Japan FinTech Observer #71

Welcome to the seventy-first edition of the Japan FinTech Observer.

Welcome to the seventy-first edition of the Japan FinTech Observer.

Bank of Japan Monetary Policy Meeting, earnings season, and two of the worst 15 days in the Japanese stock market since 1980. What did Lenin say? “There are decades where nothing happens; and there are weeks where decades happen.” Crypto folks will not be flustered, there have been enough “winters” over the past decade, but could it be that the 15 years-long equity market bull might need some rest? Our thoughts on the BOJ right after this overview.

Otherwise, here is what we are going to cover this week:

- Venture Capital & Private Markets: MUFG Bank will invest USD 393m in Globe Fintech Innovations (“Mynt”), the #1 finance super app and digital cashless ecosystem in the Philippines; Sumitomo Mitsui Trust Bank invests in S64, the global alternatives FinTech and solutions partner to the wealth management industry; HiJoJo Partners becomes the first Japanese and Asian investor in Nasdaq Private Market (NPM); MPower Partners Fund has invested in Teamshares, an employee ownership platform for small businesses; The Dai-ichi Life Insurance Company has invested USD 40 million in “DigitalBridge Partners III”

- Banking: MUFG, SMFG, and Mizuho earnings; Norinchukin Bank repairs its capital position; SMBC Group’s “Olive” has surpassed 3 million customers; Rakuten and Rakuten Bank have postponed the Group’s FinTech re-organization to January 2025

- Payments: DG Financial Technology has launched specialized payment solutions for its cashless payment service “CloudPay Neo”; JCB is launching a metal card in autumn

- Capital Markets: Nomura reported strong first quarter results, with earnings per share tripling; Daiwa Securities reported underwhelming first quarter earnings; GMO Financial Holdings took additional provisions for doubtful accounts at GMO-Z com Securities (Thailand); the Tokyo Stock Exchange’s Asia Startup Hub has reached 30 partners and 4 observers; an update on TSE disclosures; social stock trading startup Woodstock now allows account opening through a tap of your My Number card

- Asset Management: The Pension Fund Association has established the Corporate Pension Stewardship Promotion Council to enable corporate pension plans to work together to monitor the stewardship activities of investment managers; Franklin Templeton has launched the Franklin FTSE Japan Ucits ETF

- Digital Assets: Aozora Securities and Tokai Tokyo Securities have joined the “ibet for Fin Consortium” (a security token platform), bringing the total member count to 20; as previously announced in March, Sony Bank released “Sony Bank CONNECT”, a web3 entertainment app

- The Last Word: Blood in the Streets

Bank of Japan Monetary Policy Meeting

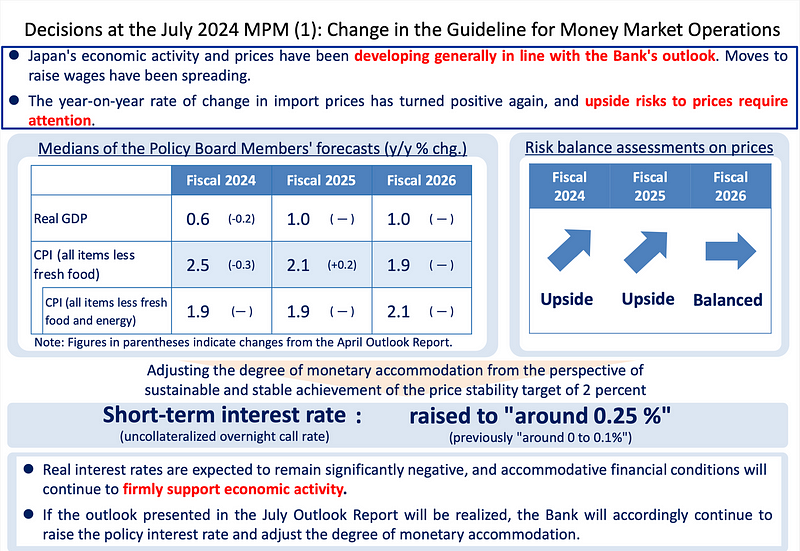

The Bank of Japan has proven that we follow a smart bunch of analysts. “Most of the analysts we follow expect the rate hike during this meeting (although swap rates on Friday indicated only a 50% likelihood)” we wrote last week. It is really painful to read news headlines these days, which kept talking about a “surprise” raise and an “inflation revolution” by the Bank of Japan. Who is making that stuff up? This was a mere 15 basis points hike, and the odds of the next raise are fairly split between October and January.

