Integral Corporation Third Quarter Financial Results

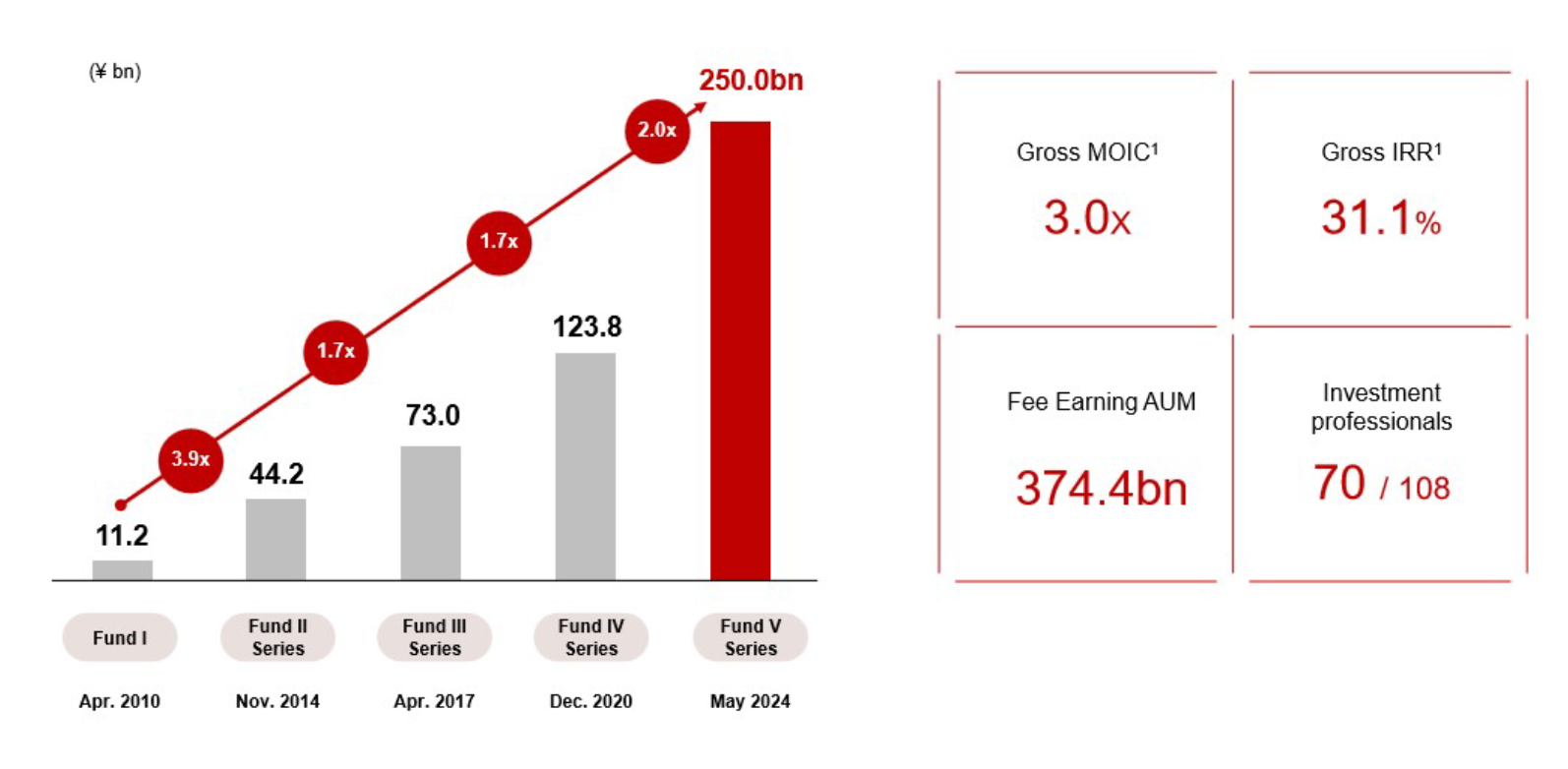

For the nine months ended September 30, 2025, Integral Corporation's financial results show a year-over-year decrease in top-line revenue and profit, a direct result of significant fair value gains recorded in the prior year. However, this comparison masks a period of strong underlying operational performance, highlighted by the successful launch of the large-scale Fund V Series and substantial growth in recurring fee-based earnings. The successful launch of the large-scale Fund V Series, a brisk pace of investment and exit activity, and substantial growth in recurring revenue streams underscore the underlying operational momentum and position the firm for sustained, long-term value creation.

