Finatext Second Quarter Financial Results

Finatext Holdings second quarter of fiscal year 2025 (Q2 FY2025) was marked by significant top-line growth and the successful execution of key strategic initiatives, reinforcing the company's position as a leading B2B financial technology platform. Strong performance in the core Financial Infrastructure and Big Data Analytics segments, coupled with major new enterprise partnerships, validates Finatext's strategy and underpins a confident outlook for the full fiscal year.

The key takeaways from the quarter are as follows:

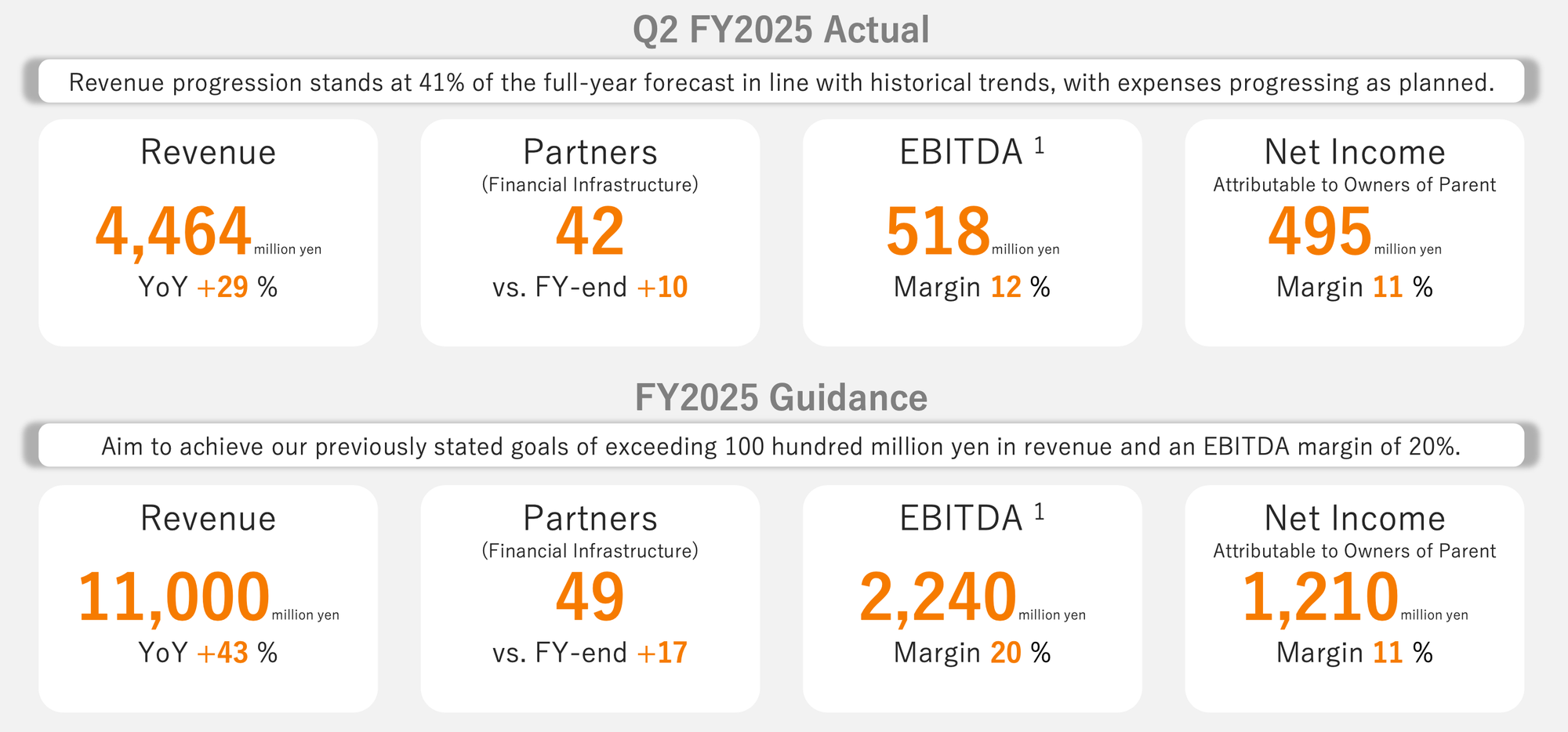

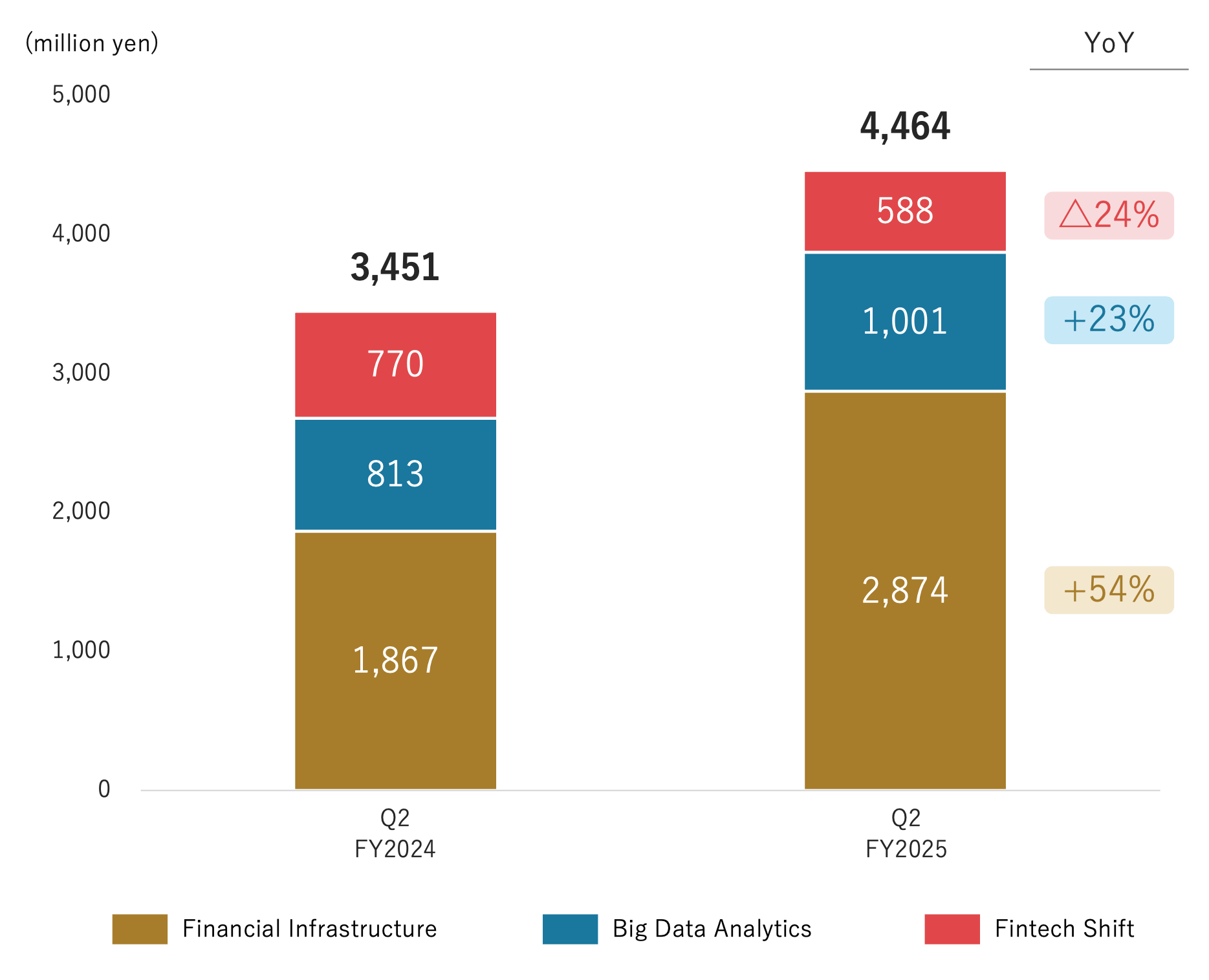

- Robust Revenue Growth: Consolidated revenue reached ¥4,464 million for the first half of the fiscal year, a strong 29% year-over-year (YoY) increase, demonstrating sustained business momentum.

