Japan FinTech Observer #61

Welcome to the sixty-first edition of the Japan FinTech Observer.

Welcome to the sixty-first edition of the Japan FinTech Observer.

Here is what we are going to cover this week:

- Venture Capital & Private Markets: Carlyle Group racks up $2.8bn for its fifth Japanese PE fund; Japan Investment Corporation has decided to make an LP investment of USD 27 million in Headline Asia V; Coral Capital has raised JPY 25m for Coral Capital IV; SMBC Group has established a “Social Value Creation Investment Fund” of 40 billion yen; Woodstock has raised approximately JPY 500 million

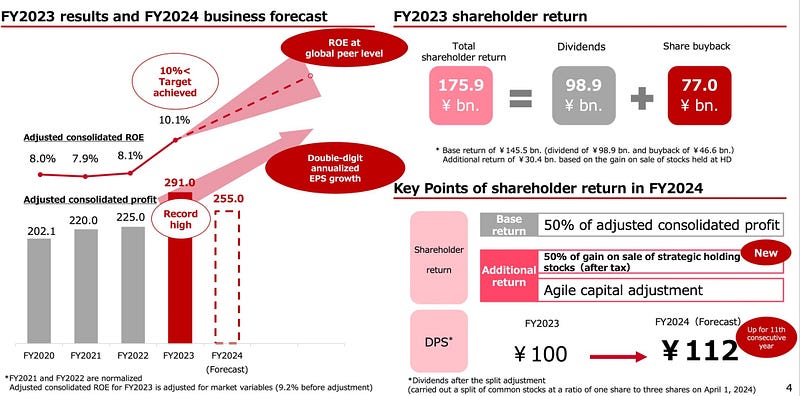

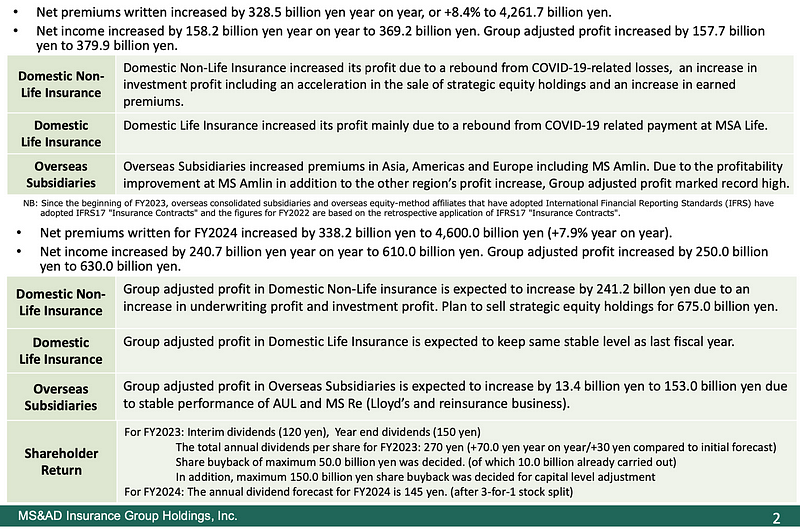

- Insurance: Tokio Marine Holdings, Sompo Holdings, and MS&AD Insurance Group report FY2023 earnings

- Banking: Norinchukin Bank is considering a capital increase of more than 1 trillion yen; mall operator AEON’s shariah-compliant digital bank has launched in Malaysia; NEC is partnering with AIRA Factoring in Thailand for supply chain finance solutions

- Payments: JPYC is being evaluated for the settlement of digital carbon credits; JPYC and Hokkoku Bank plan to test the exchange of different types of stablecoins; JCB visualizes CO2 emissions by product and payment method; Nudge has launched a “club” credit card to support the activities of the virtual artist group “V.W.P”

- Capital Markets: the Tokyo Stock Exchange published a comprehensive review of the market restructuring implemented in April 2022 and its impact on listed companies

- Asset Management: the Japanese government has chosen Tokyo, Osaka, Fukuoka, and Sapporo as “Financial and Asset Management Special Zones”, according to the Nikkei; Norinchukin Value Investments and Okasan Securities partner on defined contribution plans;

- Digital Assets: Ginco has received a grant from the Aptos Foundation; Animechain.ai has published a lite paper

