GMO Payment Gateway Full Year Financial Results

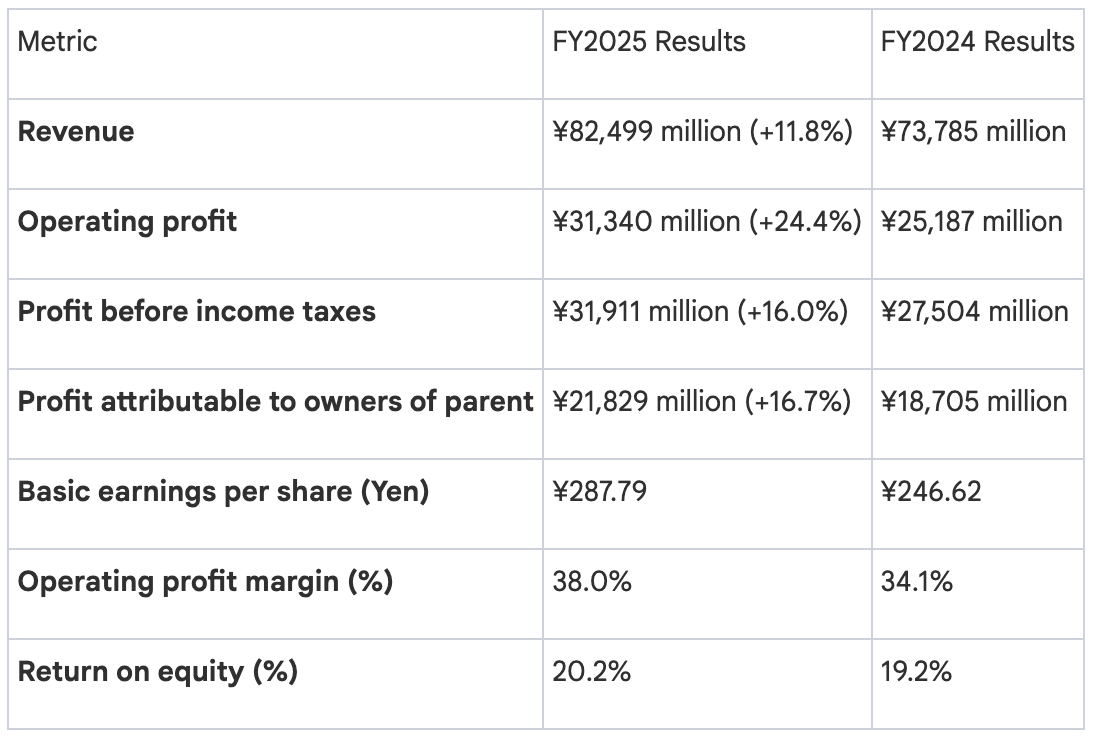

GMO Payment Gateway has reported consolidated financial results for the fiscal year ended September 30, 2025, delivering a strong performance characterized by double-digit growth across key financial metrics.

The fiscal year 2025 was marked by robust top-line growth, with revenue increasing by 11.8% year-on-year. This performance was significantly amplified on the bottom line, as evidenced by the impressive 24.4% increase in operating profit. This substantial growth in profitability directly reflects enhanced operational efficiency and the successful strategic shift towards a higher proportion of high-margin services within the revenue mix.

This strong consolidated performance was driven by distinct trends across core business segments. The following sections provide a deeper analysis of the specific business models and segments that fueled these results.

Analysis of Operating Results

A granular examination of the revenue composition and profitability drivers is essential for a complete understanding of GMO Payment Gateway's underlying financial health and strategic execution. This section breaks down the key factors that contributed to the FY2025 operating results, offering investors clearer insight into the business dynamics.