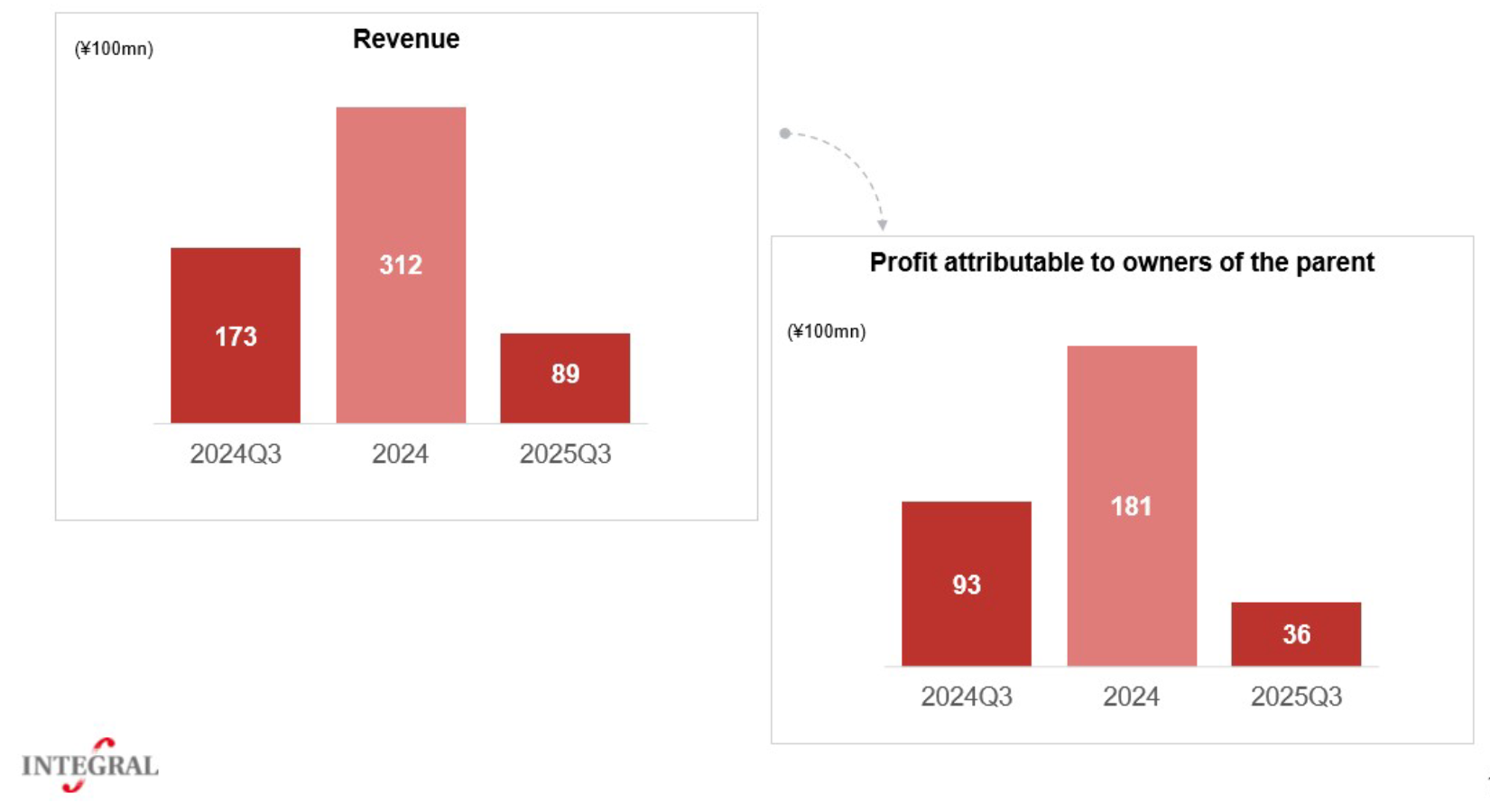

The primary financial results for the nine-month period are as follows:

