Japan FinTech Observer #108

Welcome to the one hundred eighth edition of the Japan FinTech Observer.

The digital banking landscape has become a little clearer. This week, Money Forward and MUFG ended their factoring joint venture, Biz Forward, with Money Forward making it a wholly owned subsidiary. A few days later, SMBC and Money Forward announced a 50/50 joint venture to establish a preparatory company to establish a BaaS-providing digital bank. In addition, SMBC looks to replicate its retail "Olive" success with "Trunk", a corporate digital bank. Think of Trunk as built for large corporates, with the Money Forward JV focusing on MSMEs.

As of the end of March, MUFG is the full owner of Kabucom Securities, following the agreement with KDDI to split the two JV entities, with the latter obtaining au Jibun Bank. With the acquisition of robo-advisor WealthNavi, MUFG's asset management offering appears strong, but it lacks a pure digital banking play like SMBC's "Olive".

Here is what we are going to cover this week:

- Venture Capital & Private Markets: Japan PE must tackle cultural homogeneity to capitalize on globalisation; Management Coach Mento Raises 1.6 Billion Yen in Series B Funding; RealTech Fund Completes Final Closing of 4th Fund at Approximately 12.5 Billion Yen; Cellid raised over $7.5M in Series C extension funding; Delizmart has completed a pre-series A round of funding

- Insurance: Japan’s SBI Holdings is set to increase its stake in KYOBO Life Insurance to 20 percent; managing transactional risk and insurance in Japan with Time Machine Underwriters

- Banking: Money Forward presents first quarter results; The University of Tokyo and Sumitomo Mitsui Financial Group have signed a partnership agreement; Mizuho Bank and ORIX Corporation have concluded a basic guarantee agreement for unsecured business loans targeting medium and small enterprises

- Payments: PayPay Corporation announces that four new services used in six countries can now process payments via AliPay+, and also releases "Pay by Bank" via PayPay; Digital Wallet Corporation has launched “TAX REFUND JAPAN"

- Capital Markets: Japan’s Bridgestone more than halves value of bond offering to $350 million; introduction of the “Simplified” Type 1 License

- Asset Management: Sumitomo Mitsui Trust Bank and Chicago-based GCM Grosvenor have announced a strategic partnership; Keyaki Capital announced the official launch of its Online Private Asset Investment Platform

- Digital Assets: Korean blockchain infrastructure company DSRV has signed a strategic Memorandum of Understanding (MOU) with Japan's Next Finance Tech (NFT)

- The Last Word: The Accuracy of GDP Forecasts

Venture Capital & Private Markets

- Japan PE must tackle cultural homogeneity to capitalize on globalisation; everything about Japan’s private equity industry is rapidly internationalizing, except the people; the talent buildout will be a much slower transition, but as such will deliver investors more opportunity to establish a competitive edge; the demographic and cultural challenges of seizing this moment are reflected in even the most international of domestic GPs; the Longreach Group might claim to be just that - see how they are progressing

- Management Coach Mento Raises 1.6 Billion Yen in Series B Funding to Develop "Management Success" Platform: Eight Roads Ventures Japan led this round as the lead investor, with follow-on investment from existing shareholder WiL, as well as new third-party allotment of shares to Mitsui Sumitomo Insurance Capital and AG Capital, plus financing from Shoko Chukin Bank

- RealTech Fund Completes Final Closing of 4th Fund at Approximately 12.5 Billion Yen: financial services investors include Mizuho Bank, The Senshu Ikeda Bank, Okasan Securities Group, The Kyoto Shinkin Bank, The Kyoto Chuo Shinkin Bank, Matsui Securities, and Sumitomo Mitsui Trust Bank

- Cellid, a Tokyo, Japan-based developer of AR display technology and spatial recognition engines, raised over $7.5M in Series C extension funding; backers included SBI Investment, IMM Investment Japan, and IMM Investment

- Delizmart has completed a pre-series A round of funding through a third-party allotment of new shares to four underwriters: KUSABI, New Commerce Ventures, SMBC Venture Capital, and Mitsubishi UFJ Capital, in order to further expand its "Delizmart" business, a digital transformation solution for merchandising operations in the food distribution industry

