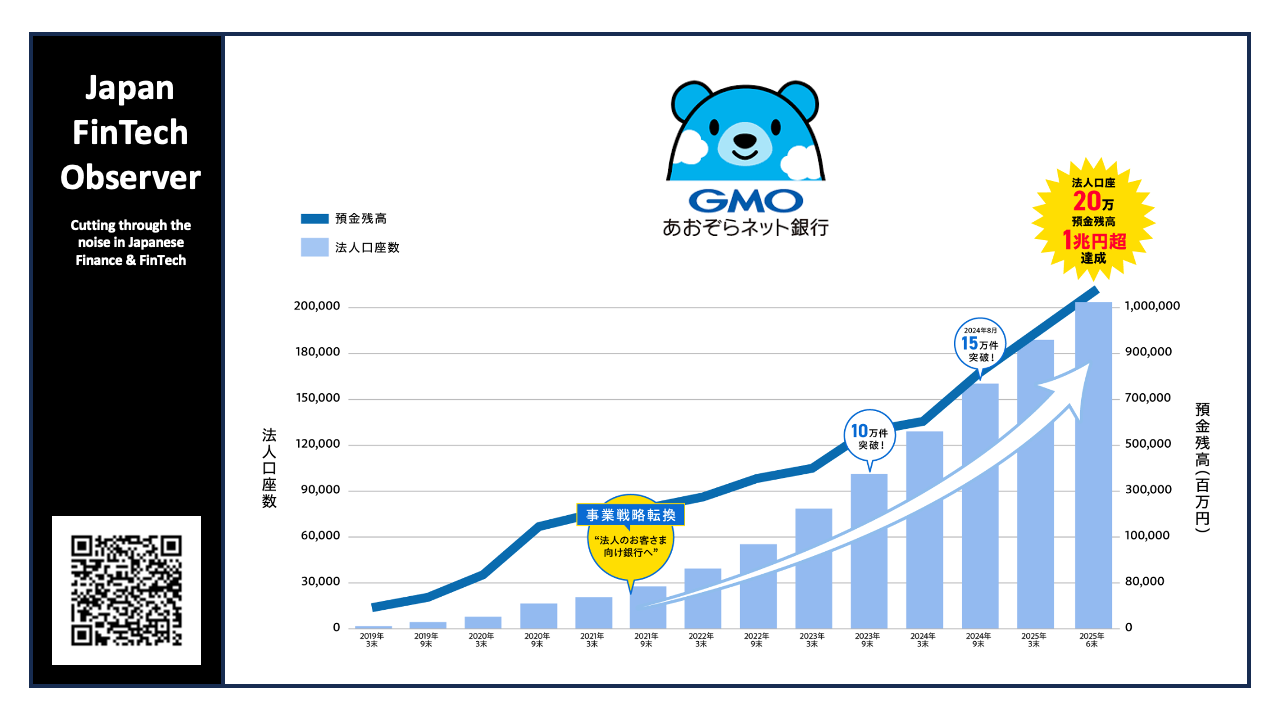

GMO Aozora Net Bank Reaches 200k Corporate Accounts & Over JPY 1trn in Deposits

GMO Aozora Net Bank has reached a major milestone as an internet-only bank in June 2025, with the number of corporate account openings exceeding 200,000 and deposit balances surpassing 1 trillion yen.

GMO Aozora Net Bank began its internet banking business in July 2018, aiming to be an online bank that is easy to use for both individual and corporate customers. After analyzing customer usage patterns, it became clear that the bank received particularly strong support from corporate customers, especially small and medium-sized enterprises and startups.

In response to this trend, GMO Aozora Net Bank positioned the period from July 2021 onward as its "Second Founding Period" and made a major strategic shift to focus on expanding services for corporate customers.

In particular, GMO Aozora Net Bank concentrated on initiatives aimed at reducing operational burden and improving convenience, such as supporting account transfers for national taxes, social insurance premiums, and employment insurance premiums, as well as payments to the Small and Medium Enterprise Management Safety Mutual Aid from the Organization for Small & Medium Enterprises and Small Business, and loan repayments to the Japan Finance Corporation. The bank also provided Pay-easy direct payment functionality. These were initiatives that GMO Aozora Net Bank boldly challenged as firsts for online banks and successfully implemented.

All of these developments came in response to daily customer requests, and through such efforts, corporate customer usage has steadily expanded, leading to this achievement of 200,000 corporate accounts and 1 trillion yen in deposits.

Evolution as a Next-Generation Tech Bank

As a next-generation tech bank, GMO Aozora Net Bank leverages its high technological capabilities to develop systems in-house. In-house development allows the bank to respond to diverse customer needs with speed, enables flexible system construction without vendor lock-in, and contributes to low-cost business operations.

Under this structure, in addition to providing highly usable internet banking and competitively priced fee structures at industry-leading low levels, GMO Aozora Net Bank has realized the provision of new services unusual for banks, such as "Transfer Fee Savings Membership," "Invoice Management and Issuance Service," "Deposit Claim Protection Service," and "Smart Transfer Approval."

Expanding Touchpoints and Recognition Through BaaS

One initiative that symbolizes the high technological capabilities is "BaaS by GMO Aozora," which GMO Aozora Net Bank has been developing as an industry pioneer. Approximately 40% of the bank's employees are engineers, and many of its sales staff are also well-versed in IT fields, enabling the bank to make proposals that align with customers' new business creation and operational challenges.

As a result, GMO Aozora Net Bank has been able to meet the needs of corporate customers who want to integrate financial functions into their own services, and the number of companies adopting BaaS is steadily increasing. BaaS creates new customer touchpoints through BtoBtoB and BtoBtoC models, and corporate and individual customers who open accounts with GMO Aozora Net Bank through starting companies have given high evaluations of the bank's account convenience and operability.

In this way, GMO Aozora Net Bank's service value is steadily penetrating to a broader user base through diverse channels, and the circle of customers using its services continues to expand daily.

Transfer Fee Reduction

Through its customers' warm support and continued use, GMO Aozora Net Bank has been able to achieve steady growth. Based on the concept that "customer business growth = company's growth," GMO Aozora Net Bank will reduce standard transfer fees to other banks from 145 yen to 143 yen starting August 1, 2025, as a token of gratitude for supporting this growth, aiming to give back to customers and continue to be an even more user-friendly bank.