Revenue Composition and Drivers

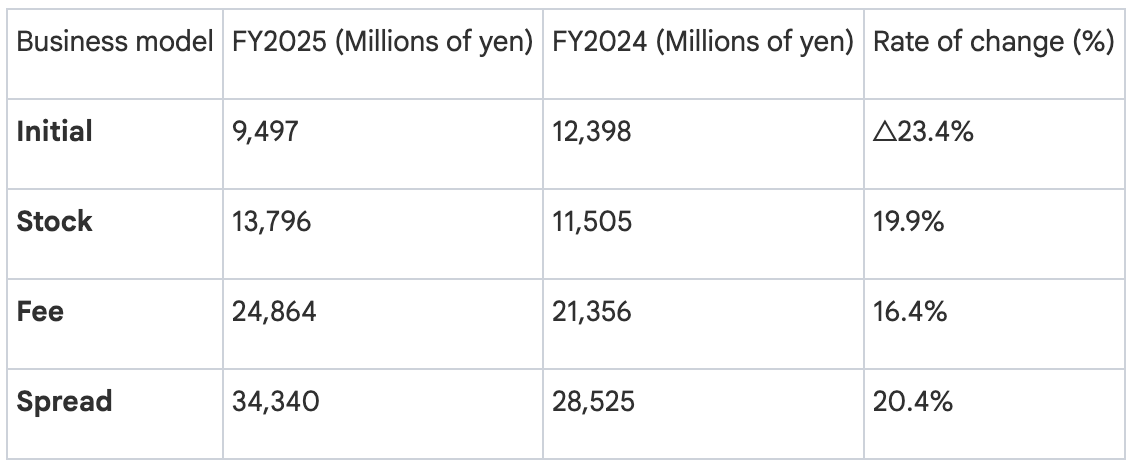

The composition of the revenue streams reflects a strategic and favorable shift towards more predictable, recurring income.

The decline in 'Initial' revenue was anticipated and is primarily attributable to a high base effect from a large-scale project in the Card Present (CP) domain during the previous fiscal year. More importantly, this was more than offset by strong, double-digit growth across recurring revenue streams. The significant increases in 'Stock' (fixed revenue), 'Fee' (transaction processing), and 'Spread' (merchant acquiring) revenues highlight the successful expansion of core services and the growing stability of the business model.

Profitability Deep Dive

Operating profit for FY2025 reached ¥31,340 million, a significant increase of 24.4% year-on-year, successfully achieving the earnings forecast for the fiscal year. This growth was propelled by strong performance across all business segments.

The disparity between operating profit growth (24.4%) and profit before income taxes growth (16.0%) is directly attributable to a one-time event in the prior fiscal year. This disparity is due to a high base effect from FY2024, which included a one-time gain of ¥1,629 million from the sale of an equity method investment. The absence of a similar gain in FY2025 is the sole reason for the moderated pre-tax profit growth rate.

The strength of these consolidated results is a direct consequence of targeted strategies within each of the core segments, which will be detailed in the next section.

Performance by Business Segment

This section dissects the performance of the three core business segments: Payment Processing, Money Service, and Payment Enhancement. This segment-level analysis reveals the specific market dynamics, strategic initiatives, and operational successes that underpin the consolidated financial results.

Payment Processing Business

- FY2025 Revenue: ¥61,677 million (+10.3% YoY)

- FY2025 Segment Profit: ¥29,779 million (+18.1% YoY)

The Payment Processing Business remains the cornerstone of GMO Payment Gateway's operations, delivering robust growth. The segment’s profit growth of 18.1%, which outpaced revenue growth, was driven by an increased proportion of high-gross margin services, specifically online payments and recurring-model revenues in CP payments. Key performance drivers included:

- Online and Recurring Billing: Revenue expanded significantly due to increased online payment volumes in the travel/ticket and food & beverage sectors. Notably, online payment revenue at GMO Payment Gateway itself grew by a favorable 19.1% YoY.

- Banking as a Service (BaaS): The footprint of GMO Payment Gateway's BaaS support service continued to expand, capturing the growing demand for cashless solutions and digital transformation among financial institutions and business operators.

- Strategic Shift in Card Present (CP): While initial revenues from payment terminal sales declined due to a high base effect, this was part of a deliberate strategic marketing shift towards terminal-free payments for SMEs. This shift, combined with increased cashless usage, drove recurring-model revenue growth beyond internal plans.

To further strengthen its position, on January 8, 2025, GMO Payment Gateway acquired enpay (now GMO Enpay), a move designed to enhance its service capabilities within the childcare and education industries.

Money Service Business (MSB)

- FY2025 Revenue: ¥19,188 million (+16.6% YoY)

- FY2025 Segment Profit: ¥5,407 million (+31.7% YoY)

The MSB segment achieved outstanding profit growth, driven by service expansion and effective risk management. Sources of growth included:

- BNPL and B2B Services: The Buy Now, Pay Later (BNPL) service and the B2B deferred payment service, GMO B2B Pay On Credit, both contributed to segment revenue growth.