- The Last Word: The Japanese yen will likely remain weak for months to come

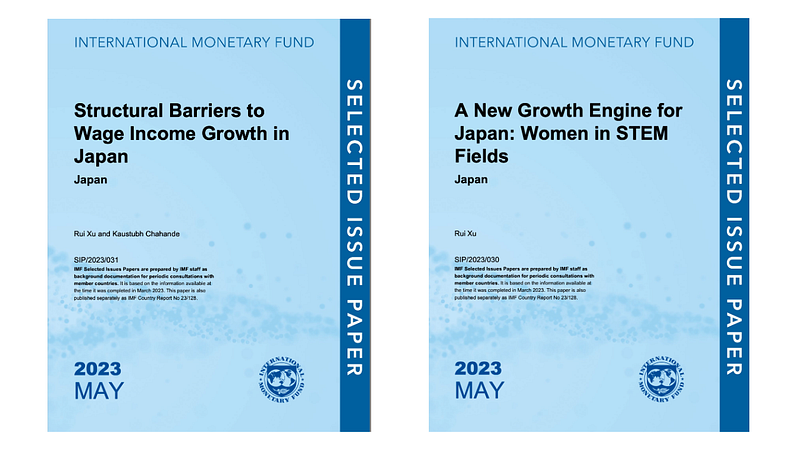

The International Monetary Fund, which during the previous week had published a “Technical Note on Regulation and Supervision of FinTech in Japan”, followed this up with two macro-economic papers, namely “Structural Barriers to Wage Income Growth in Japan”, and “A New Growth Engine for Japan: Women in STEM Fields”. We highly recommend all three publications.

Venture Capital & Private Markets

Private Equity

- The Carlyle Group racks up $2.8bn for fifth Japanese PE fund; CJP V will invest in upper middle-market opportunities in Japan across technology, media and telecom, consumer, retail and healthcare and general industries

- Japan’s ‘wall of money’ is too big a temptation to resist: Private equity funds see the country’s financial institutions and wealthy individuals as an untapped opportunity for capital, opines Leo Lewis in the Financial Times

Venture Capital — Domestic

- Japan Investment Corporation has decided to make an LP investment of USD 27 million in Headline Asia V, a VC fund managed by global VC firm IVP Advisory (“IVP”); Headline Asia V invests in the Asian region with a focus on Japan; the fund supports startups in Japan by leveraging the global network of the Headline Group, a global VC firm that operates fund series in four regions (North America, South America, Europe, and Asia)

- Coral Capital has raised JPY 25m for Coral Capital IV; Coral plans to invest anywhere from JPY 50m — JPY 3 billion into a single company anywhere from Seed to Series C; total assets under management now stand at approximately JPY 60 billion

- SMBC Group has established a “Social Value Creation Investment Fund” of 40 billion yen; this was originally set aside in April 2022 as a “Sustainability Investment Fund” of 20 billion yen to invest mainly in areas that help customers decarbonize their businesses

- Woodstock has raised approximately JPY 500 million from Japanese and US venture capital firms and angel investors, led by Delight Ventures, to further grow its SNS-style investment app woodstock.club, which allows investment in US stocks starting from JPY 1,000 for Generation Z; this brings the total funds raised to 750 million yen

- Nissay Capital, QC Investments, and Niigata Venture Capital invest in meleap’s Series C, and the Japan Investment Corporation provides debt financing for the company behind the global AR sports app “HADO”

Venture Capital — International

- Honest Bank, a Singapore-headquartered financial services startup, has recently secured an additional US$2.5 million investment for its series B round; of this amount, Rakuten Ventures contributed US$1.5 million

- REAZON CAPITAL has successfully closed an investment in Vidi Vici Digital (“Jendela”), a real estate platform with vertically integrated brokerage services in the three major cities of Indonesia; for Reazon, which began investing in Southeast Asia last year, the investment in Jendela is its first investment in Indonesia

- BIM Ventures, the Saudi Venture Studio, has signed a memorandum of understanding with SBI Holdings; this collaboration, facilitated in partnership with the Ministry of Investment of Saudi Arabia (MISA), aims to establish a joint USD 100m investment fund dedicated to nurturing startups and investing in the Saudi market

Venture Capital — Digital Assets

- MANTRA secures strategic investment from Nomura’s Laser Digital to accelerate RWA tokenization initiatives in the Middle East and Asia

