Fivot Completes Series B Funding Round Totaling 2 Billion Yen

Fivot, a startup company aiming to become a challenger bank pioneering the future through "AI × Finance," has completed a funding round consisting of a 1 billion yen third-party allotment of shares in a Series B equity round and 1 billion yen in debt financing (loans), totaling 2 billion yen. Angel Bridge and Nissay Capital served as co-lead investors, with a total of 9 companies participating as investors. This brings the cumulative equity funding since founding to 2.5 billion yen.

Background and Purpose of Fundraising

Fivot was founded in 2019 with the mission of "Creating new flows of money for new industrial structures."

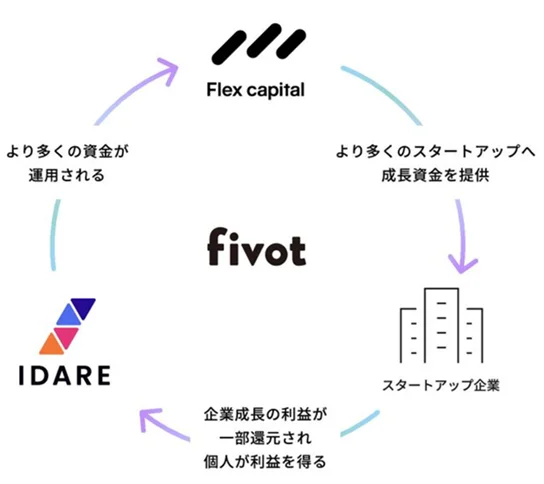

Fivot operates two businesses: "Flex Capital," a lending business for startups, and "IDARE," a cashless app with savings features for individuals. Through the construction of a capital circulation ecosystem combining these two businesses, Fivot achieves both the supply of growth capital to startups and support for individual asset formation through the redistribution of returns.

The growth of startup companies is expected to be an important driver of Japan's economic growth. However, the supply of capital to support that growth is insufficient in both quality and quantity. Behind this lies a structural challenge: traditional credit assessment methods have been unable to evaluate the unique business risks of startups with high resolution.

Fivot has constructed a proprietary loan screening model utilizing cutting-edge technology and AI. By leveraging these technologies, it has become possible to precisely evaluate the business potential of startups, enabling the supply of growth capital to potential growth companies that were difficult to support under conventional frameworks.

Finance is not only the bloodstream of the economy but also an information industry that utilizes vast amounts of data. As information technology, including AI, evolves dramatically, the company aims to use technology to unravel the information aggregate that is "finance" and pioneer Japan's future by realizing the form of finance needed for the coming era.

Through this funding round, Fivot will advance further technological development and improve its lending model through AI technology utilization. Additionally, by strengthening business collaboration with the investors who have provided funding and promoting technological innovation across corporate lending operations including small and medium-sized enterprises, Fivot will maximize the vortex of capital circulation and contribute even more to the development of Japanese society and economy.