- Revenue: ¥8,939 million (a 48.6% decrease year-on-year)

- Operating Income: ¥5,760 million (a 57.3% decrease year-on-year)

- Profit Attributable to Owners of the Parent: ¥3,652 million (a 60.9% decrease year-on-year)

The year-on-year decline is attributable to changes in fair value movements on the investment portfolio. This contrasts sharply with the positive operational developments that defined the period, including the commencement of the investment period for Fund V Series and robust deal execution across the portfolio. The following sections provide a detailed analysis of the components that drove these results, offering a clearer picture of Integral's financial health and strategic progress.

Analysis of Revenue Streams and Profitability

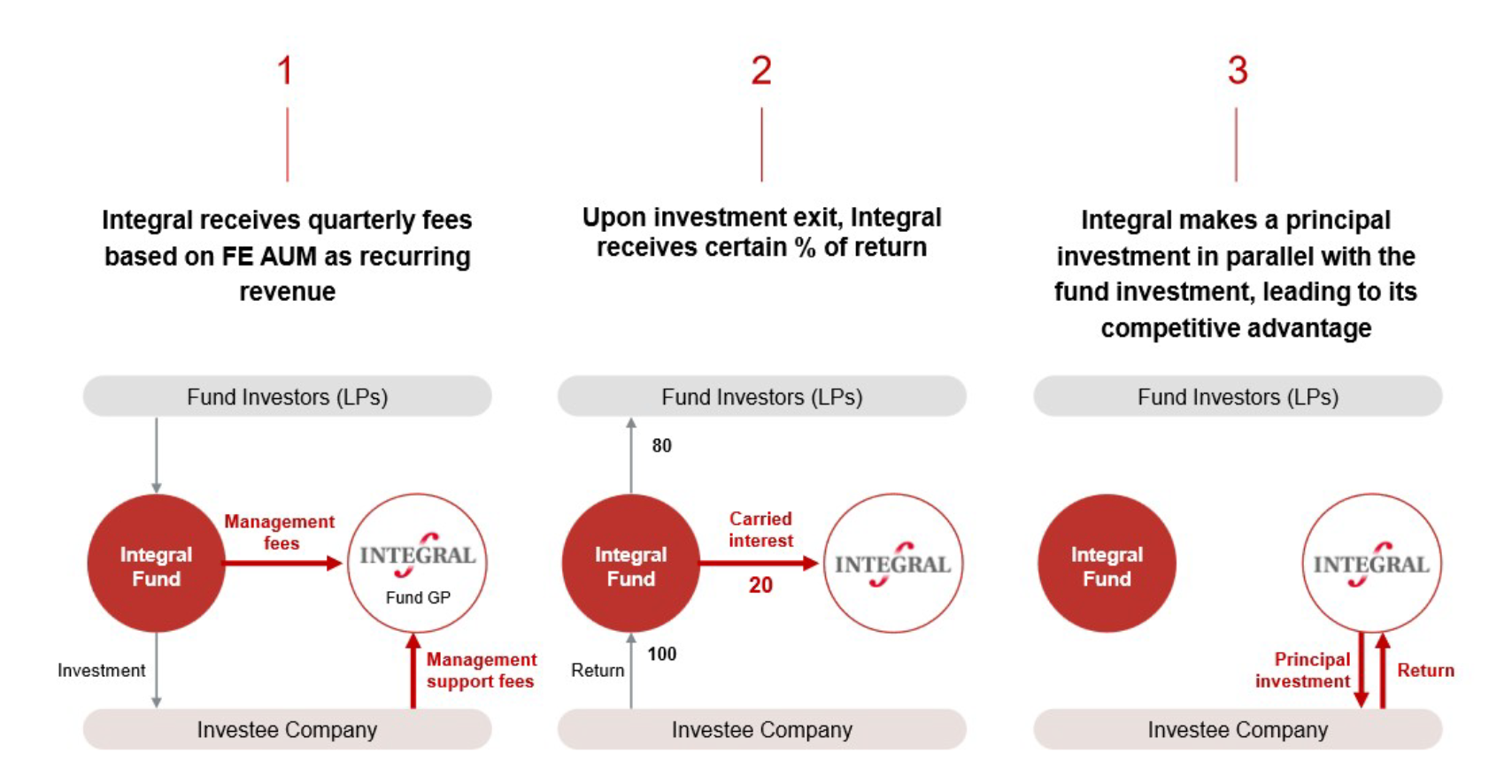

Integral Corporation's financial engine is built on a resilient, diversified revenue model. This structure provides a stable base of recurring fees while offering significant upside through performance-based income and principal investment gains. This section deconstructs Integral's Q3 FY2025 revenue into its three core pillars—Management Fees, Carried Interest, and Principal Investment—to provide a clear understanding of the performance drivers.

