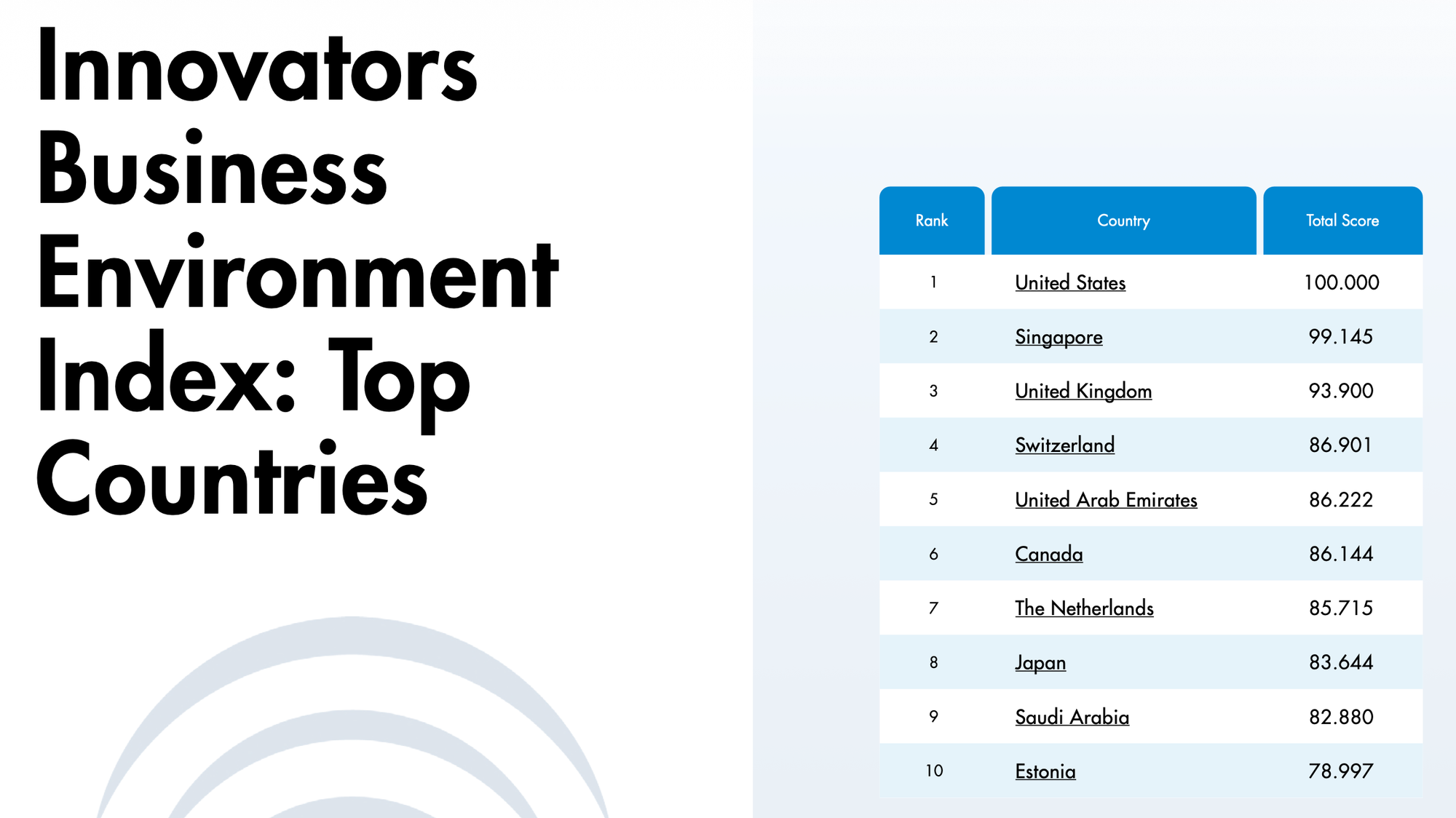

Japan's Position in the Innovators Business Environment Index 2026

This post evaluates the business environment for innovators in Japan, based exclusively on the findings of the "Innovators Business Environment Index (IBEI) 2026" published by StartupBlink. The objective is to dissect Japan's global strengths and weaknesses as identified in the IBEI and to benchmark its performance against key Asian competitors.

According to the report, Japan has secured a formidable position on the world stage, ranking 8th globally and 2nd in the Asia-Pacific region. This top-tier standing places Japan among the world's most attractive destinations for innovative enterprises. Japan's top-10 position warrants a closer look at the specific factors driving its success and how it navigates the competitive landscape of one of the world's most dynamic economic regions.

1. Japan's Global Standing: A Top-Tier Environment with Distinct Strengths

A high ranking in the Innovators Business Environment Index is of significant strategic importance, signaling a nation's capacity to attract and retain international talent, investment, and cutting-edge enterprises. Japan's 8th place finish, with a total score of 83.644, firmly establishes it among the world's elite business environments. This performance is built upon distinct and measurable advantages identified within the IBEI framework.

However, the report paints a picture of a "sleeping giant" with world-class foundational infrastructure that is currently outperforming its actual startup output. While Japan trails only Singapore in the region, a sharp divergence between its operational ease and its fiscal incentive structure suggests where policymakers must focus to close the gap with global leaders.

