Infcurion's "Xard" Supports Launch of ETC Card Handling in "Money Forward Business Card"

Infcurion's next-generation card issuance platform "Xard" has been adopted by Money Forward for the handling of ETC cards in "Money Forward Business Card."

Money Forward, with its mission "Move Money Forward. Move Life More Forward," has been deploying "Money Forward Business Card," a business card for corporations and sole proprietors that utilizes "Xard" since 2021 to promote this vision. This initiative further expands the partnership between both companies, streamlining expense settlement and accounting operations for highway toll expenses.

Background of Implementation and Value Realized by "Xard"

As the domestic B2B payment market expands, corporate cards are gaining attention as a means to improve corporate cash flow and operational efficiency. In particular, highway toll expenses have faced challenges with the complexity of collecting transaction details, accounting entries, and ETC card issuance procedures and management.

The ETC card provided by Money Forward targets "Money Forward Business Card" users and features the significant advantage of enabling online ETC card application and transaction detail management.

"Xard" is a next-generation card platform that enables easy and low-cost issuance of original international brand cards (JCB/Visa) through open APIs. By leveraging the highly flexible and extensible technology infrastructure of "Xard," Money Forward has rapidly realized ETC card handling with the following features:

1. Complete Online Application and Transaction Detail Management ETC card application and cancellation can be completed online through the "Money Forward Business Card" web management screen.

2. Overwhelming Efficiency in Expense Settlement

ETC card transaction details are automatically linked to "Money Forward Cloud." This reduces the workload in expense settlement operations and accounting tasks, and prevents account item input errors by utilizing automatic accounting rules.

3. Flexible Operation and Expense Management Visualization

Cards can be issued independently without being linked to credit cards, enabling flexible usage management such as linking to organizations or vehicles. Additionally, transaction details include information such as usage date, toll booth passage time, entrance IC, and exit IC, and centralized cloud management enables efficient expense management.

This rapid service launch has been significantly enabled by "Xard's" ability to provide necessary functions via API, reduce initial costs, and shorten the period until service launch.

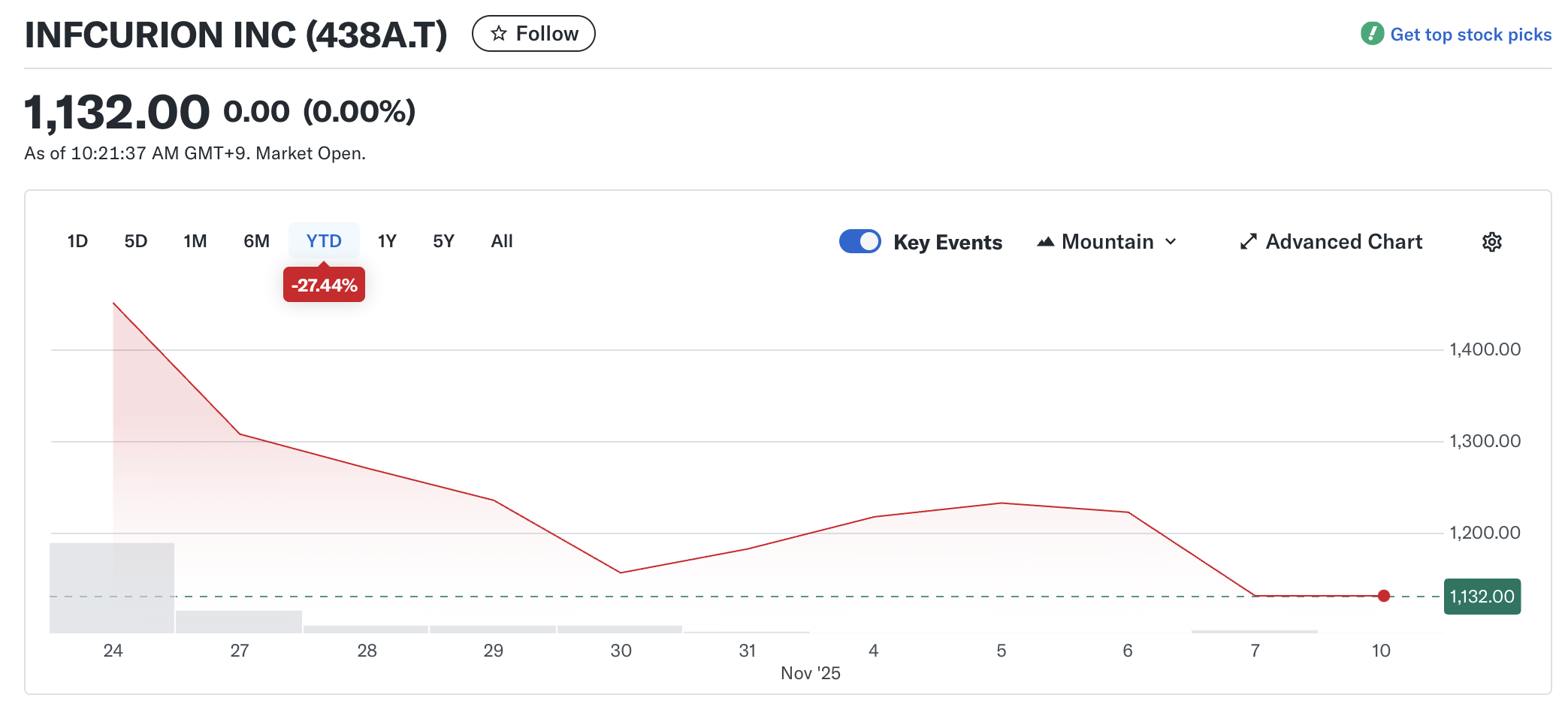

The Infcurion IPO

This is also a good opportunity to check how the Infcurion IPO has evolved. As we wrote at the time:

Infcurion debuted on the TSE’s Growth Segment on Friday, October 24, 2025. After bookbuilding resulted in a ¥1,680 reference price, above the indicated range up to ¥1,600, the stock’s first quote was ¥1,560, and the closing price ¥1,451, altogether an underwhelming debut. At the closing price, Infcurion is valued at approximately ¥30 billion, largely in line with the ¥10 billion investment SMBC Group made in September 2024 for what now turns out to be a 29% stake. “Dressed for success” for the IPO with operating expenses down 13 percentage points year-on-year, first-time consolidated profitability, and a stock market near record highs had many believe in a more dynamic debut.

Unfortunately, we do not have any good news to share. At the time of writing, Infcurion is quoted about 30% below the reference price. Second fiscal quarter results will be published on Wednesday, November 12.