Japanese Financial Consortium to Pilot First Tokenized Deposit Settlements for Security Tokens

A consortium of six major Japanese financial and technology firms—including SBI Securities, Daiwa Securities, and SBI Shinsei Bank—have announced the launch of a collaborative project to verify real-world settlement of security tokens (ST) using tokenized deposits.

The initiative aims to implement a Delivery Versus Payment (DVP) settlement scheme using "DCJPY," a digital currency backed by bank deposits. This project marks a significant step toward streamlining Japan’s rapidly expanding secondary market for digital securities.

The Consortium

The project brings together key players across the Japanese financial infrastructure:

- Trading: SBI Securities and Daiwa Securities

- Banking & Issuance: SBI Shinsei Bank

- Technology & Platform: BOOSTRY and DeCurret DCP

- Exchange: Osaka Digital Exchange (ODX)

Solving the "Settlement Gap"

Since the issuance of Japan's first digital corporate bonds in 2020, the domestic Security Token market has surged, with public offerings reaching approximately 270 billion yen ($1.8 billion) as of November 2025.

However, a technological disconnect has persisted: while the transfer of digital securities on a blockchain is instantaneous, the corresponding monetary payment currently relies on traditional bank transfers. This lag creates settlement risk and increases administrative burdens.

The consortium intends to close this gap by utilizing DCJPY—tokenized deposits issued by SBI Shinsei Bank on the platform provided by DeCurret DCP. By linking this payment leg with the securities transfer leg, the group aims to achieve true DVP settlement, where the delivery of the asset and the payment occur simultaneously.

