Japan FinTech Observer #45

Welcome to the forty-fifth edition of the Japan FinTech Observer.

Welcome to the forty-fifth edition of the Japan FinTech Observer.

Earnings season is in full swing, and we read through the results of Mizuho, Sumitomo Mitsui Financial Group, SuMiTrust, Resona, SBI Sumishin Net Bank, and Aozora. The latter produced a blooper, with mis-managed exposure in US real estate loans and US fixed income.

In insurance, we see new deals with private equity acquiring books of policies, an approach the IMF has called out in a financial stability note in December. Also, Zurich was forced to abandon a USD 20bn transaction in January due to the nature of the acquirer. Is the Japanese regulator too passive?

In digital assets, a decisive step forward has been taken with the FSA initiating the public comment period for regulation changes that would allow the tokenization of LLCs, setting the stage for connecting Decentralized Autonomous Organizations (DAOs) with traditional corporate structures.

The live edition of the Japan FinTech Observer, taking a deeper dive into select topics, will be hosted today, Monday, starting at 7pm JST, on LinkedIn Live. Last week’s recording is available on the Tokyo FinTech YouTube channel. In addition, we will take a deep dive into the Brazilian FinTech Ecosystem with Bruno Diniz on Wednesday, starting at 9pm JST, on LinkedIn Live.

Here is what we are going to cover this week:

- Venture Capital & Private Markets: SoftBank Ventures Asia is officially changing its company name to SBVA

- Insurance: Private Equity and Life Insurance in Japan; Sumitomo Life Insurance has started using the platform “LOOOKIT” provided by Waagu

- Banking: Earnings highlights from Aozora Bank, Mizuho, Sumitomo Mitsui Financial Group, SuMi Trust, and Resona

- Payments: BOJNet’s ISO20022 upgrade date set for November 2025; JCB’s “Smart Code” QR payment is now accepted at 1m+ locations; Osaka has presented the EXPO 2025 digital wallet; AOKI/ORIHICA online stores introduce Smartpay

- Capital Markets & Asset Management: the Tokyo Stock Exchange has compiled and published “Key Points and Examples” for “Management Conscious of Cost of Capital and Stock Price”; the “Rakuten Plus” series of index funds exceeded JPY 100bn in AUM; Rakuten Securities unveiled the first “Investment Consultant AI Avatar”; Lazard Asset Management names Tomohiro Kamisaku as CEO

- Digital Assets: Important ordinance revisions that will enable the establishment of DAOs in the form of limited liability companies (LLCs) in Japan have been announced; MUFJ Trust and Banking Corporation, Progmat, Standage and Ginco have entered into a joint collaborative exploration focused on the viability of Japanese stablecoins for use in international trade settlements

- The Last Word: Salarymen

Japanese Capital and FDI into the New Nordics

We have come out of podcast hibernation, and were grateful to welcome Oliver Hall, Head of Tech Investments for Europe and Japan at Copenhagen Capacity, and a Co-Founder & Investment Director for Japanese Investments at the Nordic Asian Venture Alliance.

Our discussion covers topics such as sustainability, digitalization, foreign direct investment, Japanese capital, and the New Nordics. Available on Spotify, Apple Podcasts, or most major platform via our Podlink.

Venture Capital & Private Markets

- SoftBank Ventures Asia is officially changing its company name to SBVA as of February 1st after The Edgeof acquired the company from SoftBank Group (SBG) in June of last year; the new SBVA has recently closed the “2023 Alpha Korea Fund,” with a total committed amount of approximately ₩200 billion ($150M); investors include Korea Development Bank (KDB) as the anchor LP, SoftBank, Hanwha Life, Industrial Bank of Korea (IBK), Nexon, KB Capital, and others

Insurance

- Private Equity and Life Insurance in Japan: Resolution Life, a global manager of in-force life and annuity policies, announced that its Bermudian reinsurance platform, Resolution Re, has entered into a flow reinsurance agreement with a Japanese insurer; this is Resolution Life’s second transaction in Japan following a reinsurance agreement with Dai-Ichi Life in 2022; recently, the IMF has raised potential financial stability risks for such arrangements, and Zurich’s sale of a $20bn life insurance book to German private equity-backed Viridium has collapsed