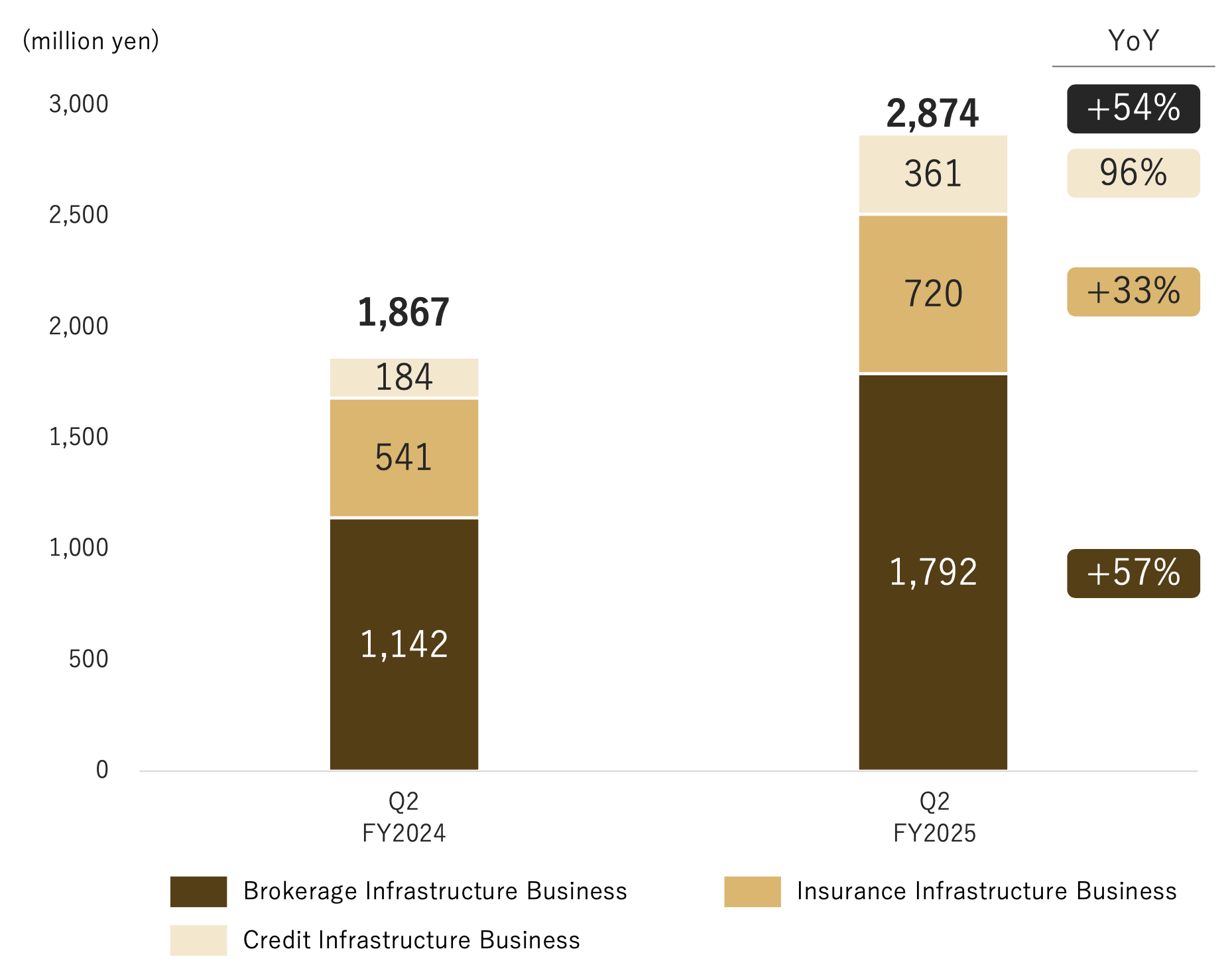

- Financial Infrastructure as the Core Engine: The Financial Infrastructure segment continued to be the primary growth driver, with revenue soaring 54% YoY to ¥2,874 million during the first half of the fiscal year.

- Shift to High-Quality, Scalable Revenue: Usage-based revenue, which scales with partner transaction volumes and assets under management (AUM), grew an impressive 96% YoY, signaling strong platform adoption and an increasingly scalable monetization model.

- Major Enterprise Partnerships: Finatext secured and launched significant new partnerships with industry leaders, including Mitsubishi UFJ Morgan Stanley