Japan FinTech Observer #151

Welcome to the one hundred fifty-first edition of the Japan FinTech Observer.

"AI is killing SaaS", or "software will be abundant and free" are the latest taglines of the AI prophets, after the path to AGI via LLMs has been discredited. Whether or not that will come true, this wave has surely induced a software bear market, and Japan has not been a safe haven. Take a look at Money Forward, for example, which is down about 50% over the past six months at the time of writing, despite the ongoing NIKKEI/TOPIX rally.

A few editions ago we noted that only weeks after SoftBank exerted itself to complete its USD 41bn investment in OpenAI, the greats of the industry were suggesting that ChatGPT’s path to super-intelligence might be a dead end. In their earnings call last week, Softbank's CFO thus was a little less committed to further OpenAI investments, suggesting "nothing has been decided." Keep a bag of popcorn at the ready.

Here is what we are going to cover this week:

- Venture Capital & Private Markets: India’s Olyv secures USD 23m Series B to scale financial inclusion platform, SMBC Asia Rising Fund joins round; Hyperithm backs 'Cork Protocol' in $5.5M Seed Round to bolster on-chain risk management; Credit Saison bets on Brazil’s Zippi in USD 42.3m FIDC expansion to fuel micro-credit boom; the inaugural meeting of the Startup Policy Promotion Subcommittee

- Insurance: Sumitomo Life confirms improper data acquisition by seconded staff; target set to withdraw all agency secondees by March 2026

- Banking: MUFG and Krungsri forge alliance with Philippines DTI and Security Bank to accelerate ASEAN cross-border innovation; Kyndryl & IBM Japan secure deal to unify Yamaguchi FG’s regional banking systems by 2029

- Payments: PayPay has filed Form F-1 for its upcoming Nasdaq IPO; PayPay targets US market in strategic alliance with Visa, eyes California for digital wallet debut; DG Financial Technology ramps up "NESTA" operations, targeting KDDI Group payment infrastructure

- Economics: DBJ's Economic Impact Report - Maximizing the "Silicon Island" resurgence following TSMC’s entry into Kyushu; structural implications of interest rate normalization on household debt archetypes; Japan’s real wages mark fourth year of decline in 2025, but inflation cooling sets stage for 2026 rebound

- Capital Markets: the Securities and Exchange Surveillance Commission conducted a search at the main office of Mizuho Securities; JPX arm taps Snowflake to build industry-wide data hub, targeting 2027 launch

- Asset Management: Nissay Asset Management becomes first Japanese firm to digitize MBS trading with Broadridge platform

- Digital Assets: SBI Holdings targets Coinhako acquisition to expand global digital asset corridor; Standard Chartered taps B2C2 to build "connectivity layer" for institutional crypto trading

- The Last Word: Sustainability of Japanese Government Debt

Venture Capital & Private Markets

- India’s Olyv secures USD 23m Series B to scale financial inclusion platform, SMBC Asia Rising Fund joins round: Olyv, the tech-driven FinTech platform formerly known as SmartCoin, has successfully closed a USD 23 million Series B funding round; the investment was led by The Fundamentum Partnership, with significant participation from the Singapore-based SMBC Asia Rising Fund, the corporate venture capital arm of Sumitomo Mitsui Banking Corporation; the capital injection comes as Olyv continues to consolidate its position in the "Emerging India" segment, targeting young, mobile-first consumers who have historically been underserved by traditional financial institutions

- Hyperithm backs 'Cork Protocol' in $5.5M Seed Round to bolster on-chain risk management: digital asset firm Hyperithm has made a seed investment in Cork Protocol, a platform specializing in on-chain risk management; the investment is part of a larger $5.5 million (approximately 7.7 billion KRW) seed funding round co-led by crypto accelerator a16z CSX and Road Capital; the round also attracted a coalition of prominent global investors and legal firms, including BitGo Ventures, 432 Ventures, and Cooley

- Credit Saison bets on Brazil’s Zippi in USD 42.3m FIDC expansion to fuel micro-credit boom: Zippi, the Brazilian FinTech specializing in working capital for micro-entrepreneurs, has successfully closed the third issuance of its Credit Rights Investment Fund (FIDC), raising BRL 220m (approximately USD 42.3m); the transaction marks a watershed moment for the São Paulo-based firm, not only as its largest single capital injection to date but also for securing its first international backer: the Tokyo-based financial services major, Credit Saison

