GREE Ventures Launches Second Fund of Funds Focused on Japanese Venture Capital

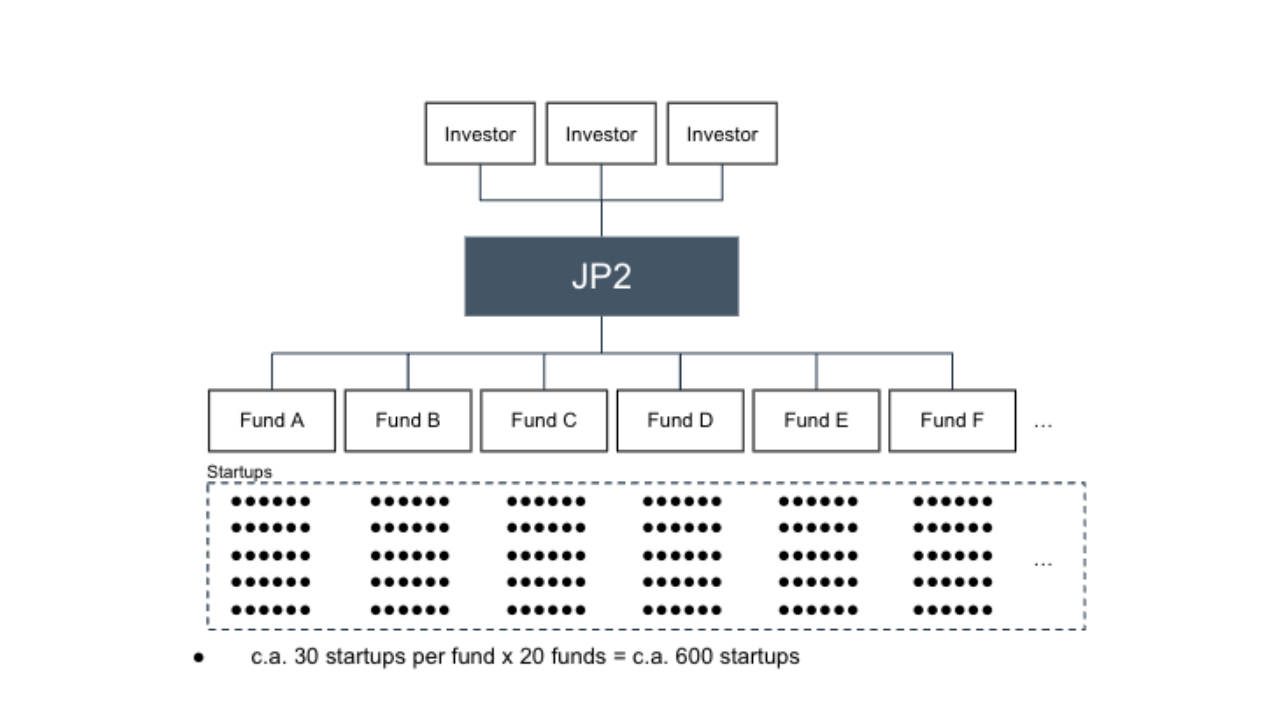

GREE Ventures has established the GREE LP Fund JP 2, Limited Partnership (“JP2”), its second fund of funds (FoF) focused on Japanese venture capital. JP2 completed its first close at ¥4.4 billion, with a target final fund size of ¥6 billion.

Overview of JP2

GREE Ventures aims to accelerate the growth of the startup ecosystem by investing in both VC funds and startups. Since 2010, GREE Holdings has made over 100 LP investments in VC funds across Japan and abroad.

Drawing on more than 15 years of investment experience, GREE Ventures leverages its network and expertise to access top-tier VC funds, conduct in-depth due diligence, and build a strong, diversified portfolio through them.

JP2 continues this strategy, with a primary focus on investing in Japanese VCs. As a fund of funds, JP2 offers diversified exposure to multiple VC funds—helping reduce risk and enabling access to high-quality, often difficult-to-access managers.

Through JP2, GREE Ventures expects to gain insights and deal flow from approximately 600 startups by investing in around 20 VC funds.

Objectives of JP2

JP2 has attracted commitments and strong interest from business corporations and corporate venture capital (CVC) units. The fund is designed to support long-term open innovation by connecting these investors with high-potential startups across a broad range of industries and stages.

Team Structure

JP2’s investment committee brings together seasoned professionals with deep expertise in U.S. and Japanese VC fund investment, alternative assets, and corporate management. The operating team includes members with diverse experience in corporate investment, VCs, M&A, and buyouts—ensuring disciplined investment execution and strategic alignment with corporate LPs.