Infcurion Reports First Quarterly Financial Results as a Public Company

Infcurion exists to accomplish what was previously considered infeasible, starting with the foundational layer of the economy: payments. Infcurion is the enabler of change, bringing modern FinTech capabilities to every corner of the Japanese economy. By embedding payment and financial functions into services across all industries, Infcurion is not just participating in Japan’s digital transformation; they are actively accelerating it. Infcurion provides the critical infrastructure that allows any business to become a FinTech company, unlocking new value and driving progress for Infcurion's partners and their customers.

This article reports on the financial results for the second quarter of Fiscal Year 2025, ending September 30, 2025, the first quarterly results for Infcurion as a public company, following its October 24, 2025. Infcurion is uniquely positioned to capture the immense and rapidly expanding market opportunity created by the digitization of Japan’s economy.

The Opportunity: Digitizing Japan's Massive B2C & B2B Economies

Japan is at a critical inflection point in its digital transformation. While significant progress has been made, the true potential for modernization in both consumer and business payments remains largely untapped. This creates a powerful and durable tailwind for growth. Infcurion sees two parallel, multi-trillion-yen markets ripe for disruption, where legacy systems are giving way to modern, efficient, and embedded financial solutions. Infcurion's strategy is precisely calibrated to capitalize on these dual secular growth trends, positioning us to capture disproportionate value as these markets digitize.

Untapped Markets Primed for Disruption

B2C Cashless Market: Accelerating Adoption | B2B Payments Market: A Vast, Untouched Frontier |

Market Size: JPY 330 Tn. Japan's cashless penetration recently reached approximately 40%, achieving the government's 2025 target a year ahead of schedule. However, this still lags significantly behind global peers like South Korea (99.0%) and the UK (83.5%). With a new government target of 80% adoption, there is a clear and substantial runway for continued, rapid growth in the consumer space. | Market Size: JPY 1,160 Tn. This market represents an even larger opportunity. Corporate card usage accounts for less than 1% of total B2B transaction volume, a fraction of the penetration seen in the U.S. (~7%). Regulatory tailwinds, including the e-Bookkeeping and Bill Digitization reforms, are creating unprecedented demand for digital payment solutions, making this a massive greenfield opportunity. |

Infcurion is the essential enabler built to capture these parallel opportunities, providing the core infrastructure for Japan's next wave of economic digitization.

Infcurion's Solution: A Full-Stack "Payment Enabler" Platform

To capitalize on this vast market opportunity, Infcurion operates as a "Payment Enabler," providing a modern, open platform that embeds sophisticated payment and financial functions directly into the services of its partners. Infcurion empowers companies across every industry—from retail and SaaS to manufacturing and mobility—to seamlessly integrate financial capabilities, transforming their business models and enhancing customer value.

Infcurion's Value Proposition

- Enabler Business Model: Infcurion embeds mission-critical payment and financial functions into service providers across all industries, allowing them to become FinTech innovators.

- Next-gen Infrastructure: Infcurion's full-cloud, API-native open platform provides modern payment infrastructure that is flexible, scalable, and rapidly deployable at a low cost.

- Comprehensive Coverage: Infcurion powers the full spectrum of economic activity, providing solutions for both the massive B2B and the high-growth B2C domains with embedded payments and finance.

Infcurion's business is architected through distinct, synergistic segments that execute this vision and drive our growth.

Infcurion's Engine: A Multi-Pillar, Synergistic Business Model

Infcurion’s strategy is executed through three distinct business segments that work in concert to create a powerful growth engine. Infcurion's Consulting arm serves as the tip of the spear, identifying strategic needs that are then captured and scaled by its high-growth Payment and Merchant Platform engines. This integrated model allows Infcurion to acquire customers efficiently, drive transaction volume, and generate a balanced portfolio of stable and high-growth revenue streams.

Payment Platform (51.0% of Sales) | Merchant Platform (28.0% of Sales) | Consulting (21.0% of Sales) |

The core growth engine, providing API-based solutions that embed financial functions into client services. Key products include the 'Xard' card issuance platform, 'Winvoice' invoice payment platform, and 'Wallet Station' mobile payment platform. 3-Year CAGR: +44.2% | Promotes cashless adoption at the merchant level. Infcurion provides 'Anywhere', an all-in-one payment solution with terminals and processing, and are developing a next-generation, full-cloud acquiring system to further digitize retail. 3-Year CAGR: +10.1% | Infcurion's profitable cash engine and strategic entry point. Infcurion provides end-to-end consulting for new financial ventures and digital transformation, leveraging deep domain expertise to build trust and identify opportunities for its platform solutions. High Repeat Order Rate: ~90% <br>3-Year CAGR: +7.2% |

Infcurion's Flywheel: Sustainable Competitive Advantages

Infcurion's success is not accidental; it is built on a set of mutually reinforcing competitive advantages that create a powerful growth flywheel. This integrated approach fundamentally differentiates Infcurion from traditional, siloed players and allows the firm to deliver superior value to its partners and the market.

