Draft Report of the Financial System Council's Working Group on Strengthening Regional Financial Capabilities

Regional Financial Institutions (RFIs) are the cornerstone of Japan's local economies. As outlined in the "Working Group on Strengthening Regional Financial Capabilities" draft report, their role extends beyond simple financing to become a driving force for regional economic vitality. However, their capacity to fulfill this critical function is under threat from profound structural challenges. Persistent population decline, the shrinking scale of regional industries, and an emerging bifurcation in the financial health of RFIs are creating an environment of uncertainty that demands a proactive policy response.

The purpose of this proposal is to advocate for a series of targeted legal and systemic reforms, referred to collectively as "environmental improvements" (環境整備), designed to fortify the management base of these essential institutions. Without a modernized and supportive regulatory framework, RFIs cannot sustainably meet the evolving needs of their communities or serve as catalysts for regional revitalization.

This article details three core proposals for reform. It will begin by outlining necessary amendments to the Financial Functions Enhancement Act to provide more durable and flexible support, followed by proposals to modernize the supervisory and monitoring framework for early risk identification, and conclude with a specific legal reform to improve capital-raising mechanisms for cooperative financial institutions.

2. The Strategic Imperative for Regulatory Reform

Proactive regulatory and environmental improvements are not merely administrative updates; they are a strategic necessity. RFIs are now expected to contribute to regional revitalization in multifaceted ways that go far beyond traditional lending. To empower them to meet these expectations sustainably, one must address the mounting pressures that constrain their operational capacity and threaten their long-term stability. A robust regulatory support system is the foundation upon which this expanded role can be built.

The working group draft report identifies several key pressures that underscore the urgency for reform:

- Escalating Operational Costs: RFIs of all sizes face rising costs associated with implementing advanced cybersecurity measures, ensuring compliance with sophisticated anti-money laundering (AML) protocols, and securing the specialized personnel and systems required to manage these complex domains.

- Erosion of the Deposit Base: In many regions, the compounding effects of population decline and aging are leading to a net outflow of personal deposits. This trend, particularly acute for credit unions and cooperatives, became a noticeable reality starting in December 2023, narrowing their future strategic options and eroding their core funding base.

- Heightened Systemic Risk: The potential for a future large-scale natural disaster or a new pandemic poses a significant threat. Such an event could severely damage the management base of regional institutions, disrupting essential financial services at a time of critical need.

These challenges are structural and long-term, requiring equally forward-looking solutions. They form a direct link to the need for specific, actionable legislative changes, beginning with a modernization of the Financial Functions Enhancement Act.

3. Proposal #1: Modernizing the Financial Functions Enhancement Act

The Financial Functions Enhancement Act is a crucial existing framework for maintaining financial stability. However, it was designed to address past crises and requires significant updates to effectively confront the long-term, structural challenges facing Japan's regions today. The following proposals aim to transform the Act into a more forward-looking, flexible, and robust tool for securing the future of regional finance.

3.1 Enhancing the Capital Participation System

A Long-Term Extension of the Application Deadline: From Crisis Response to Structural Support

The current application deadline of March 2026 for the capital participation system is inadequate for addressing problems that will unfold over decades. The economic and social costs of an RFI's failure are vastly greater than the cost of pre-emptive capital support. By providing a long-term support framework, regulators can empower RFIs to manage structural shifts without resorting to last-minute crisis measures. A long-term extension of the application deadline is therefore essential. This extension must, however, be paired with rigorous and continuous monitoring by authorities to prevent moral hazard and ensure that public support incentivizes sound management, not complacency.

Establish a Permanent Special Framework for Disasters

Japan is perpetually exposed to the risk of large-scale natural disasters. To prepare for future catastrophic events like the anticipated Nankai Trough earthquake (南海トラフ地震), one must move from a reactive to a proactive support posture. This proposal advocates for the creation of a permanent, activatable special provision (災害等特例の常設化) for capital participation, modeled on the successful frameworks implemented for the Great East Japan Earthquake and the COVID-19 pandemic. This reform would allow regulators to designate a specific event and immediately activate a pre-established support mechanism, enabling a swift, decisive, and predictable response that ensures vital financial functions are maintained when communities need them most.

Mandate Stronger Governance and Oversight for Recipients

The case of misconduct at Iwaki Shinkin Bank, a recipient of public capital, has made it clear that existing oversight mechanisms are insufficient. To protect public funds and ensure the integrity of the system, governance and monitoring requirements for all capital recipients must be fundamentally strengthened. The draft report proposes a three-point plan to be codified within the Act:

- Universal Review: All applications for capital participation, regardless of the specific type or method, must be subject to a mandatory opinion-hearing process with the Financial Functions Enhancement Examination Board. This removes exceptions and ensures a consistent standard of external review.

- Strengthened Auditing for Cooperatives: Any cooperative financial institution receiving capital must amend its management enhancement plan to include the appointment of multiple outside auditors. Critically, at least one of these auditors must be fully independent, meaning they are not an executive from a "major business partner" (主要な取引先の役員等でないなど).