New Funds

- Plug and Play Japan has established the investment limited partnership "Plug and Play Japan Fund I" to support the global expansion of startups in Japan; for the first close, they have received investments totaling over 3 billion yen from MUFG Bank, the Organization for Small & Medium Enterprises and Regional Innovation, Tokyu Land, and SAZABY LEAGUE; Plug and Play aims for a total fund size of 5 billion yen and will continue activities toward the final close in parallel with fund management

- Sapphireterra Capital, an independent investment management firm based in Chicago, has launched its first investment fund; the fund is designed to leverage Sapphireterra Capital’s activism engagement investing strategy to unlock value in Japan’s public companies

- Murata Manufacturing will establish WONDERSTONE Ventures, a new corporate venture capital (CVC) arm aimed at exploring new business opportunities and sustainable growth, in April 2025 in the US; the objective of this CVC arm is to invest in startup companies, which Murata will apply to creating future innovation; through the CVC arm, Murata plans to invest 50 million USD over the next five years

Insurance

- Japan’s SBI Holdings is set to increase its stake in KYOBO Life Insurance to 20 percent, becoming the second-largest shareholder of the South Korean insurer; the Tokyo-based financial group is seeking to acquire an additional 11 percent stake from other financial investors, following its purchase of roughly 9 percent in March from private equity firm Affinity Equity Partners

- Managing transactional risk and insurance in Japan: Financier Worldwide discusses transactional risk and insurance in Japan with Kosuke Inada, Toshifumi Kajiwara and Takuya Miyazawa at Time Machine Underwriters Inc., the first MGA in Japan specialized in transactional insurance solutions, backed by Mitsui Sumitomo Insurance

Banking

- Sumitomo Mitsui Financial Group, Sumitomo Mitsui Banking Corporation, and Sumitomo Mitsui Card will launch "Trunk," a digital comprehensive financial service for corporate customers, in May 2025; for the development of this service, Visa Japan, which collaborated on "stera" and "Olive," and Infcurion, with which SMBC Group has established a capital and business alliance in 2024, are also participating; SMBC Group will deepen collaboration with both companies for the development of new services in the future

- The University of Tokyo and Sumitomo Mitsui Financial Group have signed a partnership agreement with the goal of establishing mechanisms to monetize the diverse assets of UTokyo, return this value to society, as well as to lead and pioneer initiatives for "Japan's Regrowth" through these efforts; SMBC Group plans to contribute over JPY 3 billion over three years, primarily focusing on the Forest GX Project, and UTokyo also plans to make proportionate contributions

- SMBC and Money Forward to Partner on BaaS/Digital Banking: Money Forward has decided that it will enter into a basic agreement with Sumitomo Mitsui Financial Group and Sumitomo Mitsui Banking Corporation regarding the establishment of a preparatory company to consider the provision of BaaS/digital banking, and that it concluded the agreement; each partner will hold 50% of the joint venture entity; the preparatory company will proceed with considerations aimed at establishing and launching a new bank, subject to the necessary approvals and permits from relevant authorities

- Money Forward reported strong Q1 FY2025 results, demonstrating significant year-over-year (YoY) growth in sales (23%), SaaS ARR (26%), and adjusted EBITDA, achieving record highs; the company is confident in achieving its full-year forecast; key strategic initiatives highlighted include a proactive approach to potential macroeconomic risks (specifically related to US tariff policies), the unveiling of their "Money Forward AI Vision 2025" focusing on "AI Transformation" (AX), and a detailed business domain profit plan aiming for substantial margin improvement by FY2028; furthermore, Money Forward announced strategic capital allocation initiatives, including the transfer of the insurance agency business and considerations for alliances or stake transfers in other domains; the company emphasizes its "Talent Forward" and "Society Forward" strategies and the ongoing evolution of its integrated report into a "Vision Report."