- Sumitomo Life Insurance has started using the platform “LOOOKIT” provided by Waagu, a startup company in Silicon Valley, at its Vitality Service Center; the LOOKIT service enables operators and customers to instantly share screens without having to download or install specific applications; explanations that were previously given verbally (over the phone) can now be given while sharing the same screen remotely with customers, enabling more understandable explanations and smoother communication

Banking — Aozora Bank

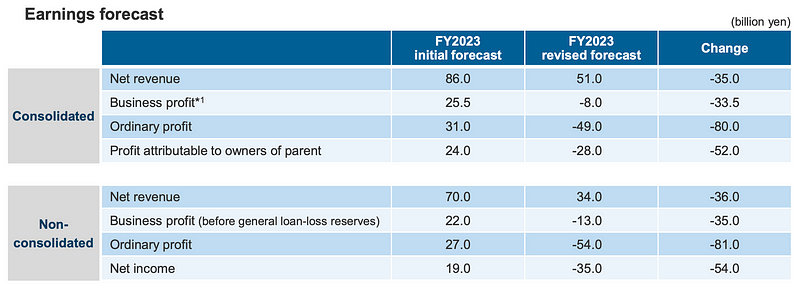

Aozora Bank revised earnings forecast

- Aozora Bank delivered a swing of JPY 80bn to its FY2023 forecast on the back of US non-recourse office loans, and the restructuring of its security portfolio

- The bank has reevaluated all U.S. non-recourse office loans and reviewed property valuations from a forward-looking perspective, taking into account the risk of price declines over the next two years, in addition to the appraisal of properties based on current conditions; as a result of this process, credit-related expenses of 32.4 billion yen were recorded in the third quarter which included the maximum possible provision expected at this time; with this, the loan loss reserve ratio for U.S. non-recourse office loans increased to 18.8% as of December 31, 2023, which the bank believes provides an adequate reserve level and minimize the risk of future losses

- However, if one takes the Loan-to-Value (LTV) of the non-performing loans (NPL), registered at 177%, and normalizes to 100% (not leaving any buffer), one arrives at an estimated real estate value of USD 406m, covered by only USD 320m of reserves, leaving room for further earnings disappointments

- In its security portfolio, the bank sold foreign currency ETFs in the third quarter and plans to sell a further portion of the remaining foreign currency ETFs and mortgage bonds; as a result, a loss of 11.1 billion yen was recorded in the third quarter and an additional loss of 29.8 billion yen is expected in the fourth quarter resulting in an expected loss of 41.0 billion yen in the second half

- Since unrealized losses on securities were reduced from a net loss of 92.6 billion yen as of September 30, 2023 to a net loss of 81.5 billion yen as of December 31, 2023, and are expected to further improve to a net loss of 56.0 billion yen as of March 31, 2024, these measures also leave room for further earnings disappointments

- Please note that the bank states its bond durations as of December 31, 2023 as 5 years for U.S. government bonds and 6 years for MBS (the higher the duration, the higher the sensitivity to interest rate moves)

Banking

- Mizuho delivered solid earnings overall, and left its full-year forecast unchanged, giving itself some buffer to potentially realizing some losses on its fixed income portfolio in the fourth quarter; however, the duration of its bond portfolio is much healthier than at Aozora, stated as 0.7 years for JGBs and 2.3 years for foreign bonds

- Sumitomo Mitsui Financial Group, just like Mizuho, delivered solid earnings, beating expectations slightly; most notably, SMFG realized profits on some bond positions it accumulated earlier in the fiscal year, taking advantage of overseas interest rates declining from its peak around November 2023; SMFG’s JGB duration was 2.2 years

- SuMi Trust revealed a share buyback capped at JPY 20bn, and disclosed a capital plan, reassuring investors; the trust has its own investment issues to work through, announcing losses from its bear funds after H1, for which it expects to book further losses of JPY 37.7bn in Q4

