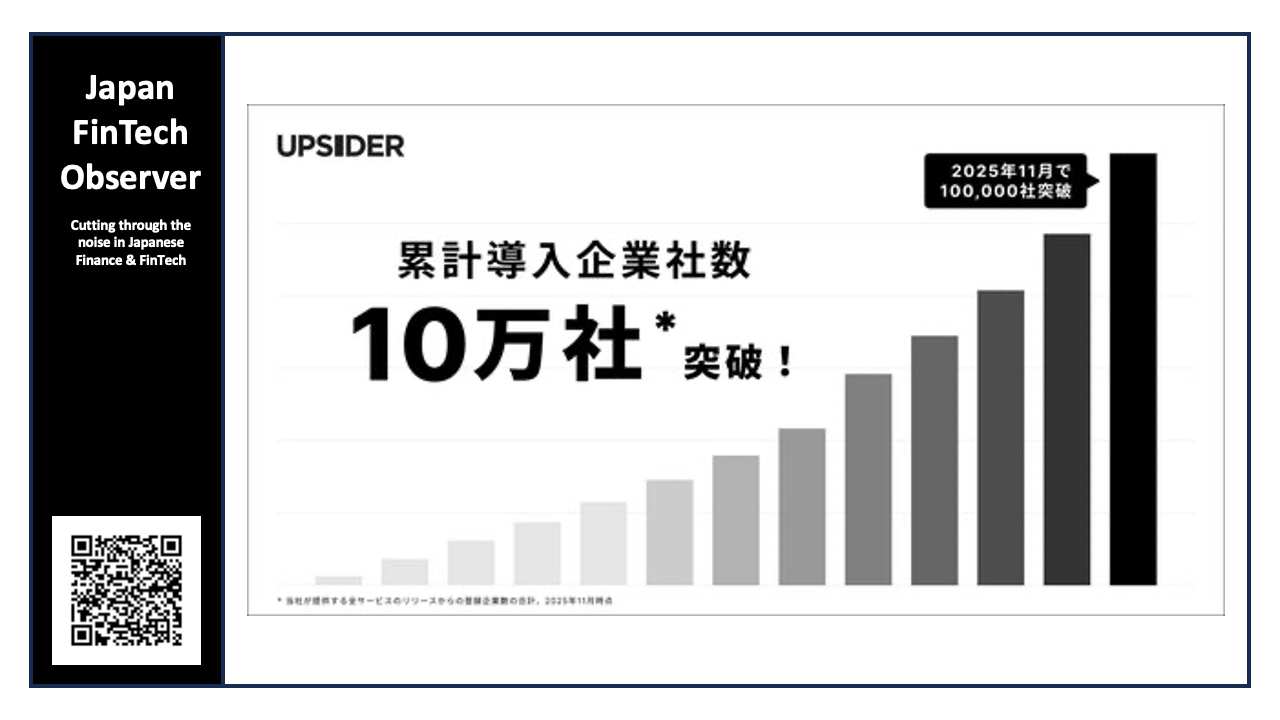

Five Years of UPSIDER: 100,000 Client Companies

On its 5th anniversary since business launch, UPSIDER's cumulative number of client companies has exceeded 100,000, and the cumulative transaction volume of its corporate card "UPSIDER" and invoice card payment service "Shiharai.com" has surpassed ¥1 trillion.

Reaching 100,000 Companies in 5 Years: Supporting Challengers Through Six Diverse Services

The cumulative number of client companies using all of UPSIDER's services exceeded 100,000 as of November 2025. Since launching the corporate card "UPSIDER" in 2020, adoption has grown as a payment infrastructure supporting the cash flow of growth companies. UPSIDER has subsequently expanded its business domains with "Shiharai.com" (which extends invoice payment terms), "UPSIDER AI Accounting" (which replaces accounting operations through AI-human collaboration), "PRESIDENT CARD" (a corporate card empowering business leaders), "UPSIDER BLUE DREAM Fund" (a growth debt fund), and "Breakthrough GRID" (a community for next-generation business leaders).

Currently, with these six services as pillars, UPSIDER supports companies across a wide range of growth phases, from startups to small and medium-sized enterprises and listed companies.

The expansion of usage over these five years stems from UPSIDER's mission to "create a global financial platform supporting challengers," addressing challenges faced in finance and management while providing new technology-driven solutions. UPSIDER will continue to provide multifaceted support according to companies' growth stages.

Annual Revenue Scale Reaches Approximately ¥10 Billion: Sustained High Growth Over 5 Years

UPSIDER's annual revenue scale reached approximately ¥10 billion as of the end of April 2025. UPSIDER continues to maintain annual revenue growth exceeding 50%, sustaining an exceptional growth pace for a startup in Japan's BtoB financial sector.

This growth is underpinned by structural challenges in fundraising and business management that Japanese startups and small to medium-sized enterprises have faced for years. Factors such as credit barriers due to insufficient financial data, difficulty raising capital before profitability, and delays in financial closing and cash flow complexity due to accounting personnel shortages have constrained growth.

UPSIDER has addressed these challenges through multifaceted solutions including credit expansion via corporate cards, flexible invoice payments, AI-automated accounting operations, and growth debt funds supplying growth capital. These initiatives have supported the growth of many companies, resulting in business expansion.