Governor Ueda apparently does not have any concerns about consumption. We might have to send him grocery shopping. Others are talking about a “cost of living crises”, and we started writing about a year ago “the Japanese consumer is about to get whacked”. It will still take until October data becomes available to see whether the spring wage agreements have made it through to the small enterprises and into the services sector. At least, a suddenly surging yen will take the edge of import prices.

If there was a surprise, it was the bearish market reaction that was not triggered so much by the BOJ, but rather by the Fed’s announcement that September rate cuts are on the table, and the following weak employment numbers. Hindsight is 20/20, and two of the 15 worst days in the Japanese stock market since 1980 just show how much leverage had been built up in the system.

Remember that the JPY/USD exchange rate at the beginning of the year was exactly where it is at the time of writing. At that point, the Fed was expected to make up to six (quarter point) cuts. Now we are hearing some analysts predicting a 50 basis points cut in September, and possibly another one before year end. As we said before, the JPY/USD exchange rate is driven more by Fed action than by the BOJ.

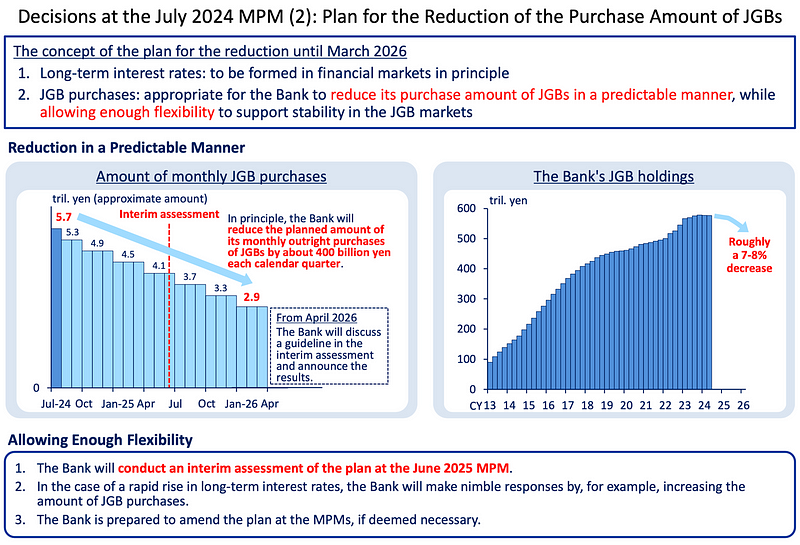

The reduction of the purchase amount of JGBs was also in line with median expectations, pushing the monthly purchases down below JPY 3trn per month by April 2026 through quarterly reductions of JPY 400bn. This will reduce the Bank of Japan JGB holdings by merely 7 to 8% at the end of this period. Although an “interim assessment” will take place, the program is set up to run on autopilot, with clear messaging to the market.

Venture Capital & Private Markets

- MUFG Bank will invest USD 393m in Globe Fintech Innovations (“Mynt”), the #1 finance super app and digital cashless ecosystem in the Philippines; this latest deal pushed Mynt’s valuation to USD 5 billion, more than doubling its $2 billion valuation from the last funding round in 2021; as of 2023, Mynt recorded PHP 6.7 billion of net income

- S64, the global alternatives FinTech and solutions partner to the wealth management industry, has closed its Series A funding round which includes investments from HPS Investment Partners and Sumitomo Mitsui Trust Bank, two prominent institutional investors

- Nasdaq Private Market (NPM), a leading provider of secondary liquidity solutions to private companies, employees, and investors, has added HiJoJo Partners (HJJ) as a new investor and the company’s first Japanese and Asian-based financial institution; HJJ will join NPM’s existing consortium of premier global financial institutions and investors to strengthen the private market products and investment vehicles available to the burgeoning Japanese private equity sector