Management Fees: Growth in Recurring Revenue

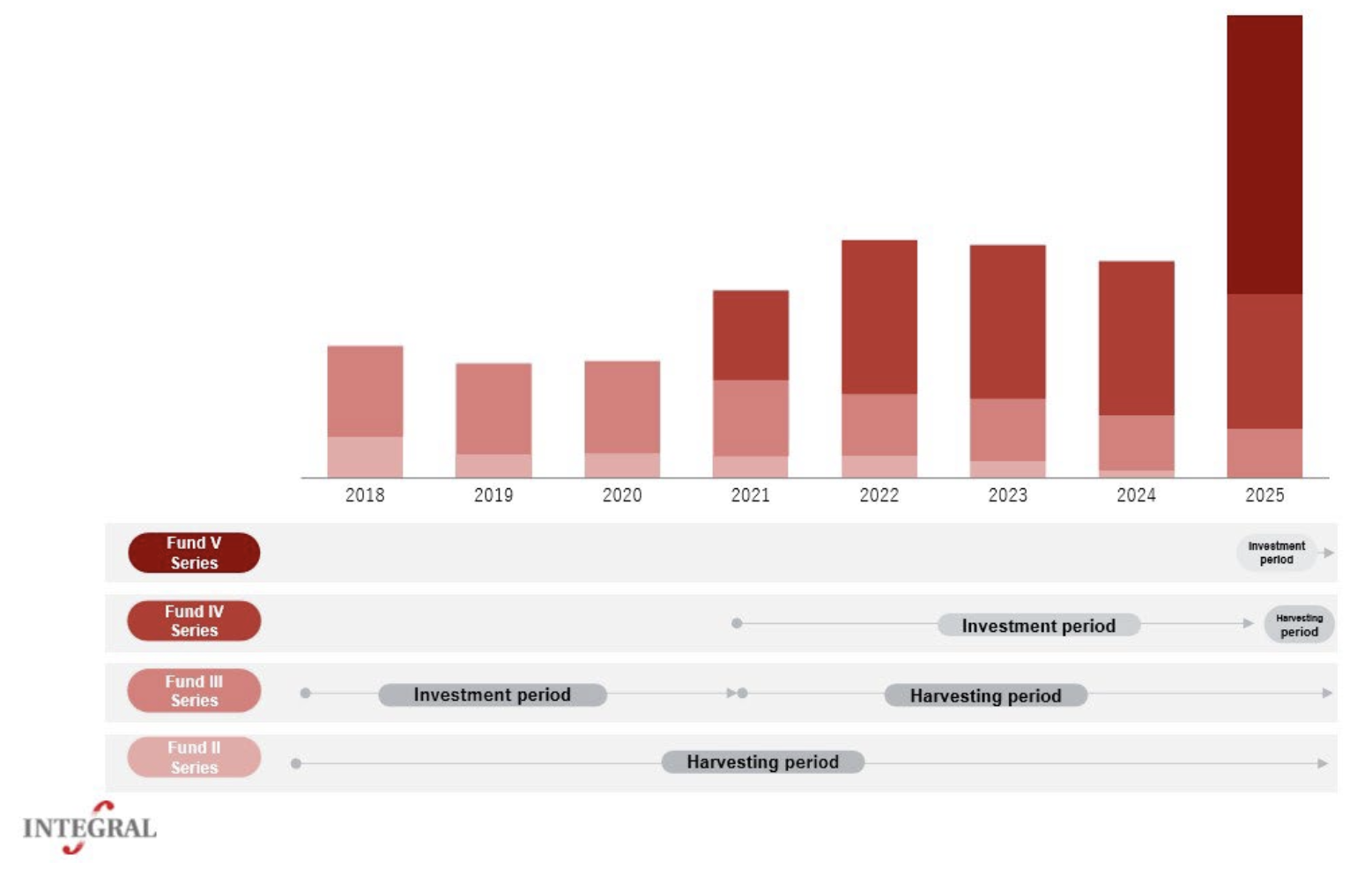

The Management Fees revenue stream, which forms the bedrock of Integral's recurring income, demonstrated exceptional growth. For the nine-month period, Management Fees totaled ¥5,567 million, with growth about twice as much as in the previous quarter. This substantial increase is a direct result of the successful launch and commencement of the investment period for the Fund V Series in January 2025. This milestone event more than doubled Integral's Fee-Earning Assets Under Management (AUM) to JPY374.4 billion, securing a larger, more predictable revenue base for the years ahead.

Carried Interest: Realizing Performance Gains

Integral generated ¥1,364 million in Carried Interest during the nine-month period. This performance-based income was realized following the partial exit of Primo Global Holdings, a portfolio company within the Fund III Series. This successful exit crystallizes value from the Fund III portfolio and demonstrates Integral's ability to generate significant performance-based income.

