IHI, Fujitsu & Mizuho Bank to provide total support scheme for J-Credit

IHI, Fujitsu, and Mizuho Bank have entered into a memorandum of understanding regarding a joint business venture to provide the “J-Credit…

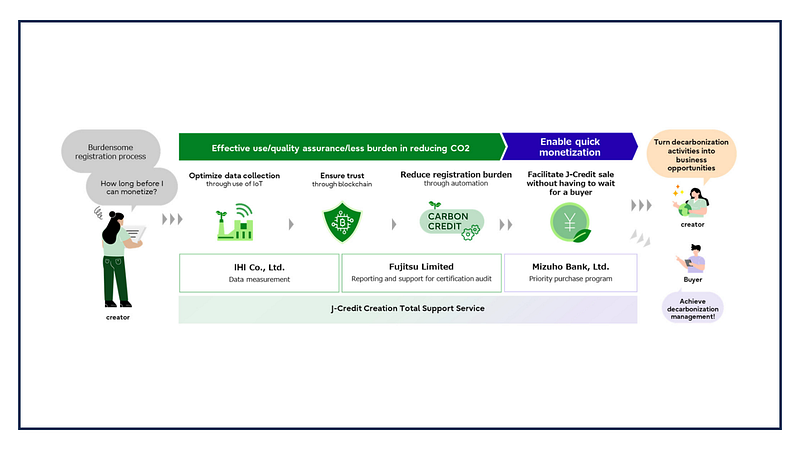

IHI, Fujitsu, and Mizuho Bank have entered into a memorandum of understanding regarding a joint business venture to provide the “J-Credit Creation Total Support Service.” This service will optimize the J-Credit creation process in J-Credit scheme and support rapid monetization for J-Credit creators.

Currently, in order for companies and organizations to create J-Credits, various procedures are necessary across each of the phases, from project registration to J-Credit creation, and the significant time and effort required is an issue. In addition, there is an inherent risk that a buyer won’t be found after the credits are created, and that monetization will be delayed.

In order to tackle these issues, and increase J-Credit creation ahead of expected rising demand, this joint enterprise will combine the Mizuho Bank network with the MRV Support System, which digitizes the process of creating environmental value (i.e., measurement, reporting, and verification) and was developed by IHI and Fujitsu, to offer a total support service for J-Credit creators. In addition, in the first quarter of fiscal 2025, the effort aims to start providing J-Credits creation support for activities to reduce emissions through the introduction of photovoltaic power generation facilities to replace grid electricity.

The J-Credit Creation Total Support Service combines Fujitsu’s blockchain and automation technology with IHI’s knowledge regarding J-Credit creation and data collection engineering know-how to enable highly reliable data management and storage and reduce burden through automation of application procedures required for J-Credit creation. Moreover, through the J-Credit priority purchase program-which utilizes Mizuho Bank’s customer network, the three companies provide a one-stop service.

IHI leverages its engineering and IoT capabilities to collect operational data on customer facilities, calculate CO2 reductions, and support the creation of environmental value including through the creation of J-Credits. By utilizing the environmental value management platform and promoting further digitalization of the creation process, IHI will work to create a system that can create credible environmental value efficiently and further contribute to the realization of a decarbonized society.

Under the Fujitsu Uvance business model, which focuses on resolving societal issues, Fujitsu’s platform for the management of ESG, that supports the realization of corporate ESG management by visualizing, measuring, and optimizing CO2 reductions, uses AI to analyze ESG data, including data on CO2 emission reductions collected at the time of J-Credit creation and provides simulations needed for sophisticated management decision-making as well as recommendations. Through these measures, Fujitsu supports to acceleration of its customers sustainability transformation (SX.)

Mizuho Bank aims to facilitate decarbonization for its customers and society as a whole by playing an intermediary role for the emerging carbon credit market in its capacity as a financial institution. As the only financial institution designated as a “Best Market Maker” in the Tokyo Stock Exchange’s carbon credit market, Mizuho Bank is working to promote the liquidity and progress of the J-Credit market, and make contributions to both the environment and the economy.

Through this collaboration, the three companies seek to expand the J-Credit Creation market, accelerate decarbonization management and contribute to the creation of a sustainable society.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.