Japan’s ANRI Targets 30 Billion Yen for Sixth Seed Fund; Unveils Balance-Sheet Pre-Seed Initiative

ANRI, a Tokyo-based independent venture capital firm, has established "ANRI Fund No. 6," an investment vehicle with a targeted final corpus of 30 billion yen. The firm also disclosed the launch of the "ANRI Pre-Seed Program," a strategic initiative funded directly from the firm’s balance sheet designed to support founders facing high levels of uncertainty.

Fund No. 6: Deep Tech and Internet Focus

Building on the momentum of its predecessor, Fund No. 6 aims to be one of Japan’s largest seed-stage funds. The vehicle will maintain the firm's broad investment mandate, deploying capital across sectors ranging from consumer internet services to life sciences and deep tech.

The firm stated that by combining the scale of a 30 billion yen fund with the agility of the new pre-seed program, it intends to balance the swift decision-making characteristic of smaller funds with the continuous follow-on support typical of larger institutional funds.

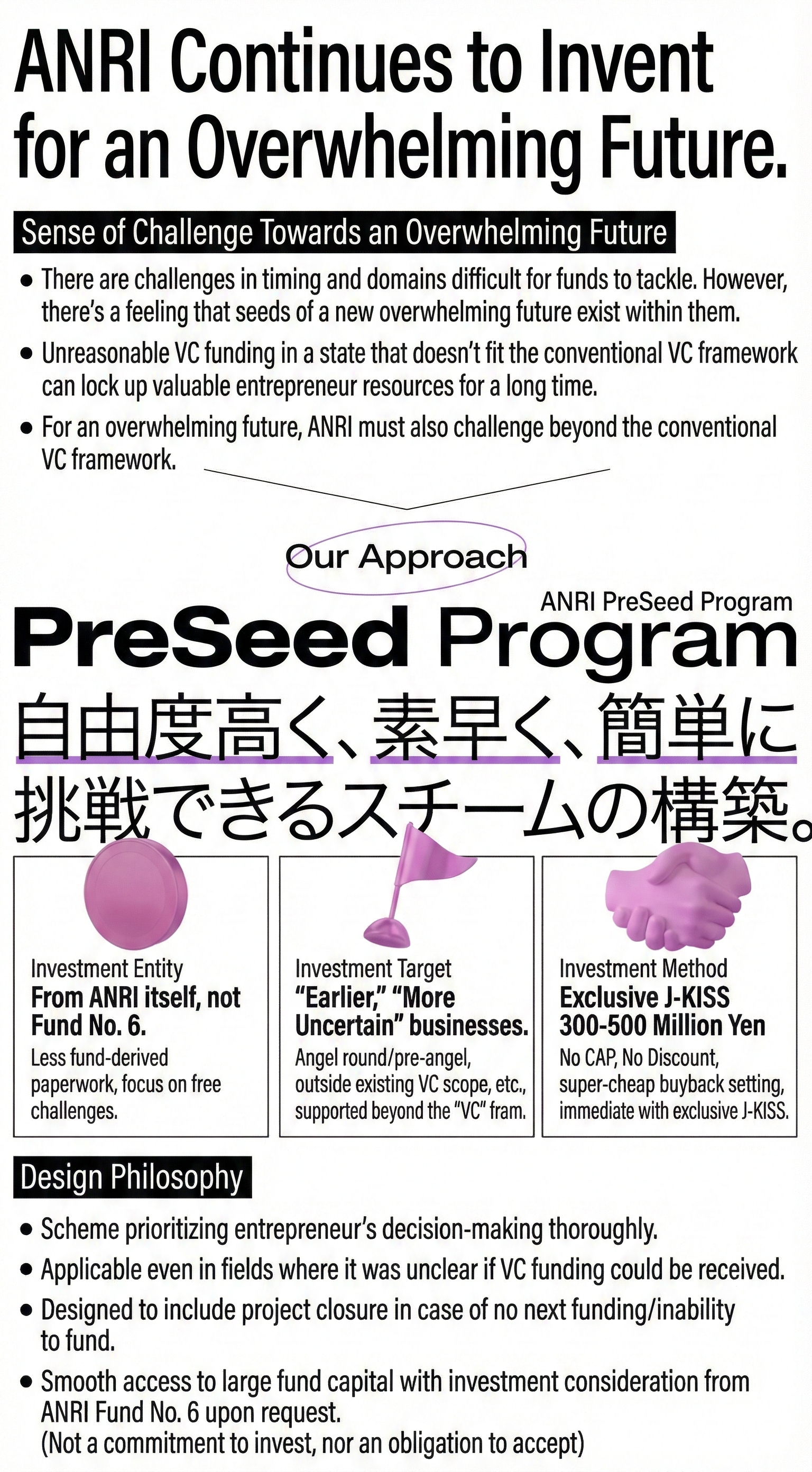

New Pre-Seed Architecture

Coinciding with the new fund, ANRI introduced the "ANRI Pre-Seed Program." This initiative is distinct in that investments are made from ANRI’s corporate entity rather than the LP-backed fund. The program targets the "pre-angel" phase, offering flexible capital to entrepreneurs navigating unproven business models or significant technical risks.

Key features of the program include:

- Instrument: Exclusive use of J-KISS (Keep It Simple Security) convertibles.

- Ticket Size: 3 to 5 million yen.

- Terms: No valuation caps or discounts to ensure speed; focused purely on enabling immediate execution.

- Strategy: Designed to prioritize founder autonomy and increase the sheer volume of new ventures by removing early fundraising friction.

In a statement, the firm noted that while the recent surplus of seed capital in the ecosystem is positive, early over-capitalization can sometimes restrict a founder's ability to pivot. This program aims to solve that liquidity trap by offering "no-strings" capital to validate concepts before entering the traditional VC cycle.

Leadership Expansion

ANRI also announced the expansion of its General Partner (GP) partnership to a four-person structure. Shunsuke Nakaji and Yusuke Miyazaki have been promoted to General Partner, joining existing GPs Anri Samata and Junichiro Kawano.

Both Nakaji and Miyazaki joined the firm in 2018 and have successfully transitioned from associates to leadership roles, validating ANRI’s internal talent development strategy.

- Shunsuke Nakaji: Formerly of Google Japan and DCM Ventures, Nakaji has led investments in LUUP, Plott, and Dinii.

- Yusuke Miyazaki: Holding a Ph.D. from Stanford University and formerly with BCG, Miyazaki specializes in the life sciences sector. His portfolio includes Strand Therapeutics and xFOREST Therapeutics.

About ANRI

Founded in 2012, ANRI is an independent venture capital firm that has supported over 300 startups since its inception. Self-styled as "Changer Capital," the firm focuses on seed-stage investments with the goal of fostering companies that can realize an "overwhelming future."