Overview of Flex Capital

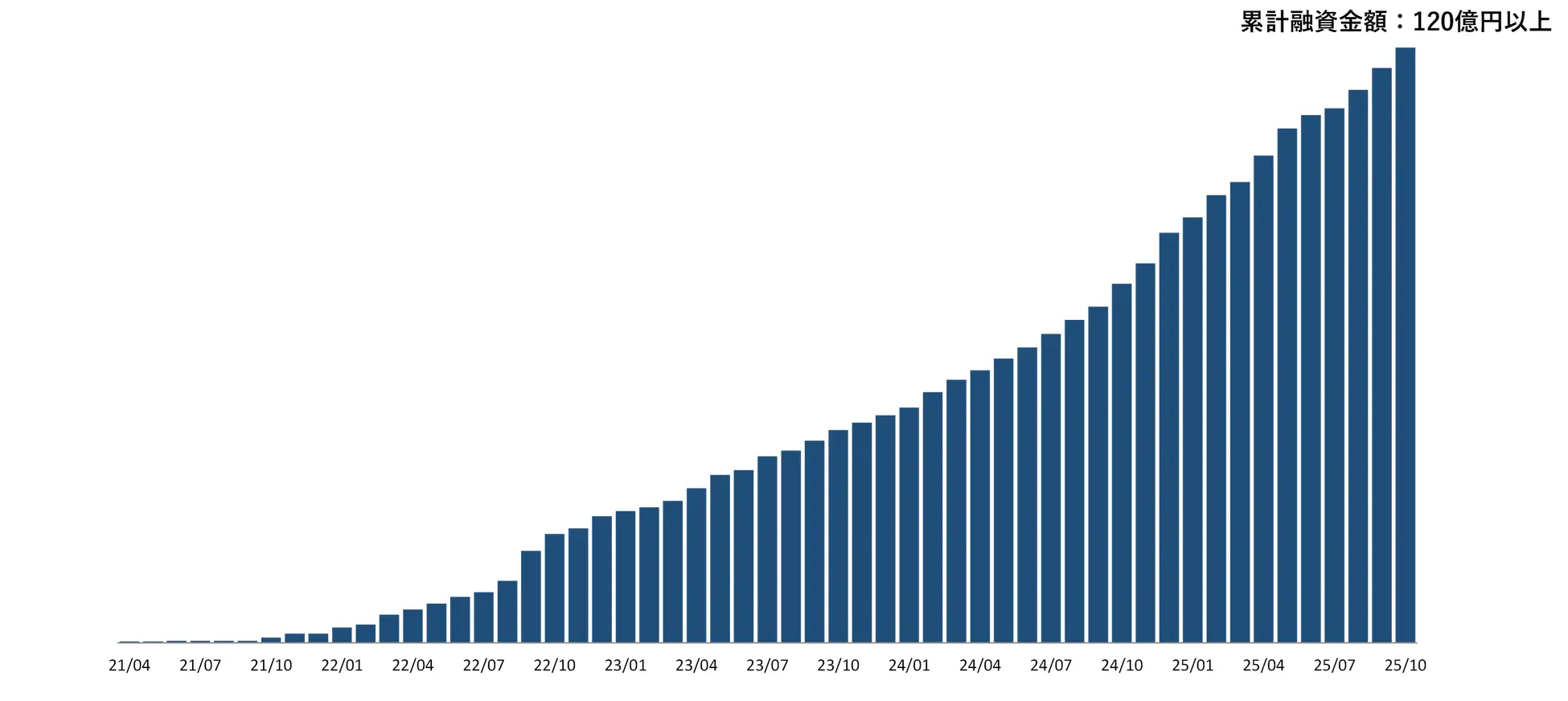

Flex Capital offers three products for growth companies centered on startups: venture debt without equity dilution, RBF (Revenue Based Finance), and "Flex Capital Invoice," an invoice advance payment service. Under the motto "Deep with data, fast with AI," Fivot has constructed a loan screening model utilizing cutting-edge technology and AI. Providing swift and flexible debt financing, Flex Capital has achieved a track record of cumulative loan amounts exceeding 12 billion yen, support for over 300 companies, and stable business operations with a low default rate in the 0.3% range.

Overview of IDARE

The savings cashless app "IDARE" is a payment app with Visa-branded prepaid functionality. Through a bonus structure unique among payment apps that returns an annual equivalent of 2% on saved balances, it provides a "mechanism for natural savings." Additionally, through features such as the AI-powered "Professional Baseball Support Box" function, it offers "fun saving" features tailored to hobbies and lifestyles, supporting individual asset formation.

IDARE will continue to advance feature development to provide new saving experiences so that individuals can realize the dreams they wish to fulfill and the lifestyles they envision.

Overview of Equity Fundraising in This Round

Funding Amount: 1 billion yen

Funding Method: Third-party allotment of shares

List of Investors (in no particular order):

<Co-Lead Investors>

- Angel Bridge (Lead investor continuing from Series A)

- Nissay Capital

<New Investors>

- DG Resona Ventures No. 1 Investment Limited Partnership (GP: Resona Innovation Partners Inc. and DG Ventures)

- T&D Innovation Investment Limited Partnership (commonly known as "T&D Innovation Fund," GP: Spiral Innovation Partners)

- Hokuhoku Capital

- Nippon Venture Capital

<Existing Investors>

- SBI Investment

- DG Daiwa Ventures

- SMBC Venture Capital