First 30 Billion Yen Scale, High-Grade Office Security Token Collaboration for "ALTERNA"

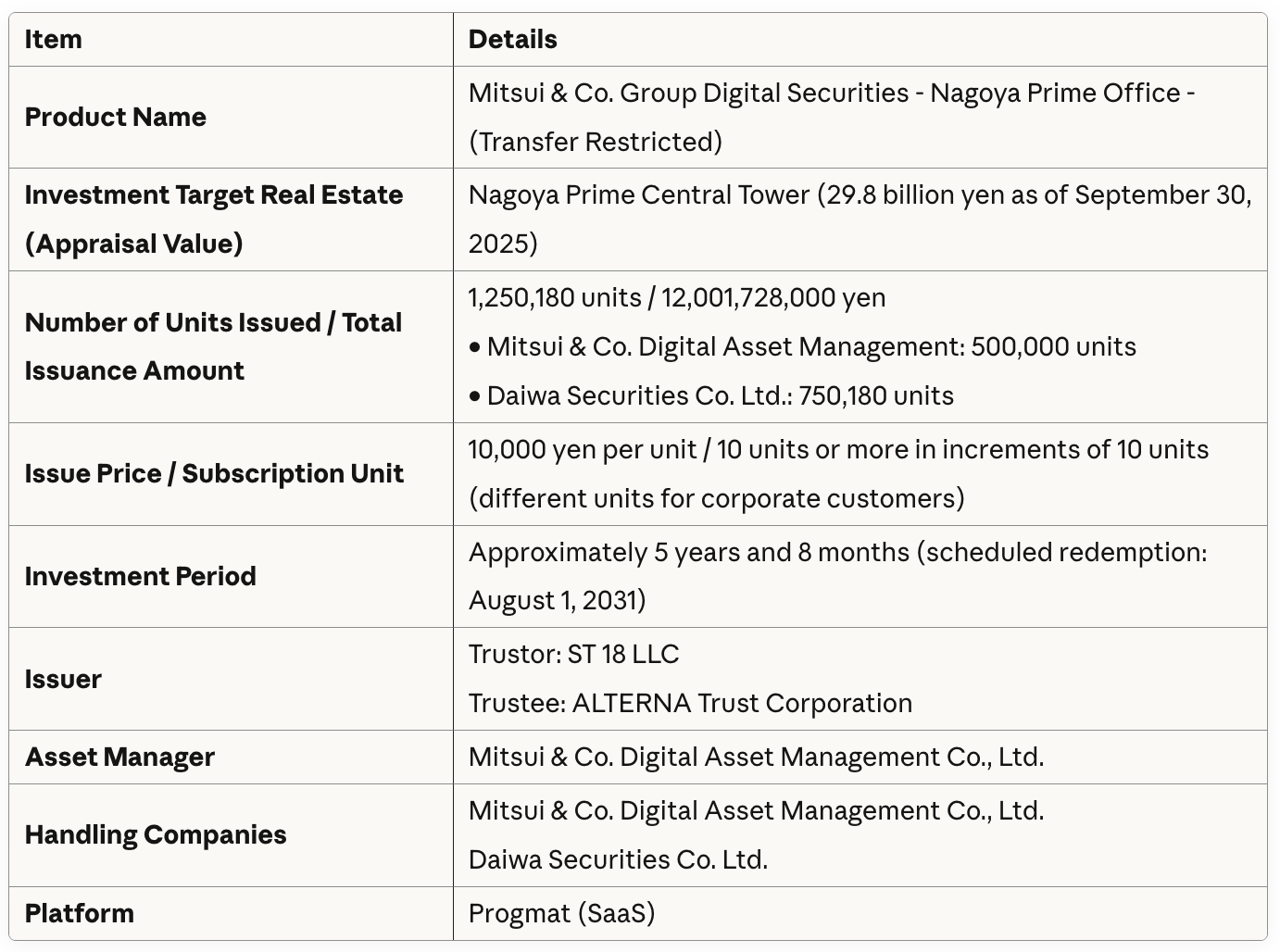

ALTERNA Trust, Mitsui & Co. Digital Asset Management, Daiwa Securities, and Progmat have completed the fundraising and issuance for the security tokenization (ST) of "Mitsui & Co. Group Digital Securities - Nagoya Prime Office - (Transfer Restricted)".

This project marks the first ST issuance for both ALTERNA Trust, which began operations on July 3, 2025, and the "ALTERNA" brand asset management service developed and provided by MDM.

Through collaboration between

- ALTERNA Trust (established as an ST-specialized trust company to expand the ST fund lineup and further accelerate product development),

- MDM (No. 1 domestically in real estate ST project origination and sales),

- Daiwa Securities (No. 1 domestically in cumulative ST sales), and

- Progmat (No. 1 domestically in ST market transaction scale, number of projects, and number of companies using the platform),

the partners have realized flexible and speedy ST issuance targeting large-scale real estate.

1. Project Overview

The investment target real estate for this project is "Nagoya Prime Central Tower," a large-scale high-grade office building with an appraisal value of approximately 30 billion yen, located within walking distance of Nagoya Station. It provides an opportunity to invest in this rare Nagoya Station area large-scale high-grade office property starting from 100,000 yen.