- Leading Position Covering the Entire Payment Domain Unlike the traditional, fragmented payment industry with multiple intermediaries, Infcurion’s model covers the entire payment lifecycle, including issuing, acquiring, and processing. This allows the firm to build a low-cost, end-to-end seamless platform that eliminates inefficiencies and maximizes value for its clients and their end-users.

- Flexible and Lightweight Open Platform Infcurion's technological advantage is clear. It operates a full-cloud, API-native platform that enables the rapid deployment of sophisticated payment infrastructure at a fraction of the cost of legacy systems. This architecture allows any business, from a high-growth startup to a large enterprise, to become a FinTech company, embedding financial services without the enormous cost and complexity of traditional system integration.

- A Proven Growth Model Built on Consulting & Product Synergy Infcurion has perfected a "Land & Expand" flywheel. The deep consulting expertise allows Infcurion to solve its clients' most complex challenges, driving demand for high-impact product delivery. The data and real-world feedback generated from the platform solutions then fuel continuous product evolution and innovation. This virtuous cycle creates scalable customer growth and an ever-improving product suite.

This integrated flywheel is not a theoretical construct; it is the engine translating Infcurion's strategic advantages directly into the superior financial performance and accelerating profitability.

Q2 FY2025 Performance: Exceptional Growth & Profitability

Infcurion's Q2 FY2025 results provide clear evidence that its strategy is working. Infcurion has not only achieved strong top-line growth but has also reached significant profitability, demonstrating the scalability and leverage inherent in its business model. Critically, Infcurion has already exceeded its full-year profit forecast as of the second quarter, a testament to its disciplined execution and the market's enthusiastic adoption of its platforms.

Q2 FY2025 Consolidated Financial Highlights (Cumulative)

Metric | Q2 FY2025 (JPY Million) | Q2 FY2024 (JPY Million) | YoY Change |

Net Sales | 4,279 | 3,325 | +28.7% |

Gross Profit | 1,962 | 1,413 | +38.9% |

Operating Profit | 272 | -66 | Turned Profitable |

Net Income | 382 | -57 | Turned Profitable |

EBITDA | 321 | -46 | Turned Profitable |

Key Performance Indicators Demonstrating Scalability

- Massive GTV Growth: B2B Gross Transaction Value (GTV) surged 66.1% YoY to JPY 108.6 billion, driven by the rapid adoption of the 'Xard' and 'Winvoice' platforms.

- Rapid Client Acquisition: The number of Payment Platform client companies grew 55.8% YoY, exceeding 80,000 as the network effect strengthens.

- Profitability Achieved: Profit at all levels below operating profit has already exceeded the full-year forecast as of Q2, highlighting the powerful operating leverage in the business model.

This exceptional performance is underpinned by a high-quality financial structure designed for sustainable, profitable growth.

Financial Deep Dive: A Model of High-Quality Revenue & Operating Leverage

The strength of Infcurion's financial performance lies not just in its growth rate, but in the quality of its revenue and the scalability of its cost structure. The financial model is designed to translate top-line expansion directly into accelerating profitability through powerful operating leverage.

- High-Growth Recurring Revenue: Infcurion's revenue model is rapidly transitioning towards "usage-based stock revenue," which is tied directly to its clients' growing transaction volumes (GTV). This creates a predictable, recurring, and high-growth revenue stream. In the core Payment Platform segment, this stock revenue grew an exceptional 82.9% YoY.

- Improving Profitability: Infcurion's consolidated gross profit margin improved by a significant 3.4 points year-on-year to 45.9%. This margin expansion is driven by the favorable economics of the platform model, including a declining cost of goods sold (COGS) ratio for Infcurion's high-growth stock revenue.

- Powerful Operating Leverage: Infcurion is investing strategically in talent to fuel future growth, with SG&A expenses increasing 14.3% YoY. However, the revenue is growing much faster. As a result, the SG&A-to-Net Sales ratio decreased from 44.5% to 39.5%, clearly demonstrating the high operating leverage that drives accelerated EBITDA growth as the firm scales.

Infcurion's strong financial foundation enables it to aggressively pursue strategic initiatives that will secure its market leadership for years to come.

Strategic Growth Levers for Market Leadership

Infcurion's growth strategy is multi-pronged, designed to expand its customer base, deliver deeper value through product innovation, and scale rapidly through major strategic alliances. These initiatives work in concert to accelerate GTV growth, which is the primary driver of Infcurion's long-term value creation.