- MPower Partners Fund has invested in Teamshares, an employee ownership platform for small businesses; with investments by MUFG Innovation Partners (MUIP) in February, and Nomura in March, Teamshares recently expanded its employee ownership succession model to Japan and anticipates having its first employee-owned business in Japan this year

- The Dai-ichi Life Insurance Company has invested USD 40 million in “DigitalBridge Partners III”, a digital infrastructure fund managed by DigitalBridge Investment Management; this marks the first time that Dai-ichi Life has invested in a fund that specializes in digital infrastructure

- The upcoming wave of startup IPOs in India will produce handsome gains for the SoftBank Vision Fund, both in terms of cash and value; e-scooter maker Ola Electric, kidswear retailer FirstCry.com (BrainBees Solutions Ltd.), software firm Unicommerce and food-delivery major Swiggy are among the SoftBank-backed companies going public; the Japanese tech investor holds shares worth about $1.5 billion in Ola Electric and FirstCry; its Unicommerce stake will amount to about $42 million; in Swiggy, which has made a confidential IPO filing, SoftBank will hold shares worth $700–800 million

Banking

- All three Japanese mega banks reported strong earnings last week; all of them initally performed strongly after the Bank of Japan raised its policy rate to 0.25%, as they should, since their net interest margin is expected to widen further; then they all got caught in the sell-off over first days of August, and are generally available for a 30% discount on last Wednesday’s prices; However, MUFG achieved 34% of its net operating profit target for the year in the first quarter, and 37% of its net income; SMBC achieved 29% and 35%, respectively; and Mizuho 30% and 38%, respectively; all three have budgeted the FY2024 with a JPY/USD exchange rate in the range between 135 and 140, i.e. an even stronger yen than we have today

- Norinchukin Bank, which by September 2023 had accumulated unrealized losses on bond positions of close to JPY 3trn, has published first quarter earnings for FY2024, and announced specific capital raising and conversion measures that it hopes will allow the bank to improve its investment portfolio during this fiscal year, and achieve stable profits from FY2025 onwards

- Sumitomo Mitsui Banking Corporation (SMBC) and Sumitomo Mitsui Card Company (SMBC Card) announced that “Olive,” a comprehensive financial service for individual customers, has surpassed 3 million accounts

- As announced in April 2024, Rakuten Group and Rakuten Bank have executed a Memorandum of Understanding to initiate discussions aimed at the reorganization of Rakuten Group’s FinTech Business; Rakuten Group and Rakuten Bank have engaged in discussions with the aim for the Reorganization to take effect in October 2024; they have now agreed to target the Reorganization to take effect in January 2025

- Sumitomo Mitsui Financial Group has published the “SMBC Group Sustainability Report 2024”; previously, the SMBC Group has been issuing separate reports for each social issue, such as the “SMBC Group TCFD Report” for climate change, the “SMBC Group TNFD Report” for natural capital, and the “SMBC Group Human Rights Report” for respect for human rights; however, these social issues are not independent of each other but are closely interconnected, and an integrated approach is considered essential for their resolution

Payments

- DG Financial Technology (DGFT) has launched specialized payment solutions for its cashless payment service “CloudPay Neo”, which in the first phase offers a “Dynamic QR Code Generation Function” that generates and displays QR codes embedded with variable service fee information for field service businesses such as home appliance repair, house cleaning, and home care visits

- JCB is launching a metal card in autumn; you must be a member of the invitation-only “JCB The Class” card, and then the metal card will be provided as a second card for an issuance fee of JPY 30,000

