"JPYC Prepaid" Transitions to Japanese Yen-Based Electronic Payment Instrument

JPYC announced that their previously issued prepaid payment instrument "JPYC Prepaid" will be treated as an electronic payment instrument starting June 1, 2025, following the required transition period after the amended Payment Services Act took effect on June 1, 2023.

Handling of "JPYC Prepaid" from June 1, 2025

JPYC explains the handling of "JPYC Prepaid" from June 1, 2025, as follows:

- New issuance orders for "JPYC Prepaid" and the JPYC Prepaid v2 exchange services will end at 1:00 PM on May 30, 2025 (Friday). The final deposit deadline is 6:00 PM on May 30, 2025 (Friday).

- New issuance of "JPYC Prepaid" will end at 0:00 AM on June 1, 2025 (Sunday). After this point, "JPYC Prepaid" will not be issued for any reason whatsoever.

- Redemption of "JPYC Prepaid" for cash is not currently planned.

- Already purchased "JPYC Prepaid" will continue to be available as prepaid payment instruments that fall under electronic payment instruments, for use as payment methods for gift certificate sales on the JPYC app and as a means of free balance transfer on all issued public blockchains, unchanged from before.

JPYC has not yet completed the registration required for issuing electronic payment instruments, and therefore must discontinue new issuance of "JPYC Prepaid" based on the Cabinet Office Ordinance provisions of the amended Payment Services Act. However, already issued "JPYC Prepaid" can continue to be used by users themselves without hindrance.

Future Milestones

Taking this opportunity of becoming a Japanese Yen-based electronic payment instrument issuer, JPYC will work more actively toward early achievement of the following milestones:

1. Money Transfer Business Registration

As an electronic payment instrument issuer, to ensure higher reliability and safety, JPYC aims to complete registration as a Type II Money Transfer Business by summer this year as their top priority.

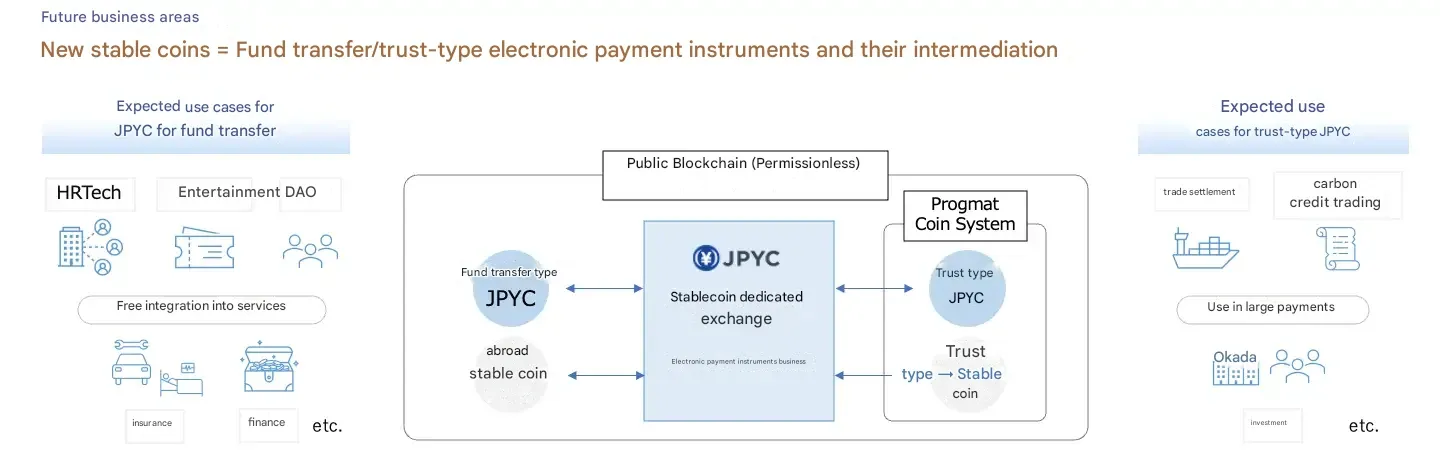

2. Issuance and Redemption of Type 1 Electronic Payment Instruments

After completing above money transfer business registration, JPYC aims to quickly issue a new Japanese Yen stablecoin "JPYC" as a "Type 1 Electronic Payment Instrument" that allows for issuance and redemption for cash.