- Deepening Strategic Alliance with SMBC Group: the partners have launched "Trunk," its first major collaboration with SMBC Group. This comprehensive digital financial service for SMEs significantly expands Infcurion's footprint in the vast B2B payments market. By providing the core platform for a service targeting 300,000 accounts and JPY 3 trillion in deposits, this alliance validates Infcurion's technology and provides a massive channel for customer acquisition and GTV growth.

- Product & Market Expansion: Infcurion is successfully expanding its flagship 'Xard' platform from its B2B base into the JPY 300+ trillion B2C market, powering the Hokkoku Bank 'one paretto' debit card. Simultaneously, ongoing feature enhancements for 'Xard' in the B2B space, such as ETC card issuance, are expanding use cases and accelerating GTV growth among Infcurion's corporate clients.

- Securing High-Profile Enterprise Partnerships: the platform's scalability and reliability are attracting major enterprise clients. Infcurion is providing the mobile payment platform for JR West's 'Wesmo!' service and deploying cashless payment solutions for over 70,000 taxi rear-seat tablets operated by GO. These partnerships demonstrate the firm's ability to power payments at a national scale, further cementing our market leadership.

These powerful growth levers are aligned with Infcurion's ambitious long-term financial vision.

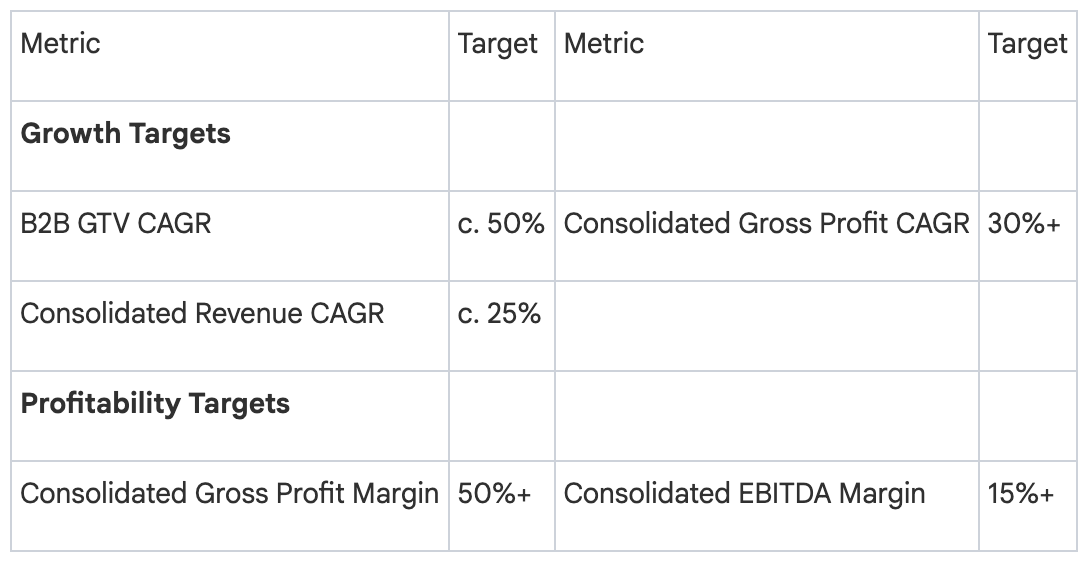

Infcurion's Mid-Term Vision: Sustainable High Growth & Expanding Margins

Infcurion has established a clear and ambitious set of mid-term financial targets that reflect its confidence in its strategy and the massive market opportunity ahead. These goals are not merely aspirational; they are grounded in the demonstrated scalability of its business model, the powerful tailwinds of Japan's digital transformation, and its disciplined operational execution.

Mid-Term Financial Targets

Infcurion will achieve these targets by continuing to execute its proven strategy. High GTV growth will drive top-line revenue, which, combined with a predominantly fixed-cost structure, will create powerful operating leverage. This will enable Infcurion to deliver rapid and sustainable EBITDA growth, expanding its margins while continuing to invest in innovation and market expansion.

This vision is being executed by a proven leadership team with deep industry expertise.

Leadership Team

Infcurion is led by a team of seasoned executives who are recognized pioneers and leaders in Japan's financial and technology sectors. Their deep domain expertise and track record of innovation provide the strategic vision and operational discipline required to execute Infcurion's ambitious growth plans.

- Hiroki Maruyama (Co-founder, President & CEO): A leader in Japan's financial sector, combining innovation at JCB and Infcurion with policy-shaping roles at the Fintech Association and Cashless Promotion Council.

- Takenori Kida (Director and Executive Officer, COO): Joined from JCB and has been instrumental in shaping and executing Infcurion's core business strategies since its founding.

- Kenichi Nogami (Director and Executive Officer, CFO): Combines top-tier investment banking experience at Sumitomo Mitsui Banking Corporation and Morgan Stanley with proven entrepreneurial execution as the founder of biotech startup Metcela.