Securities for a digital asset platform, SBI Insurance for group insurance digitization, and the J:COM Group for a new personal loan service.

- Strengthened Leadership in AI and Data: The strategic acquisition of AI startup Behavior and receiving the "Industry Solution Partner of the Year" award from Snowflake highlight Finatext's expanding capabilities and industry recognition in generative AI and data analytics.

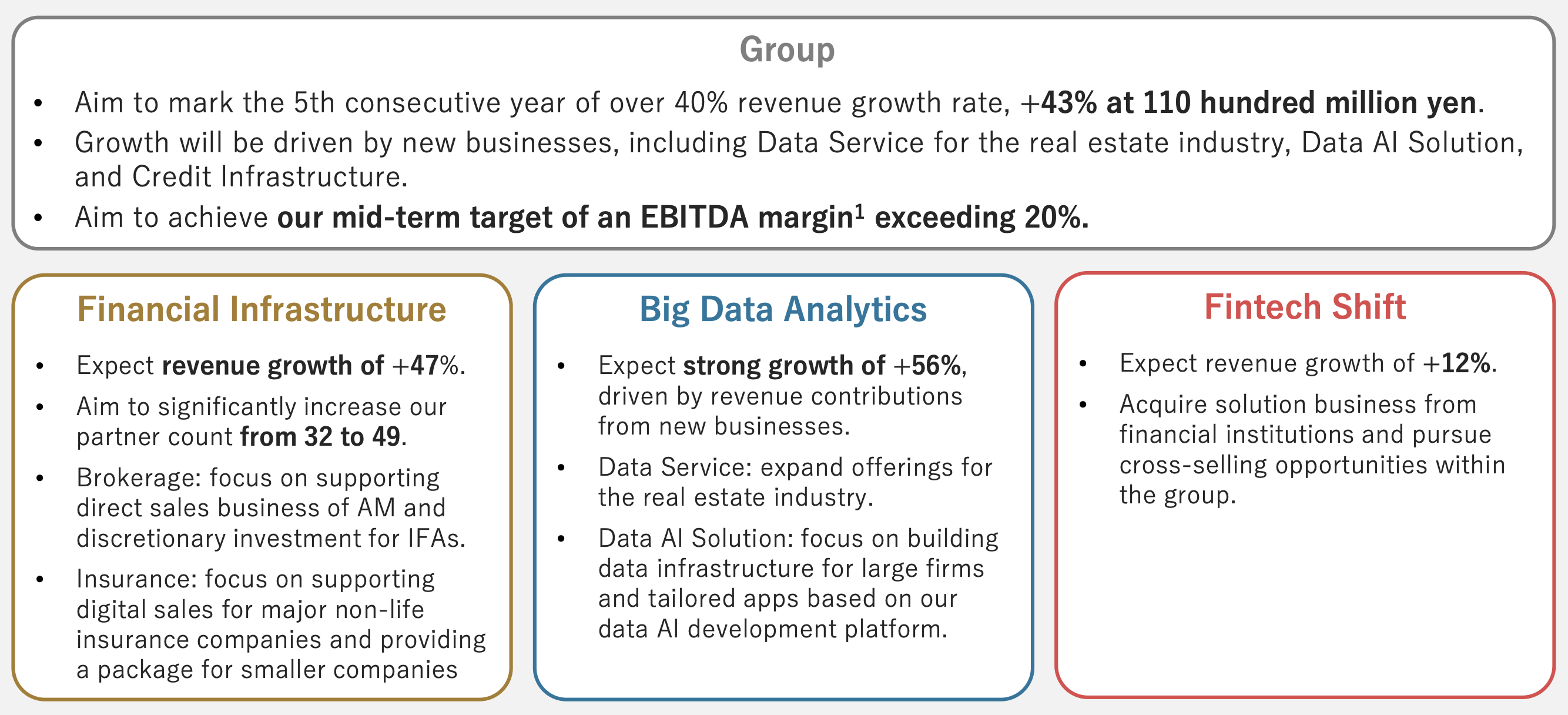

- Reaffirmed Full-Year Guidance: Management has confidently reaffirmed its ambitious full-year forecast, targeting ¥11,000 million in revenue (+43% YoY) and achieving its mid-term target EBITDA margin of 20%.

