FSB Global Regulatory Framework for Crypto-Asset Activities: Japan

The Financial Stability Board (FSB) has published its 100+ page "Thematic Review on FSB Global Regulatory Framework for Crypto-asset Activities," from which we have extracted all information related to the regulatory environment in Japan for Crypto-Asset Activities (CA) and Global Stablecoin Arrangements (GSC).

Regulatory Framework Summary (Overall Status)

Japan is considered to have a finalized regulatory framework for both Crypto-asset Activities (CA) and Global Stablecoin Arrangements (GSC), reflecting significant progress in implementation.

The oversight of crypto-asset exchange services and stablecoin activities is provided by the Financial Services Agency (FSA). Japan adopted the approach of extending existing financial regulations (specifically the Payment Services Act) to encompass crypto-assets, aligning oversight with traditional financial regulatory frameworks.

1. Crypto-Asset Service Provider (CASP) Regulation (CA Recommendations)

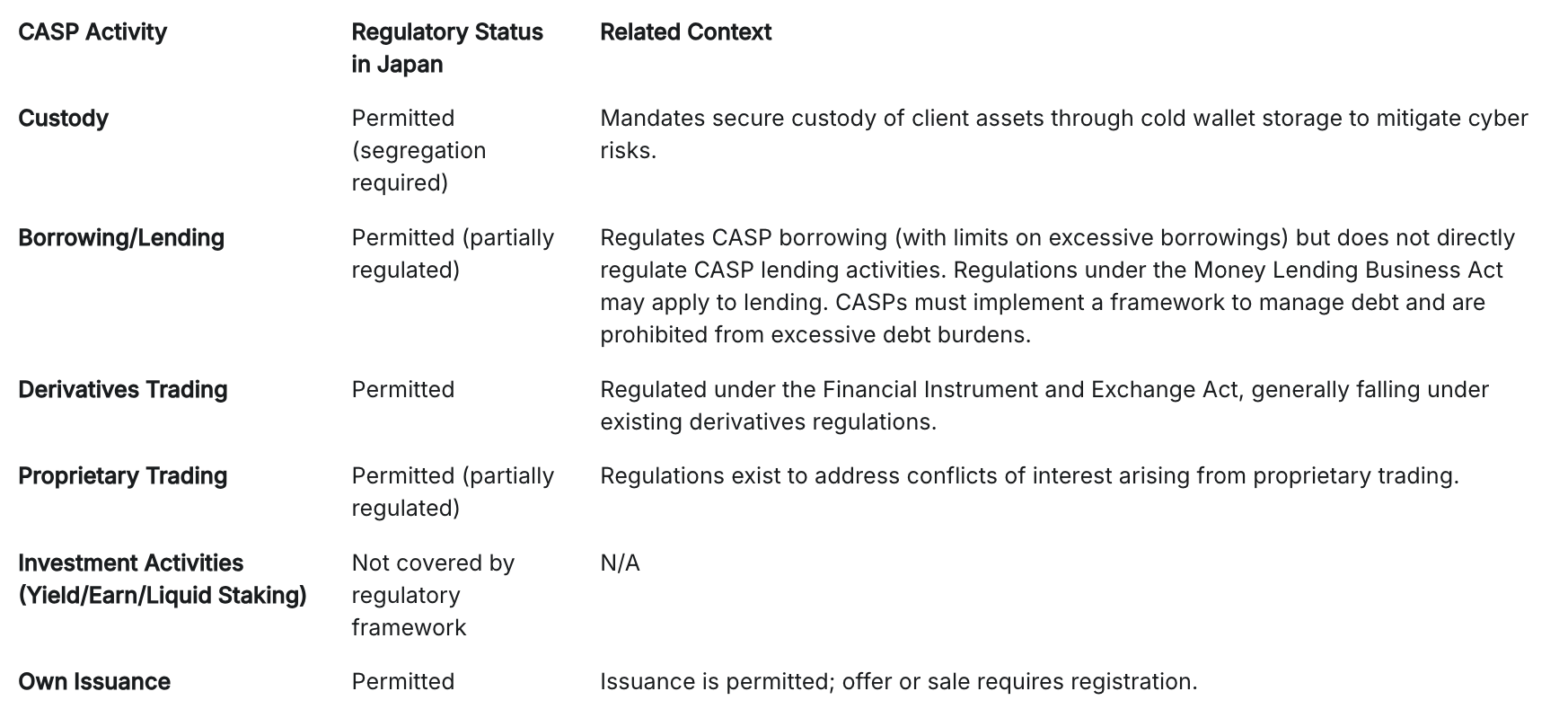

A. Licensing and Scope of Activities

Japan’s CASP framework regulates various activities, though coverage varies, sometimes relying on existing laws outside the core crypto-asset framework.

