Japan FinTech Observer #73

Welcome to the seventy-third edition of the Japan FinTech Observer.

Welcome to the seventy-third edition of the Japan FinTech Observer.

We will host the Japan FinTech Observer weekly call again tonight, like every Monday evening, starting at 8pm JST on LinkedIn Audio. You can find today’s event here.

So much for our Obon summer lull. Earthquake warnings, typhoon warnings, and a not much loved Prime Minister riding into the sunset. Thankfully, only the last item truly materialized (the typhoon did not make landfall). We cover the steps to elect the next LDP President in “The Last Word”.

SPACs are dead, or so we thought. However, the first Japanese FinTech is listing today on the London Stock Exchange in a reverse takeover transaction, after announcing a non-binding agreement in December. As incredible as it sounds, it makes us re-think the odds of Oki Matsumoto taking his Coincheck franchise public through a US SPAC by the January 2025 deadline.

Otherwise, here is what we are going to cover this week:

- Venture Capital & Private Markets: MUFG Bank’s Ganesha Fund invests in India’s Neo Wealth and Asset Management; SMBC’s Asia Rising Fund invests in India’s trade credit infrastructure platform Vayana; Saison Investment Management Private Limited provides debt financing to Bangladesh’s leading B2B commerce platform ShopUp; SoftBank will join a USD 130m fund by Taizo Son to invest in AI startups; Incubate Fund Asia has successfully closed its third fund with a total corpus of USD 30m; Venture capital firm Andreessen Horowitz, also known as a16z, has announced plans to open its first office in Asia, in Tokyo

- Insurance: Meiji Yasuda’s StanCorp will acquire Allstate’s two subsidiaries that operate employer voluntary benefits businesses

- Banking: SMBC CloudSign has launched “AI Contract Management Pro”

- Capital Markets: Morgan Stanley posted record revenue in Japan driven by gains in share and bond trading; the first Japanese FinTech company listed on the LSE will come through a SPAC transaction

- Digital Assets: Mitsubishi UFJ Morgan Stanley apparently is interested in issuing digital securities; Komainu will become a Core Custodian for Nasdaq’s suite of Crypto Indices

- The Last Word: How to elect an LDP President

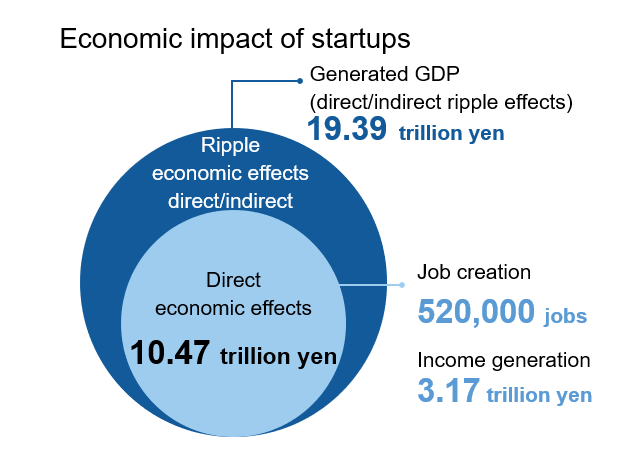

The Economic Impact of Startups in Japan

The “Economic Impact of Startups in Japan” report, published in July 2024 by the Ministry of Economy, Trade and Industry (METI), examines the significant role startups play in driving economic growth and shaping the future of Japan’s economy. The report reveals several key findings about the economic impact of startups in Japan:

- Significant GDP Contribution: Startups in Japan generated an estimated 19.39 trillion yen in GDP (including indirect effects), comparable to the nominal GDP of many prefectures in Japan. This underscores the substantial contribution of startups to the national economy.

- Employment Generation: Startups created 520,000 jobs and generated 3.17 trillion yen in income. This highlights the role of startups in fostering employment opportunities and contributing to individual income growth.

- Impact of EXITed Companies: Startups that have undergone an “exit” event, either through an IPO or M&A, demonstrate a disproportionately large impact on the overall economic impact. These companies, although a smaller proportion of the total number of startups, contribute significantly to GDP growth.

- Role of Venture Capital (VC): Startups that have received VC funding show a higher economic impact. 70% of the startups surveyed had received VC funding, and these companies generated 72% of the total GDP contribution from startups. This highlights the importance of VC funding in supporting startup growth and driving economic impact.

- Sectoral Analysis: The information and communications technology (ICT) sector plays a dominant role in the startup landscape, followed by business services, commerce, real estate, and finance & insurance. These five sectors account for 78% of the total GDP generated by startups.

- Potential for Transformation: The report highlights the potential of startups to reshape the Japanese economy. Notably, the increasing trend of startups acquiring other startups and the high proportion of female entrepreneurs in startups point towards a dynamic and transformative force within the Japanese economy.