Cumulative Transaction Volume Exceeds ¥1 Trillion: Becoming Financial Infrastructure Supporting Growth Companies

The cumulative transaction volume through the corporate card "UPSIDER" and invoice card payment service "Shiharai.com" exceeded ¥1 trillion as of November 2025. "UPSIDER" has reached ¥850 billion and "Shiharai.com" ¥150 billion, meeting diverse funding needs of companies through both services. Additionally, the cumulative credit limit for the corporate card "UPSIDER" has reached ¥5 trillion.

Behind this is UPSIDER's proprietary AI credit model. Traditional systems tend to heavily emphasize past financial statements, making it difficult to provide sufficient credit to newly established companies or rapidly growing startups. By utilizing real-time transaction data and multifaceted information about business growth potential, UPSIDER more accurately evaluates companies' possibilities, achieving credit assessments in as fast as a few seconds and providing credit limits up to ¥1 billion.

This enables many companies to secure stable cash flow and expand their businesses without slowing their pace of challenge. UPSIDER will continue to enhance reliability and convenience as a daily-use financial infrastructure.

Total Loans Exceed ¥13 Billion, Second Fund Established: Becoming Japan's Largest Independent Venture Debt Fund

The cumulative total loans of the growth debt fund "UPSIDER BLUE DREAM Fund," operated by the subsidiary UPSIDER Capital, exceeded ¥13 billion as of July 2025. With an average loan amount of approximately ¥400 million and maximum loan of ¥1 billion, UPSIDER rapidly provides the capital needed for growth-stage startups to challenge themselves.

In July 2025, UPSIDER established its second fund "UPSIDER BLUE DREAM Growth Fund No. 2" with a total of ¥14.3 billion. Combined with the first fund, the total scale reached ¥24.3 billion, making it Japan's largest independent venture debt fund with participation from multiple financial institutions and investors. Participation by regional banks and insurance companies has also strengthened UPSIDER's system to supply capital to a broader range of companies.

"UPSIDER BLUE DREAM Fund" uses AI to predict cash flow based on real-time deposit/withdrawal data from banking APIs, providing term sheets within an average of 10 business days. This achieves both the speed and precision that traditional reviews found difficult, significantly improving the fundraising environment for growth companies.

Going forward, UPSIDER aims to extend this mechanism beyond startups to the small and medium-sized enterprise sector, provide technology to other financial institutions, develop new loan products, and revolutionize Japan's financial infrastructure itself.

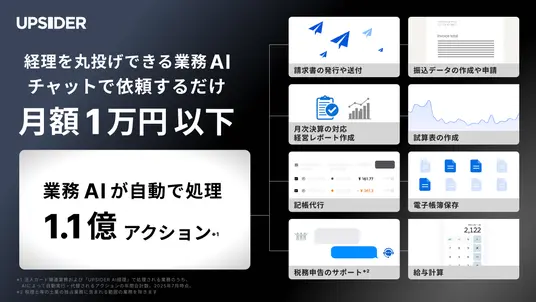

AI Replaces Approximately 110 Million Annual Tasks: Accelerating Corporate Growth Through Finance and Operations

Under the banner of "AI-human collaboration," UPSIDER has streamlined complex operations in accounting and payment domains. In addition to automating expense settlement and document processing for the corporate card "UPSIDER," in 2024 UPSIDER launched "UPSIDER AI Accounting," an accounting outsourcing service for business leaders. Based on July 2025 estimates, tasks automatically executed or replaced by AI through corporate card-related operations and "UPSIDER AI Accounting" are projected to reach approximately 110 million annually.

Small and medium-sized enterprises face severe accounting personnel shortages. By entrusting routine tasks such as document processing, journal entries, and monthly closings to AI, UPSIDER has provided an environment where personnel can focus on value-added work. Furthermore, in August 2025, through a partnership with freee, UPSIDER began offering "UPSIDER AI Accounting" through accounting firms, contributing to productivity improvements across the accounting industry.

AI utilization goes beyond efficiency, serving as a foundation to accelerate corporate decision-making and enhance overall business management capabilities. UPSIDER will continue to advance collaboration with partners and promote an environment where challengers can focus on their challenges.

Full-time Employees Increased 25-fold in 5 Years: Building a Foundation for Sustainable Growth

Organizationally, the number of full-time employees has expanded approximately 25-fold over the past five years. Beyond finance and technology specialists, people with diverse experiences and perspectives have gathered to evolve UPSIDER's services and organization. UPSIDER will continue to provide long-term support for challenging companies based on its diverse organizational structure.

Future Outlook – Further Evolution as a Financial Platform Supporting Challengers

What UPSIDER has been working on is challenging the "structural issues in fundraising and business management" that Japanese startups and small to medium-sized enterprises have faced for years. UPSIDER has rebuilt foundational areas such as credit and accounting with technology, creating an environment where companies can focus on their challenges.

The metrics communicated in this report represent only a portion of these results. This 5th anniversary is merely a milestone for UPSIDER. Under its mission to become "a global financial platform supporting challengers," UPSIDER will further advance the fusion of technology and finance to realize sustained value creation.

Recently, leveraging UPSIDER's group integration with Mizuho Financial Group, the firm is strengthening its system to deliver rapid and sustainable support to more small and medium-sized enterprises nationwide by combining their extensive network with its AI technology. Additionally, through collaboration with accounting firms and financial institutions, UPSIDER aims to provide technology across industries to renovate Japan's financial infrastructure itself and realize a society where challenging companies are properly evaluated.