Capital Markets

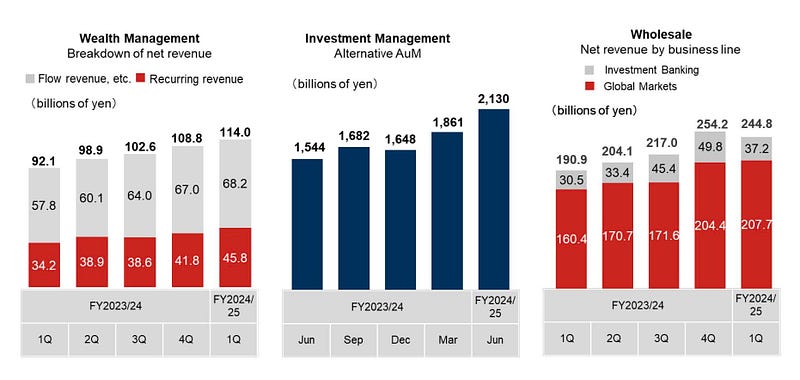

- Nomura reported strong first quarter results, with earnings per share tripling; three segment pretax income of Y86.6bn, up 12% QoQ and 3x stronger YoY; best quarterly Wealth Management pretax income in nine years driven by record high recurring revenue assets and recurring revenue; Investment Management AuM of Y92.5trn at all-time high on net inflows and strongest business revenue since division established in April 2021; Alternative AuM surpassed Y2trn; Wholesale pretax income higher QoQ on solid Spread Products and Equities performance, while Investment Banking net revenue slowed due to decline in deals executed and Japan seasonal factors; earnings per share of Y22.36, up 24% QoQ and 3x YoY; first quarter ROE of 8.1%

- Daiwa Securities reported underwhelming first quarter earnings on Thursday, August 1, and saw its stock price getting severely punished in one of the worst days for the TOPIX in more than four decades (Friday), giving up close to 19% and being quoted under JPY 1,000 for the first time since the very first trading days of this calendar year (and another 15% on Monday, August 5)

- During July, GMO Financial Holdings took additional provisions for doubtful accounts at GMO-Z com Securities (Thailand) for the second quarter of the fiscal year ending December 2024, and as a result, provided a dividend forecast that is significantly below the FY2023 payouts

- The Tokyo Stock Exchange (TSE) announced the launch of the TSE Asia Startup Hub in March of this year, with the aim of building an ecosystem that supports the growth of promising Asian startups; as of the end of July, 16 new organizations have joined the TSE Asia Startup Hub as partners, and the Ministry of Economy, Trade and Industry (METI), the Japan Business Federation (KEIDANREN), and the Kansai Economic Federation (Kankeiren) have also agreed to support the initiative as observers; this brings the total number to 30 partners and 4 observers

- As of June 30, 2024, 74% of Prime Market listed companies and 28% of Standard Market listed companies have disclosed information regarding “Action to Implement Management that is Conscious of Cost of Capital and Stock Price” — the TSE would like you to believe the numbers are 81% and 40%, respectively, but we have always refused to accept the “under consideration” into the count; this whole exercise has been going on for close to 18 months, and any executive team that is still “considering” voluntary compliance with the guidelines deserves the boot from its shareholders — which they are now safe from for another year

- Social stock trading startup Woodstock now allows account opening through a tap of your My Number card; this authentication method is fast becoming the UI/UX standard for Japanese mobile apps

Asset Management

- The Pension Fund Association has established the Corporate Pension Stewardship Promotion Council to enable corporate pension plans to work together to monitor the stewardship activities of investment managers

- Franklin Templeton has launched the Franklin FTSE Japan Ucits ETF designed to provide European investors with access to over 500 Japanese companies across various industries; the ETF was listed on the Deutsche Börse Xetra the London Stock Exchange and Euronext Amsterdam last week, and Borsa Italiana will follow on September 4, 2024; it will be available in Austria, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Spain, Sweden, and the UK

Digital Assets

- During July, Aozora Securities and Tokai Tokyo Securities have joined the “ibet for Fin Consortium” (a security token platform), managed by BOOSTRY, bringing the total member count to 20

- As previously announced in March, Sony Bank released “Sony Bank CONNECT”, a web3 entertainment app that is based on the theme of “connecting” to create exciting experiences that anyone can enjoy easily and safely; to view your NFT collection, you need to connect to SNFT, a marketplace where you can purchase and manage NFTs; SNFT is 100% invested by Sony Group

The Last Word: Blood in the Streets

If you would like to see more of our content, please head over to the Tokyo FinTech YouTube Channel or check out the eXponential Finance Podcast. Registrations for the Tokyo FinTech Meetup have moved to Luma.

We have also created two LinkedIn groups, the “Japan Startup Observer” if your interest in Japan goes beyond FinTech, and the “FinTechs of India” to capture the developments on the subcontinent. We invite you to join both these groups.

Have an awesome week ahead.