Other

- The inaugural meeting of the Startup Policy Promotion Subcommittee: the inaugural meeting of the Startup Policy Promotion Subcommittee, held in early February, marked a subtle shift in Japanese industrial policy; while historically the domain of the Ministry of Economy, Trade and Industry (METI), the subcommittee’s establishment under the Japan Growth Strategy Council indicates a direct Prime Ministerial mandate; operationally handled by the National Growth Strategy Bureau within the Cabinet Secretariat, this move is designed to create an alternative pathway to the bureaucracy and move the needle from quantity-based metrics—simply counting new entities—to the creation of "megaliths" capable of driving national GDP

- Evercore has published "Inside the Japanese LP mindset: Norinchukin Zenkyoren Asset Management's view on the future of Japanese alternatives"

Insurance

- Sumitomo Life confirms improper data acquisition by seconded staff; target set to withdraw all agency secondees by March 2026: Sumitomo Life Insurance Company has released the findings of an internal investigation, confirming that employees seconded to independent insurance agencies engaged in the improper acquisition of sensitive business information; the investigation, which spanned operations from April 2022 through October 2025, revealed that seconded staff transmitted proprietary data back to Sumitomo Life’s agency department using inappropriate channels, including personal smartphones and physical transfers of hard copies; according to the report, the breach affected eight agencies and involved the unauthorized transfer of 780 distinct items of information; the leaked data primarily consisted of agency insurance sales records, performance evaluation criteria for sales personnel, and confidential product information regarding other life insurance companies

Banking

- MUFG and Krungsri forge alliance with Philippines DTI and Security Bank to accelerate ASEAN cross-border innovation: Bank of Ayudhya (Krungsri) and its parent company, Mitsubishi UFJ Financial Group, have formalized a four-way strategic partnership with the Philippines’ Department of Trade and Industry (DTI) and Security Bank Corporation; the Memorandum of Understanding, executed in Manila, aims to stimulate the regional digital economy by creating a cross-border corridor for startup capital and market expansion across Japan, Thailand, and the Philippines; the collaboration leverages the balance sheets and networks of Japan’s largest financial group and Thailand’s fifth-largest lender to support the ASEAN startup ecosystem; the initiative is further backed by the banks' respective corporate venture capital arms, MUFG Innovation Partners (MUIP) and Krungsri Finnovate, signaling a concrete channel for equity investment into emerging tech firms

- Kyndryl & IBM Japan secure deal to unify Yamaguchi FG’s regional banking systems by 2029: Kyndryl and IBM Japan have been selected to lead a major modernization of Yamaguchi Financial Group’s core banking systems, a move designed to consolidate the regional lender’s IT operations into a single, unified platform; the modernization effort is targeted for completion by January 2029; according to the agreement, Kyndryl Japan will be responsible for the IT infrastructure domain and foundational management, leveraging artificial intelligence and other advanced technologies to drive the transformation; IBM Japan has been retained to support the business application side of the overhaul; Kyndryl, formerly IBM’s managed IT services business, was spun off by in late 2021

Payments

- PayPay has published Form F-1 for its upcoming Nasdaq IPO

- PayPay targets US market in strategic alliance with Visa, eyes California for digital wallet debut: PayPay Corporation has entered into a strategic partnership agreement with Visa to spearhead its international expansion, beginning with a significant entry into the United States market; the deal outlines a roadmap for PayPay’s first major global venture; the companies plan to establish a new, PayPay-led entity to develop a digital wallet specifically for the U.S. consumer; this new platform will function as a hybrid payment solution, supporting both NFC (contactless) technology and QR code payments; according to the joint statement, the U.S. rollout will initially focus on establishing a merchant network in California; both corporations have committed to contributing capital, technology, and personnel to the venture, with Visa providing additional support through consulting and its managed services programs; the launch is subject to regulatory approvals and licensure

- DG Financial Technology ramps up "NESTA" operations, targeting KDDI Group payment infrastructure: Digital Garage and its payment subsidiary, DG Financial Technology (DGFT), announced the full-scale operational launch of "NESTA," a next-generation payment platform developed in joint partnership with au Financial Service; the system has officially begun handling billing & settlement processing for the telecommunications charges of au and UQ mobile, two of Japan’s primary mobile carriers under the KDDI umbrella