- Resona reported largely in line with expectations; its payment-related income was a highlight, attributed to premium debit cards and the Resona Card, turning fee income overall positive for the year after a decline during the first half; Resona’s JGB durations stands at 7.5 years

Payments

- The Bank of Japan has decided on a date for upgrading the ISO20022 messaging standard for payment messages used by the Bank of Japan Financial Network System BOJNet for foreign exchange yen settlements and current account transactions related to deposits of overseas institutions; the version upgrade will be conducted in November 2025

- JCB announced that its “Smart Code” QR payment is now accepted at 1m+ locations; with Smart Code, JCB provides a payment processing platform that connects code payment operators and stores, unifies merchant contracts, reducing the burden on operators and stores

- Osaka has presented the EXPO 2025 Digital Wallet, with the following features: MYAKU-PE!, a mobile payment service that can be used at any payment-enabled merchant nationwide, both inside and outside the Expo grounds; MYAKU-PO!, earn points by participating in initiatives related to SDGs and the Expo, and get exclusive Expo merchandise and services; and MYAKU-N!, using blockchain technology, exclusive NFTs of MYAKU-MYAKU will be given away at the EXPO

- AOKI/ORIHICA online stores introduce Smartpay, Japan’s leading BNPL (Buy Now, Pay Later) service, allowing customers to divide the purchase price of a product and pay in installments; since the purchase price is automatically deducted from the customer’s credit card or bank account, the payment is performed without having to fill in payment forms or incurring transfer fees

Capital Markets & Asset Management

- In light of the expectations from many shareholders and investors in Japan and overseas for further progress in companies’ initiatives, the Tokyo Stock Exchange has compiled and published “Key Points and Examples” for “Management Conscious of Cost of Capital and Stock Price”; the report is based on interviews with many investors in Japan and overseas, including a summary of the key points of initiatives that investors expect from companies, and also examples of initiatives that investors deemed as fulfilling these expectations

- The “Rakuten Plus” series of index funds exceeded JPY 100bn in AUM, tripling since the beginning of the year on the back of the new NISA; in addition to low fees, the funds also offer returns in Rakuten Points; in line with the NISA flows observed so far, the majority of the funds invest outside of Japan

- Rakuten Securities unveiled the first “Investment Consultant AI Avatar” using NVIDIA’s Avatar Cloud Engine (ACE), a cloud API that provides a suite of real-time AI solutions for building and deploying interactive avatars; the “Investment Consultant AI Avatar” can respond to voice-based questions about investments with human-like answers and listening gestures

- Lazard Asset Management names Tomohiro Kamisaku as CEO; Kamisaku joins Lazard from Amundi Japan, where he was most recently Executive Vice President and Head of the firm’s Japan Institutional business; he has held senior leadership roles at several firms serving Japanese investors, including at J.P. Morgan Asset Management and UBS Asset Management

Digital Assets

- Important ordinance revisions that will enable the establishment of DAOs in the form of limited liability companies (LLCs) in Japan have finally been announced; under previous regulations, tokenizing LLC membership rights as “Paragraph I Securities” under the Financial Instruments and Exchange Act (FIEA) subjected them to strict disclosure and sales regulations, making them functionally impractical; with these revisions, tokenized LLC membership rights can be treated as “Paragraph II Securities” under certain conditions, exempting them from the above regulations and allowing LLCs with tokenized rights to be established and operated like normal LLCs

- MUFJ Trust and Banking Corporation, Progmat, Standage and Ginco have entered into a joint collaborative exploration focused on the viability of Japanese stablecoins for use in international trade settlements; through integration between STANDAGE’s blockchain-powered trade settlement system with Progmat’s “Progmat Coin” platform, it is now possible to deliver quick, reliable and secure international / inter-corporate settlements

The Last Word: Salarymen

Follow Kaisha corp (Tanaka san) for more insights.

If you would like to see more of our content, please head over to the Tokyo FinTech YouTube Channel or check out the eXponential Finance Podcast.

We have also created two LinkedIn groups, the “Japan Startup Observer” if your interest in Japan goes beyond FinTech, and the “FinTechs of India” to capture the developments on the subcontinent. We invite you to join both these groups.

Have an awesome week ahead.