The strong Q2 results provide a solid foundation for Finatext's full-year targets. The following sections offer a more detailed analysis of the financial performance and the strategic initiatives driving this growth.

Analysis of Q2 FY2025 Financial Performance

A detailed examination of Finatext's quarterly financial results is crucial to understanding the underlying health of the business. This section dissects the key performance indicators to evaluate the quality of its revenue streams, operational efficiency, and progress toward its long-term profitability goals.

Consolidated Financial Summary

The table below presents the core financial metrics for Q2 FY2025 compared to the same period in the prior year, illustrating the company's growth trajectory.

Metric | Q2 FY2024 | Q2 FY2025 | YoY Change |

Revenue | ¥3,451M | ¥4,464M | +29% |

EBITDA | ¥511M | ¥518M | +1% |

EBITDA Margin | 15% | 12% | -3 pts |

Net Income | ¥287M | ¥495M | +72% |

While revenue grew a robust 29% YoY, the EBITDA margin experienced a temporary decline to 12%. This is attributed to the Finatext's typical business cycle, where revenue is more heavily weighted toward the second half of the fiscal year, while fixed costs and expenses are progressing as planned. The significant 72% YoY growth in Net Income was primarily driven by a significant +¥225 million corporate tax adjustment related to a change in tax effect classification during Q1, masking an 11% YoY decline in operating income.

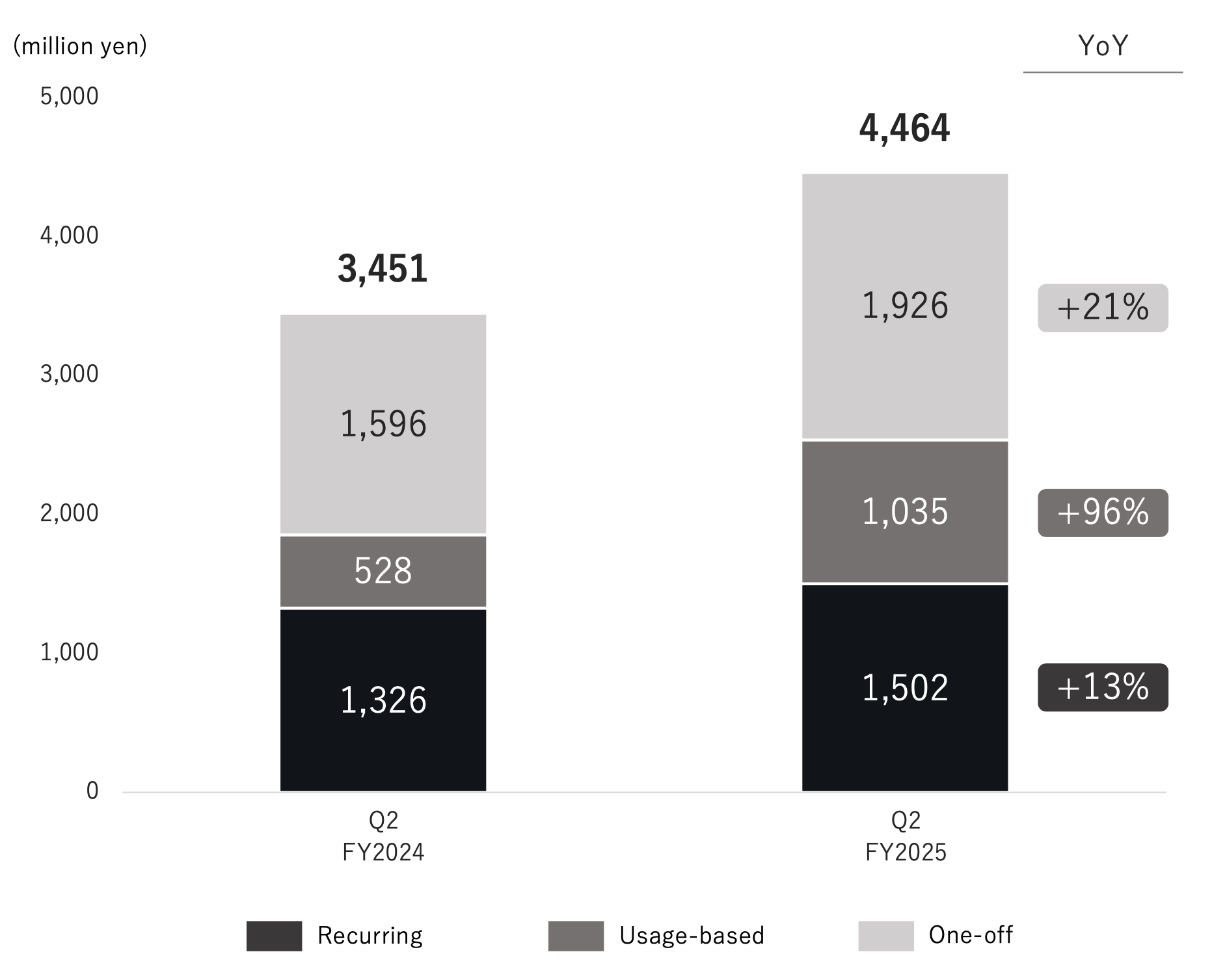

Revenue Composition: A Deeper Dive into Growth Drivers

Finatext's revenue growth is driven by a strategic shift towards higher-quality, scalable revenue models.

