Draft Report of the Roundtable on the Supply of Growth Funds to Startup Companies

The Japan Securities Dealers Association has been holding a "Roundtable Meeting on the Supply of Growth Funds to Startup Companies and Other Entities" to consider issues regarding the trading system for unlisted shares based on the needs of market participants, and the FSA has been participating in this meeting as a co-host and to advance the discussions.

The Roundtable has published its draft report as of July 31, 2025, outlining a strategic vision and a detailed set of policy recommendations aimed at revitalizing Japan's startup ecosystem by enhancing the mechanisms for capital supply to unlisted companies. It directly addresses the goals set forth in the Japanese government's "Five-Year Plan for Startup Development" (November 2022) and the "Regulatory Reform Implementation Plan" (June 2024), which call for the vitalization of both the primary (issuance) and secondary (trading) markets for unlisted stocks.

The State of Startup Funding in Japan: An Overall Assessment

The report begins by acknowledging the dual nature of startup investment: it offers the potential for significant returns but is inherently fraught with risks. These include high business uncertainty, significant information asymmetry between issuers and investors, low liquidity of shares, and the absence of insider trading regulations that apply to public markets. Consequently, the roundtable asserts that investment in this asset class must be predicated on the principle of self-responsibility, undertaken by investors who possess the requisite risk tolerance and understanding.

A central theme is the need to cultivate a more diverse and robust pool of funding providers, drawing comparisons to the mature ecosystem in the United States. The report identifies critical roles for different investors at various stages:

- Angel Investors: Experienced entrepreneurs and executives are vital for the high-risk seed stage, providing not just capital but also crucial management support and strategic advice.

- Venture Capital (VC) and Large-Scale Investors: As startups mature into the early and later stages, the need for larger capital infusions grows. The report emphasizes the importance of expanding investment from VCs, growth capital funds, private equity (PE) funds, and crossover investment trusts that invest in both public and private companies.

A significant deficiency identified in Japan's current ecosystem is the near-total absence of a secondary market for unlisted stocks. The report argues that a functioning secondary market is indispensable. It provides crucial liquidity, offering diverse exit opportunities for early investors and employees beyond a traditional IPO. This, in turn, de-risks primary investment and encourages a virtuous cycle of capital reallocation into new ventures. The lack of such a market in Japan is a key factor hindering the flow of funds to startups.

The role of market intermediaries, such as securities firms, is also examined. In Japan, their activities are constrained by a JSDA self-regulatory rule that, in principle, prohibits the solicitation of investment in unlisted shares. This forces such activities into a few specific, and often cumbersome, exempted channels, limiting the proactive role intermediaries could play in connecting startups with capital.

A New Direction: Key Goals and Proposed Reforms

The core of the report is a multi-pronged strategy for reform, centered around setting a clear target and implementing concrete policy changes across the ecosystem.

1. Setting a Key Goal Indicator (KGI)

To ensure accountability and measure progress, the roundtable proposes a Key Goal Indicator (KGI) aligned with the government's national strategy. The central goal is:

- To increase the annual amount of startup fundraising that involves market intermediaries to ¥180 billion by fiscal year 2027.

This target is ambitious, representing a more than fourfold increase from the 2024 baseline of approximately ¥42 billion and making it comparable to the total amount raised in IPOs that year. This KGI will track funds raised not only through formal solicitation systems but also through financial advisory (FA) services and matching events, reflecting the broad role of intermediaries. This will be supplemented by reference indicators, such as the volume of secondary trading and the utilization rate of specific systems like J-Ships.

2. Attracting Large-Scale and Institutional Investors

To address the funding gap in the middle and later stages, the report stresses the need to attract more large-scale domestic and international investors. While Japan has active domestic VCs and corporate venture capital (CVC) arms, it lacks a deep pool of growth capital. The report recommends several initiatives to tackle this:

- Promoting Best Practices: Encouraging the adoption of best practices for VCs (VCRHs) to make them more attractive to institutional asset owners.

- Tax System Reforms: Expanding the Open Innovation Promotion Tax System to include secondary stock acquisitions and reviewing the PE tax exemption for foreign limited partners to remove barriers for overseas investors.

- Improving Startup Readiness: Acknowledging that attracting large investments requires startups to establish strong governance and provide continuous information.

3. Expanding Investment Vehicles and Channels

The report advocates for the broader use of modern investment vehicles that can pool capital and facilitate investment.

