JPYC Bridges the Gap to Retail: Yen-Pegged Stablecoin to Power Touch Payments via Japan’s National ID System

JPYC, the prominent Japanese Yen-pegged stablecoin, is set to undergo a significant stress test in the physical retail environment, moving beyond the digital realm to power real-world transactions through Japan’s My Number Card system.

In a move that signals the increasing convergence of Web3 assets and traditional payment infrastructure, Sumitomo Mitsui Card Company (SMCC) and MynaWallet have announced a continuous proof-of-concept (PoC) program. The initiative places JPYC at the core of a new payment ecosystem designed to allow consumers to spend stablecoins as easily as tapping a transit card.

The Pilot: JPYC on the Hardwood

The first phase of this rollout is scheduled for January 23 and 24, 2026, at the home arena of the pro basketball team, Rising Zephyr Fukuoka. In this experiment, JPYC will serve as the medium of exchange.

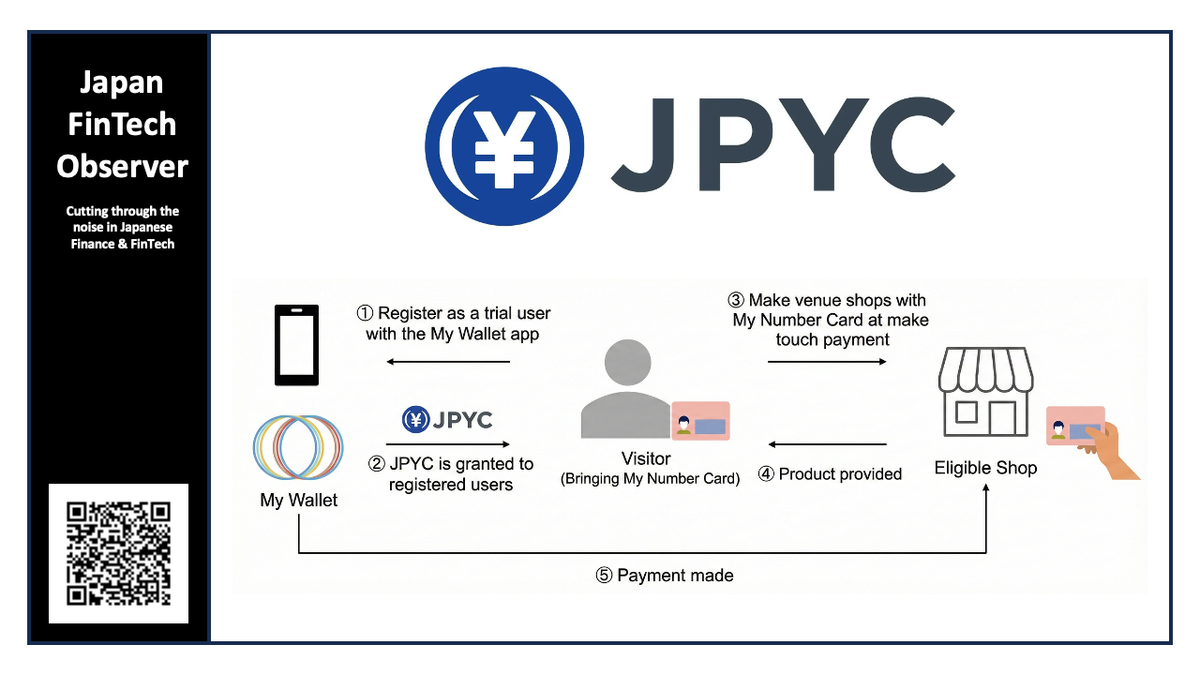

Unlike typical crypto payments that often require scanning QR codes via specialized third-party apps, this pilot utilizes the My Number Card—Japan’s government-issued ID—as a hardware wallet. Attendees will be able to verify their identity via the "MynaWallet" application, receive JPYC, and then purchase goods at the venue simply by tapping their ID cards on SMCC’s ubiquitous "stera" payment terminals.

Behind the scenes, the transaction triggers a transfer of JPYC balances on the blockchain, effectively settling the payment while the user experiences a familiar "touch-and-go" interaction.

Solving the UX Puzzle

The integration addresses a critical bottleneck in stablecoin adoption: the user experience (UX) friction for non-technical demographics. By leveraging the My Number Card and Public Personal Authentication (JPKI), the partnership aims to create a secure environment where JPYC can be utilized by the elderly and children alike, without the steep learning curve associated with managing private keys or complex wallet interfaces.

For JPYC, gaining access to SMCC’s "stera" terminals represents a massive potential on-ramp to physical merchants. The "stera" platform serves as an open infrastructure capable of handling credit, electronic money, and QR codes, now expanding to include blockchain-based assets.

Roadmap: From Domestic Grants to Global Stablecoins

While the immediate focus is on domestic retail usage of JPYC, the program outlines an ambitious roadmap for blockchain payments in Japan. Following the Fukuoka pilot, the companies plan to expand JPYC utilization to:

- Public Sector: Administrative fees and public utility payments.

- Regional Revitalization: Distribution of digital regional currencies and government benefits via stablecoins.

- Tourism: Usage in commercial and sightseeing facilities.

Perhaps most notably for the broader crypto market, the PoC is positioning this infrastructure as a gateway for inbound tourism. The long-term vision includes enabling foreign visitors to spend foreign-issued stablecoins (such as USDC) at Japanese merchants via the stera terminals, effectively creating a cross-border payment rail that bypasses traditional currency exchange friction.

This initiative, adopted under the "Fukuoka City Full Support Project," marks a pivotal step in transforming JPYC from a digital-native asset into a practical tool for everyday commerce in Japan.