Economics

- DBJ's Economic Impact Report - Maximizing the "Silicon Island" resurgence following TSMC’s entry into Kyushu: the entry of Taiwan Semiconductor Manufacturing Company (TSMC), operating through its subsidiary JASM, is a systemic catalyst for the resurgence of Kyushu’s "Silicon Island"; this transition marks a pivot from the region’s historical identity as a domestic manufacturing base toward its emergence as a high-value node in the global semiconductor value chain; however, data from the Development Bank of Japan (DBJ), published in a January report, suggests that this resurgence is characterized by a "Structural Decoupling": while macro-indicators like capital investment and land prices show exceptional growth, a gap persists in local supplier integration and regional end-user demand; to ensure long-term industrial cluster autonomy, stakeholders must address the disconnect between global manufacturing standards and local industrial capabilities; without strategic intervention, a significant portion of the economic ripple effect will continue to bypass local SMEs

- Structural implications of interest rate normalization on household debt archetypes: the Japanese mortgage market is undergoing a structural pivot as the era of ultra-low interest rates yields to normalization; floating-rate (variable) products continue to dominate the landscape, capturing approximately 84% of new originations; however, the velocity of change is increasing; while variable rates previously sat at a floor of 0.3%–0.4% during the negative interest rate era, current minimums have migrated toward the 0.6%–0.7% range; this shift is accompanied by a significant institutional bifurcation: digital banks and regional banks (particularly those in Kyushu and southern Japan) have spearheaded the move toward 50-year loan terms to preserve affordability; in contrast, mega banks have remained the conservative holdouts, generally maintaining traditional 35-to-40-year ceilings; these innovations are survival mechanisms triggered by a widening chasm between property valuations and stagnant nominal wages

- Japan’s real wages mark fourth year of decline in 2025, but inflation cooling sets stage for 2026 rebound: Japanese real wages contracted for a fourth consecutive year in 2025, though recent data signals that the country’s prolonged struggle with eroding purchasing power may be nearing an end, according to a recent report published by the Itochu Research Institute; monthly labor survey data released by the Ministry of Health, Labour and Welfare showed that inflation-adjusted real wages for the full year of 2025 fell by 1.3%, widening from the 0.3% decline recorded in 2024; while nominal cash earnings grew by 2.3%, this pace slowed compared to the previous year, weighed down by a significant deceleration in bonus growth and persistent inflationary pressure

- The ASEAN+3 Macroeconomic Research Office has published its "Annual Consultation Report" for Japan

Capital Markets

- The Securities and Exchange Surveillance Commission conducted a search at the main office of Mizuho Securities last month on suspicion that an employee had been involved in insider trading; the commission is analyzing materials seized during the search to possibly file a criminal complaint with prosecutors; on Monday, Mizuho Securities said in a statement that the commission's investigation is ongoing and that it will continue to cooperate fully with the investigation

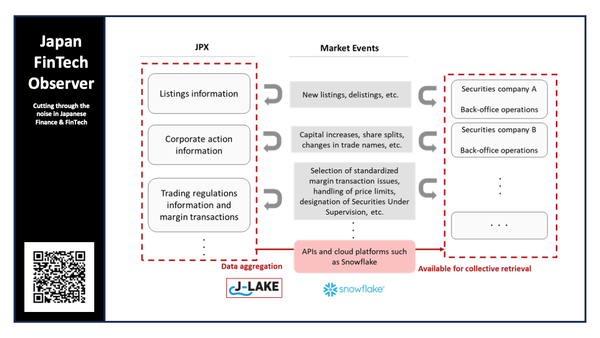

- JPX arm taps Snowflake to build industry-wide data hub, targeting 2027 launch: JPX Market Innovation & Research (JPXI) has initiated a major overhaul of the Japanese securities industry’s digital infrastructure, announcing plans to construct a common cloud-based data platform aimed at eliminating legacy inefficiencies in back-office operations; the project, which leverages technology from data cloud company Snowflake, seeks to replace the sector’s reliance on manual data entry with an automated, standardized system; JPXI aims to open a beta environment in early 2027, with a full service launch projected for the spring

- Nomura’s new global markets strategy: less risk, more return Japan’s top dealer is moving away from risk warehousing, chasing real money clients and going global

- Franklin Templeton has published its "Japan 2026 Outlook"