- Analysis by Revenue Type: The primary engine of growth was Usage-based revenue, which is tied to partner success metrics like AUM and premiums.

- Usage-based: +96% YoY

- Recurring: +13% YoY

- One-off: +21% YoY The outstanding growth in usage-based revenue was fueled by an expanding partner base in the Financial Infrastructure segment and increasing AUM on its platforms.

- Analysis by Segment: Growth was concentrated in the company's core strategic segments, validating its focused execution.

- Financial Infrastructure: +54% YoY

- Big Data Analytics: +23% YoY

- Fintech Shift: -24% YoY The 24% YoY decline in the Fintech Shift segment is not a sign of weakness but rather a positive indicator of disciplined capital allocation. Management is successfully pivoting away from lumpy, lower-margin project work to focus resources on the highly scalable, recurring, and usage-based revenue streams of its core growth engines.

This strong financial performance is a direct result of operational achievements within the company's key business segments.

Strategic Deep Dive: Segment Performance & Key Initiatives

Finatext's growth is fundamentally driven by targeted strategic initiatives and technological innovation within its core business segments. This section examines the key operational highlights that are fueling the company's financial success and expanding its competitive moat.

3.1. Financial Infrastructure: The Primary Growth Engine (+54% YoY)

The Financial Infrastructure segment delivered an impressive performance, generating ¥2,874 million in H1 revenue (+54% YoY). This growth was supported by an expanding ecosystem, with the partner base growing from 37 to 42 during the quarter. Key new partnerships serve as powerful validation of the platform's capabilities.