- New Regulatory Authority: The Act should be amended to grant regulatory authorities a new legal power to order changes to a recipient institution's management enhancement plan. This provides a crucial enforcement tool to ensure plans remain effective and that institutions adhere to their commitments.

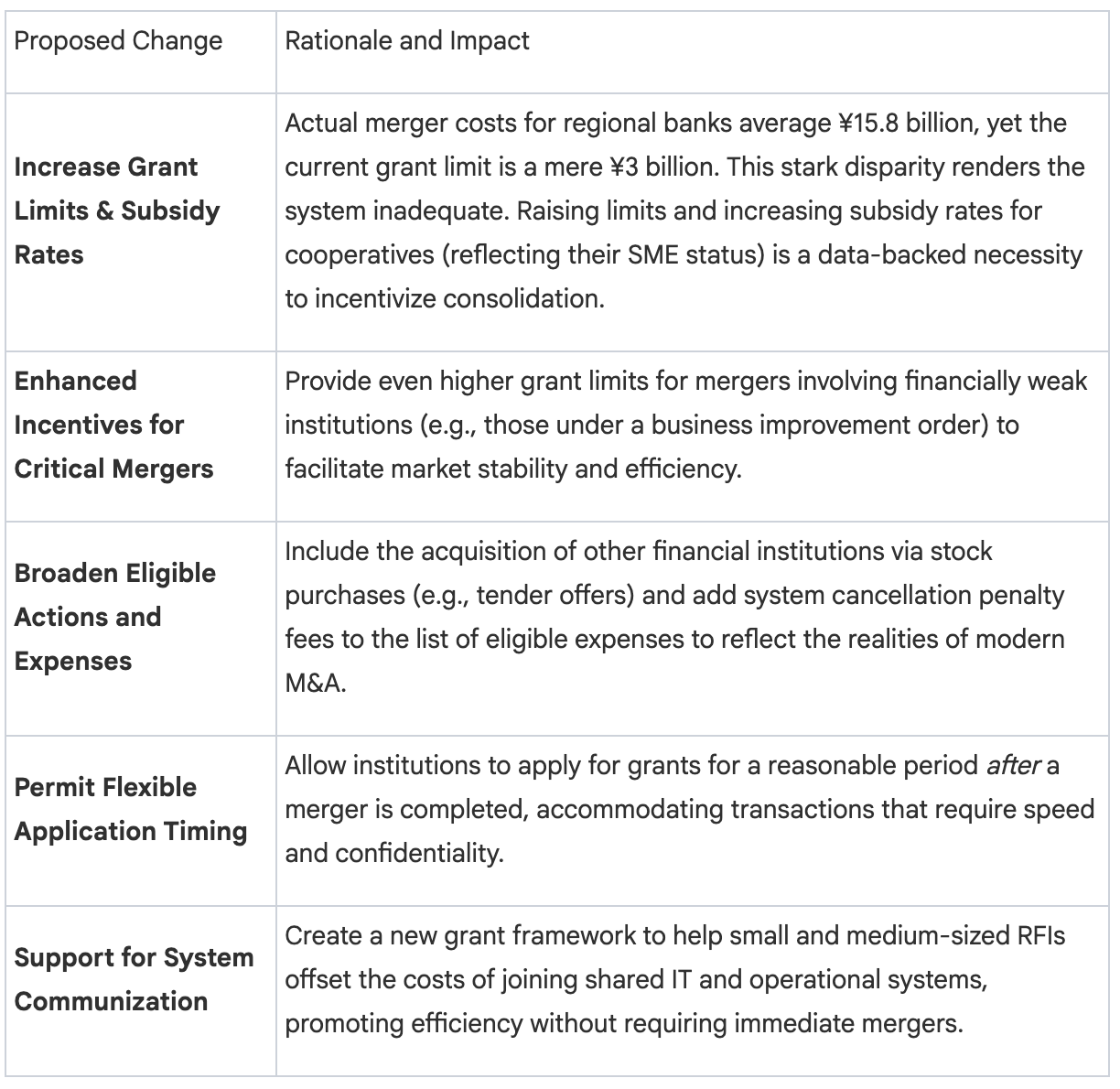

3.2 Extending and Expanding the Grant System

Advocate for Deadline Extension and Scope Expansion

The grant system, which supports costs associated with mergers and business restructuring, is another critical tool that requires modernization. Its application deadline should be extended beyond March 2026 to align with related long-term policies, such as the special provisions in the Antimonopoly Act that expire in November 2030. This provides a stable and predictable runway for institutions contemplating necessary consolidation.

Detail the Proposed System Expansions

To enhance the system's effectiveness and reflect the modern realities of financial sector consolidation, the following expansions are proposed:

By moving beyond direct financial support, the conversation naturally shifts to the importance of proactive supervisory frameworks in identifying risks before they escalate into crises.