- Kelp DAO, an Ethereum liquid restaking platform based on EigenLayer, has raised $9 million in a private token sale; SCB Limited and Laser Digital led the round with a combined $3.5 million investment

Insurance

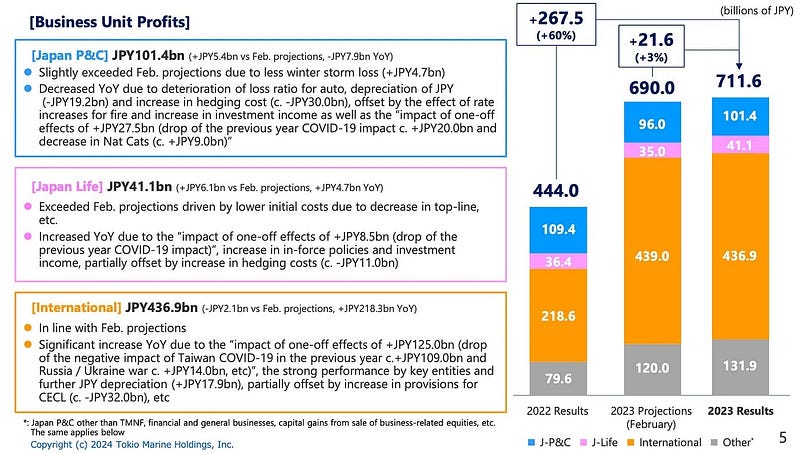

- Tokio Marine Holdings released its financial performance in fiscal year 2023, including projections for FY2024, and unveiling a new Mid-Term Plan with key performance indicator targets

Banking

- Norinchukin Bank is considering a capital increase of more than 1 trillion yen ($6.4 billion) to bolster its financial standing that is undermined by unrealized losses from its holdings of overseas bonds, including U.S. Treasuries

- The Bank of Japan has published a paper titled “Foreign Currency Liquidity Risk Management at Japanese Major Banks: Efforts and Enhancement”; in light of the difficulties at Aozora Bank and Norinchukin Bank, this paper could hardly be more timely

- Sumitomo Mitsui Financial Group has established a group-based expense budget of 10 billion yen to create Social Value, which is approximately 1% of the parent company’s net income target of 1,060 billion yen for this fiscal year

- Malaysia’s first shariah-compliant digital bank AEON Bank has officially launched; offering a range of exclusive sign-up perks — including an upsized profit rate of 3.88% p.a. — it is the second digital bank to launch in Malaysia, and a big step forward for mall operator AEON’s financial services ambitions

- NEC Corporation in Thailand has announced a strategic partnership with AIRA Factoring to elevate digital supply chain finance solutions through innovative technology and collaborative efforts

- Saudi EXIM Bank signed two cooperation agreements with SMBC and MUFG, aimed at fostering cooperation and creating co-financing opportunities to promote non-oil exports in target markets

Payments

- Mitsubishi UFJ Trust and Banking, Progmat, JPYC, KlimaDAO JAPAN, and Optage have begun a joint study to utilize the stablecoin “JPYC (Trust Type)” issued on the “Progmat Coin” platform for the settlement of digital carbon credits

- Hokkoku Bank, Digital Platformer, and JPYC have commenced a joint study aimed at enabling the purchase of “JPYC,” a money transfer-based stablecoin planned for issuance by JPYC, using “Tochika,” a deposit-based stablecoin issued by Hokkoku Bank through Digital Platformer’s technology

- JCB, East Japan Railway Company (JR East), Mash Style Lab, Lumine, and Your Arbor (Arbor) have jointly launched a proof-of-concept to verify behavioral changes among consumers through the visualization of CO2 emissions by product and payment method

- Nudge has launched a “club” credit card to support the activities of the virtual artist group “V.W.P” belonging to the YouTube-based creative label “KAMITSUBAKI STUDIO” for its Nudge Card; In the “V.W.P CARD” club, a portion of the Nudge Card’s usage amount is allocated to the activities of the five-member virtual artist group “V.W.P”, and club members can receive limited benefits based on their card usage amount