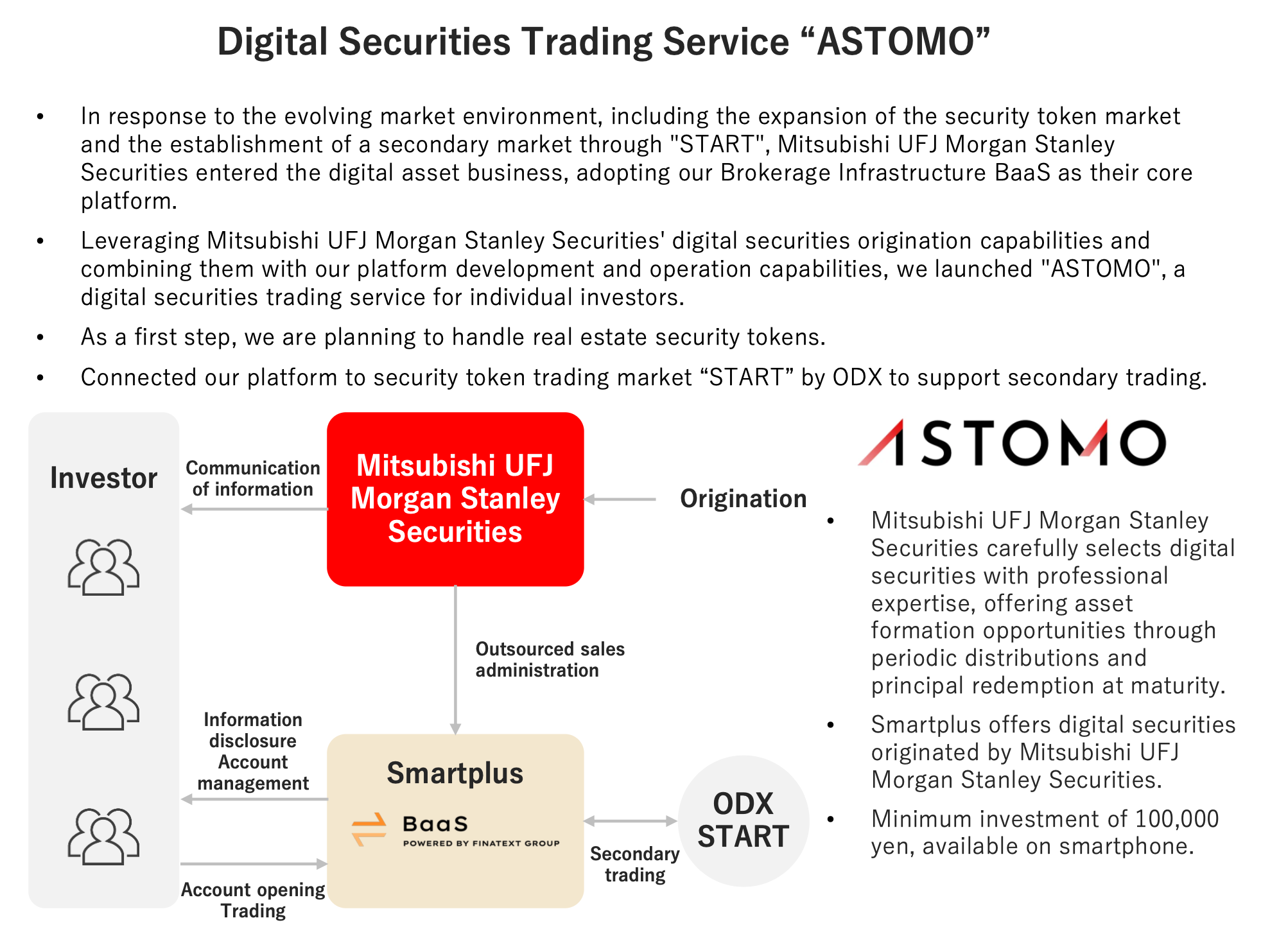

- Mitsubishi UFJ Morgan Stanley Securities: Adopted Finatext's Brokerage Infrastructure BaaS for "ASTOMO," its new digital asset business. This landmark partnership includes the first-time offering of security token trading on the platform. Crucially, this partnership involved connecting Finatext's platform to ODX's 'START' secondary market, evolving the Brokerage BaaS from a primary issuance tool into a comprehensive platform covering the full lifecycle of a digital security.

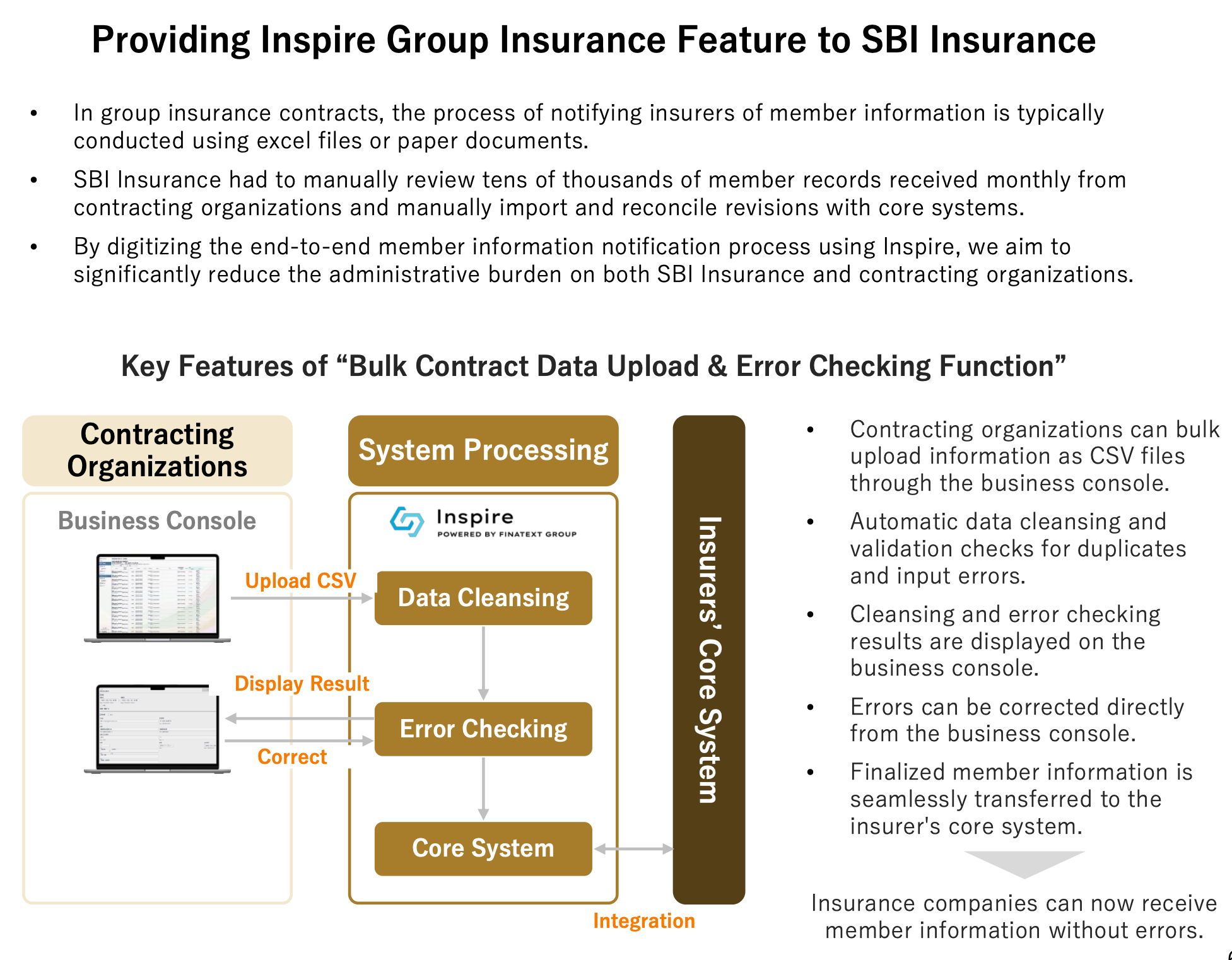

- SBI Insurance: Adopted the "Inspire" Insurance Infrastructure to digitize its group insurance operations. The implementation of the "Bulk Contract Data Upload & Error Checking Function" is designed to dramatically reduce the administrative workload for both SBI Insurance and its contracting organizations by automating a historically manual and error-prone process.