World-Class Credit Conditions

Japan's most significant competitive advantage lies in its financial landscape. The IBEI report ranks Japan 1st globally for "Lending Rate and Getting Credit." This top ranking indicates exceptionally favorable conditions for businesses seeking financing, a critical component for both startups and established companies looking to innovate and expand. Easy access to credit at competitive rates reduces a primary barrier to growth and provides a stable foundation for long-term investment.

Effective Policy and Governance

Beyond finance, Japan demonstrates strong policy effectiveness. It ranks 3rd worldwide in the "Rewards and Penalties" mechanism, a position it shares with other highly stable, innovation-focused economies like Switzerland and Canada. According to the report, this metric reflects a "strong use of friction-reducing policy levers versus the existence of structural frictions in the business environment." This suggests that the government has been successful in implementing policies that actively smooth the path for businesses, counteracting inherent structural complexities within the economy.

In line with trends observed among the IBEI's Top 20 countries, Japan's high ranking is associated with robust "Access to Capital & Financial Infrastructure" and "Regulation & Governance." However, the report also notes a common pattern for this elite cohort: "Taxation is seldom a key strength." This observation provides important context, highlighting that Japan's overall strength is built on institutional and financial pillars.

The Incentive Gap

If operational ease is Japan's engine, fiscal policy may be the brake. While ranking 8th overall, Japan drops significantly to 31st globally in the Business Incentives pillar.

The report highlights that the Taxation Functional Category represents a primary area for development. When compared to regional rival Singapore—which ranks 1st globally in Business Incentives—Japan’s tax regime and financial incentives for early-stage ventures appear conservative. While initiatives like the "Open Innovation" tax credit exist, the index suggests that incentive modernization lags behind the aggressive fiscal maneuvering seen in hubs like Dubai and Singapore.

While Japan's global position is formidable, its standing is best understood through a competitive lens against its regional rivals, where the battle for innovation leadership is particularly intense.

2. Competitive Benchmark: Japan vs. Key Asian Rivals

The Asia-Pacific region is a hotbed of economic dynamism, with nations fiercely competing to establish themselves as the preeminent hub for innovation. A direct comparative analysis based on the IBEI 2026 findings reveals Japan's strong competitive posture, as well as the areas where regional rivals excel. The following table summarizes the rankings of Japan and its primary competitors in the region.

2.1 Analysis: Japan vs. Singapore (The Regional Leader)

The data clearly establishes Singapore (2nd globally) as the undisputed leader in the Asia-Pacific. While Japan's 8th place ranking is impressive, Singapore's performance places it in a class of its own within the region. The key differentiators are foundational. While Japan's primary strength is its world-leading credit conditions, the IBEI report reveals Singapore's dominance is broad-based, ranking it 1st globally in three foundational areas:

- Market Perception Pillar: Reflecting top global assessments of governance, stability, and international accessibility.

- Business Incentives Pillar: Indicating the most attractive fiscal and financial incentive conditions in the world.

- Regulation & Governance Functional Category: Signaling best-in-class legal, regulatory, and procedural frameworks.

This broad-based excellence makes Singapore a uniquely powerful competitor and the benchmark for business environment quality in Asia.

2.2 Analysis: Japan vs. Taiwan & South Korea (The Challengers)

The IBEI data reveals a significant performance gap between Japan and other major East Asian economies. Japan's 8th place ranking is substantially higher than that of Taiwan (29th) and South Korea (32nd). While these nations are major technological and industrial players, their overall business environments for innovators are assessed as having considerably more friction than Japan's.

It is worth noting Taiwan's specific area of strength; the report recognizes it as a global leader in governance, ranking 7th worldwide in the "Regulation & Governance" category. This indicates a robust institutional framework. However, this strength does not translate into a similarly high overall rank. Based on the comprehensive data in the IBEI, Japan offers a markedly more favorable and holistic environment for innovators when compared to both Taiwan and South Korea.

3. Strategic Outlook and Conclusion

The Innovators Business Environment Index 2026 paints a clear and compelling picture of Japan as a global innovation powerhouse that holds a strong, but not unassailable, position in Asia. The analysis confirms that Japan's business environment is among the world's most conducive for entrepreneurs and innovators, buoyed by exceptional financial conditions and effective policymaking. However, the competitive landscape, particularly the dominance of Singapore, underscores the continuous need for strategic enhancement.

The core findings of this analysis can be distilled into several key takeaways:

- Global Elite: Japan's 8th place global ranking solidifies its status as one of the world's most attractive business environments for innovators.

- Unmatched Credit Access: Its #1 global rank in "Lending Rate and Getting Credit" is a critical and unique differentiator, providing a powerful advantage for businesses requiring capital for growth and innovation.

- Strong but Second in Asia: While a regional leader, Japan is significantly outpaced by Singapore, which dominates on multiple foundational pillars like business incentives, market perception, and governance.

- Clear Lead Over Other Rivals: Japan maintains a substantial competitive advantage over other regional players like Taiwan and South Korea, whose overall business environments are ranked much lower in the index.

Ultimately, Japan's strategic challenge is twofold: to maintain its elite global status by reinforcing its unique strengths while simultaneously addressing areas where it may lag the world's absolute top performers, such as the taxation environment common to many top-ranked nations, in order to secure its leadership position in the dynamic Asian market.