Itochu and Seven Bank Enter into Capital and Business Alliance

Seven Bank is entering into a capital and business alliance with ITOCHU to adapt to a changing financial landscape (digital payments, new competition) and drive new growth. The goal is to combine Seven Bank's expertise in ATMs and retail financial services with ITOCHU's vast consumer-related business platforms to create new financial services and enhance the corporate value of both companies.

The immediate and most significant initiative is the agreement to begin installing Seven Bank ATMs in FamilyMart convenience stores, which are operated by a subsidiary of ITOCHU. The companies will also engage in discussions for further collaboration on credit cards, payment services, and other financial businesses.

This move is presented as the first major step in Seven Bank's strategy to evolve into a comprehensive "financial service platformer" for the entire retail industry, expanding beyond its traditional base in Seven-Eleven stores.

The strategy involves broadening the function of its ATMs under the brand "ATM+" to go beyond simple cash transactions, enabling services like electronic money charging and other procedures. By expanding its physical presence into a rival convenience store chain, Seven Bank aims to become the "most familiar presence in daily life even in a cashless society," serving a wider range of customer needs for both cash and cashless services.

Capital Alliance Details

To solidify this partnership, Seven Bank will execute a "Disposal of Treasury Stock through Third-Party Allotment."

- Shares: 191,700,000 shares of Seven Bank's common stock.

- Recipient: All shares will be allotted to ITOCHU Corporation.

- Price: ¥268 per share.

- Total Funds: The transaction will raise approximately ¥51.4 billion for Seven Bank.

- Resulting Ownership: Following the transaction, ITOCHU will hold a 16.34% stake in Seven Bank, becoming its second-largest shareholder.

Financial Details and Rationale

- Use of Funds: The ¥51.4 billion raised will be used for "growth investments," primarily to fund the cost of installing new ATMs (presumably in FamilyMart stores) between April 2026 and June 2027.

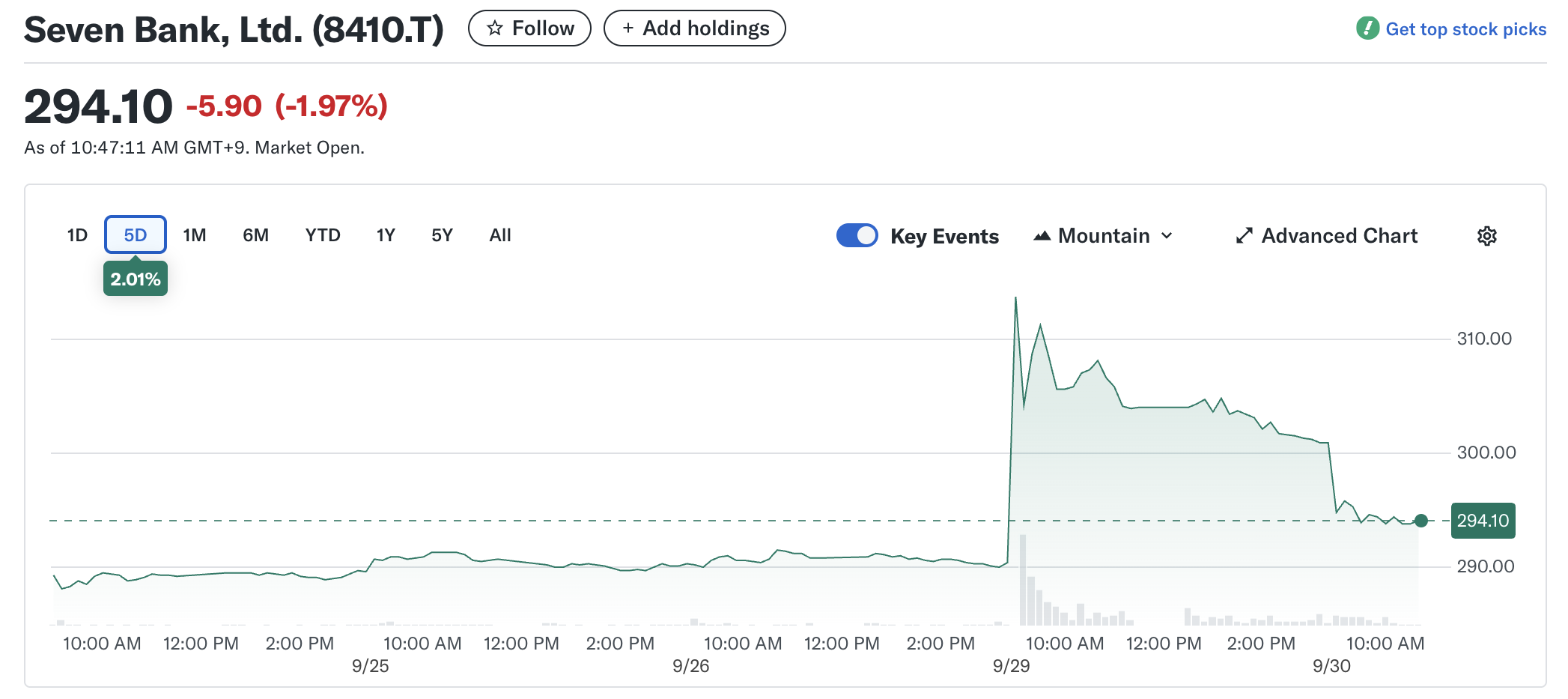

- Price Justification: The ¥268 share price was calculated based on the average closing price over a specific two-month period to ensure fairness and eliminate short-term market volatility. This price represents a small discount to recent closing prices but is compliant with regulatory guidelines.

- Dilution Justification: Seven Bank acknowledges that the issuance will result in a 19.55% dilution for existing shareholders. However, it argues this is reasonable because the alliance is critical for long-term growth and will ultimately enhance shareholder value. A Special Committee of independent directors reviewed the transaction and concluded that it was necessary, suitable, and not disadvantageous to shareholders. It appears that so far, the market agrees.

Change of Major Shareholders

The transaction will significantly alter Seven Bank's shareholder structure. Seven-Eleven Japan's stake will decrease from 39.90% to 33.38%, while ITOCHU will emerge as a new major shareholder with a 16.34% stake. ITOCHU has also expressed its intent to potentially increase its holding to 20% through market purchases in the future.