B. Governance, Risk Management, and Prudential Requirements

- Governance: Japan focuses on basic governance standards, such as minimum capital and eligibility requirements for management. It mandates the establishment and public disclosure of a conflicts of interest policy.

- Operational/IT Risks: The framework focuses on specific operational and cyber risks (e.g., secure custody, IT risk management, and reporting blockchain-related incidents, such as deficiencies in wallet security). It does not currently include resilience testing.

- Prudential Requirements: Japan focuses on foundational requirements, such as JPY 10 million in minimum capital for CASPs and secure storage of client assets.

C. Supervision and Enforcement

- Supervisory Mandate: Supervision covers internal controls, IT risk management, and governance.

- Exams Conducted: FSA conducts comprehensive inspections covering internal controls, IT risk management, and governance.

- Data Reporting: Japan has comprehensive reporting requirements (though non-financial risks are collected on an ad hoc basis) and is able to request data ad hoc from CASPs and third parties.

- Financial Statements: Quarterly

- Financial Risks: Monthly

- Non-financial Risks: Ad-hoc

- Regulatory Compliance: Quarterly

- Other Reporting: Ad-hoc

2. Global Stablecoin (GSC) Regulation

A. Licensing and Structure

- Entities Permitted to Issue: Apart from banks, only trust companies and funds transfer service providers are permitted to issue stablecoins, leveraging their payment expertise and infrastructure.

- Bank Issuance: Banks are allowed to issue balance sheet backed stablecoins (without a dedicated reserve requirement).

B. Regulatory Requirements

- Risk Management: Comprehensive. Japan aims to ensure financial stability through strict asset management practices. Stress testing is partially required (mandatory for trust banks, but not for "funds transfer service providers”).

- Redemption: Issuers must provide redemption “without delay” under the Payment Service Act, ensuring prompt action but lacking a defined minimum timeframe. Redemption occurs at face value.

- Stabilisation Mechanisms: Full Reserve or balance sheet backing.

- Custody of Reserves: Local custody is required. Japan prohibits stablecoin issuers from self-custodying reserve assets.

- Capital Requirements: Fixed minimum. Japan requires at least JPY 100 million for trust companies and JPY 2 billion for trust banks.

- Recovery and Resolution: Partially required (implied, though contingency plans are listed as "None"). Japan’s framework does not establish prudential liquidity requirements in addition to the stabilisation mechanism.

C. Reserve Collateralisation and Asset Eligibility

- Reserve Collateralisation: Required to ensure the full amount of trust assets are managed in safe deposits.

- Asset Eligibility: Japan is one of the only jurisdictions that currently imposes a minimum amount of deposits as part of the overall reserve. Reserve assets must be managed entirely in demand deposits or savings with depository institutions that meet soundness standards.

- Government Bonds: Government bonds are allowed as reserve assets without a specific maturity limit, provided they meet liquidity and safety standards. (Legislative amendments are introducing a maximum maturity limit of three months on government bonds held as reserve assets issued as trust beneficiary rights, capped at 50% of total reserve assets.)

D. Data, Disclosure, and Reporting

- Public Disclosures: Governance attributes and redemption rights must be disclosed, but the reserve asset composition is not specified publicly. Japan requires regular internal audits, though specific timelines are not outlined.

- Supervisory Reporting: Reserve asset composition is reported to the FSA. Issuers must notify regulators of any changes to governance structures, reserve management policies, or other critical aspects.

3. Cross-Border Cooperation

- Foreign Stablecoins: Japan prohibits the circulation or intermediary activities relating to foreign-issued stablecoins unless the foreign issuer obtains the specific requisite “Electronic Payment Instruments Exchange Service Provider” license.

- Cooperation Tools: Japan is a signatory to the IOSCO MMoU and EMMoU, and the APRC SMMoU (Asia-Pacific Regional Committee Supervisory MMoU).