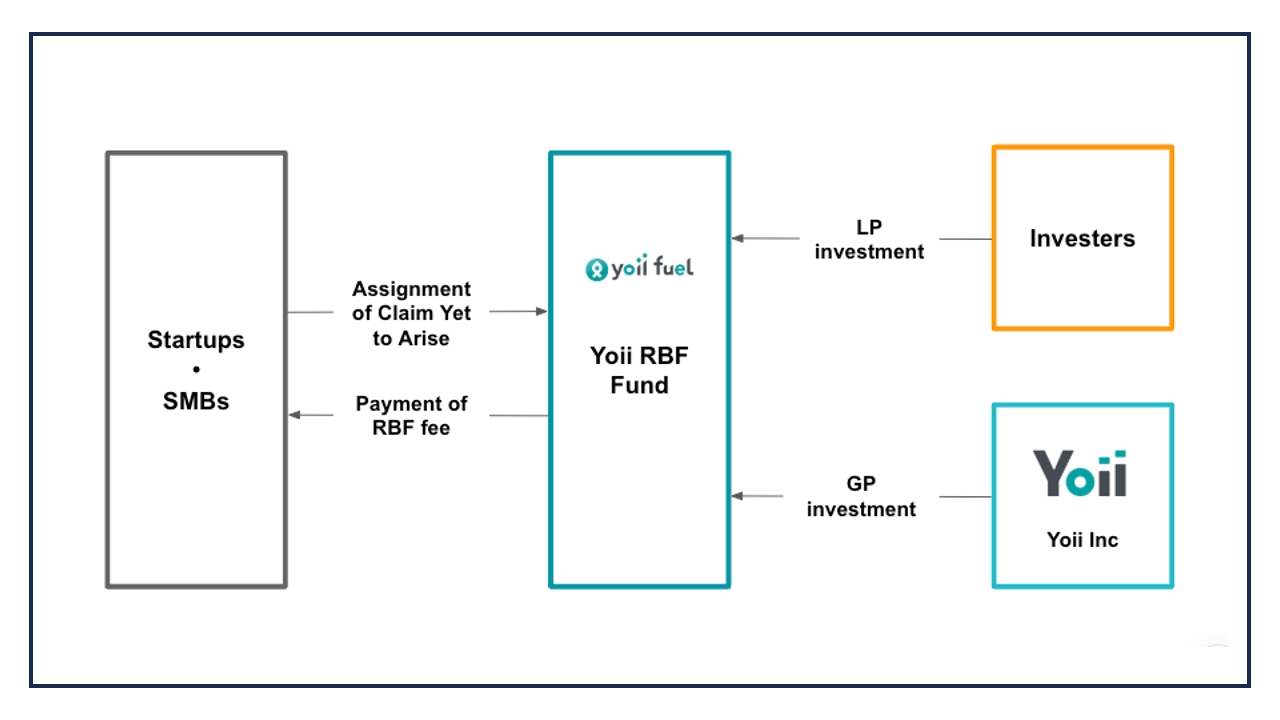

- SPV Schemes: Special Purpose Vehicle (SPV) schemes, commonly used in the U.S. and Europe to syndicate investments from multiple individuals, are underdeveloped in Japan. The report calls for creating model contracts to streamline their use and facilitate the secondary trading of SPV interests.

- Investment Trusts: While the rules have been eased to allow public investment trusts to allocate up to 15% of their assets to unlisted stocks, practical hurdles remain. The report suggests further regulatory easing and exploring new frameworks for funds specializing in illiquid assets, modeled on the EU's ELTIF and the UK's LTAF frameworks.

- Angel Investment: With angel investment in Japan lagging far behind international peers, the report recommends a significant expansion of the Angel Tax System. Proposed changes include making investments via vehicles like trusts eligible for tax benefits and relaxing the eligibility criteria for qualifying startups.

4. Reforming Rules for Sophisticated Investors

The report proposes significant reforms to the frameworks governing investment by professional and other sophisticated investors.

- J-Ships System: This existing system for soliciting professional investors is deemed too burdensome, with disclosure requirements that are difficult for all but the latest-stage startups to meet. The report calls for a review to ease these requirements. It also highlights a critical flaw: once a stock is issued via J-Ships, its subsequent secondary trading is severely restricted, a major obstacle that requires urgent review.

- Professional Investor Framework: The FSA recently clarified and effectively broadened the criteria for individuals to be classified as professional investors. The report supports this and recommends that the FSA conduct a further review of the requirements by FY2026. It also proposes considering a shift to an "opt-out" system for the annual renewal of professional investor status, which would reduce administrative burdens, while noting the need for caution.

- "Quasi-Professional Investors": A new framework is proposed to allow solicitation of "quasi-professional investors"—those who meet the professional criteria but have not formally transitioned—via small-group private placements, under new investor protection rules to be developed by JSDA.

5. Vitalizing the Secondary Market through PTS

A cornerstone of the proposed reforms is the vitalization of the secondary market, with a focus on Private Trading Systems (PTS). The report identifies a key impediment: the current rule requiring "brokerage-type" PTS platforms to publicly disclose transaction prices and material company information. Startups fear this disclosure could negatively impact their valuations in subsequent funding rounds. The recommendation is to:

- Relax Disclosure Rules: For PTS platforms where trading is restricted to professional or other highly sophisticated investors, the requirement for public price and information disclosure should be relaxed.

6. Overhauling the General Ban on Solicitation

Perhaps the most fundamental change proposed is a paradigm shift away from the JSDA's long-standing self-regulation that generally prohibits securities firms from soliciting investments in unlisted stocks. The report argues that this rule, established in a different era, is now a significant impediment. Given that investor protection laws are now much stronger, it recommends:

- Moving from Prohibition to Regulated Permission: The framework should be changed from a "general prohibition with specific exceptions" to one where solicitation is permitted, provided it is conducted through specific, well-regulated systems designed to protect investors. A JSDA working group will be tasked with developing this new regulatory framework, with a conclusion expected in FY2026.

Finally, the report recognizes that these complex systems and reforms are not well understood. It calls on the FSA and JSDA to conduct active and sustained public relations campaigns to educate issuers, investors, and intermediaries on how to effectively utilize these new and existing tools for startup funding. The roundtable will continue its work by monitoring the KGI and the real-world effects of these reforms to ensure the creation of a dynamic and sustainable startup ecosystem in Japan.