2. Role of Each Company

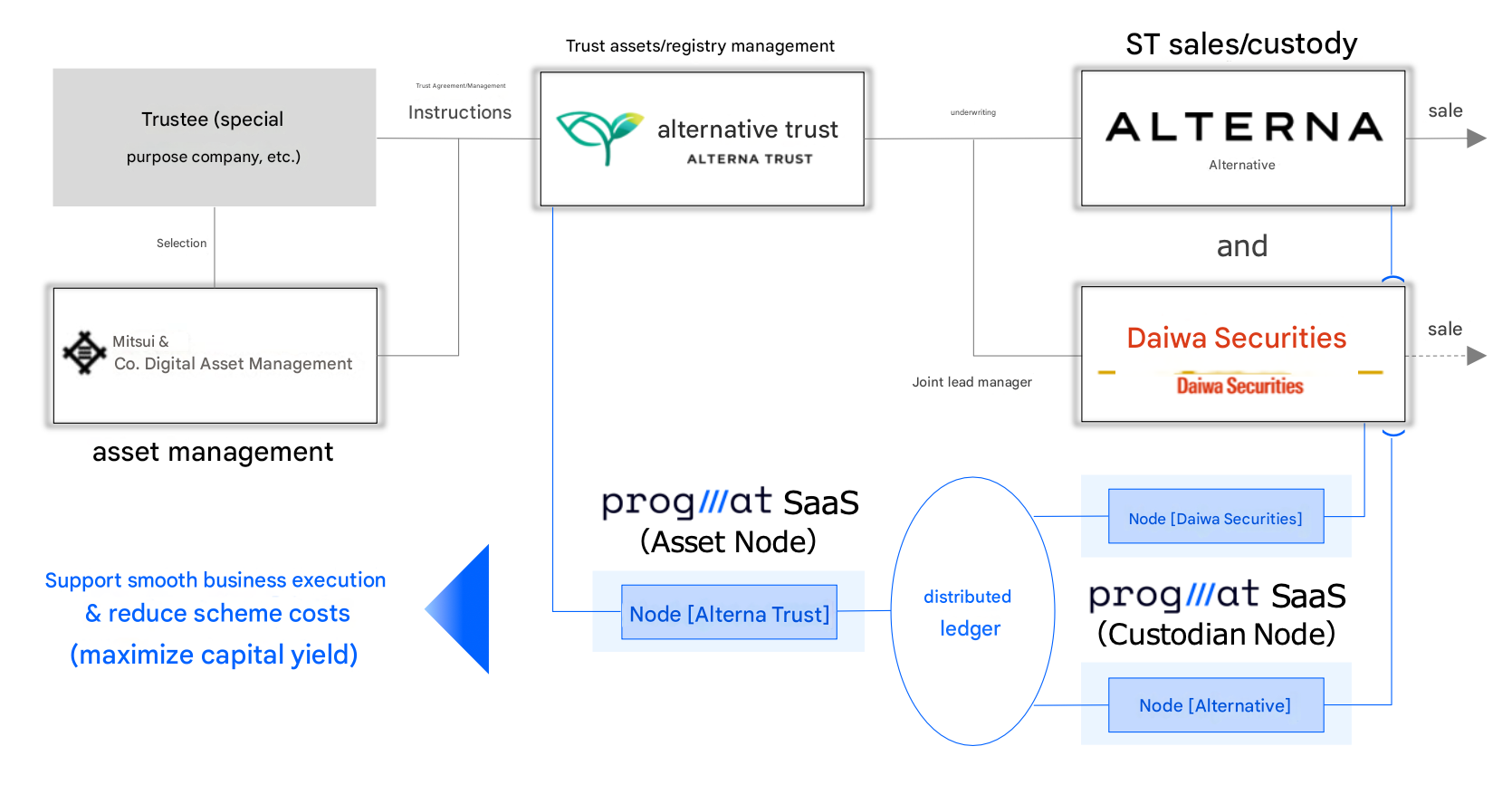

ALTERNA Trust

ALTERNA Trust was established as a trust company specializing in beneficial securities issuance trusts, which play an important role in ST issuance. It aims to contribute to the development of the digital securities market by combining MDM's financial-specialized AI and other digital technologies with Sumitomo Mitsui Trust Bank's trust administration expertise to provide efficient and speedy trust administration. As trustee, ALTERNA Trust serves as a hub, collaborating closely with asset management companies and securities firms to advance ST origination.

MDM

MDM is a leading company in Japan that handles both the origination and management of ST funds as an investment management company, as well as the sales of ST funds it manages as a financial instruments business operator, providing integrated services. It actively utilizes digital technologies including AI to develop and provide "ALTERNA," an asset management platform for individual investors. To date, it has provided a cumulative total of 19 funds (the highest number domestically) - 5 through external securities companies, 13 through its own "ALTERNA" service, and this project as the 19th.

Daiwa Securities

Daiwa Securities is a company leading Japan's real estate security token market. Including the underwriting amount of this ST, Daiwa Securities' cumulative total underwriting amount of asset-backed security tokens represents the largest track record in Japan. Targeting diverse real estate assets including offices, hotels, and logistics facilities, it provides innovative products utilizing blockchain technology. Through handling this ST, Daiwa Securities accelerates pioneering initiatives in the digital securities field and will continue to provide new real estate investment opportunities to investors.

Progmat

Progmat provides "Progmat SaaS" to ALTERNA Trust, MDM, and Daiwa Securities, supporting smooth business operations. "Progmat SaaS" is a product that enables a wide range of financial institutions to easily start digital asset-related businesses (registry management, custody, etc.) without building blockchain/distributed ledger nodes on their own servers, and also enables a wide range of securities companies/intermediaries to complete private key management for investors in-house without delegating to third parties (custodians). By providing this product, it contributes to reducing scheme costs and maximizing yields returned to investors.

Moving forward, the partners will continue to create diverse fundraising methods through cross-industry collaboration and provide further investment opportunities to investors.