Capital Markets

- The Tokyo Stock Exchange published a comprehensive review of the market restructuring implemented in April 2022 and its impact on listed companies; the report delves into the status of various initiatives undertaken by the TSE to enhance the effectiveness of the restructuring, along four key initiatives: (I) Transitional measures regarding continued listing criteria, (II) Initiatives to enchance corporate value, (III) English disclosure, and (IV) Enhancing the functionality of the Growth Market

- In light of derivative instruments indexed to LIBOR having been phased out, and Euroyen TIBOR scheduled to disappear by the end of 2024, the Japan Exchange Group has published a Working Paper providing an overview of the Japanese alternative risk-free rate, TONA, and the OSE 3-month TONA futures

Asset Management

- The Japanese government is actively promoting the development of “Financial and Asset Management Special Zones” as a key initiative for achieving its “Asset Management Nation Realization Plan”; local governments were able to apply, with submissions due in February and March this year; as the Nikkei reported on Friday, Tokyo, Osaka, Fukuoka, and Sapporo have been chosen

- Norinchukin Value Investments and Okasan Securities have concluded a business tie-up agreement regarding the provision of the company-type defined contribution (DC) plan “Owners Class”

- Mitsubishi UFJ Trust and Banking has completed the acquisition of the issued shares of Link Administration Holdings Limited, as originally announced on December 18, 2023; the new name of the company will be MUFG Pension & Market Services Holdings Limited

Digital Assets

- Ginco has received a grant from the Aptos Foundation, and will utilize the funds to promote Aptos support and use case creation for the Company’s Web3 infrastructure, such as the Ginco Web3 Cloud and the Ginco Enterprise Wallet

- Animechain.ai has published a lite paper outlining Animechain.ai, a project using AI and blockchain to support creators with their creative activities; the project will develop an opt-in model specialized in anime production that resolves copyright issues while securing the traceability of training data and output by harnessing blockchain technology, with the aim of establishing an ethical ecosystem that ensures creators and rewards them appropriately

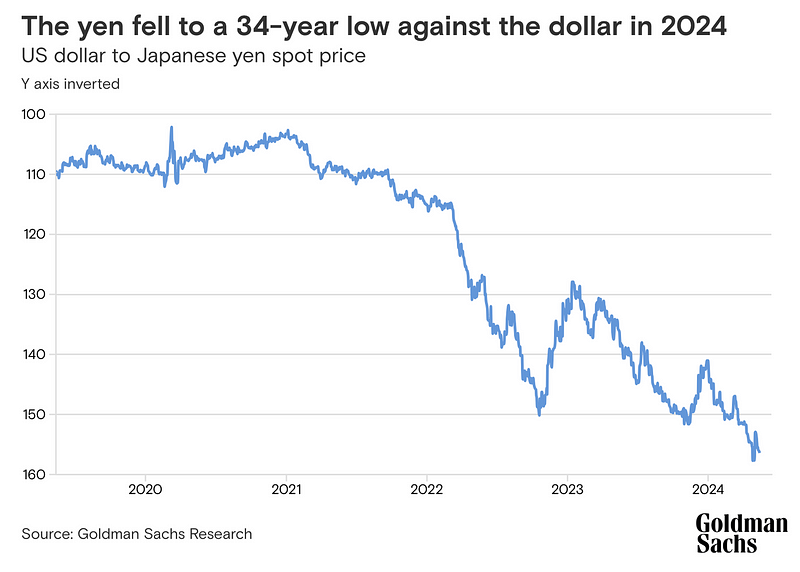

The Last Word: The Japanese yen will likely remain weak for months to come

The Japanese yen has been steadily depreciating since the beginning of the year, thanks in part to the delayed prospect of rate cuts by the US Federal Reserve and the strength of the US economy.

Goldman Sachs Research expects the yen to remain at or above 150 to the dollar over a 12-month horizon. In late April, the yen hit 157.8 to the dollar, a level not seen since 1990. On April 29 and May 2, Japan’s finance ministry made two apparent interventions in the foreign exchange markets, selling dollars to shore up its currency.

If you would like to see more of our content, please head over to the Tokyo FinTech YouTube Channel or check out the eXponential Finance Podcast. Registrations for the Tokyo FinTech Meetup have moved to Luma.

We have also created two LinkedIn groups, the “Japan Startup Observer” if your interest in Japan goes beyond FinTech, and the “FinTechs of India” to capture the developments on the subcontinent. We invite you to join both these groups.

Have an awesome week ahead.