Venture Capital & Private Markets

- India’s Neo Wealth and Asset Management has raised approximately USD 48m in its latest funding round led by MUFG Bank’s Ganesha Fund and New York-based Euclidean Capital

- India’s trade credit infrastructure platform Vayana has raised USD 20.5m as part of its ongoing series D funding round, led by SMBC’s Asia Rising Fund, and with participation from existing investors, including International Finance Corporation, Chiratae Ventures, Jungle Ventures, and family offices Quantum State Investment Fund and Emerald Company

- ShopUp, a leading B2B commerce platform in Bangladesh, raised USD 6.5m in debt capital funding from Saison Investment Management Private Limited, a credit venture arm of Japan’s Credit Saison, to make it a fully local supply chain through technology

- Korean conglomerates such as SK Networks, LG Electronics, Hanwha Group and Japan’s SoftBank will join a USD 130m fund to invest in AI startups by the end of the month; the Korean companies, SoftBank and an unnamed Thai conglomerate recently signed a deal to join the Alpha Intelligence Fund, set up by SBVA

- Incubate Fund Asia has successfully closed its third fund with a total corpus of USD 30m; despite falling short of its initial target of USD 50m, this fund showed the firm’s support for early-stage startups; the fund, which has recently been rebranded from Incubate Fund India to Incubate Fund Asia, will focus on making approximately 20 early-stage investments and providing follow-on funding to portfolio companies

- Venture capital firm Andreessen Horowitz, also known as a16z, has announced plans to open its first office in Asia, in Tokyo; this strategic move marks a significant expansion for the firm, which is known for its investments in technology and innovation sectors; the new office in Japan aims to strengthen a16z’s presence in the Asian market and foster closer relationships with local startups and entrepreneurs; in other news, “The Verge” had an excellent piece on a16z, titled “The moral bankruptcy of Marc Andreessen and Ben Horowitz”

Insurance

- Meiji Yasuda Life Insurance Company announced that StanCorp Financial Group, a U.S. subsidiary of Meiji Yasuda, has agreed with The Allstate Corporation, a major U.S. property and casualty insurance company, that StanCorp will acquire Allstate’s two subsidiaries that operate employer voluntary benefits businesses; subject to the approval of regulatory authorities in Japan and the United States, the acquired companies will be wholly owned and consolidated subsidiaries of Meiji Yasuda

Banking

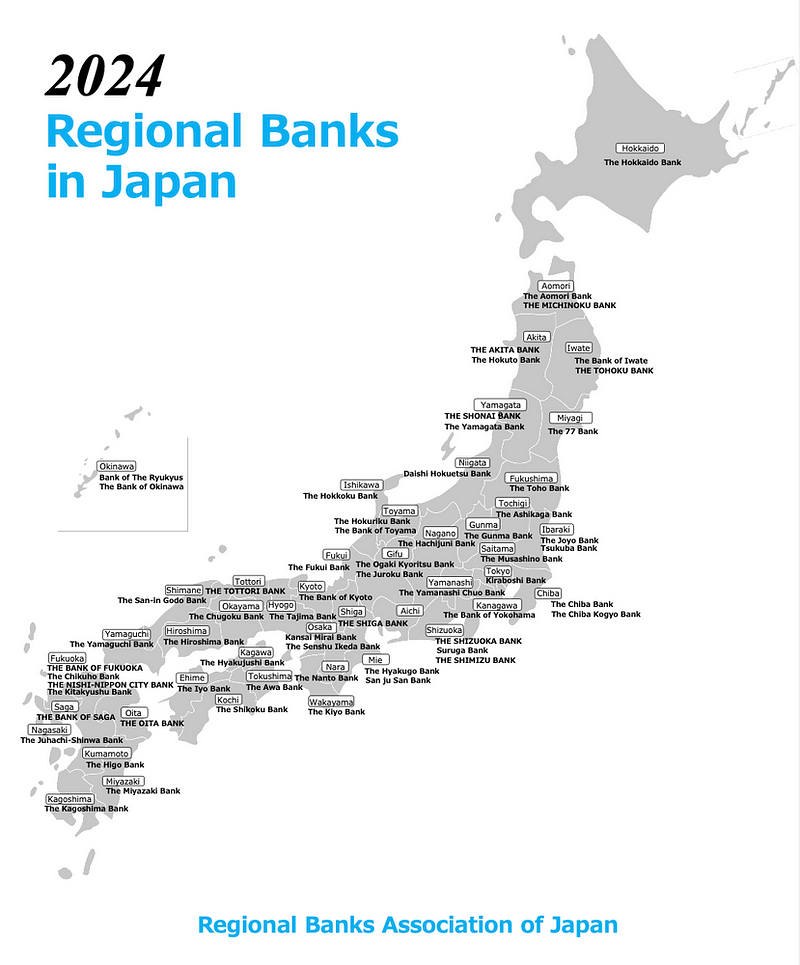

- The Regional Banks Association of Japan has published an updated list of its 62 members; these are not all regional banks, however, as there is a “Second Association of Regional Banks”; remarkably, however, these 62 members operate 28,051 ATMs, which is just about as many as Seven Bank runs in its network (27,604); this brings us back to the old question the FSA once asked: how many regional banks can be sustained in each prefecture?

