"elepay Bill Payment" improves operational efficiency and CX with new functions

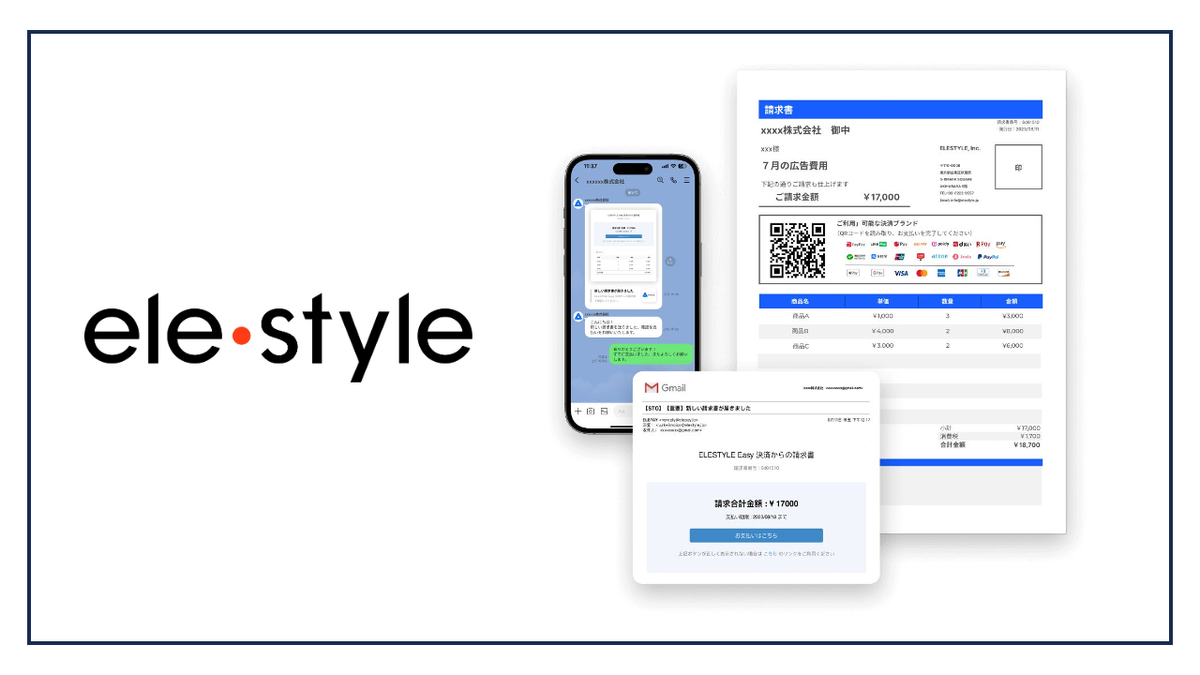

"elepay bill payment" is a service that allows users to create invoices on the "elepay" management screen or through API integration. Until now, payment methods such as bank transfers and credit cards have been mainstream in Business-to-Consumer (B2C) businesses. "elepay" is a cashless specialized service that allows users to choose their payment method from up to 20 cashless brands, including PayPay and credit cards, by reading the QR code printed on the invoice. Not only does it expand the payment options for customers, but it also contributes to the efficiency of the billing side, as the payment is automatically cleared on the "elepay" management screen when the payment is received.

New Features

In order to further promote business efficiency, elepay will be releasing four new functions in early March 2025.

- CSV import function: By importing large amounts of customer information and transaction data in a CSV file, users can reduce the time and errors required for manual input. Invoices from bulk imported files can also be generated in bulk.

- Visualize invoice list: The management screen allows users to check the payment status of their customers in real time, and expired transactions are automatically listed. This eliminates the need to extract the list individually, significantly reducing payment management and man-hours.

- Invoice PDF preview function: Users can preview the invoice in PDF format. They can check not only the invoice amount but also details such as the brand logo and company seal.

- Invoice template and tax settings: Templates can now be customized to suit business types and tax rates. For example, by registering a template that includes a complex tax calculation formula, users will no longer need to calculate taxes every time.

Strengths of "elepay bill payment"

- Create an invoice in 30 seconds: By simply selecting a customer and pressing a button, anyone can easily create an invoice in just 30 seconds per invoice.

- Real-time invoicing: Invoices can be sent in a variety of ways, including not only email and PDF, but also by sending a URL via LINE or a QR code via SNS.

- A wide range of payment options: Users can choose from approximately 20 domestic and international payment methods and cashless brands, including credit cards, PayPay, dPay, au PAY, Paidy, Alipay, and WeChat Pay (separate screening required).

- Real-time update of payment status: When a customer makes a payment, the status is reflected in real time on the management screen. Cancellations and refunds can also be handled with one click on the management screen.

- Link with My Page via API: If integrated with the customer portal via API, any changes that customers make to their billing or subscriptions on their My Page will also be reflected on the admin screen.

About ELESTYLE

ELESTYLE offers the multi-mobile payment platform "elepay," which supports payment methods such as QR codes, cards, and postpaid payments while integrating terminals, and the multi-mobile payment SaaS "OneQR," which can handle everything from self-ordering to cashless payments with a single QR code. The aim is to fully support businesses in their digital transformation and cashless transition.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.