4. Proposal #2: Reforming the Supervisory and Monitoring Framework

Supervision and monitoring should not be viewed as a regulatory burden, but as a critical component of environmental improvement. A modernized supervisory approach enables regulators to anticipate future risks, ensures that public support is used effectively, and helps build a more resilient and forward-looking regional financial system.

4.1 Reforming the Early Warning System

The current Early Warning System has significant limitations. It tends to rely on simple extrapolations of current trends, which is insufficient for identifying risks stemming from long-term structural changes like demographic decline. A fundamental reform is needed to shift the system from a reactive to a proactive model.

This proposal recommends that the Financial Services Agency (FSA) adopt a more dynamic and data-driven approach. Regulators should leverage high-granularity loan data to conduct quantitative, scenario-based analyses of RFI health. These forward-looking scenarios must incorporate key future variables, including:

- Projected demographic shifts within an institution's specific operating area.

- The impact of various interest rate change scenarios on institutional assets, particularly their securities portfolios.

The intended outcome of this reform is to foster a shared, evidence-based understanding of future risks between regulators and RFI management. By presenting compelling, data-driven scenarios, regulators can compel more forward-looking strategic decisions and encourage institutions to address vulnerabilities before they become critical.

4.2 Implementing a Fundamental Reinforcement of Monitoring

Recent incidents, including the serious misconduct at a capital recipient institution, demonstrate an urgent need to fundamentally strengthen the monitoring regime. Authorities must move beyond routine check-ins to a more intensive and holistic form of oversight, especially for institutions receiving public funds.

The key pillars of this enhanced monitoring framework should include:

- Proactive On-Site Inspections: A more effective and strategic use of on-site inspections, conducted by coordinated teams of FSA and Local Finance Bureau staff, must be prioritized. This is particularly crucial for institutions that have received public capital injections.

- Enhanced Information Gathering: Regulators must actively utilize all available information channels to gain a comprehensive, real-world view of an institution's operations. This includes systematically leveraging whistleblower hotlines (情報受付窓口) and other sources of intelligence.

- Holistic Follow-Up on Management Plans: For capital recipients, monitoring must go beyond simply tracking financial intermediation targets. It must continuously verify the integrity of their governance, risk management, and compliance systems to ensure the institution is being managed responsibly.

This comprehensive supervisory framework sets the stage for a final legal reform aimed at improving the capital structure and resilience of cooperative institutions.

5.0 Proposal #3: Improving Capital Flexibility for Cooperative Financial Institutions

Cooperative financial institutions (e.g., credit unions and shinkin banks) face unique capital-raising challenges. Their primary capital source is member contributions (ordinary shares), and existing law severely constrains their ability to redeem preferred shares issued to outside investors. This rigidity creates a significant barrier to attracting new capital.

The core problem lies within the current Preferred Share Act (優先出資法). The law does not permit these institutions to use capital or legal reserves to redeem preferred shares. This makes it difficult for them to repay capital providers in a predictable manner, which in turn deters investment from funds and other institutional backers who require a clear path to exit.

The proposed solution is to amend the Preferred Share Act to allow cooperative financial institutions to use their capital and legal reserves as a source for share redemption. This reform is not a radical new idea, but rather a logical harmonization of legal principles, bringing the Act in line with the more modern and flexible precedent already established by the special provisions within the Financial Functions Enhancement Act. To ensure financial soundness is never compromised, this reform must include two critical safeguards:

- The institution must maintain a healthy capital adequacy ratio that is well above the minimum regulatory requirement after the redemption.

- The process must include robust, legally mandated creditor protection procedures to ensure that the interests of depositors and other creditors are fully protected.

This targeted reform will increase the predictability of capital recovery for investors. By making preferred shares a more attractive investment instrument, it will make it significantly easier for cooperative financial institutions to attract the capital they need to strengthen their financial base and serve their local communities.

6.0 Conclusion and Call to Action

Japan's regional financial institutions are at a critical juncture, facing the relentless pressures of demographic decline, escalating operational costs, and heightened systemic risks. To secure their future—and the future of the local economies they support—a decisive modernization of the regulatory environment is imperative.

This proposal puts forth a clear, actionable roadmap for reform, centered on three strategic pillars:

- Modernizing financial support mechanisms through targeted reforms to the Financial Functions Enhancement Act, making it a more durable and flexible tool for long-term stability.

- Strengthening proactive supervision by implementing a data-driven Early Warning System and a fundamentally enhanced monitoring regime to identify risks before they materialize.

- Unlocking new capital for cooperative institutions by amending the Preferred Share Act to provide much-needed flexibility in share redemption, thereby encouraging new investment.

Regulatory bodies and legislators should move with purpose and urgency to implement these interconnected legal and systemic reforms. If RFIs are to meet the challenges of tomorrow, they must be empowered to make the necessary strategic decisions today. This requires a "forward-looking" (フォワードルッキングな対応) approach from all stakeholders. These proposals represent an essential investment not only in the stability of the financial system but also in the sustainable and dynamic development of Japan's regional economies for generations to come.