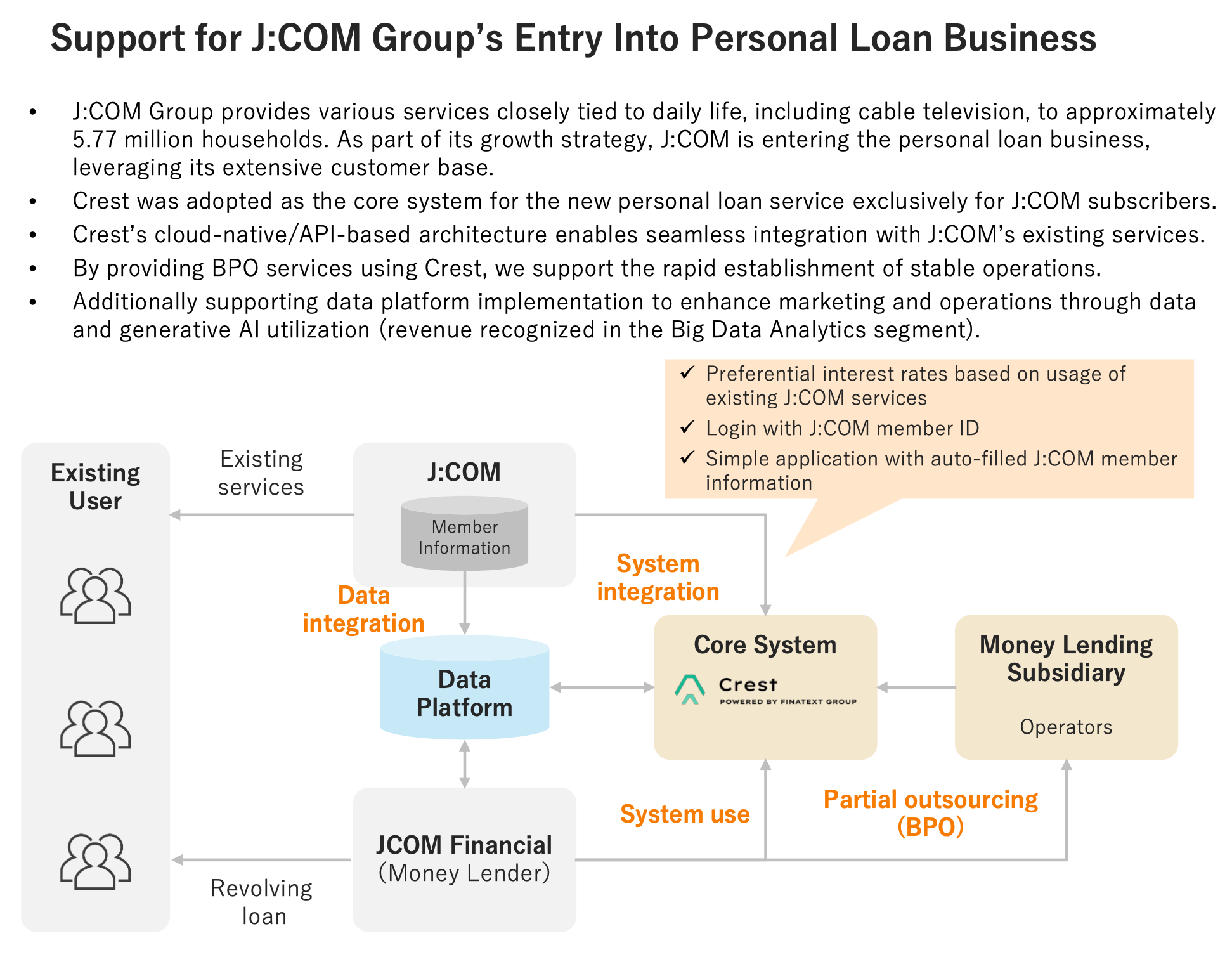

- J:COM Group: Adopted the "Crest" Credit Infrastructure for a new personal loan service targeting its 5.77 million households. This partnership marks Finatext's first full-scale Business Process Outsourcing (BPO) service offering and includes building a group-wide data platform that will leverage data and generative AI to enhance marketing and operations. This deal is a prime example of Finatext's powerful cross-sell strategy, where a single client engagement drives revenue and deepens integration across multiple, high-growth business segments (Credit Infrastructure and Big Data Analytics).