Asset Management

- Nissay Asset Management becomes first Japanese firm to digitize MBS trading with Broadridge platform: Nissay Asset Management (NAM) has selected Broadridge Financial Solutions to modernize its post-trade operations, becoming the first asset manager in Japan to implement Broadridge’s Mortgage-Backed Securities Trade Assignment Portal (TAP); the announcement signals a shift in the Japanese asset management sector toward digital consolidation, specifically regarding To-Be-Announced (TBA) mortgage-backed securities; NAM will utilize the platform to automate the Assignment of Trade (AOT) process, moving away from legacy manual workflows

Digital Assets

- SBI Holdings targets Coinhako acquisition to expand global digital asset corridor: Japanese financial services giant SBI Holdings is set to significantly expand its footprint in the Southeast Asian crypto market, announcing its intention to acquire a majority stake in Coinhako, a leading Singapore-based digital asset platform; SBI confirmed that its subsidiary, SBI Ventures Asset, has signed a letter of intent with Holdbuild, the operator of the Coinhako Group; the proposed transaction involves both a fresh capital injection into Coinhako and the acquisition of shares from existing shareholders; upon completion, Coinhako is expected to operate as a consolidated subsidiary of the SBI Group

- Standard Chartered taps B2C2 to build "connectivity layer" for institutional crypto trading: Standard Chartered has entered a strategic partnership with digital asset market maker B2C2, a move designed to bridge the gap between traditional banking infrastructure and the cryptocurrency markets for institutional clients; the collaboration aims to integrate Standard Chartered’s extensive global banking and settlement "rails" with B2C2’s deep liquidity across spot and options markets; the initiative targets a sophisticated client base—including asset managers, hedge funds, and family offices—seeking to mitigate the counterparty risks and settlement friction often associated with fiat-to-crypto transactions

The Last Word: Sustainability of Japanese Government Debt

Japan's government debt rose to a record high at the end of last year. The Ministry of Finance says the outstanding government debt stood at 1,342.172 trillion yen, or about 8.6 trillion dollars, at the end of 2025. That is up by about 24.5 trillion yen from a year earlier.

A breakdown shows that government bonds stood at around 1,197.6 trillion yen, short-term financing bills at almost 100.4 trillion yen and borrowings at about 44.1 trillion yen. The government bond figure rose by more than 24 trillion yen.

The debt does not include the issuance of government bonds for the more than 18-trillion-yen supplementary budget that the Diet passed in December last year.

The balance continues to increase due to the accumulation of government bond issuances covering rising social security costs and other spending, as well as a compilation of supplementary budgets each fiscal year.

The government of Prime Minister Takaichi Sanae advocates "responsible and proactive public finances." It says it will lower the ratio of outstanding debt to GDP steadily.

However, Daniel Dowd, Global Head of Investment Research at UBS, explains: "The market’s reaction to Japan’s election result has been swift, and understandably so. With the LDP securing a decisive mandate under PM Takaichi, investors are already asking whether this opens the door to a more activist fiscal stance. JGB yields have pushed higher on the prospect of wider deficits."

"But amid the noise, it’s worth stepping back and looking at the underlying dynamics, because Japan’s debt story is more resilient than one might assume."

"Even with debt-to-GDP around 230%, the real carrying cost of that debt is among the lowest in the world. If inflation settles around 2%, 10-year JGBs at roughly 2.5%, and growth just under 1%, our projections show Japan’s debt ratio could still fall by close to 3 percentage points of GDP per year, even with a primary deficit near 2% of GDP."

"The reason is simple but often overlooked: Japan’s consolidated public sector holds substantial assets. In 2024 alone, pension funds, financial institutions and local governments held domestic equities and foreign bonds worth more than 100% of GDP, generating annual gross returns near 6% over the last decade. In effect, money is coming in faster than it’s going out, despite the high headline debt load."

"None of this removes the need for discipline. But it does mean the debate should be grounded in the full picture, not just the liability side of the balance sheet."

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. Our short weekly digest, the “Japan FinTech Observer”, is published on LinkedIn, on Medium, Substack & Paragraph, or here on our own FinTech Observer website. Only the latter provides you with the option to subscribe to individual news stories as they are published.

Should you wish to further discuss the Japanese (or Asian) FinTech ecosystem, you may book a consultation via Intro - all proceeds flow towards covering the operating cost of the Tokyo FinTech Association, and research for the Japan FinTech Observer.