- SMBC CloudSign, a subsidiary of Sumitomo Mitsui Financial Group, has launched “AI Contract Management Pro,” an upgraded version of its “AI Contract Management” service developed jointly with Sumitomo Mitsui Banking Corporation, further supporting the revised Electronic Bookkeeping Law which came into effect in January 2024, and also improving the efficiency of contract management

Capital Markets

- Morgan Stanley posted record revenue in Japan driven by gains in share and bond trading as it pledged to help boost investment in the country; net revenue at Morgan Stanley MUFG Securities, the US firm’s majority-owned brokerage venture with Japan’s largest banking group, rose 13% in the year ended March 2024 to 135.8 billion yen ($923 million), according to filings; that was the highest since the unit was established in 2010 and its second straight year of record revenue performance, reports Bloomberg

- It took a little while, but the deal is coming through; as we reported in December 2023, Bowen FinTech, a special purpose acquisition company (SPAC) formed to acquire businesses in the technology innovations sector with a focus on the financial services industry, had signed conditional, non-legally binding agreement to acquire 93.49% of the issued share capital of MINNADEOOYASAN-HANBAI (MOH); the company will list on August 19, 2024, as “MOH Nippon Plc”

- SuMi TRUST Asset Management has published a report introducing the differences in factor investing effectiveness between the global market and Japanese market, the reasons behind these differences, and the efforts made to adapt investment strategies to the Japanese market, focusing on Value, Momentum, and Quality factors; the authors also present the representative investment strategies that have been implemented in these areas

- Nikko Asset Management has considered how to wean off a weak yen without fading Japan’s recovery

- The Tokyo Stock Exchange has published a guide to its Banks Index, ETFs, and Futures

Digital Assets

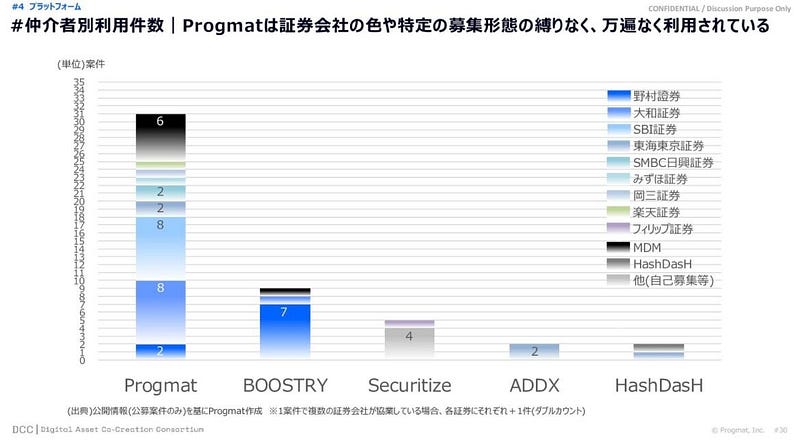

Progmat — Security Token Issuances by Platform & Securities Firm (February 2024)

- As the Nikkei reported Mitsubishi UFJ Morgan Stanley’s interest in issuing digital securities, Tatsuya Saito, Founder & CEO at Progmat, helpfully re-circulated the above statistics on security token issuances from a presentation given in February; Progmat, positioned as “national infrastructure” with a consortium of owners when it spun out of MUFG Trust & Banking, leads Nomura’s BOOSTRY platform

- Nasdaq has announced Komainu, a joint venture between Nomura, Ledger and CoinShares, as a Core Custodian for its suite of Crypto Indices, underscoring the commitment of both organizations to upholding rigorous standards in the digital asset markets

The Last Word: How to elect an LDP President

The LDP announced today (August 19) that the candidate list will close on September 12, with voting scheduled for September 27. The LDP presidential election will only be contested by those candidates endorsed by at least 20 LDP members of the Diet.

There will be 367 votes from LDP Diet members, and an equal number as a proportional representation of the local LDP chapters. If no candidate is able to achieve an absolute majority during the first round, a run-off is help among the top two candidates.

In the run-off, the local votes will be aggregated by prefecture and cast as a single vote based on first-round voting. Thus, the party base has much less influence during the second round.

Wikipedia provides a reasonably current list of nominated and declared candidates. Given the requirement of 20 endorsements, names might be added or drop off the list until September 12.

If you would like to see more of our content, please head over to the Tokyo FinTech YouTube Channel or check out the eXponential Finance Podcast. Registrations for the Tokyo FinTech Meetup have moved to Luma.

We have also created two LinkedIn groups, the “Japan Startup Observer” if your interest in Japan goes beyond FinTech, and the “FinTechs of India” to capture the developments on the subcontinent. We invite you to join both these groups.

Have an awesome week ahead.