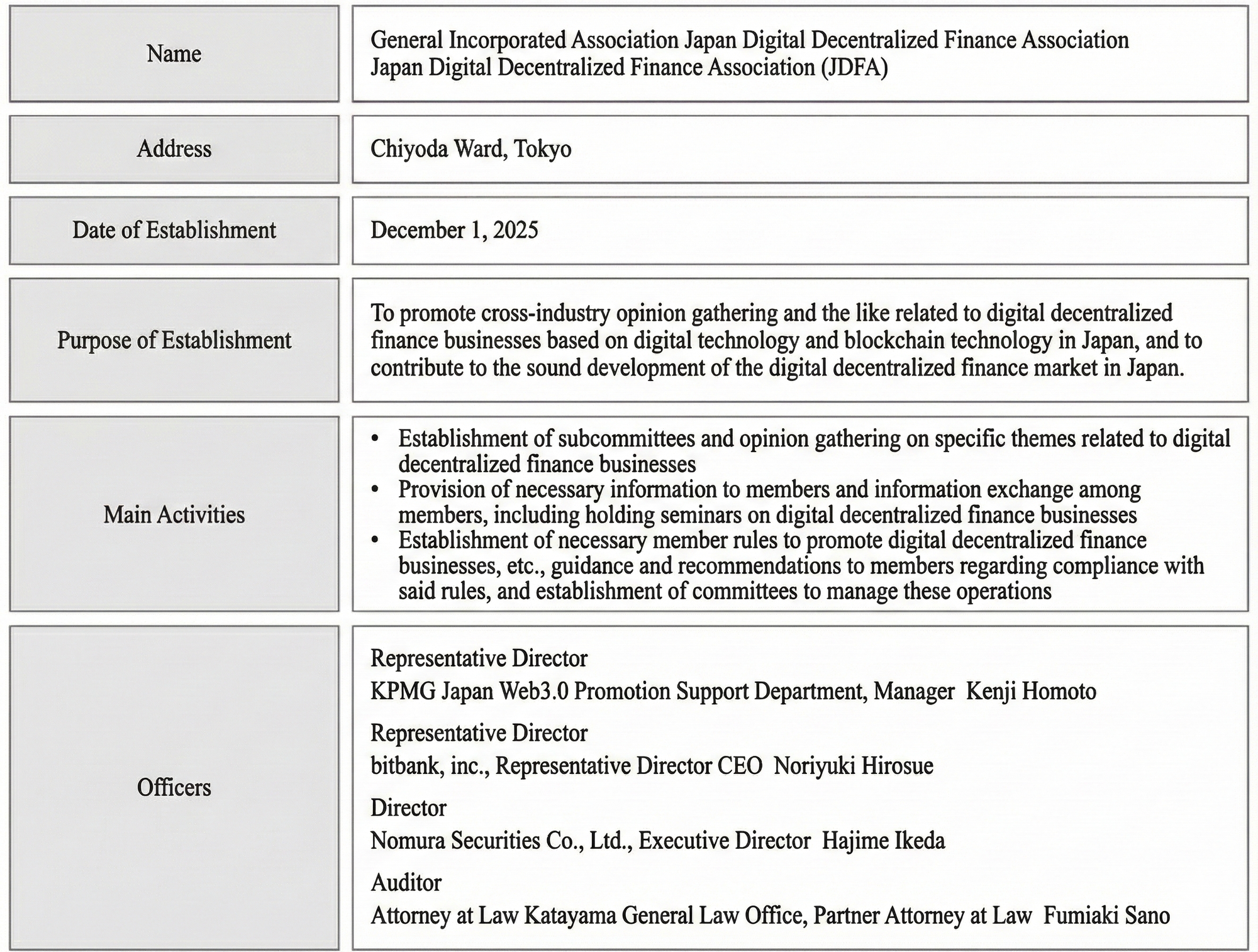

Introducing the Japan Digital Decentralized Finance Association (JDFA)

The General Incorporated Association Japan Digital Decentralized Finance Association (JDFA) has been established on December 1, 2025, led by KPMG Japan, which has run study groups on cryptocurrency ETFs. It was created to guide the growth of new financial technologies in Japan by bringing together experts from across the industry. Approximately 20 financial institutions, including Daiwa Securities, Asset Management One, Mitsubishi UFJ Trust and Banking Corporation, Sony Bank, and SBIVC Trade, have expressed their intention to participate. Full-scale activities will begin in January.

This post provides a clear overview of the JDFA's purpose and the key activities it plans to undertake to build a secure and innovative foundation for these powerful new technologies in Japan.

The JDFA will mark the establishment of yet another industry group, alongside the Japan Virtual and Crypto-assets Exchange Association (JVCEA), the self-regulatory body for crypto-currency exchanges, the Japan Cryptoasset Business Association (JCBA), an industry & lobbying body that - unlike the JVCEA - also includes law and consulting firms, among others, and which has been vocal in advancing cryptocurrency tax reform.

1. The Core Mission: Building a Secure and Vibrant Market

The association's primary goal is to foster a healthy and trustworthy environment for the emerging world of digital finance. The JDFA's official "Purpose of Establishment" clearly states this mission:

To promote cross-industry opinion gathering and the like related to digital decentralized finance businesses based on digital technology and blockchain technology in Japan, and to contribute to the sound development of the digital decentralized finance market in Japan.