- Money Forward has decided to make Biz Forward, which develops online factoring services and billing agency services for small and medium-sized enterprises, a wholly owned subsidiary, taking over MUFG's share in the joint venture; through the decision to make Biz Forward a 100% group company, and the subsequent business integration with Money Forward Kessai, and unification of service brands, Money Forward will improve operational efficiency and further accelerate its SaaS × Fintech strategy

- Mizuho Bank and ORIX Corporation have concluded a basic guarantee agreement for unsecured business loans targeting medium and small enterprises; new business loans with ORIX guarantees are scheduled to begin on May 1, 2025; the focus will be on companies with sales of 5 billion yen or less, with 30,000 to 40,000 companies eligible; unsecured loans will be provided for working capital and equipment funds up to a maximum of 5 million to 100 million yen

Payments

- In the current issue of the Nomura Research Institute's "Financial Information Technology Focus", Daisuke Tanaka lays out projections for individual payment instruments through 2030, based on available 2023 data;

- PayPay Corporation announces that four new services used in six countries can now process payments at PayPay merchant locations that use "Alipay+"; the newly added services are "K PLUS" (Thailand), "Kaspi.kz" (Kazakhstan), "Bluecode" (Germany, Austria), and "BigPay" (Thailand, Malaysia, Singapore); with these additions, users of 25 cashless payment services from 14 countries and regions, including previously connected overseas cashless payment services, can now make payments at PayPay merchant locations when visiting Japan; this covers services used in 7 of the top 10 countries for visitors to Japan in 2024, including South Korea, mainland China, Taiwan, Hong Kong, and Thailand, allowing merchants to widely accommodate inbound tourism demand

- Also, PayPay payments are now available through direct debits from PayPay Bank accounts: PayPay Corporation has launched a new payment method, "PayPay Bank Balance," starting April 15, 2025; this payment option is available through the PayPay Bank app provided by PayPay Bank Corporation; payments made through the PayPay interface within the PayPay Bank app will be directly debited from the Japanese yen savings deposit balance at PayPay Bank

- Digital Wallet Corporation (DWC), owner and operator of Smiles Mobile Remittance, Japan’s most popular mobile international money transfer provider, has launched “TAX REFUND JAPAN,” a new service designed to support the revised tax-free shopping system for inbound tourists, which will start in November 202; this first-of-its-kind service from a licensed funds transfer provider in Japan allows international visitors to receive their consumption tax refunds via overseas remittance

- Digital Garage and its payment business subsidiary, DG Financial Technology, have partnered with the All Japan Real Estate Association (Zennichi), which comprises about 30% of real estate companies nationwide, to provide "Rabby Pay Powered by Cloud Pay Neo" service to over 35,000 Zennichi member companies nationwide using the company's terminal-less cashless payment service "Cloud Pay Neo"; this enables payments related to real estate rental contracts such as initial costs, rent, renewal fees, and down payments for real estate purchase contracts to be made using credit cards and PayPay without the need for dedicated payment terminals

Capital Markets

- According to Apollo Global Management, the term premium in US Treasuries is rising; the market does not know if this is because of the fiscal situation, inflation expectations becoming unanchored, or discussions about who the next Fed Chair will be; some of the move higher in rates has been technical, driven by unwinds of levered basis trades and swap trades; in addition, the move lower in the dollar is telling us that the move higher in rates is also because of foreigners selling Treasuries; for example, Japanese investors have in recent weeks been significant sellers of foreign bonds, and this has been associated with a significant appreciation of the yen relative to the dollar; this does not necessarily mean that Japanese investors are questioning American exceptionalism; in fact, in 2022, when the Fed started raising interest rates, Japanese investors were also significant sellers of foreign bonds, see chart above

- Japan’s Bridgestone more than halves value of bond offering to $350 million: the sale by the tyre maker, which has an investment grade credit rating, is seen as a litmus test for market sentiment; while the offer value is lower than hoped, there are signs that the corporate bond market is stabilising; a 600 billion yen offering from SoftBank Group has attracted healthy retail demand and some brokerages have already sold out their pre-orders; the bond was priced with a coupon rate of between 3% and 3.6%; on the other hand, between 700 billion yen and 800 billion yen ($4.9 billion – $5.6 billion) – making up roughly half the total – of offerings intended for April have been postponed or cancelled so far, said Masahiro Koide, joint head of the capital markets division at Mizuho Securities

