A Shift to Greener Pastures

For Zodia Custody, the termination of the Japanese joint venture was not a retreat from its international ambitions but a calculated strategic pivot towards markets offering more favorable conditions for growth. The company has been clear that its "commitment to Asia is unchanged," emphasizing that the decision was a specific response to the unique challenges of the Japanese market, not a broader withdrawal from the strategically vital Asia-Pacific region.The move is best understood as a case study in global expansion through regulatory arbitrage, where a firm with finite resources prioritizes jurisdictions that provide a clearer and faster path to operational viability and revenue generation.

A Flurry of Global Moves

The contrast between Zodia's lack of progress in Japan and its rapid expansion elsewhere is stark and illuminating. While the Japanese venture remained stalled in pre-application discussions, Zodia was executing a series of decisive strategic moves across the globe:

- Middle East Expansion: In a significant move, Zodia acquired Tungsten Custody Solutions in the United Arab Emirates (UAE). This acquisition provided an immediate, turnkey entry into the rapidly growing and crypto-friendly Middle Eastern market, a region actively positioning itself as a global hub for digital assets with a supportive regulatory framework.

- Establishing Asia-Pacific Hubs: Zodia successfully launched full-fledged operations in several key APAC markets. It established a presence in Singapore, a major global financial center with a well-defined digital asset framework under the Monetary Authority of Singapore (MAS). It also expanded into Hong Kong, which is aggressively courting digital asset firms with a new licensing regime under the Securities and Futures Commission (SFC). Furthermore, the company launched services in Australia, a market with a deep pool of institutional capital and a maturing regulatory conversation.

The Rationale: Seeking Regulatory Clarity and Speed

Zodia's global strategy is explicitly focused on targeting markets with "favorable regulatory environments." CEO Julian Sawyer has articulated this approach clearly, noting in interviews that progressive Asian hubs like Hong Kong and Singapore are "filling the void" previously left by the regulatory uncertainty in the United States. He refers to the frameworks in these markets as "second generation of crypto regulations," which demonstrate a much greater understanding of the asset class and provide a clearer roadmap for institutional participants. This strategic focus on regulatory clarity is a direct response to the ambiguity and friction encountered in Japan. By prioritizing jurisdictions where the rules of engagement are well-defined and the regulators are actively fostering institutional growth, Zodia can deploy its resources more efficiently, reduce time-to-market, and provide its institutional clients with the certainty they require.

The following table provides a comparative analysis of the regulatory landscapes in the key jurisdictions relevant to Zodia's strategic decisions, factually demonstrating the rationale behind its pivot away from Japan.

This comparative analysis makes Zodia's strategic calculus transparent. Faced with the prospect of a protracted and uncertain regulatory process in Japan, the firm made a logical decision to redirect its focus and capital toward jurisdictions that offer not only regulatory clarity but also active government and regulatory support for the institutional digital asset industry.