Fujitsu and Mizuho Target SME Efficiency Crisis with Automated Payment and Data Platform

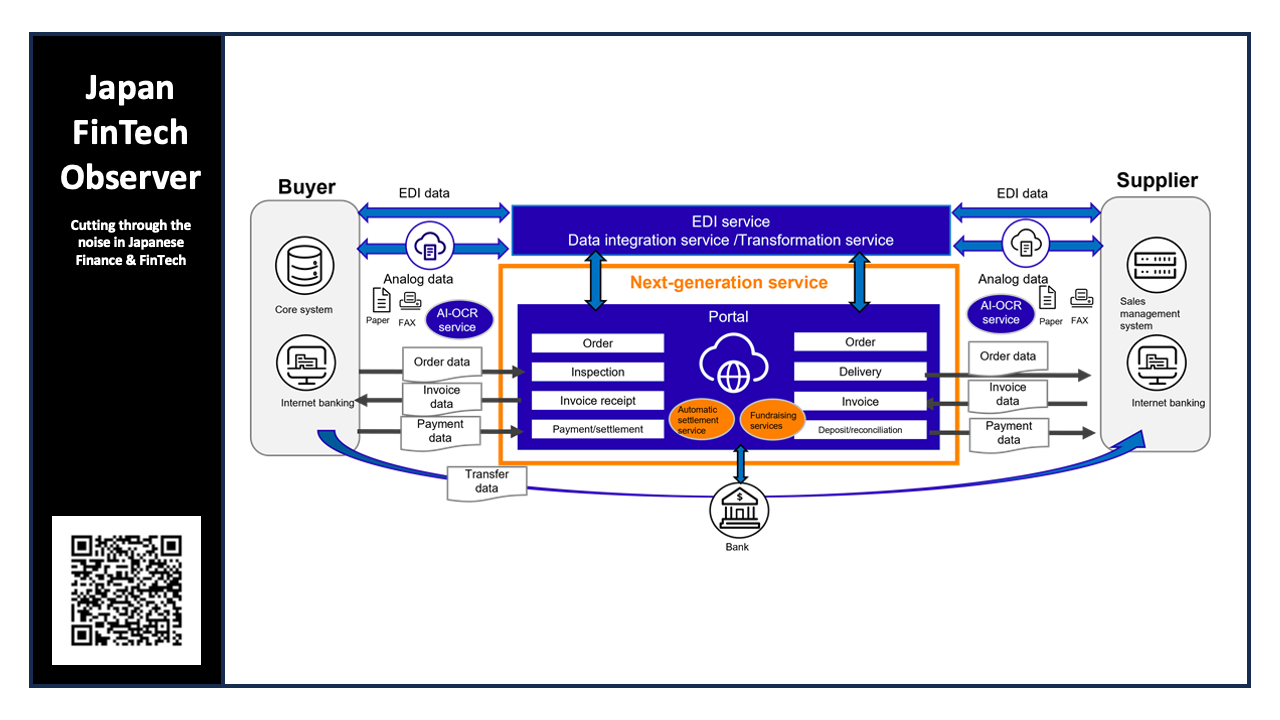

Fujitsu and Mizuho Bank have entered into a strategic collaboration aimed at overhauling the fragmented infrastructure of business-to-business (B2B) transactions in Japan. The partnership seeks to introduce a new order and payment processing service designed to streamline operations for Small and Medium-sized Enterprises (SMEs), aimed at cutting manual administrative workloads by as much as 70%.

The initiative addresses a persistent bottleneck in the supply chain: the lack of interoperability between legacy Electronic Data Interchange (EDI) systems. According to Fujitsu, while approximately 30% of inter-company transactions utilize EDI, a significant disconnect remains between the "Ryutsu BMS" standard used by major purchasing firms and the "Common EDI" utilized by smaller suppliers. This incompatibility currently forces businesses to spend an average of 170 hours per month on manual reconciliation and data entry for roughly 2,500 monthly transactions.

Leveraging Fujitsu’s "TradeFront/6G" distribution service, the two companies have successfully piloted technology that automatically converts and links these disparate data formats. The resulting automation eliminates the need for manual cross-referencing of order and payment data.

For Mizuho and Fujitsu, the play extends beyond simple process automation. By consolidating order data onto a single service platform, the partners aim to bridge the operational gap between large enterprises and their SME counterparts. Furthermore, the integration of verified order data opens new revenue channels in financial services, allowing Mizuho to offer data-driven financing solutions tailored to the specific cash-flow needs of SMEs.