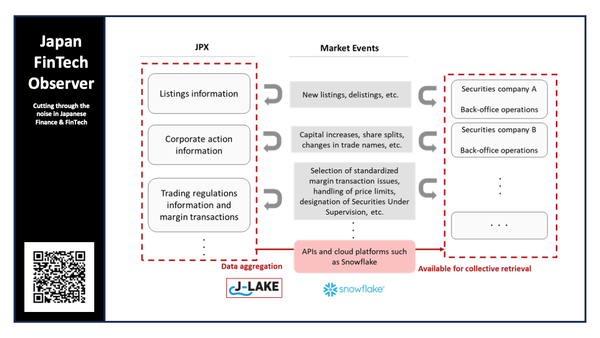

- Introduction of the “Simplified” Type 1 License, courtesy of Anderson Mori & Tomotsune: on May 15, 2024, the Diet passed into law amendments to the Financial Instruments and Exchange Act; while the Amendments contain many important measures, one of the noteworthy measures is to deregulate the requirements for the registration of a Type 1 financial instruments business under the FIEA for a person who engages only in the distribution of unlisted securities to certain professional investors; the proposed subordinated regulations under the Amendments relating to the introduction of a new special intermediary business operator license dealing with unlisted securities, which is the so-called “simplified” Type 1 License, have undergone the public comment process and were finalized on March 28, 2025; they are scheduled to become effective on May 1, 2025

- The Financial Services Agency notes a sharp increase in the number of cases of unauthorized access and unauthorized trading on Internet trading services using stolen customer information (login IDs, passwords, etc.) from fake websites (phishing sites) disguised as websites of real securities companies

- The Ministry of Finance - Japan has published the "JGB Newsletter April 2025"

- The NLI Research Institute has published "Investors Trading Trends in the Japanese Stock Market: An Analysis for March 2025"; in March, foreign investors were the largest net sellers with a total of 1,544.8 billion yen in physical and futures combined

Asset Management

- Sumitomo Mitsui Trust Bank and Chicago-based GCM Grosvenor have announced a strategic partnership to offer clients best-in-class alternative investment products to capitalize on the attractive Japanese market demand for alternative investment solutions that add value to investment portfolios; the two companies have collaborated since 2016 across private equity, credit, and infrastructure strategies; as part of this partnership, SuMi TRUST has agreed to purchase $50 million in newly issued shares of GCM Grosvenor Class A common stock and committed $100 million in the fourth quarter of 2024 to Elevate, GCM Grosvenor’s private equity seeding strategy

- Keyaki Capital, a Tokyo-based, VC-backed, and tech-enabled financial services platform led by CEO Taiki Kimura, announced the official launch of its Online Private Asset Investment Platform; this platform is the first of its kind in Japan to exclusively offer private equity, private credit, and other private asset investment funds online to high-net-worth investors, following Keyaki Capital's registration to conduct electronic offering services (電子募集取扱業務) for privately placed funds under Japan’s Financial Instruments and Exchange Act

Digital Assets

- Korean blockchain infrastructure company DSRV has signed a strategic Memorandum of Understanding (MOU) with Japan's Next Finance Tech (NFT); NFT is a blockchain infrastructure company headquartered in Tokyo that was acquired by Nasdaq-listed Coincheck Group in February; it serves major exchanges and financial institutions in Japan, providing custody and research services for enterprises; DSRV is preparing to operate services tailored to Japan's regulatory environment based on its technical expertise in areas such as Ethereum staking; the agreement with NFT represents the first official collaboration to expand local partnerships

The Last Word: The Accuracy of GDP Forecasts

The Sompo Institute Plus (SRI), the think tank of Sompo Group, has published a report that analyzes how accurate government economic growth forecasts have been in Japan, particularly focusing on projections made in 2015 for the period through 2023. It examines why these forecasts often missed the mark, finding that:

- Actual economic growth fell significantly short of projections (achieving only 1/3 of the optimistic "Economic Revitalization Case")

- Total Factor Productivity (TFP) growth was much lower than expected, dragging down overall growth

- Labor participation rates actually exceeded even the optimistic projections

- Government forecasts were revised in 2018, but still remained too optimistic

The report concludes by examining the latest forecasts from January 2025, which include a new middle-ground "Growth Transition Case," but suggests these may still be overly optimistic about productivity improvements and capital investment.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or here on the FinTech Observer website.

We also provide a regular short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.