- Overseas Lending and Remittance: The lending service to overseas FinTech operators expanded with new borrowers in North America and India. Concurrently, the remittance service posted a significant 26.7% YoY revenue increase.

- Expanded Service Portfolio: Revenues from the salary prepayment service, "Instant Salary byGMO," and the B2B credit card payment service, "Invoice Card Pay byGMO," increased due to a steady rise in transaction volumes.

- Exceptional Profitability: The remarkable 31.7% increase in segment profit was primarily due to low default rates in the Payment After Delivery service. This was achieved through improved credit screening accuracy, which successfully controlled credit-related costs.

Payment Enhancement Business

- FY2025 Revenue: ¥1,766 million (+17.0% YoY)

- FY2025 Segment Profit: ¥418 million (+11.9% YoY)

This segment continues to deliver strong growth by providing value-added services that support merchants' operations. The main contributor was GMO Payment Gateway's consolidated subsidiary, GMO Reserve Plus, which saw a 36.2% YoY revenue increase from its "Medical Kakumei byGMO" reservation management system for medical institutions. Increased revenue from security enhancement services also contributed to the segment's positive performance.

The strong operational results across all segments are clearly reflected in the health of the consolidated financial position, as detailed in the following section.

Consolidated Financial Position and Cash Flow Analysis

An analysis of the consolidated balance sheet and cash flow statement provides critical insight into GMO Payment Gateway's financial stability, liquidity, and capital structure. At the end of fiscal year 2025, GMO Payment Gateway maintained a robust financial position, well-equipped to fund future growth.

Statement of Financial Position (As of September 30, 2025)

- Total Assets stood at ¥406,800 million, an increase of ¥62,097 million from the prior year-end. This growth was primarily driven by a ¥45,986 million increase in cash and cash equivalents and a ¥9,770 million rise in trade and other receivables.

- Total Liabilities increased to ¥290,622 million. The primary drivers were a rise in deposits received of ¥34,763 million and the issuance of new corporate bonds totaling ¥20,002 million. This increase was partially offset by a significant decrease in borrowings of ¥9,942 million, reflecting a strategic shift in the capital structure.

- Total Equity grew to ¥116,177 million, up ¥10,358 million from the previous year. This was mainly due to the Profit for the period of ¥22,538 million, which was partially offset by dividend payments of ¥9,403 million.

Analysis of Consolidated Cash Flows

- Cash Flow from Operating Activities: GMO Payment Gateway generated ¥53,759 million in net cash from operating activities. This strong performance was primarily the result of profit before income tax of ¥31,911 million and a significant increase in deposits received of ¥34,753 million, reflecting the growth of business operations.

- Cash Flow from Investing Activities: Net cash used in investing activities totaled ¥7,328 million. Key investments included the purchase of intangible assets (¥3,368 million), the purchase of investment securities (¥2,178 million), and the purchase of shares in a subsidiary (¥1,718 million) related to the acquisition of GMO Enpay.

- Cash Flow from Financing Activities: Net cash used in financing activities was ¥1,242 million. Major activities included proceeds from the issuance of corporate bonds (¥19,911 million), which were largely offset by outflows from a net decrease in short-term borrowings (¥11,400 million) and dividend payments to shareholders (¥9,399 million).

As a result of these activities, the closing balance of cash and cash equivalents at the end of the fiscal year was ¥220,040 million, representing a net increase of ¥45,986 million for the year. This strong financial position directly supports GMO Payment Gateway's commitment to providing consistent returns to its shareholders.

Shareholder Returns and Dividend Policy

GMO Payment Gateway places a high management priority on balancing the need for internal reserves to fund future business expansion with its commitment to providing stable and growing returns to its shareholders. The dividend policy for fiscal years 2025 and 2026 reflects this core philosophy.

For the fiscal year ended September 2025, GMO Payment Gateway has upwardly revised its dividend forecast. The year-end dividend will be ¥144 per share, a ¥20 increase from the initial forecast of ¥124. This revision was made because "financial results for FY2025 are expected to exceed initial forecast and to return profits to shareholders." It is important to note that the prior year's total dividend of ¥124 included a special dividend of ¥8.00 per share, making the growth in the ordinary dividend particularly robust.