The Pilot Scheme

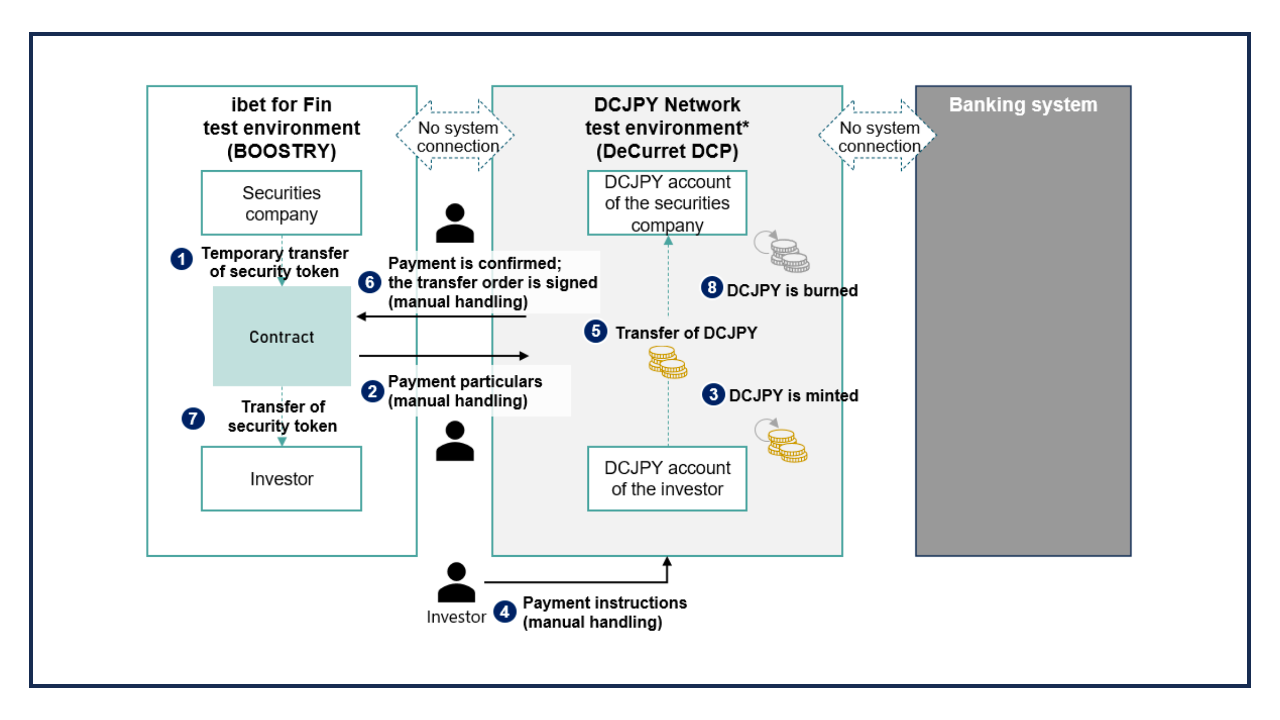

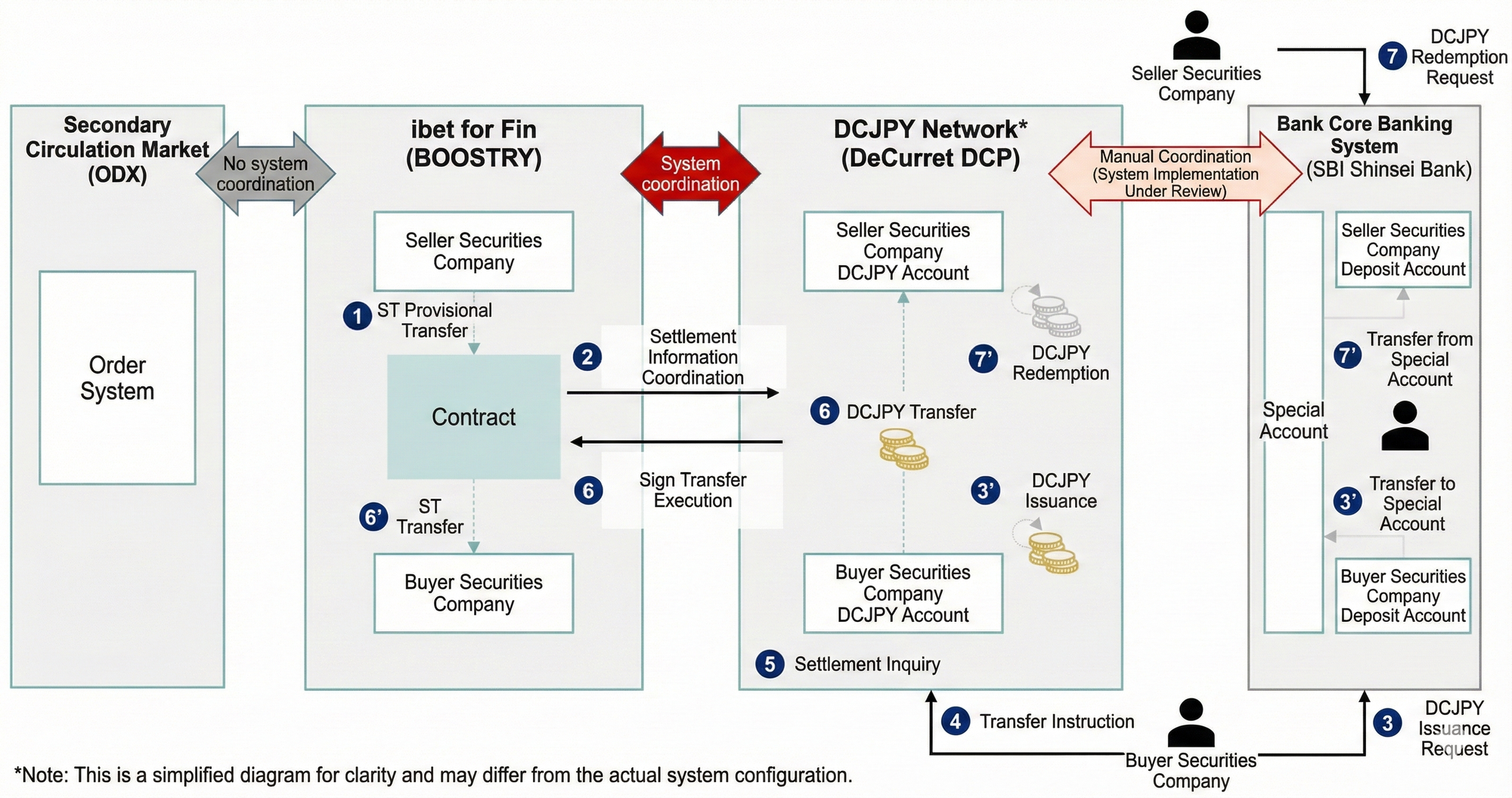

The verification process will integrate two distinct blockchain platforms:

- "ibet for Fin": A consortium blockchain led by BOOSTRY for issuing and managing the Security Tokens.

- DCJPY Network: A platform provided by DeCurret DCP for managing the tokenized deposits.

In the proposed workflow, SBI Securities and Daiwa Securities will trade STs. The settlement data will trigger an automated flow where SBI Shinsei Bank mints DCJPY, which is then instantly transferred to settle the trade against the simultaneous transfer of the security token.

Progress and Future Outlook

The group successfully completed a proof-of-concept using test data in August 2025, confirming that the system architecture could handle the necessary data synchronization for DVP settlement.

Moving forward, the consortium will proceed with verification using actual issued tokens. The ultimate goal is to standardize this settlement model for the "START" secondary market operated by ODX, thereby enhancing market efficiency and reducing counterparty risk for institutional investors.