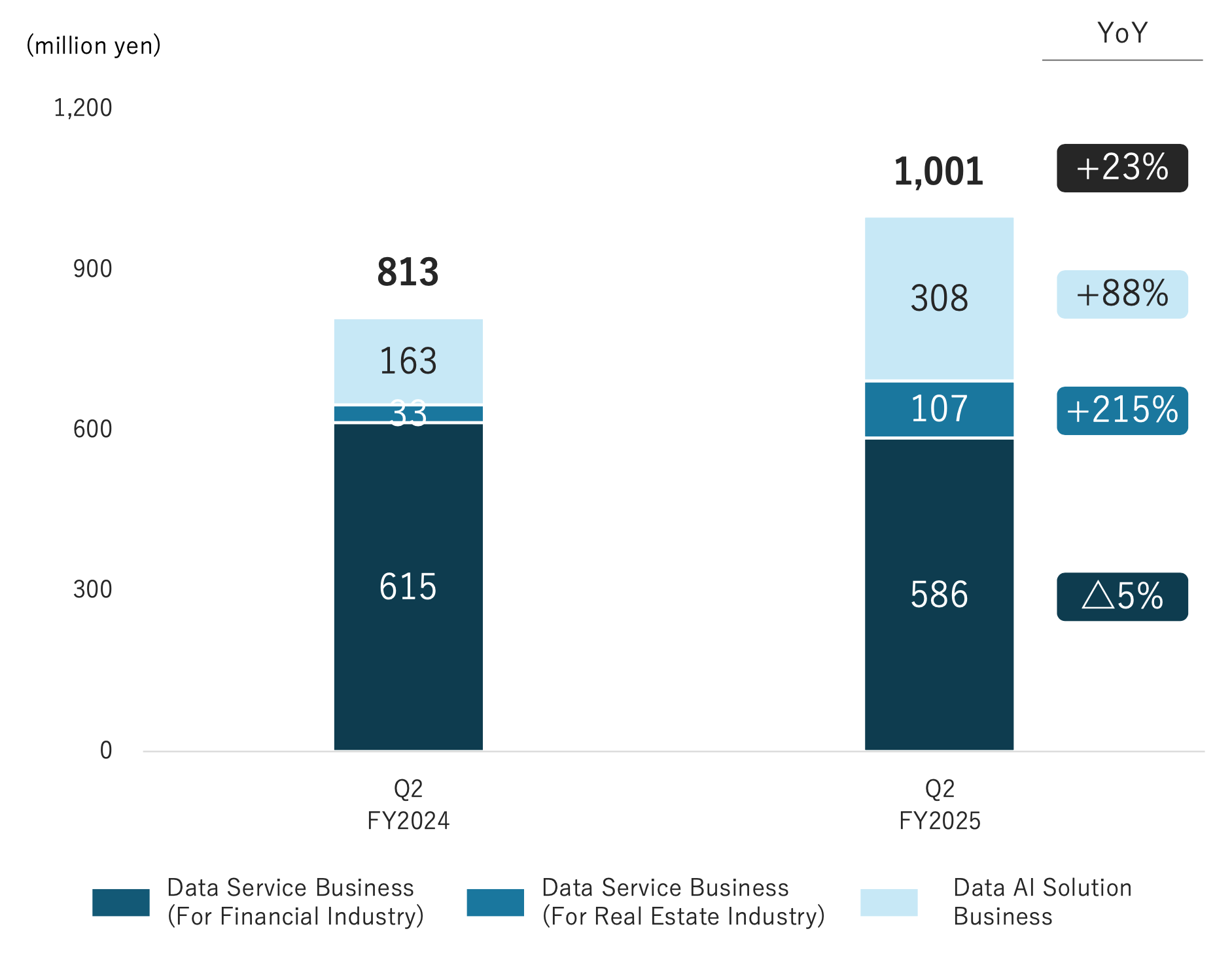

Big Data Analytics & AI: Securing a Technological Edge (+23% YoY)

The Big Data Analytics segment achieved first half revenue of ¥1,001 million (+23% YoY), driven by new generative AI projects and the launch of new data services. The company has made significant strides in solidifying its technological leadership.

- New Product Launch: Finatext released "DataLens for Office Leasing," a sales DX tool for the real estate industry that uses multiple data sources to identify companies with high office relocation potential. The service has already been adopted by industry leaders Mitsubishi Estate and Sumitomo Realty & Development.

- Industry Recognition & Expertise: The company received the prestigious "Industry Solution Partner of the Year" award from Snowflake, recognizing its innovative data analysis solutions. Building on this expertise, Finatext launched "SnowCast," a framework to help enterprise clients accelerate their own data and AI initiatives using Finatext's proven data platform architecture.

- Generative AI Innovation: A Proof-of-Concept (PoC) was initiated with Medicare Life to streamline insurance claims assessment using generative AI. This project showcases the powerful synergy between the Data AI Solution and Insurance Infrastructure teams, demonstrating Finatext's ability to deploy advanced AI in core financial operations.

- Strategic Acquisition: Finatext acquired Behavior, Inc., an AI x InsurTech startup known for its 'Hoken-no-AI' chat service and 'LifeLight' planning agent. This move is designed to integrate Behavior's core strengths in precise, user-centric needs assessment and conversational AI design to develop advanced sales support solutions for a diverse range of financial products, moving beyond its initial insurance focus.

These strategic achievements provide a strong foundation for the company's confident forward-looking guidance.

FY2025 Guidance and Investment Thesis

The strong performance in the first half of the fiscal year provides a solid base for Finatext's ambitious full-year targets. Management has reaffirmed its guidance, signaling confidence in its ability to accelerate growth and expand profitability in the second half.

Reaffirmed Full-Year Guidance

Finatext's full-year FY2025 guidance projects significant growth across all key metrics.

- Group Level:

- Revenue: ¥11,000 million (+43% YoY)

- EBITDA: ¥2,240 million (+89% YoY)

- EBITDA Margin: 20% (achieving the mid-term target)

- Segment Revenue Growth Targets:

- Financial Infrastructure: +47%

- Big Data Analytics: +56%

- Fintech Shift: +12%

Consistent with historical patterns, revenue is expected to be concentrated in the second half of the fiscal year. This seasonality supports the targeted improvement in the full-year EBITDA margin to 20%, despite the 12% margin recorded in Q2.

Concluding Summary: Investment Thesis

Finatext is successfully executing its strategy to become a dominant B2B financial technology platform. The company's business model benefits from the compounding effect of a growing partner base, which fuels the highly scalable, usage-based revenue stream. Its demonstrated leadership in high-growth areas is validated by the landmark partnership with Mitsubishi UFJ Morgan Stanley Securities to enter the security token market and the strategic acquisition of AI-startup Behavior to enhance its generative AI capabilities. The strong Q2 performance, coupled with a confident full-year outlook, reinforces Finatext's position as a compelling investment opportunity in the FinTech sector.