Looking ahead, the dividend forecast for the fiscal year ending September 2026 is planned to be ¥170 per share. This substantial increase is based on expectations of continued favorable business conditions and GMO Payment Gateway's dedication to continuing the trend of consecutively increasing the ordinary dividend.

Dividend Summary and Forecast

GMO Payment Gateway's robust dividend policy is supported by a confident outlook and a clear earnings forecast for the upcoming fiscal year.

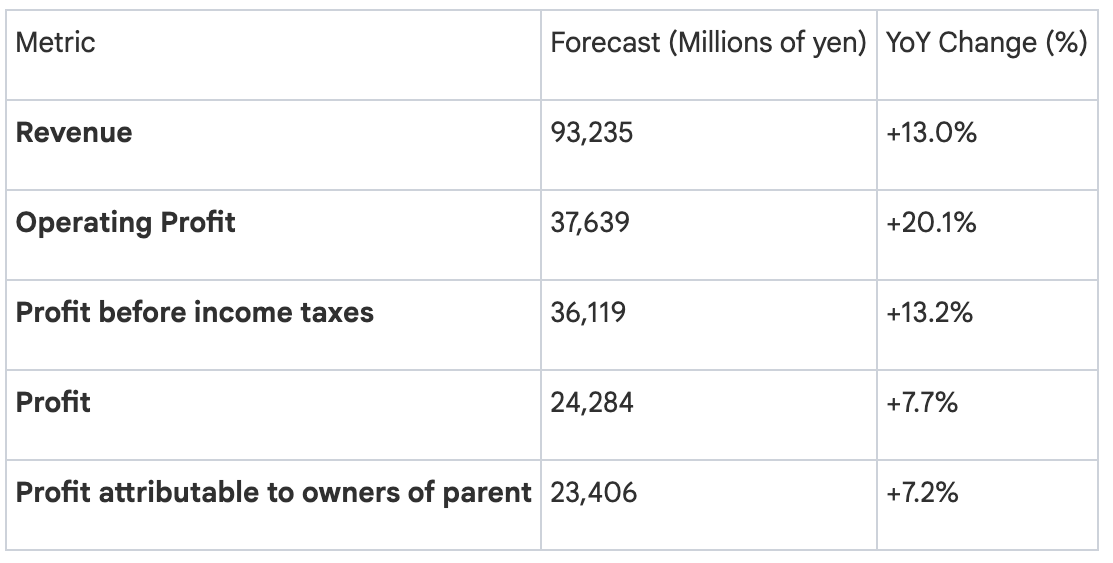

FY2026 Earnings Forecast and Strategic Outlook

This section outlines GMO Payment Gateway's official earnings forecast for the fiscal year ending September 30, 2026. This forecast is grounded in the analysis of the prevailing business environment, macroeconomic trends, and GMO Payment Gateway's clearly defined strategic priorities for achieving sustained growth.

Business Environment Assumptions

GMO Payment Gateway's FY2026 forecast is based on several positive market trends:

- Continued expansion of the B2C E-Commerce market.

- Steady growth in online payments for non-merchandise domains, including public utilities and taxes.

- An acceleration of cashless adoption in the Card Present (CP) domain.

- Favorable macroeconomic factors, including increased inbound tourism and rising wages, which are expected to support private sector consumption.

Consolidated Earnings Forecast for FY2026

Strategic Priorities

To achieve this forecast and drive long-term value, GMO Payment Gateway will focus on several priority initiatives:

- Acquiring large-scale, growth-oriented merchants and securing large-scale projects.

- Developing industry-specific platforms that provide integrated “payment+α” solutions.

- Expanding the Banking as a Service (BaaS) support services to more financial institutions and business operators.

- Promoting the adoption of the next-generation payment platform, ‘stera’.

These strategic pillars are aligned with the long-term management KPI of achieving an operating profit of ¥100.0 billion by FY2030 or FY2031, reinforcing GMO Payment Gateway's ambition for sustainable, large-scale growth.

GMO Payment Gateway's excellent performance in fiscal year 2025 demonstrates its capacity for strong, profitable growth and disciplined strategic execution. With a robust financial position, clear market-leading priorities, and favorable industry tailwinds, GMO Payment Gateway is confident in its ability to deliver on its FY2026 forecast and drive toward its long-term goal of ¥100 billion in operating profit, creating significant and sustainable value for its shareholders.