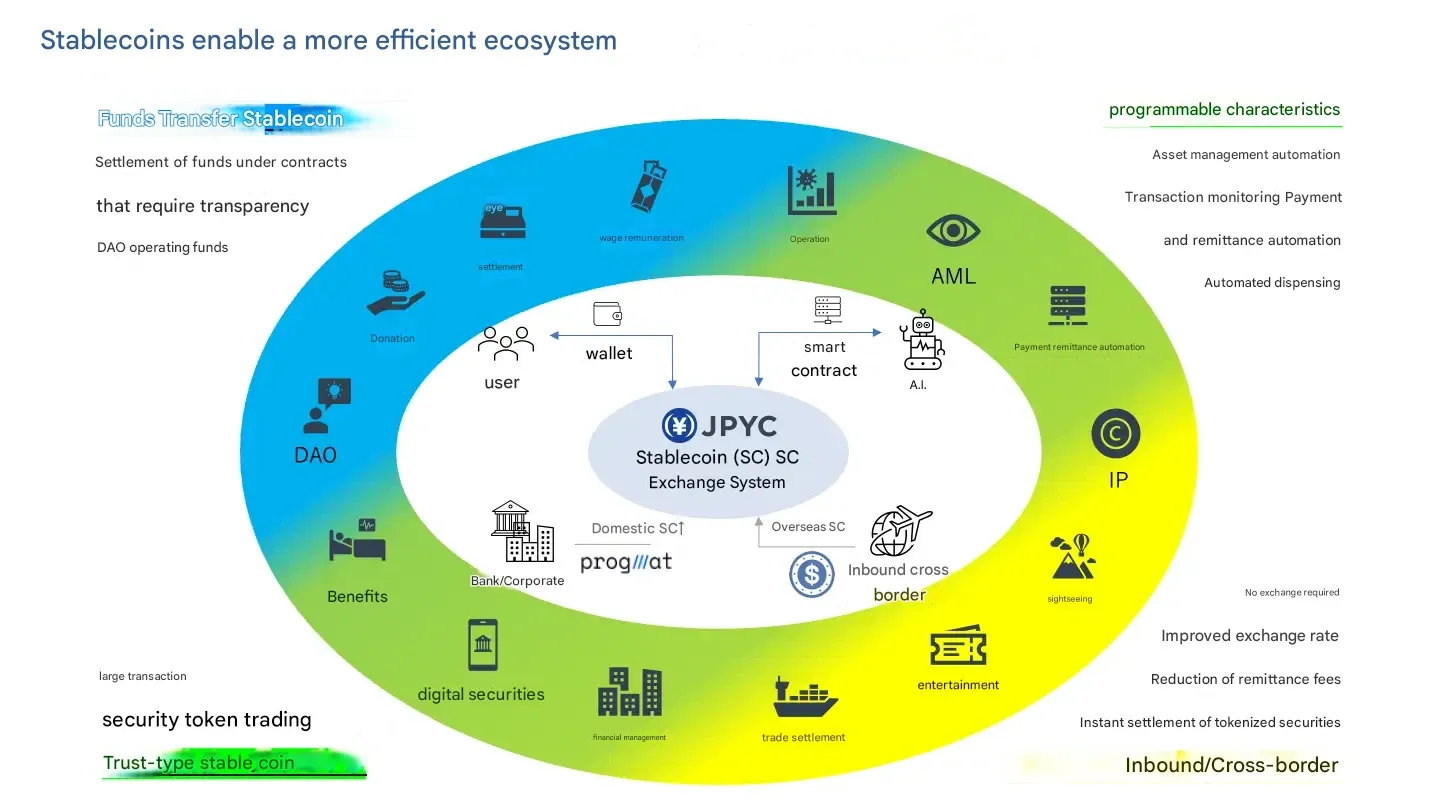

This response to legal amendments represents an important turning point in JPYC's business operations and a major challenge to contribute to the development of Japan's digital currency ecosystem. Going forward, JPYC will not only comply with relevant laws and establish a robust and appropriate operational system as an electronic payment instrument issuer, but also actively consider developing new services of higher value to customers and expanding existing functions.

A "Type 1 Electronic Payment Instrument" refers to a type of "electronic payment instrument" defined in the amended Payment Services Act that meets the following requirements:

- Currency-denominated asset: An asset linked to the value of currency, such as Japanese Yen or foreign currency

- Electronically recorded and transferred: Recorded as electronic data and transferable through networks

- Usable for payment to unspecified persons: Can be used for payment of goods and services to anyone

- Tradeable with unspecified persons: Can be bought and sold with anyone

- Issued by banks or money transfer operators: The issuing entity must be a bank or money transfer operator