In simple terms, the JDFA works to bring different companies together to create a safe, reliable, and growing market for new financial technologies like crypto assets, DeFi, and stablecoins. It aims to build a strong foundation so that these innovations can flourish responsibly within Japan. The following section outlines the specific methods the JDFA aims to use to accomplish this mission.

2. Key Activities: How the JDFA Achieves Its Goals

To support the industry and its members, the JDFA plans to engage in several key activities designed to promote collaboration, safety, and smart regulation.

- Fostering Collaboration and Discussion: The JDFA creates specialized subcommittees and holds seminars that allow members to exchange critical information, discuss challenges, and consolidate their opinions on specific topics. This ensures the industry can speak with a more unified voice.

- Developing Industry Standards: The association establishes necessary rules and provides guidance to its members to promote compliance with laws and best practices. This function is vital for building a secure and trustworthy market that protects both businesses and consumers.

- Advocacy and Research: The JDFA conducts in-depth research into digital finance and uses its findings to make proposals to government agencies and other organizations. This helps shape a positive and well-informed regulatory environment for the industry's future.

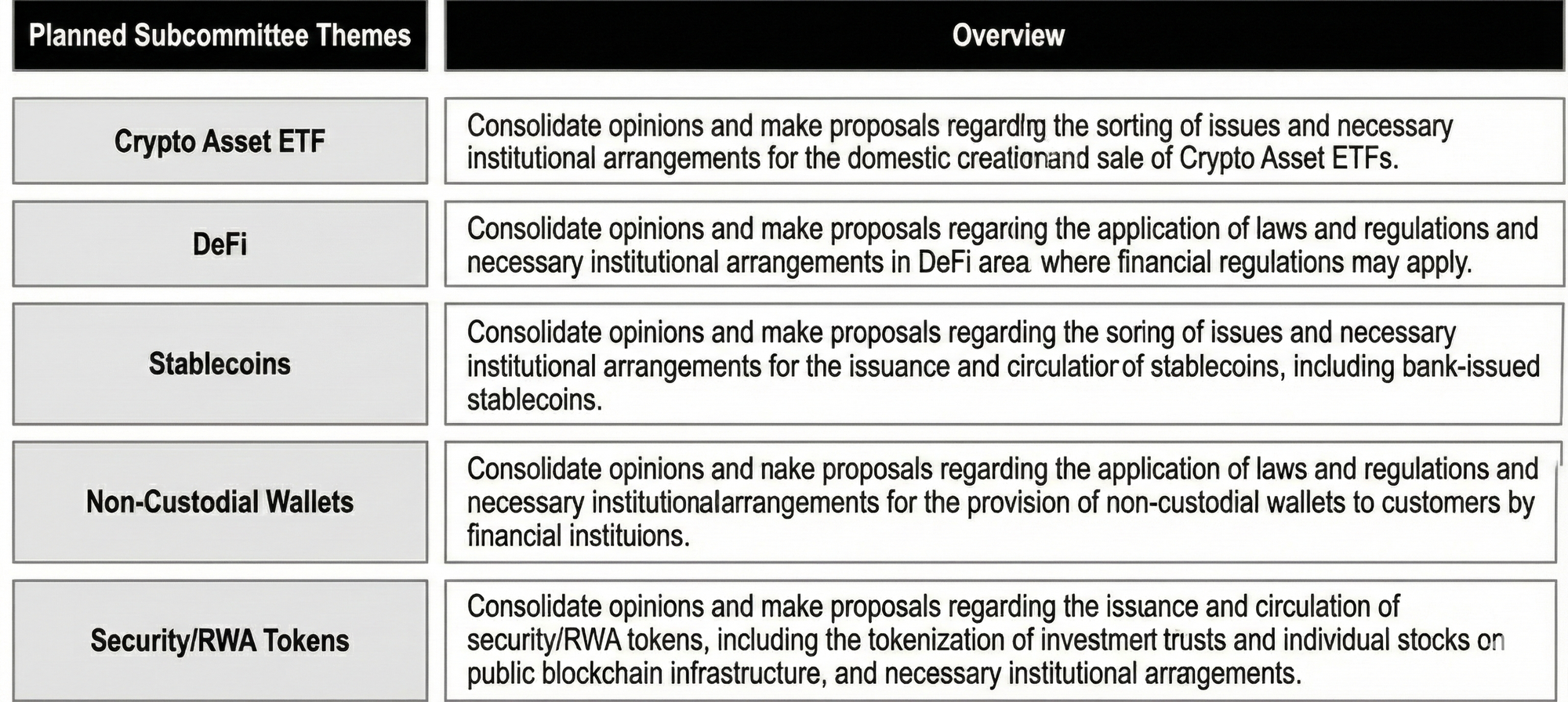

This work is spearheaded by several planned subcommittees, each tasked with tackling a pressing issue facing the industry.

3. Areas of Focus: The Planned Subcommittees

To address the most important issues in digital finance, the JDFA has planned several expert subcommittees, each with a clear objective.

4. Summary: Supporting a Bright Future

The Japan Digital Decentralized Finance Association (JDFA) aims to play a vital role in shaping the future of finance in Japan. By bringing together industry experts to tackle concrete challenges—from establishing rules for Crypto Asset ETFs to clarifying regulations for DeFi and stablecoins—the JDFA looks to actively build the foundation for a safe, innovative, and responsible digital finance ecosystem in Japan.