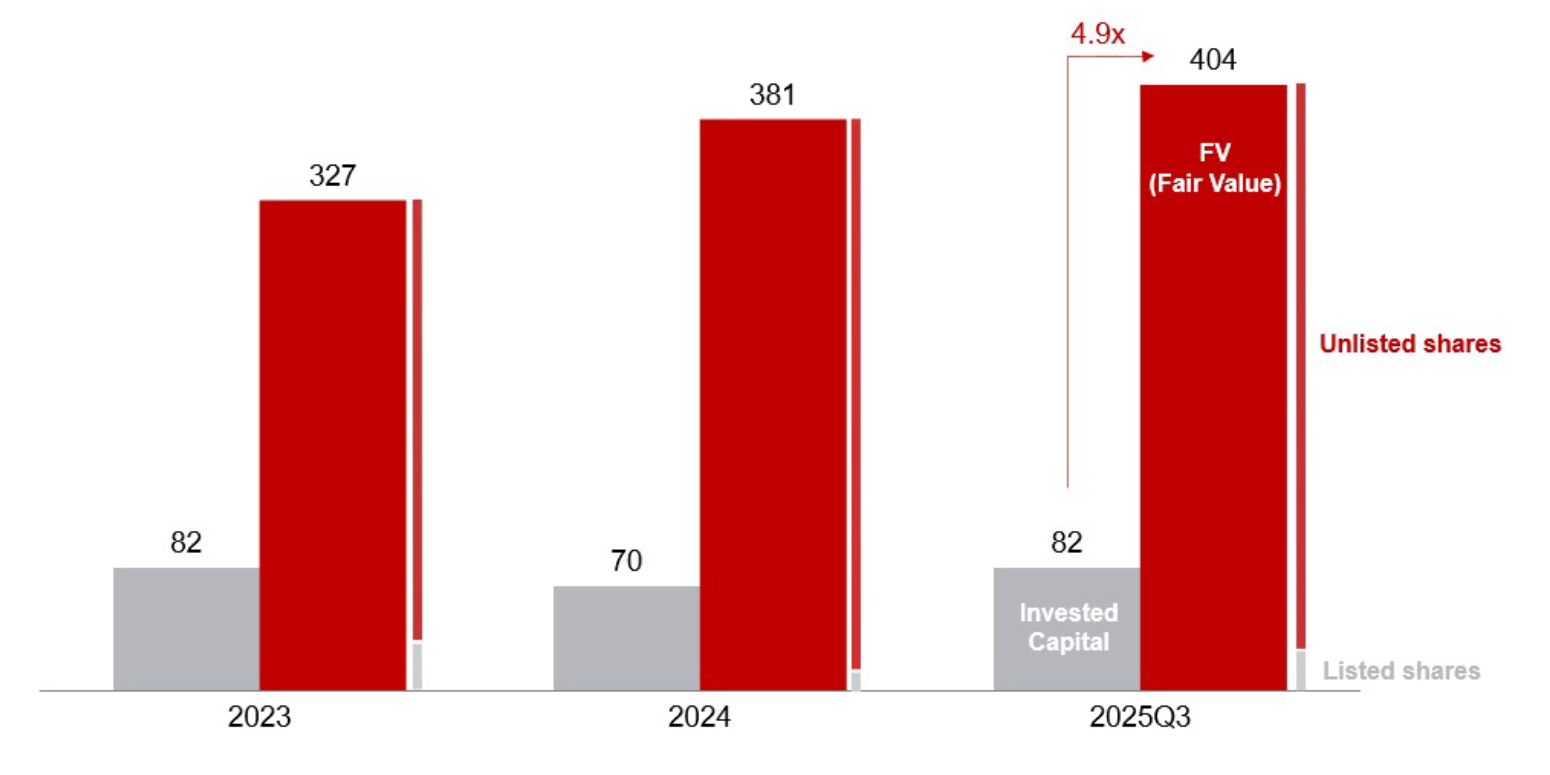

Principal Investment & Fair Value: A Mixed but Positive Picture

The Principal Investment pillar, captured on the income statement as "Gross investment return," delivered a positive contribution of ¥1.7 billion. This result reflects a nuanced but ultimately favorable landscape. While the performance of some of the principal investees was in an "adjustment phase," this was more than offset by two key positive factors: increased valuations of the listed investees, driven by higher share prices, and improved fair value of other unlisted investees, resulting from enhanced performance and stronger balance sheets.

Disciplined Expense Management

On the expense side, while personnel costs increased due to Integral's strategic and aggressive hiring of top talent—growing the team to 108 professionals—overall operating expenses decreased by ¥0.8 billion year-over-year. This decrease is attributed to the absence of significant one-time expenses related to the Fund V Series fundraise, which were incurred in the previous year. This disciplined management of the cost base, combined with successful execution within the revenue pillars, provides a strong foundation for the investment activities that drive future growth.

Investment and Exit Activity: Driving Portfolio Momentum

A dynamic and disciplined investment strategy is the lifeblood of a private equity firm. During the reporting period, Integral executed three new investments, demonstrating the team's execution capabilities and its ability to identify compelling opportunities in the market. This activity not only expands the portfolio but also validates Integral's investment theses through profitable divestitures.

Subsequent to the close of the third quarter, Integral's momentum continued with the execution of two new investments (MEDICOM TOY CORPORATION via Fund IV Series and Extrink via Fund V Series) and the significant first exit for Fund IV Series through the IPO of Tekscend Photomask. This steady flow of deal-making underpins the performance of Integral's funds, which remain the ultimate measure of its success.

