First Japanese FinTech to go public on the London Stock Exchange in SPAC transaction

It took a little while, but the deal is coming through. As we reported in December 2023, Bowen FinTech (LSE: BWN), a special purpose…

It took a little while, but the deal is coming through. As we reported in December 2023, Bowen FinTech (LSE: BWN), a special purpose acquisition company (SPAC) formed to acquire businesses in the technology innovations sector with a focus on the financial services industry, had signed conditional, non-legally binding agreement to acquire 93.49% of the issued share capital of MINNADEOOYASAN-HANBAI (MOH).

As a result, the Company was granted a temporary suspension of the listing on the Official List of the Financial Conduct Authority (“FCA”) of the Company’s ordinary shares of £0.01 each and of its trading on the Main Market for listed securities of the London Stock Exchange Group plc (“LSE”) until such time as it publishes a prospectus in relation to theacquisition.

On 30 July 2024, the Company entered into an acquisition agreement, pursuant to which it has conditionally agreed to acquire 97.41 per cent. of the issued share capital of MOH from KBC for a total consideration of £34,466,864, to be satisfied by the issue and allotment of 229,779,093 new Ordinary Shares at a deemed issue price of £0.15 per Consideration Share. KBC recently (and subsequent to the Company’s announcement of 22 December 2023) increased its ownership of MOH to 97.41 per cent of theissued share capital by acquiring shares from other shareholders of MOH prior to entering into the acquisition agreement.

The Acquisition constitutes a Reverse Takeover under the UK Listing Rules as it will result in a fundamental change in the business and management of the Company. The Acquisition is conditional, inter alia, upon the re- admission of the Company’s 55,000,000 existing Ordinary Shares and the admission of the Consideration Shares to the Official List (“Admission”) and the approval by Existing Shareholders of the resolutions at the Company’s General Meeting to be held on 16 August 2024, notice of which is set out at the end of the Prospectus and which was sent to Shareholders on July 31, 2024.

On Admission, the Company’s Ordinary Shares will be admitted to the Equity Shares (transition) category of the Official List.

The FCA has confirmed that the Suspension will remain in place until Admission.

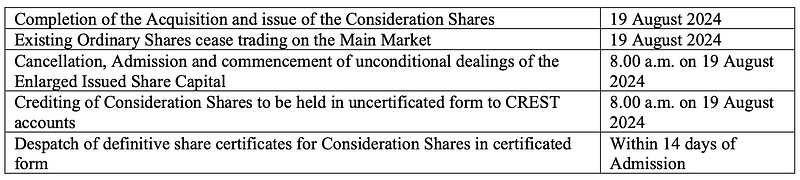

After the Shareholders approved the Resolutions proposed at the General Meeting today, applications will be made to the FCA for the re-admission of the Existing Ordinary Shares and for the admission of the Consideration Shares to the Official List and to trading on the Main Market. It is anticipated that the existing listing on the Official List and trading in the Existing Ordinary Shares on the Main Market, will be cancelled immediately before 8.00 a.m. on 19 August 2024 and that the Admission will become effective, and that unconditional dealings in the Existing Ordinary Shares and the Consideration Shares will commence at 8.00 a.m. on 19 August 2024.

On or prior to Admission, the Company’s name will be changed to MOH Nippon Plc and its TIDM will become ‘MOH’.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn. Our global Finance & FinTech Podcast, “eXponential Finance” is also available through its own LinkedIn newsletter, or via our Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.