Fund Performance and Health Metrics

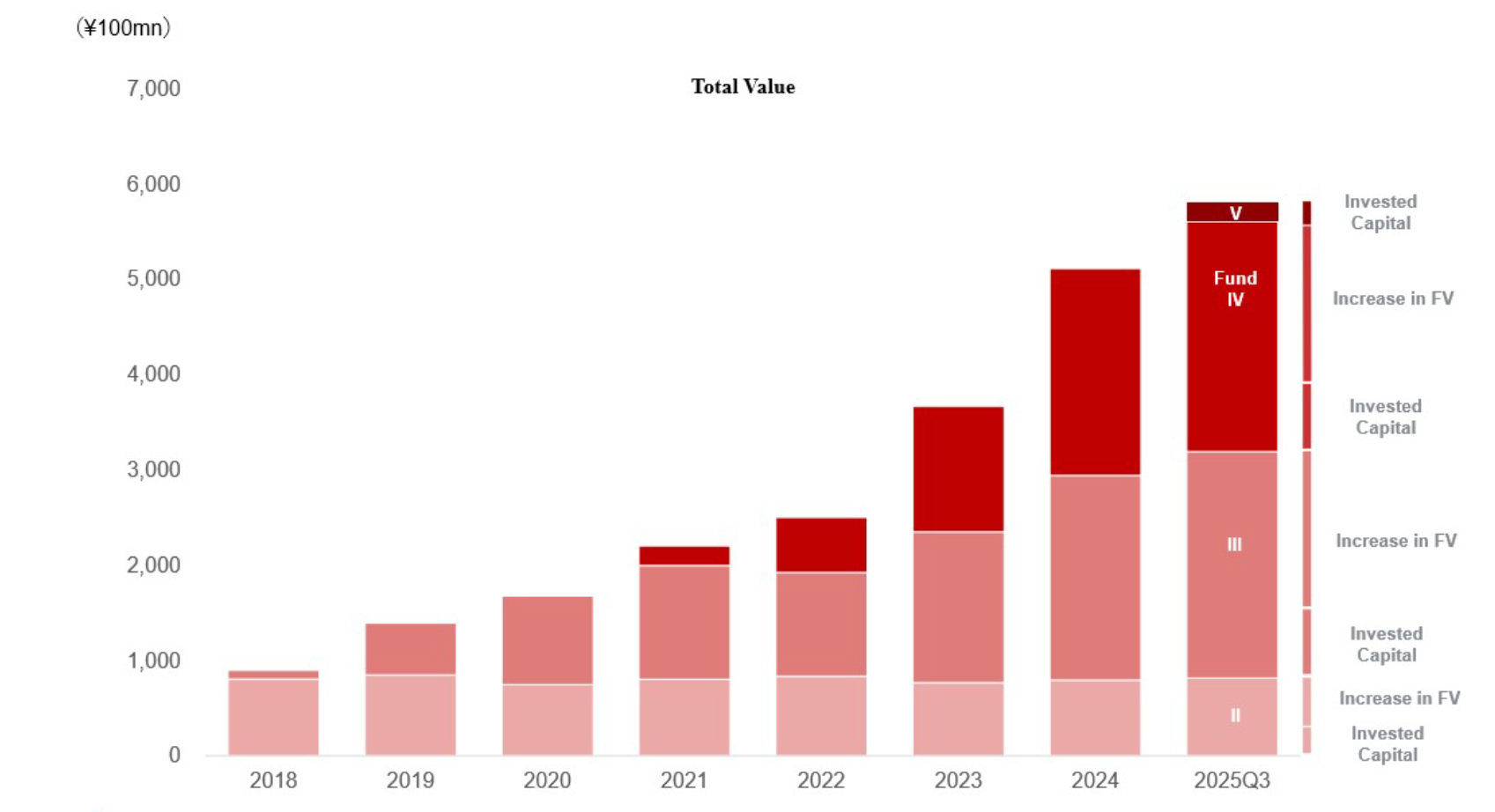

The ultimate measure of a private equity firm's success lies in the performance of its funds and the returns generated for its limited partners. Integral's established funds continue to demonstrate strong, consistent performance, validating its investment strategy and management approach. This section evaluates the health and progress of Integral's key fund series using industry-standard metrics.

Across Integral's mature funds, the aggregate performance remains exceptional, with a Gross MOIC (Multiple on Invested Capital) of 3.0x and a Gross IRR (Internal Rate of Return) of 31% for Funds I through IV combined.

The performance of the individual funds continues to show positive momentum:

- Fund III Series: The fund's MOIC has increased to an impressive 4.2x, a gain partially driven by the rise in share prices of its listed portfolio companies.

- Fund IV Series: Performance has steadily increased, reaching a 2.7x MOIC.

- Fund V Series: The investment period for this new flagship fund began on January 31, 2025, positioning it as a key driver for Integral's future growth and fee revenue.

This quarter, Integral has also enhanced its transparency by introducing a new key metric for the Fund IV Series: DPI (Distribution-to-Paid-In Capital). DPI measures the amount of capital returned to investors relative to the amount invested. This metric provides a direct measure of realized value creation and is a key indicator of the fund's maturity and its progress towards generating carried interest for Integral. Following the first exit for Fund IV Series (Tekscend Photomask) in October, Integral has begun disclosing DPI for the fund in its quarterly report to provide investors with greater insight into its path toward realizing performance fees.

The strong performance of these core private equity funds is now being complemented by new, diversifying business lines designed to become future growth engines.

Strategic Diversification and New Growth Engines

Strategic diversification is crucial for building long-term resilience and creating new avenues for growth. In line with this vision, Integral has launched two new investment businesses in FY2025—Real Estate and Global Tech & Growth—both of which are already demonstrating significant progress and validating Integral's expansion strategy.

Real Estate Investment

Launched in January, Integral's real estate investment business has executed its strategy with speed and scale. To date, the business has acquired a total of 21 properties, with a cumulative acquisition value exceeding ¥30 billion. The portfolio is diversified across asset classes, including residences, offices, and hotels. Through its value-add strategy of implementing "renovations and conversions," Integral is actively working to enhance property values. Importantly, some assets have already been sold and have started to contribute to earnings, demonstrating the business's ability to quickly execute its cycle of acquiring, improving, and monetizing assets.

Global Tech & Growth Investment

In March 2025, Integral formally launched its Global Tech & Growth business to capture opportunities in high-growth companies across Japan, Asia, and the United States. This initiative is anchored by key strategic partnerships with Granite Asia Capital and Touring Capital, providing Integral with deep expertise and deal flow in these critical markets. This new business has hit the ground running, having already executed two investments since its inception.

These growth initiatives are not merely adjacent strategies; they are integral to broadening Integral's financial base and enhancing the overall value proposition of the firm.

Financial Position and Shareholder Value Creation

A comprehensive assessment of Integral's strength extends beyond the income statement to the resilience of its balance sheet and the growth of its intrinsic value. This section analyzes Integral's robust financial position and its unique metric for shareholder value, the "Economic Net Worth."

To provide a more comprehensive view of Integral's "true strength," the firm calculates its Economic Net Worth. This metric is defined as the sum of the company's net assets and its UCAT (Unrealized Carried-Interest After Tax). It represents the potential value that could be realized for shareholders as the funds mature. As of the end of September 2025, Integral's Economic Net Worth was ¥78.7 billion and is steadily increasing.

The consolidated financial position as of September 30, 2025, remains solid:

- Total Assets: Increased to ¥79,406 million.

- Total Equity: Increased to ¥59,996 million.

- Cash and Cash Equivalents: Decreased to ¥15,029 million. This decrease was anticipated and is mainly due to cash used in operating activities, including strategic increases in the investment portfolio as capital gets deployed into new opportunities.

This strong financial footing enables Integral to pursue its strategic priorities with confidence and discipline.

Outlook and Strategic Priorities

Due to the nature of the private equity business, where exit opportunities and fair value movements are inherently difficult to predict with precision, Integral Corporation does not provide formal earnings forecasts. However, to provide investors with a transparent view of its baseline performance, Integral offers the following reference information.

Based on the recurring revenue streams and projected operating expenses through Q3, the projected revenue for the fiscal year ending December 2025 is ¥10.8 billion, with a projected profit of ¥4.1 billion. It is critical to note that this estimate excludes the potential impact of any fair value changes in Q4.

Looking ahead, Integral's strategic priorities are clear and are reinforced by the progress made this quarter:

- Active Execution: Investment and exit activity remained brisk through Q3 and into October. Integral plans to actively pursue both new acquisitions and value-realizing exits in Q4 and beyond.

- Recurring Revenue Growth: Integral's fund management fees, a key source of stable and recurring revenue, have increased significantly with the full launch of Fund V Series, providing a strong foundation for profitability.

- Successful Diversification: Integral's strategic diversification is progressing steadily. Both the real estate and global tech businesses are now actively investing, with the real estate arm already contributing to the company's earnings.

As Integral moves toward the close of the fiscal year, the firm remains focused on executing its strategy and creating lasting value for its stakeholders.